Redefining the decentralized stablecoin: A complete interpretation of the path to advancement of USDD 2.0

Reprinted from chaincatcher

02/11/2025·29DAs the cryptocurrency market is greeting with a big event: On January 25, the decentralized stablecoin USDD announced a new journey to launch the "upgraded version" USDD 2.0, aiming to build a truly zero trust Zero censorship, fully decentralized, never-freeze-and-safe and reliable stablecoin.

The launch of USDD 2.0 undoubtedly injected a "stable shot" into the turbulent cryptocurrency market recently. The circulation volume exceeded 100 million in less than two weeks after it was launched. Many industry insiders believe that decentralized stablecoins may be Redefinition, this article will deeply interpret USDD's advanced path.

Why upgrade USDD?

USDD was originally listed on the crypto market as an algorithmic stablecoin, initiated by TRON DAO Reserve and mainstream blockchain institutions. It runs on the TRON network and connects to Ethereum and Binance Chain through the BTTC cross-chain protocol. The original intention of launching USDD was actually the crypto community that the current prosperity of the stablecoin industry has been controlled by various large centralized institutions. Once the extreme environment and emergencies are faced with extreme environments and emergencies, the safety of user property is exposed to risks, so it is urgently needed. A new decentralized stablecoin solution that does not rely on central institutions and is not disturbed by external regulatory factors, USDD, as a "breaker", came into being.

In fact, upgrading USDD is not a whim. Justin Sun had planned the upgrade path of USDD in his open letter in 2022, and divided the development of USDD into four versions: 1.0 space, 2.0 heavenly palace, 3.0 moon, and 4.0 Mars, symbolizing humans and waves. Four goals for participating in space exploration in the future.

In the 1.0 space version, Tron USDD Development will fully entrust Tron United Reserves to cooperate with mainstream industry institutions for management. At the beginning of its establishment, Tron United Reserves will preserve and host the $10 billion high-liquid assets raised by the sponsors of the blockchain industry. As an early reserve, maintain the exchange rate stability and rigid interest rate redemption of Tron USDD. At the beginning of its establishment, the basic risk-free interest rate of USDD was set at 30%, and coordinated the implementation of relevant decentralized and centralized institutions that receive USDD. This interest rate.

The upgrade of USDD 2.0 is designed to enhance its security, decentralization and overall stability, ensuring that USDD can better be achieved by integrating stronger mechanisms such as secure liquidation processes, dynamic collateral ratio adjustments and enhanced risk management protocols. Resist market volatility, such as when USDD prices skew, arbitrage opportunities will encourage buying or selling to get the price back on track and always stay 1:1 pegged to the US dollar.

It can be said that Tron USDD is a small step in the development of Tron stablecoins, but a big step in human beings to achieve ultimate financial freedom.

What is the difference between USDD 2.0 and the old version?

**** USDD 2.0 is a fully decentralized stablecoin pegged to the US dollar and backed by cryptocurrency collateral. Unlike traditional stablecoins, USDD 2.0 operates without a central authority, while also planning to introduce more community-driven features, Enable users to actively participate in governance and decision-making, ensuring agreements evolve based on collective input, while also enhancing the transparency and efficiency of the system, improving collateral management and liquidity solutions. The new USDD is designed to provide users with safer and more adaptable stablecoins, making it easier to integrate with the Decentralized Finance (DeFi) platform and ensure long-term growth and sustainability of the ecosystem.

In addition, USDD 2.0 is not tampered with and cannot be frozen, giving users complete control of their assets. With its decentralized features, it avoids the risk of centralization and provides trustless solutions for transactions within the DeFi ecosystem, aiming to Blink the gap between traditional finance and the ever-evolving DeFi world and provide users with stable and reliable currency for trading and investment.

Compared with previous versions, USDD 2.0 introduces a number of key improvements and innovations, further enhancing its decentralization and security.

The core innovation of USDD 2.0 coin minting lies in over-collateralization, that is, all issued USDDs are backed by more than 100%. Users can mint USDDs by collateralizing assets such as TRX and USDT. The mortgage ratio is usually set above the industry standard. (See below) to prevent the stability risks brought by market fluctuations. Once the mortgage rate is lower than the set value, the system will trigger a liquidation mechanism and automatically sell some collateral to maintain stability.

In addition, USDD 2.0 introduces the Price Stability Module (PSM) to perform stablecoin-to-USDD conversion. PSM allows seamless, near-zero fee exchange between USDD and supported stablecoins (first USDT), and will gradually increase in the future Support for other stablecoins to enhance user flexibility and accessibility.

PSM features are designed for easy use, providing fast and secure conversions without slippage or extra fees, making it an important tool for users who seek to maintain a 1:1 pegged USDD when interacting with other stablecoins, and also allowing the market to spontaneously maintain USDD The price is stable. If the USDD price falls to 0.98 USDT in the market, arbitrageurs can buy USDD at a low price and exchange it for USDT in a 1:1 ratio through PSM, which will push the USDD price back to 1 USD; on the contrary, if the USDD price is higher than 1 USD, users can exchange it. More USDD, increase market supply and curb price increases. Through PSM, USDD avoids the risk of collapse like UST and has stronger market adaptability.

More importantly, to ensure transparency and security, all USDD-enabled collateral is stored in publicly verifiable smart contracts. Users can view the contract address on the blockchain browser to verify funds at any time, ensuring that the collateral is not affected and completely safe. Users only need to visit TRONSCAN and enter the contract address to view the fund balance.

In addition, security is a top priority for USDD 2.0, and its smart contracts are subject to strict security audits by blockchain security company ChainSecurity to ensure the security and integrity of the protocol, which evaluate potential vulnerabilities and verify system robustness. ChainSecurity notes in the report that the contract code base of USDD 2.0 provides satisfactory high levels of security while performing well in asset solvency and functional correctness.

Based on the above analysis, we can briefly summarize the pairs, such as the following:

It is worth mentioning that Justin Sun previously posted on the X platform: "USDD 2.0 APY is 20%, completely subsidized by TRON DAO, all interest will be sent to the transparent address in advance, no other reason - just because we have enough money. So, stop asking me questions like 'where' where the income comes from'."

Frankly speaking, the reason why USDD 2.0 can achieve 20% annualized returns provided by JustLend is mainly based on the strong support of the TRON ecosystem, the excess collateral model, the income subsidy mechanism and the dominance of Tron in the stablecoin market. First of all, TRON DAO subsidies ensure the stability of income distribution. Official data shows that the total market value of stablecoins based on TRON has reached nearly 63 billion.

Secondly, the TRON ecosystem generates profits through various methods such as DeFi lending, transaction fee income, etc., which also provides effective support for the high returns of USDD 2.0.

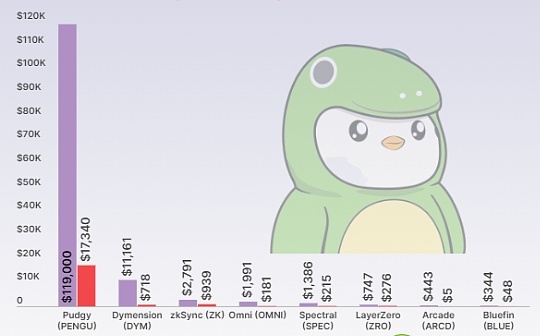

From this we can see that the 20% return of USDD 2.0 has strong financial support, ensuring the user's interest source is stable and reliable, and it can also be said to be "far ahead" compared with its industry peers:

How to migrate to USDD 2.0?

USDD 2.0 has launched a migration function, allowing users who hold USDDOLD to seamlessly upgrade to the new version of USDD. Moreover, the migration is not limited by time and can convert tokens at any time. Just navigate to the migration page to access the migration page to access the migration function.

Enter the migration amount: Specify the amount of USDDOLD you want to convert to a new USDD and make sure the amount entered does not exceed your wallet balance.

Confirm transaction: Use the associated wallet to approve and confirm the migration. Once confirmed, the new USDD of equivalent value will be credited to the wallet. The migration process only involves gas transaction fees.

**USDD 2.0 was born with a golden spoon in it? The new version of USDD

may be a part of Justin Sun 's long-term strategy**

With Trump successfully elected the 47th president of the United States, the global crypto industry has begun to enter a new period of change. The adjustment of US policy and regulatory support for stablecoins will give USDD 2.0 greater market potential.

In fact, the time when Justin Sun announced the launch of USDD 2.0 was very "interesting" -

- Last November, Justin Sun joined the Trump family project World Liberty Financial (WLFI) as a consultant. WLFI said on the X platform: "Yuchen Sun's insights and experience will help us continue to innovate and develop." It is reported that the day before the announcement was released, Justin Sun invested $30 million in WLFI, becoming its largest investor.

- On January 19, people familiar with the matter revealed that World Liberty Financial (WLFI), a crypto project supported by the Trump family, plans to include Tron TRON's mainnet token TRX into its cryptocurrency reserves.

- On January 20, on-chain data monitoring Justin Sun spent $15 million to buy 1 billion WLFI tokens for the Trump family's crypto project.

- On January 25, USDD announced a new journey to launch the "upgraded version" USDD 2.0.

According to Arkham monitoring data, TRX has now become the second largest token for the market value of WLFI holdings in the Trump family's crypto project, second only to USDC:

1. USDC: 15.478 million pieces, approximately US$15.49 million;

2. TRX: 40.718 million pieces, approximately US$9.54 million;

3. STETH: 1829 pieces, approximately US$4.85 million.

It seems that it is not an exaggeration to say that Justin Sun has its own resource advantages, which can be seen only from his relationship with the Trump family project. On this basis, it is also natural to upgrade USDD. It can not only use resources and connections to promote the effective implementation of the upgrade, but also It can ensure security in the process. In addition to the core position of the TRON ecosystem in the stablecoin market, it means that USDD 2.0 is not a stablecoin that "starts from 0", but was born with a golden spoon in it. Justin Sun is even on social media. The top shouted with confidence, "Welcome to contact and cooperate with CEX, and will give you a 20% annualized USDD reward."

Not only that, David Sacks, the White House crypto and AI director, also expressed his concern for stablecoins at a recent press conference on digital assets. David Sacks is a well-known Silicon Valley investor, an early executive of PayPal, and a staunch supporter of Web3 and decentralized finance. He has long promoted the integration of cryptocurrencies with traditional financial systems and repeatedly stated that stablecoins will play in the global payment field. Core role.

David Sacks and the Silicon Valley capital force behind it may push USDD 2.0 into the global financial system, making it a key variable in the stablecoin market, as USDD 2.0, which adopts DAO governance and over-collateralization models, is in line with the decentralized stablecoin. Trends may even become a decentralized alternative to payment networks such as PayPal and Stripe. It can be seen that USDD 2.0 may not just be an upgrade of the TRON ecological stablecoin, but Justin Sun's long-term layout in the global stablecoin market and DeFi system.

USDD 2.0, as the core stablecoin of the TRON ecosystem, is expected to be used in global payments and cross-border settlement. The over-collateralization + decentralized governance model it adopts also meets WLFI's requirements for decentralized finance. If WLFI receives further policy support, USDD 2.0 is entirely possible to become the "decentralized dollar" in the TRON ecosystem and occupy an important position in the global stablecoin market.

Summarize

The change of dragon and snake, between wood and geese means that gentlemen should be flexible and flexible when dealing with the world, and can not only maintain inner stability, but also decisively attack at critical moments. At the same time, they know how to judge the situation, maintain moderateness, and do not go to extremes. Justin Sun chose Upgrading USDD 2.0 while the dragon and snake alternate seems to be in line with the general trend.

Of course, USDT is still the overlord of the stablecoin market at present, and the USDT transaction volume on the TRON network is also very huge. It is still a bit difficult for USDD to challenge USDT's status. In addition, other emerging stablecoins may also become the future competitors of USDD. For example, First Digital USD (FDUSD) has received strong support from Binance Exchange, and market competition will inevitably become increasingly fierce.

However, with the support of Justin Sun and TRON ecosystem, USDD 2.0 has demonstrated its unique advantages as a decentralized stablecoin, and it will be a complete part of the stablecoin market in the future.

jinse

jinse

panewslab

panewslab