Revealing Hyperliquid's revenue engine, a progressive decentralization victory

Reprinted from panewslab

03/06/2025·1MAuthor: Ryan Watkins , Syncracy Capital

Compiled by: Felix, PANews

In the fourth quarter of 2024, Syncracy Capital launched a large-scale position in HYPE and continued to increase positions in the first quarter of 2025. Recently, Syncracy Capital published a document to disclose multiple reasons for its increase in HYPE.

The following is the full text (this article has been deleted and modified):

Hyperliquid has a unique revenue engine that combines exchanges and smart contract platforms, making it the most expensive blockchain in the crypto economy. Moreover, its vertically integrated design combines these two businesses through a unified interface, allowing Hyperliquid to aggregate users more effectively than any other platform to date, providing a structural advantage for it to accommodate all financial businesses around the world.

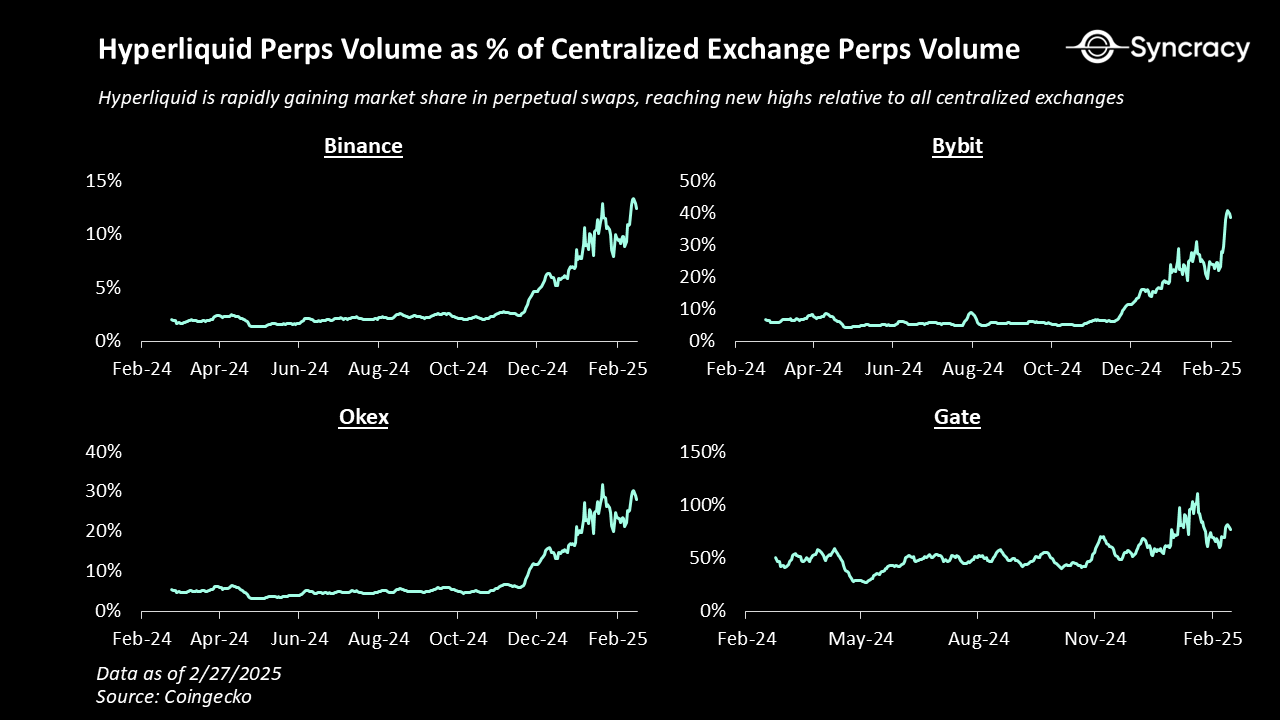

In the long run, Hyperliquid has the potential to "superrupt" Binance, providing performance that outperforms other decentralized platforms and outperforms centralized exchanges in terms of cost, accessibility, auditability, composability, security, and asset availability. Meanwhile, its smart contract platform has the potential to become one of the leading application ecosystems, leveraging Hyperliquid’s exchange and trader base as the basis for its growth.

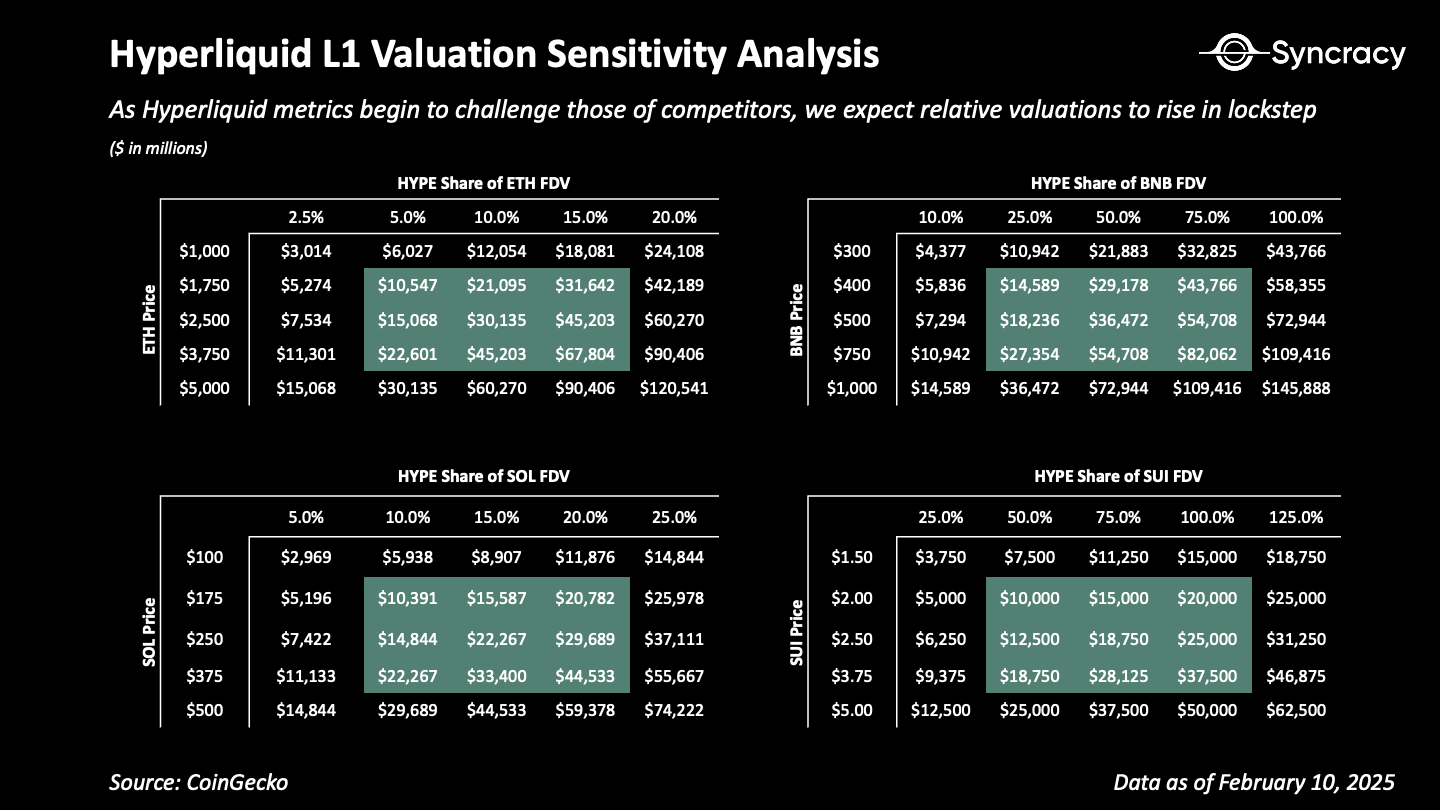

Syncracy estimates that the combined market size of its exchanges and smart contract platforms will reach hundreds of billions of dollars in the next few years.

The art of progressive decentralization

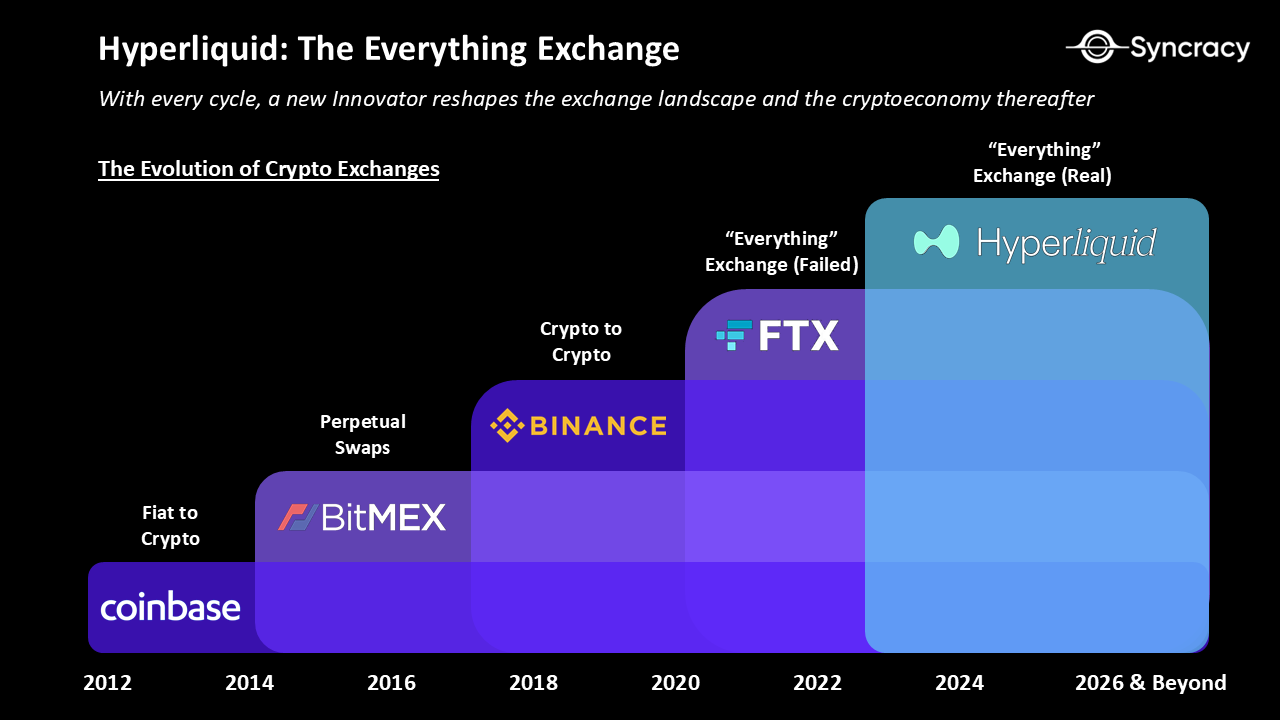

Trading is one of the killer applications in the crypto economy to date, but most transactions are still on centralized platforms. Is it possible to build a decentralized exchange with features similar to the origin of Bitcoin? This is a question that Hyperliquid co-founder Jeff Yan started answering when launching a new exchange from the ruins of FTX in 2022.

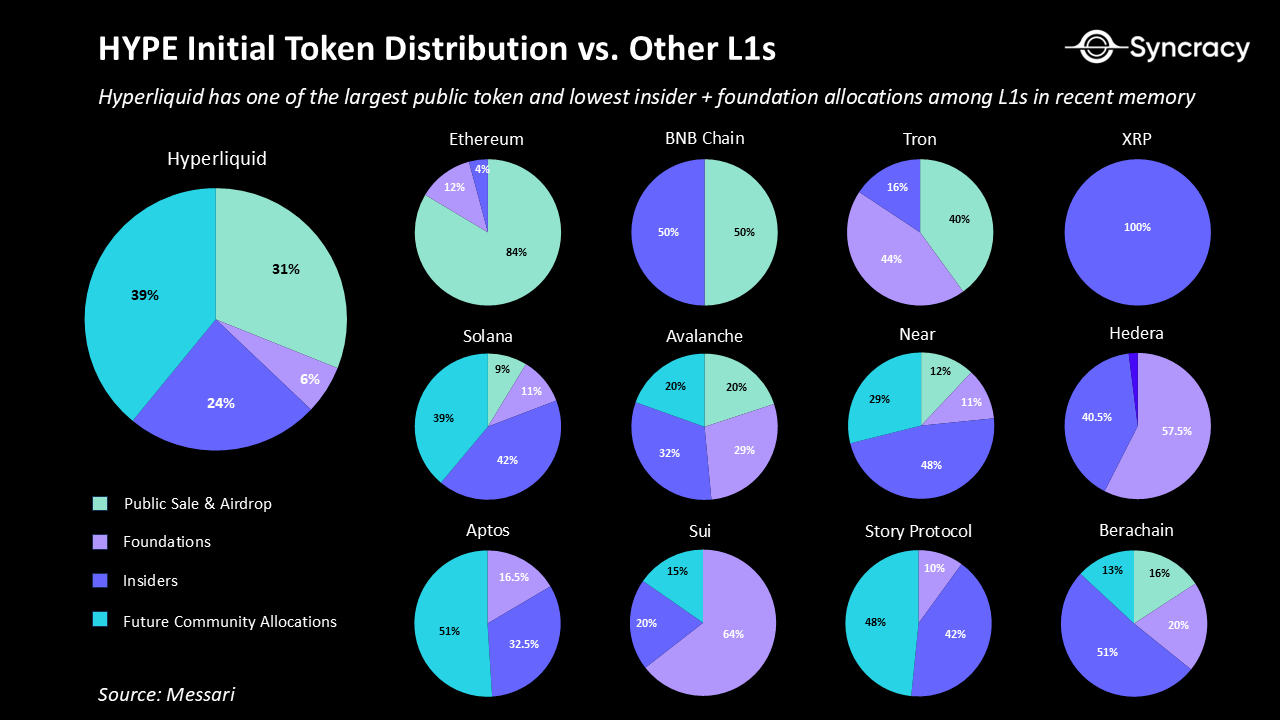

Rather than obtaining any external funds from VCs, Hyperliquid chose to raise funds entirely. This is a key decision that allows the team to focus on developing the product without external pressure and ultimately allocate most ownership to the community.

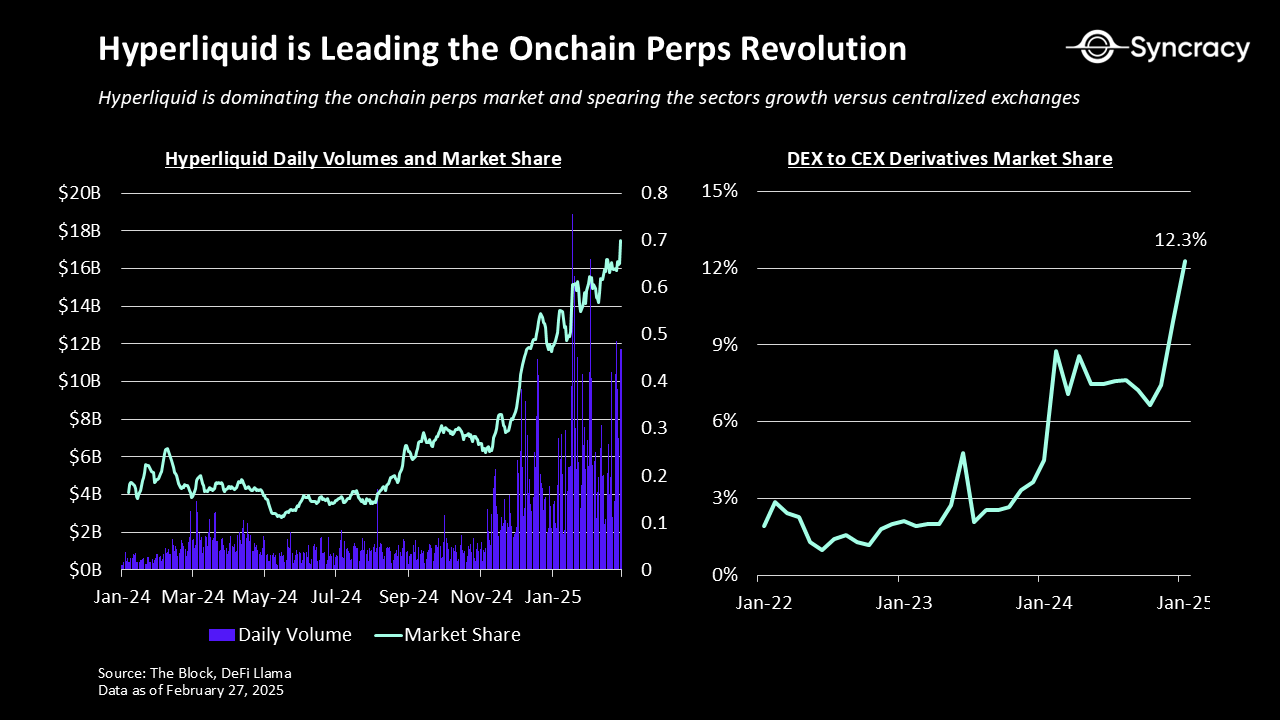

Two years later, Hyperliquid has become one of the fastest growing projects in the crypto economy, accounting for more than 60% of the on-chain perpetual contract market. In this process, Hyperliquid played a key role in leading the transformation to on-chain perpetual contract trading, which currently accounts for about 12% of global transaction volume.

The key to success

It all starts with the team's product-first philosophy. The team is not optimizing for ideological purity, for example, from the beginning, it is not the maximum decentralization, but rather the best on-chain trading experience. This strategy can be understood as incremental decentralization—a practical way to build successful projects in a crypto economy, involving teams first finding product-market fit and market, and then gradually giving up control over time.

While decentralization and open source are critical to reducing counterparty risk over the long term and improving product scalability, most users prefer performance and usability rather than strictly abide by the Cypherpunk principles. Therefore, in the two years before the release of the HYPE token, the team perfected the platform through direct contact with traders.

This feedback proved valuable because the Hyperliquid team often implements feature requests and bug fixes within hours, thus building deep trust in the community. It also brings key product features such as traders’ order cancellation priorities, which enable market makers to quote smaller spreads, and Hyperliquid vaults, which enables exchanges to quickly guide liquidity in new token pairs. The result is a high-performance chain with a fixed order book (CLOB) capable of achieving throughput of 100,000 transactions per second (TPS) and sub-second finality, which is one order of magnitude higher than other platforms' performance.

As transaction volumes grew exponentially by the end of 2024, Hyperliquid airdropped 31% of the token supply to users. Airdrops have been a huge success.

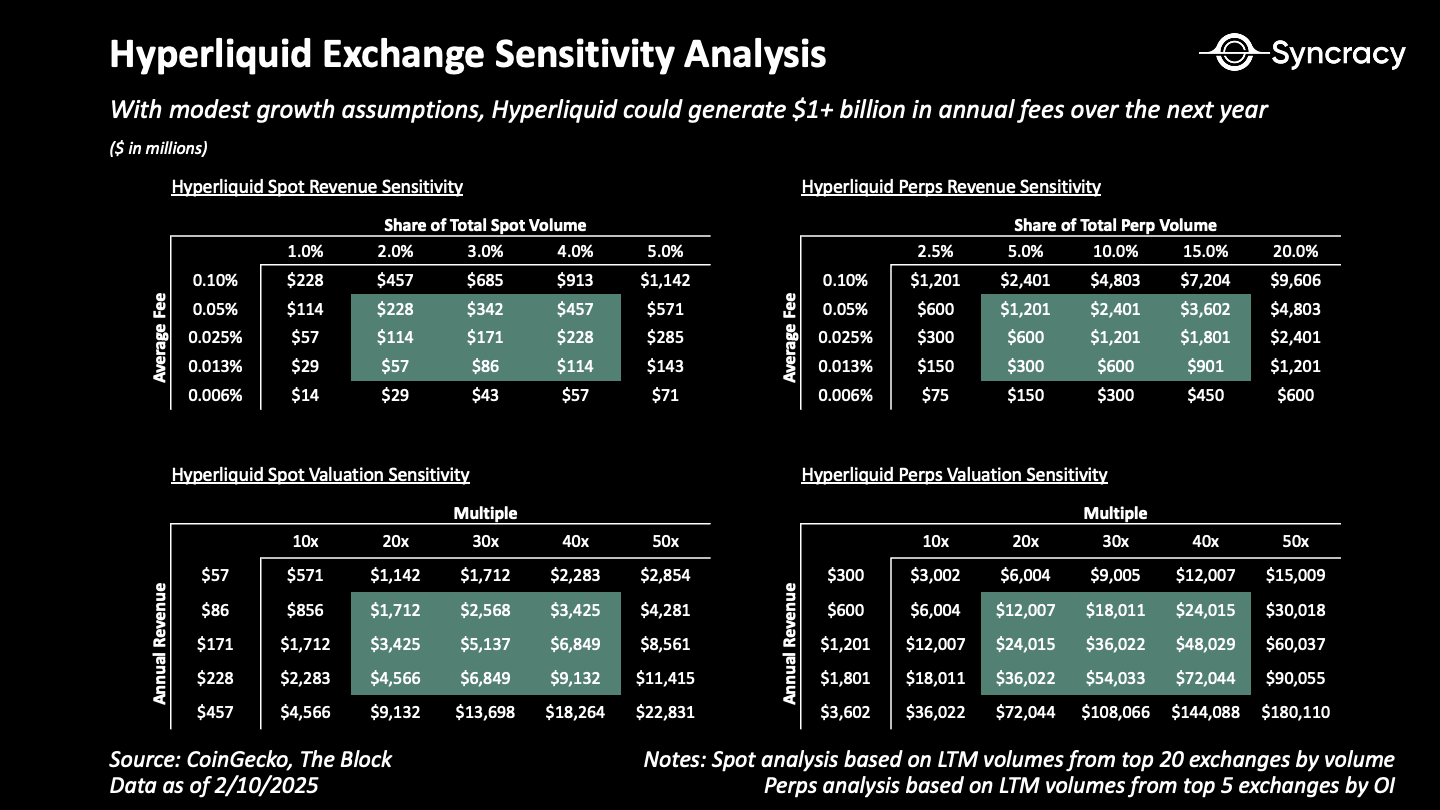

Crucially, the HYPE token also has a clear intrinsic value, at the time the fee was $228 million per year. This not only provides the incentive for the recipient to hold rather than sell, but also drives large-scale buybacks due to high revenues and also brings buying momentum to HYPE. Additionally, large buyers must purchase on the open market as there is no pre-allocation to any insider outside the core team. Not only did these participants force directly to join Hyperliquid and simultaneously increase trading volume, it also highlighted that Hyperliquid's next development is more than just a simple derivatives exchange.

Everything Exchange

Exchanges are winner-takes-all markets, with factors such as liquidity network effects, scale efficiency, brand equity and regulatory moats focusing trading activities on a few leading participants. This model has shaped centuries of financial market structure, cementing the Chicago Mercantile Exchange’s dominance in derivatives, the New York Stock Exchange and Nasdaq’s dominance in the stock sector, and Binance’s dominance in the centralized crypto market. However, despite its size, no exchange can completely unify the liquidity of multiple asset classes on a global ledger—a concept known as “Everything Exchange”.

Climbing this gap requires more than just dominance in a single market, infrastructure that can seamlessly integrate multiple asset classes, unified liquidity and global scale. This is how Hyperliquid’s design differs from traditional exchanges, providing a vertically integrated system that can operate on its own high-performance blockchain while integrating liquidity in the spot and derivatives markets.

Blockchain-based exchanges have structural advantages in auditability, efficiency, security, composability and accessibility. Instead of delegating assets to centralized entities with risk opaque risk, users can use autonomous smart contracts as intermediaries to self-customize assets and trade in global markets with almost instant settlements 24/7.

These benefits are not just theoretical. It has now driven the growth of on-chain transaction volume. This trend is not only reflected in the data, but also in the strategies of Binance and Coinbase, the two major exchanges in the industry, which have launched their own blockchains: Binance Smart Chain and Base.

Hyperliquid has taken the first step: expanding to the crypto spot market. The solution begins with allowing users to send native assets on blockchains such as Bitcoin, Ethereum, and Solana to Hyperliquid through a fixed interface. Hyperliquid will be the only on-chain CLOB that has both multi-chain spot and derivatives markets.

Hyperliquid currently supports large-cap stock assets in the spot market, only HYPE and BTC, and are currently among the top 10 and top 5 DEX trading volumes in the world.

Hyperliquid may continue to surpass its platform because of the following advantages:

- Cost - Transaction fees and administrative fees are significantly lower than CEXs such as Binance

- Accessibility – It is easier for users to join due to its globally unauthorized nature

- Auditability – Easily verify using the basic public key encryption technology inherent in blockchain

- Composability – 3rd parties are easy to develop on it (such as builder code)

- Security – Self-hosting, decentralization improves over time

- Asset availability – Faster and transparent asset listing process

These advantages allow Hyperliquid to eventually expand beyond blockchain native assets. Hyperliquid may cover all global assets, including markets such as currency, stocks, bonds, commodities, real estate, and even sports betting and forecasting. In fact, this transformation is almost inevitable. As wallets become more and more popular, asset issuers will have an increasingly strong incentive to go public on public chains to leverage the global investor base to increase distribution and achieve minimum capital costs.

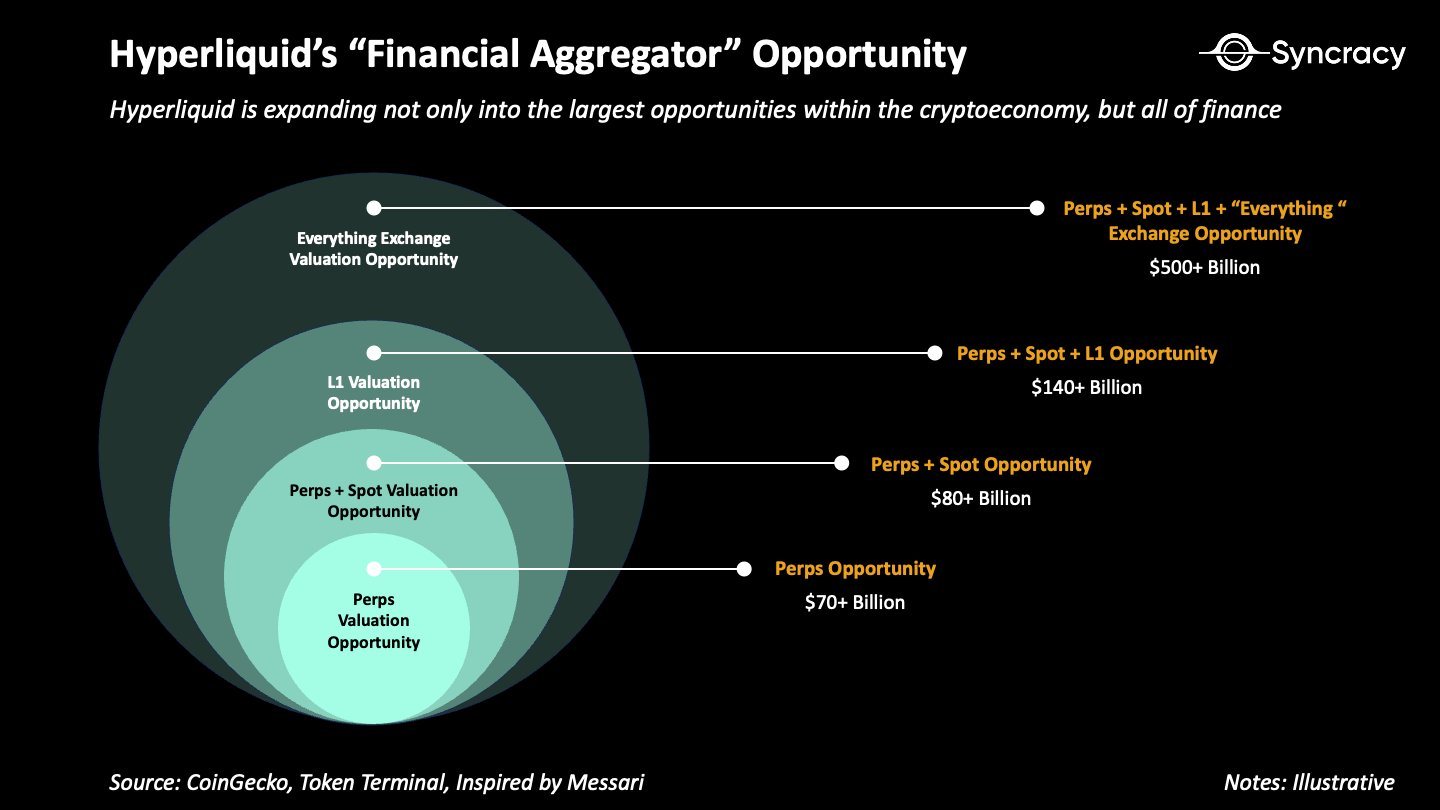

It is estimated that the opportunity in the crypto economy is worth more than $140 billion today. In addition, opportunities outside of the crypto economy (covering every asset class and exchange on the planet) are worth at least US$500 billion worldwide, which does not include large OTC markets such as privacy exchanges and foreign exchange. Including these, market opportunities can easily reach trillions of dollars.

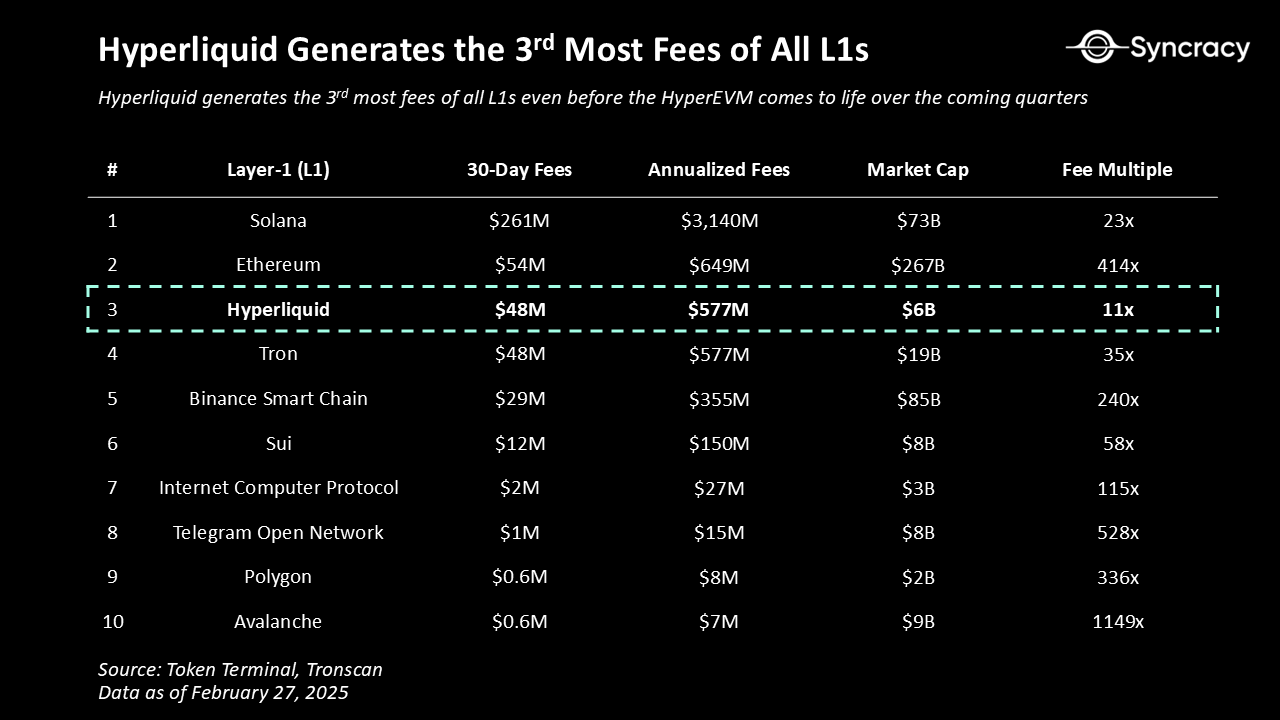

During Hyperliquid's brief history, it has achieved annual revenue of US$577 million from its perps exchange and emerging spot markets alone. If any of the above theory is realized within the next 12-24 months, revenue is expected to multiply in the future, which is likely to make Hyperliquid top the crypto economy in terms of on-chain revenue (it has already ranked third).

The road to financial aggregation

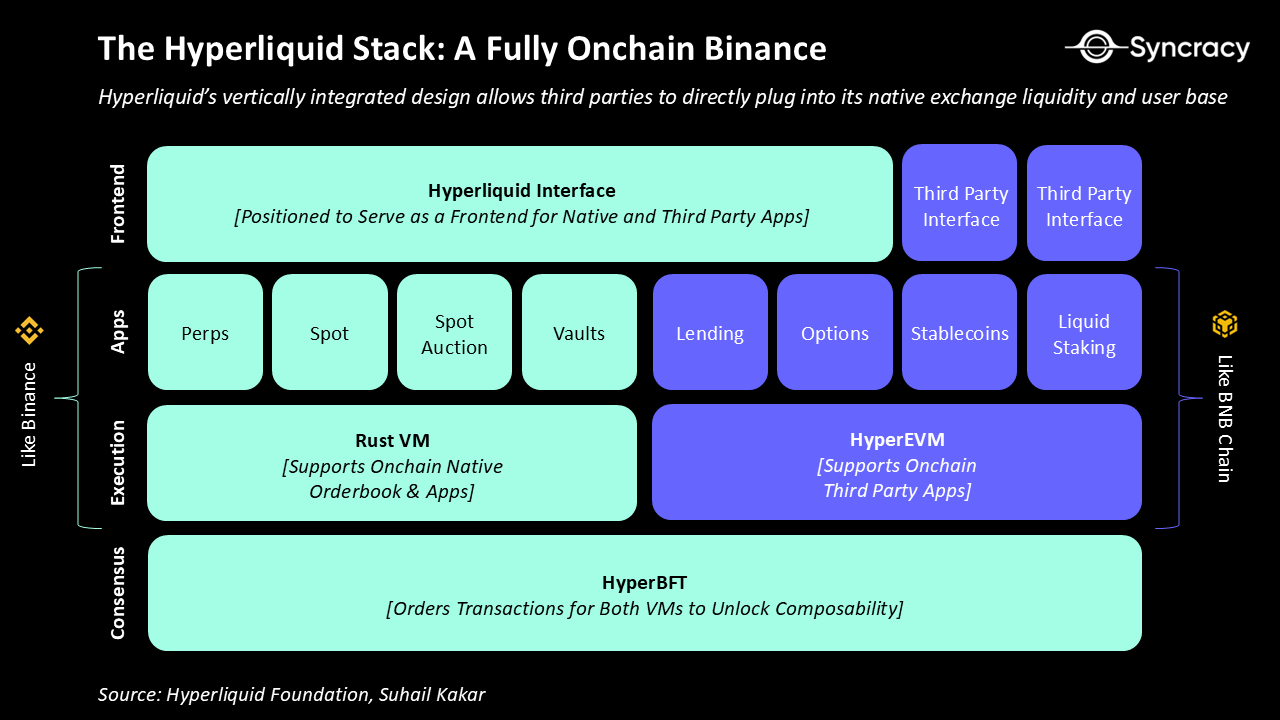

Previously, Binance and Coinbase launched BSC and Base respectively. These two chains are exchange-independent entities with independent capital statements and profit and loss statements. But what if Binance and BSC were merged? What if, essentially, combined the two most profitable businesses in the history of the crypto economy (exchange and smart contract platform)? What happens if accessed through a single interface? This is the opportunity for Hyperliquid's recent launch of HyperEVM, an EVM-compatible virtual machine that will run in parallel with its order book exchange.

Essentially, by tightly integrating its interface, exchange and smart contract platform into a cohesive experience, Hyperliquid can gather users on a large scale.

Historically, these three have been dispersed in the crypto economy. Hyperliquid integrates the entire stack, modularizing only partially its application and interface layers – a design choice that creates potential strategic advantages. Unlike an ecosystem that relies entirely on third-party applications and interfaces, Hyperliquid’s internal exchanges are both anchors and distribution centers, enhancing its network effects. Exchanges are the preferred channel for third-party developers to build applications and issue assets, and can be directly integrated with the flagship Hyperliquid interface. This creates a positive feedback: the more users there are on the exchange, the more liquidity the application is available. The more liquidity the application is available, the more useful the application is. The more useful the application becomes, the more sticky the Hyperliquid ecosystem becomes, and the more valuable the Hyperliquid becomes over time.

In summary, the shared state between the Hyperliquid exchange and HyperEVM can bring many synergies and product innovations, such as:

- Advanced collateral management – a major brokerage application that allows traders to maximize the capital efficiency of collateral – for example, lending liquid pledge HYPE through an Aave-like agreement, selling interest through earning markets such as Pendle, while using the position as collateral for derivatives transactions

- On-chain structured products – an asset management application that creates on-chain structured products similar to Ethena using Hyperliquid vaults and derivatives

- Advanced Currency Markets – A currency market agreement that integrates Hyperliquid’s derivatives exchanges to hedge collateral risk and spot exchange clearing, ultimately enabling it to provide borrowers with a higher loan-to-value ratio (LTV)

- Privacy Trading – A privacy protocol similar to Tornado Cash that allows anonymous orders on Hyperliquid exchanges (dark pool)

These examples simply involve the surface—the deep integration between Hyperliquid’s trading interface, order book and smart contract ecosystem provides fertile ground for a new wave of on-chain financials.

Hyperliquid has several important levers that can drive its ecosystem – a key competitive advantage in the increasingly saturated smart contract platform space.

- Loyal Transaction Users – Unlike most emerging smart contract platforms, Hyperliquid already has a large, highly involved user base. This solves the cold start problem that plagues ecosystems outside Ethereum, Solana and Base, providing an instant market for developers’ products

- Incentive Funds – Initially, Hyperliquid distributed 39% of its supply to community rewards and incentives, enabling it to launch multi-year, multi-billion-dollar campaigns to attract users and builders

- Aid Fund Repurchase – Hyperliquid announces that it will start purchasing ecosystem tokens with its aid fund to inspire on-chain activity and support its communities

HyperEVM ecosystem builders are keenly aware of these advantages and build their listing strategies accordingly. Many people are inspired by Jeff (Hyperliquid CEO) and highly aligned with HYPE holders, which may help projects airdrop their tokens to Hyperliquid users and HYPE stakers.

In addition, there are a few projects that promise to allocate some of their funds to HYPE, which may create additional demand for HYPE while increasing revenue. This move is important for developing HYPE into reserve assets for their respective ecosystems similar to ETH and SOL. As HYPE adoption in HyperEVM expands, its role as Gas, collateral and other roles will further drive this narrative, potentially making HYPE's valuation far exceed the valuation that MEV and execution expenses themselves can prove. Consolidate its core asset position alongside BTC, ETH and SOL.

risk

The development of Hyperliquid is not without risks. In addition to the execution risks inherent in any early stage enterprise, there are also the following risks:

- Centralization – Hyperliquid may not be able to distribute its validator set globally without degrading performance, which is currently composed of 16 servers located in Tokyo; in addition, its inability to decentralize may pose regulatory risks

- Developer ecosystem - Hyperliquid is mainly developed by the core team and has very little external contribution; most of the code is still closed source, and HyperEVM is in its infancy

- Agreement Embedding – Whether it is necessary to embed all necessary infrastructure on the chain to run an order book exchange remains an open question, especially related to a sustainable product that requires an insurance fund owned by the agreement to prevent bankruptcy

- Bridge Hackers – If Hyperliquid cannot decentralize its bridge infrastructure, its spot market may be damaged; in addition, the lack of native stablecoin support can create unnecessary counterparty risks

- Business cyclical – Exchanges are cyclical businesses, and a decrease in interest in asset classes will lead to a decrease in transaction volume and fees

The boundaries between financial markets are disappearing, converging into a single, composable, hyperliquid financial system. Over time, the collection of isolated ledgers, intermediaries and clearing houses of the old financial world will be replaced by a unified, real-time, programmable economy.

jinse

jinse

chaincatcher

chaincatcher