Spend 80 million US dollars of "subsidy" to grow, Uniswap takes a bit of a big step

Reprinted from chaincatcher

04/17/2025·2DAuthor: BUBBLE, BlockBeats

On February 14, 2025, Devin Walsh, executive director and co-founder of the Uniswap Foundation, launched a liquidity incentive proposal for Uniswap v4 and Unichain in the Uniswap Governance DAO. After passing the Temp Check on Snapshot on March 3, it finally officially completed the final proposal at tally on March 21, with a total of 53 million UNIs and 468 addresses participating in the voting. The program's technical support Gauntlet announced that the program's first phase will last for 2 weeks and will open on April 15.

Once the proposal was issued, it sparked heated discussions from the community, with some expressing support, and some deeming the plan meaningless as a damage to the interests of the DAO. This article will detail the main content of the program, how to participate, and the community’s perception.

Proposal details

The proposal also includes plans for UniSwap v4 in the next six months and Unichain's next year. The foundation aims to migrate 30-day rolling transaction volumes on v3 to v4 on the target chain in the next six months, and has applied for a total of $24 million in budget for the six-month plan.

Unichain's activities are planned to be implemented for a full year. The Uniswap Foundation's plan for the next three months is to achieve Unichain's $750 million TVL and $11 billion cumulative transaction volume. To achieve the above goals, Unichain plans to request an incentive of approximately $60 million in the first year, "including $21 million this request." Runs in a similar way to Uniswap v4, but the reward will consider non-DEX DeFi activities to increase liquidity organic demands “mainly consist of the Uniswap Foundation and other projects built on Unichain”.

The incentive activities of the two chains are slightly different, Uniswap v4's activities will focus on driving AMM transaction volume on each chain, while Unichain's activities will deploy AMM incentives more strategically to promote wider DeFi activities throughout the chain and within AMM.

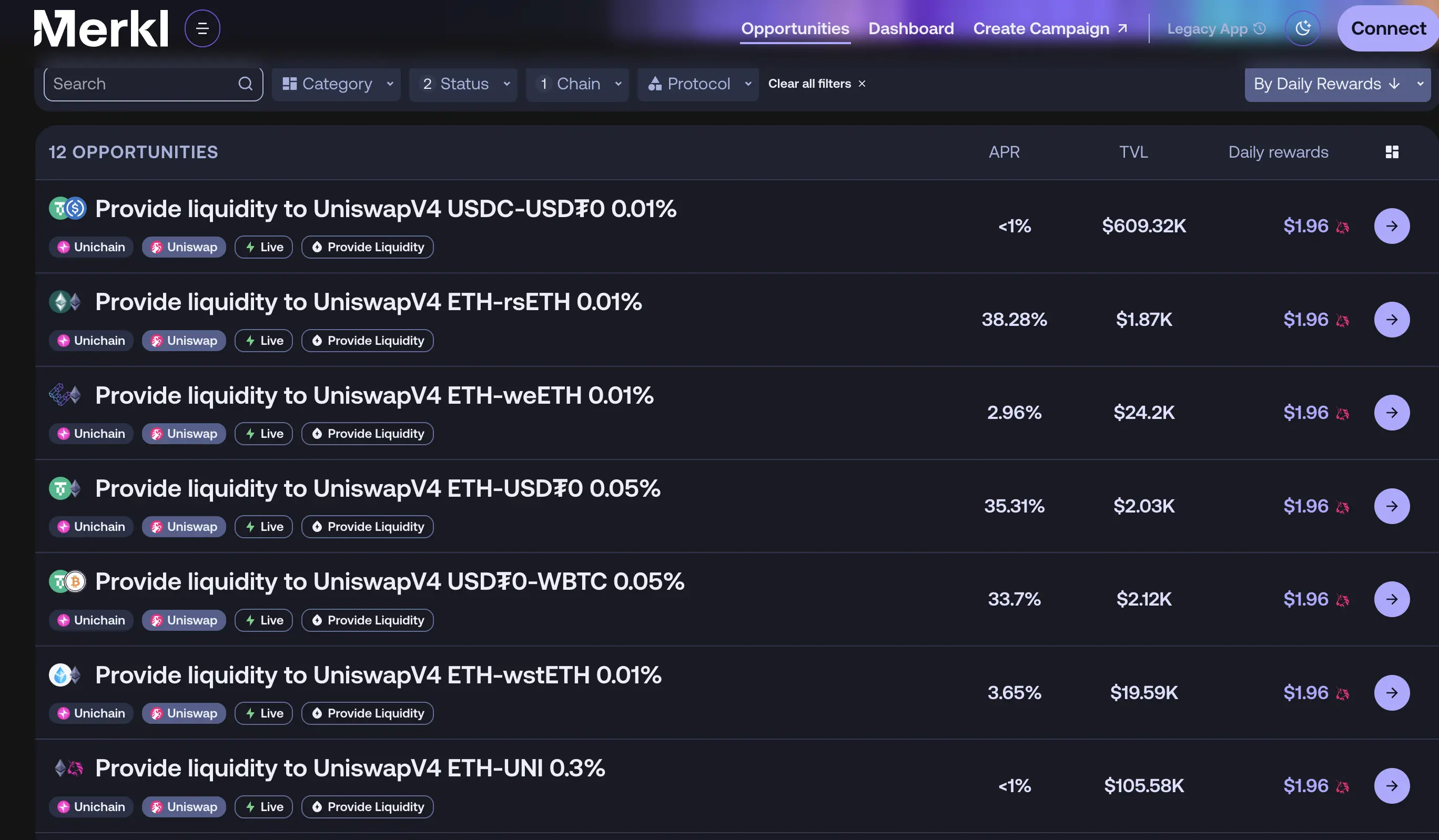

The first Unichain event will be launched on April 15, 2025, for a three-month period, with millions of dollars in incentive funds. $UNI incentives will be distributed in 12 different Unichain pools to reward LPs. The 12 mining pools below the first two weeks will receive $UNI rewards: $USDC /$ETH, $USDC /$USDT0, $ETH/$WBTC, $USDC/$WBTC, $UNI / $ETH, $ETH/$USDT0, $WBTC /$USDT0, $wstETH/$ETH, $weETH/$ETH, $rsETH/$ETH, $ezETH/$ETH, $COMP/$ETH.

In this event, Gauntlet and Merkl play a great role. Gauntlet is a simulation platform for on-chain risk management, using proxy-based simulation to adjust the key parameters of the protocol to improve capital efficiency, expenses, risks and incentives. Merkl is a one-stop platform incubated by a16z, integrating multiple chains and protocols DeFi investment opportunities.

Gauntlet provides its "Aera" vault technology, which is stored in the safe after DAO votes to pass the funds application. Gauntlet determines the liquidity pool with the highest transaction volume on each network and calculates the additional benefits required to make Uniswap v4 a more economically attractive option. Adjustments will be made in two weeks, and choosing which pools can receive how much incentives and rewards will be announced on the Merkl website .

Aggressive growth goals, clichéd growth strategies

Discussion on motivational effects and subsequent retention

Member UreNotInD first objected to the proposal in the Dao vote discussion, mainly because when the funds needed in the proposal were proposed, it compared the funds spent on liquidity by other projects, "Aerodrome is $40-50 million per month, ZkSync Ignite is $42 million per month, and Arbitrum is nearly $200 million since March last year." He believes that this is an old-fashioned strategy that many projects have tried and has little effect.

And Fluid, the strongest competitor, is seizing market share without providing any incentives. The most popular L2 network base successfully gained market share without user incentives. These measures have not solved the structural problems that can help Unichain grow. The interoperability between superchain, the development of unique usage scenarios for DeFi, and the issuance of "RWA, Meme Coin, AI Tokens" on-chain native assets is the most sticky. The foundation should attract and fund more developers through the above methods.

Member "0xkeyrock.eth" also had the same concerns, and he believed that Gauntlet's report should be shared publicly in the forum. This report cost a lot of money, but the information presented in the forum is very superficial and is not enough to support the rationality of such a large-scale incentive.

He raised several unreasonable points in the report. For example, Aerodrome's high incentives are because 100% of the fees are redistributed to veHolders and cannot be compared with this type of liquidity incentive. Secondly, zkSync's monthly token reward of $5 million will increase TVL from $100 million to $266 million.

At this time, Unichain's total TVL was only 10 million US dollars, which shows that the market's inherent demand for Unichain is insufficient. Gauntlet's TVL, which claims to be able to boost Unichain to $750 million with a $7 million monthly incentive, seems lacking in authenticity.

Even if the activity through incentive subsidy activities may temporarily increase, how demand continues, historical cases such as MODE "TVL dropped from 575 million to 19 million", Manta dropped from 667 million to 46 million", and Blast "2.27 billion to 233 million" indicate that Unichain may face the same outcome.

Based on this, from the "TVL growth per dollar" data of UniSwap's incentives for each chain by Forse Analytics, it is known that in the Base with the most complete infrastructure in L2, the best case scenario is that the TVL of 2,600 per dollar can be obtained, while the worst performance Blast is about 500. To achieve the $750 million TVL goal, a simple calculation for the former will cost $300,000 a day while the latter will cost $1.5 million.

Although the analogy data is not perfect enough, it can represent a certain proportional range. To increase Unichain's TVL to US$750 million in three months with US$7 million, it is necessary to improve the improvement of surrounding infrastructure and user level to similar to base. The worst-performing Blast chain's current TVL is more than 10 times that of Unichain.

The member also shared the activity results data of Uniswap v3's incentive plan during the deployment of new chains in 2024. The best results are Sei's DEX TVL ranks 6th in the chain ecosystem, with TVL only $718,000, the worst Polygon zkEVM and even TVL only $2,600, and DEX TVL ranks 13th in the chain ecosystem. None of these deployed TVLs exceed $1 million, and almost none of them enter the top DEXs on their chain. Most of these deployments are completely lost in vitality, with the only trading volume coming from arbitrageurs fixing outdated prices.

0xkeyrock.eth table for Uniswap's TVL harvested after deployment of incentives on multiple chains and ranking in DEX

These incentive pool deployments almost did not produce a flywheel effect, and showed a cliff-like decline after the event ended. Uniswap spent $2.75 million on these deployments “excluding matching amounts in the agreement”, while the annualized cost of these deployments was $310,000. Even if the fee conversion is used to recover the expenses "assuming 15%", DAO can only earn about $46,500 in revenue each year, equivalent to a 1.7% return rate and it will take 59 years to break even.

The two dotted lines are the incentive activity range, and you can see that almost all liquidity pools show a cliff-like decline after the activity.

Of course, some members also said that although there is a widespread cliff-like decline in liquidity after the incentive is over, this incentive plan is still the most effective strategy. Member " alicecorsini " shows the difficulty of retaining users, liquidity and transaction volume after incentive ends with Forse Analytics ' recent UNI incentive review of Uniswap v3 on Base.

In terms of base, Uniswap's biggest competitor is Aerodrome, and the data presents a more complex situation. 27.8% of Uniswap motivated LPs provided liquidity for Aerodrome after the incentive ended, with 84.5% leaving Uniswap completely, and about 64.8% of users leaving Uniswap did not turn to Aerodrome, even though they had better APR than Uniswap v3 without incentives.

Although some LPs have turned to Aerodrome, a larger proportion of users simply exit directly rather than investing in direct competitors. This suggests a broader structural challenge in retaining users and liquidity. He believes that brainstorming some ways to improve retention “while” deploying incentives is a worthwhile effort, but this incentive program is still the most effective strategy for the first step of the traffic funnel.

Community doubts about Gauntlet capabilities

Community member Pepo "@0xPEPO" expressed his concerns about Gauntlet on social media X, noting that the Uniswap Foundation had paid Aera and Gauntlet $1.2 million and $1.25 million in participation fees, respectively, before the proposal was approved. The Aera team has the ability to complete such projects but lacks a track record.

He mentioned that Gauntlet's designated Uniswap growth manager Peteris Erins was the founder of Auditless and a member of the Aera team. Although Peteris has little public track record except for his work at Aera. The only public achievement worth noting is that its agreement reached over $80 million in TVL in its first year.

However, he believes that this total lock-in value may not be a real performance, and every Aera customer is also a Gauntlet customer, and the growth data is questionable when a business's performance depends on its parent company. He further cited Aave and Gauntlet's data. Data suggest Gauntlet may have been suppressing growth, with Aave significantly improving its TVL and profitability after parting ways with Gauntlet.

Devin Walsh, executive director and co-founder of the Uniswap Foundation, responded to this that Gauntlet has gone through a more stringent scrutiny than typical collaborators before and has gone through two due diligence processes.

The first time was in early 2023, when a consultant was being selected for motivation analysis. To select suppliers, we provided similar proposals to three potential collaborators, and we evaluated the final results based on the rigor, comprehensiveness of the analysis, and the ability to drive execution after analysis. At that time, Gauntlet's achievements far exceeded those of other companies. The second time was in the third quarter of 2024, and the Foundation evaluated a group of candidates to determine who is best suited to collaborate on the incentive activities of Uniswap v4 and Unichain. We evaluate candidates’ past records, relevant experiences, and ability to achieve expected results. Based on the analysis, we believe that Gauntlet is best suited to undertake this task. At the same time, we have taken this opportunity to renegotiate the contract, currently planning to pay by event count and lock the rate to 2027.

Security issues with the USDT0 underlying technology Layer0 that have

occurred many times

Before the event began, analyst Todd " 0x_Todd " pointed out the security risks of USDT0 in social media X. USDT0 is a cross-chain version of USDT. The parent asset USDT exists on ETH, and cross-chain to other chains through Layer0 becomes USDT0. Chains that support USDT0 can also cross chains with each other, such as ETH-Arb-Unichain-bear chain-megaETH, etc.

USDT0 is led by Everdawn Labs, uses Layer0's underlying technology and has

been endorsed by Tether and INK. Todd expressed the issue of trust in Layer0,

"My trust in Layer0 is limited, and in the past, there are many cases of top

cross-chain bridge failures. From multichain to thorchai, there is no

threshold for cross-chain technology, it is nothing more than signing more

than multiple signs."

Because in the current situation, in addition to taking two risks, Tether and

Uniswap, there are also four additional risks, namely Everdawn's security,

Layer0's security, Unichain's security, and other public chains that support

USDT0. If other public chains are hacked and USDT0 is issued unlimitedly, then

Unichain's USDT0 will also be contaminated.

How do users get frying?

Enter Merkl to view the incentive pool. These incentive mechanisms may increase or decrease over time. If you want to efficiently mine $UNI, you need to pay attention to the reward changes of the 12 pools at any time.

Provide liquidity to these pools, liquidity can be provided to the incentive pool from any interface and receive rewards for liquidity activities.

Receive rewards on the Merkl personal interface, and users can receive rewards through the Merkl interface or any interface connected to the Merkl API.

In general, most community users are not optimistic about this proposal. They believe that it is harmful to the interests of $UNI holders in all aspects, but for retail investors who simply want to dig in $UNI, they need to be careful of the risks that may occur and pay attention to the biweekly changes in liquidity pool rewards. We will continue to follow up reports for possible subsequent events.

panewslab

panewslab