Taking stock of the Trump family’s investment preferences for Web3: Is the MEME & DeFi track ushering in another spring?

Reprinted from panewslab

01/20/2025·3M1. **What does Trump’s coming to power mean for the encryption

industry?**

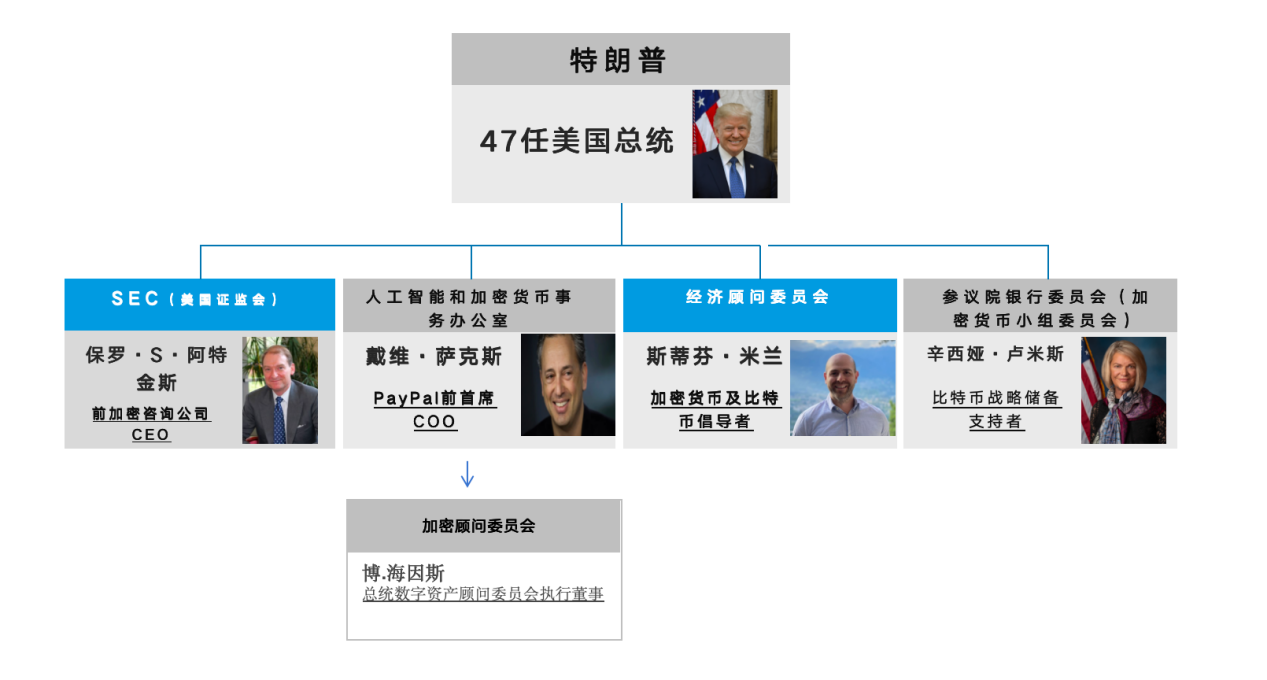

The "Trump trade" market since December has made the entire market boil. For the encryption industry, the next focus has become to what extent Trump can fulfill his campaign promises. In the vacuum period of power transfer, especially Trump very quickly nominated a number of key positions. The candidates for these positions will determine the direction of encryption policy in the United States and even the world in the next four years. This means that Trump’s coming to power will truly change the current industry structure, regardless of whether the policy is implemented. The magnitude of the effort indicates that the industry is facing new and greater opportunities and the accompanying policy uncertainty.

Before Trump officially takes office, let's first take stock of which officials have been nominated for key positions, and what are the attitudes and positions of these officials and the encryption industry.

As far as the U.S. political system is concerned, each president’s cabinet mainly consists of two parts: one is the formal cabinet members who need to be confirmed by Senate resolution after taking office (such as the secretary of state and other major executive department ministers); the other is the cabinet-level Officials, some do not require Senate confirmation (such as chief of staff, national security adviser, etc.). Therefore, currently, in the entire Trump cabinet, the organizations directly held by supporters of the encryption industry or that have influence on the direction of encryption industry policies are as follows:

From the picture above, among Trump’s entire cabinet system, the Office of Artificial Intelligence and Cryptocurrency Affairs is currently receiving the most attention. The information currently disclosed by this agency is mainly responsible for formulating the regulatory framework for the entire encryption industry, contacting the Securities Regulatory Commission, Commodity Futures Committee, Congress, etc., the subordinate Encryption Advisory Committee claims to be composed of 24 CEOs of encryption companies to provide suggestions for policy formulation. According to Trump’s promise, the following new policies are worthy of attention:

-

Make the United States the global crypto capital

-

Stop cracking down on cryptocurrencies as soon as he takes office

-

Prevent the development of central bank digital currencies (CBDC)

-

Build a strategic Bitcoin reserve

-

Fire the SEC Chairman

-

Block the sale of Bitcoin held by the U.S. government

-

Use Bitcoin to solve US debt

-

Establish a more comprehensive encryption policy

-

Establish an encryption advisory committee

Judging from Trump’s personnel appointments during the handover period, at least Articles 5 and 9 have been completed, whether it is from the newly established advisory body, to the Senate Cryptocurrency Committee, to the replacement of the SEC Chairman, these crypto officials have been promoted The resume at least shows that Trump is indeed fulfilling his campaign promises as planned.

For the encryption industry, at least from a regulatory perspective, on the one hand, the originally suppressed policies may be gradually relaxed, and on the other hand, more complete legislation will further promote the industry to become mainstream.

2. **What information does the Trump family’s first project layout

reveal?**

Trump’s change in attitude towards cryptocurrency during his second term has indeed greatly boosted the entire industry. Not only has he established a cabinet-level advisory team in the allocation of government officials, but his family has also begun to get involved in investment in the cryptocurrency industry. , which also provides a certain forward-looking basis for the subsequent easing of the entire supervision.

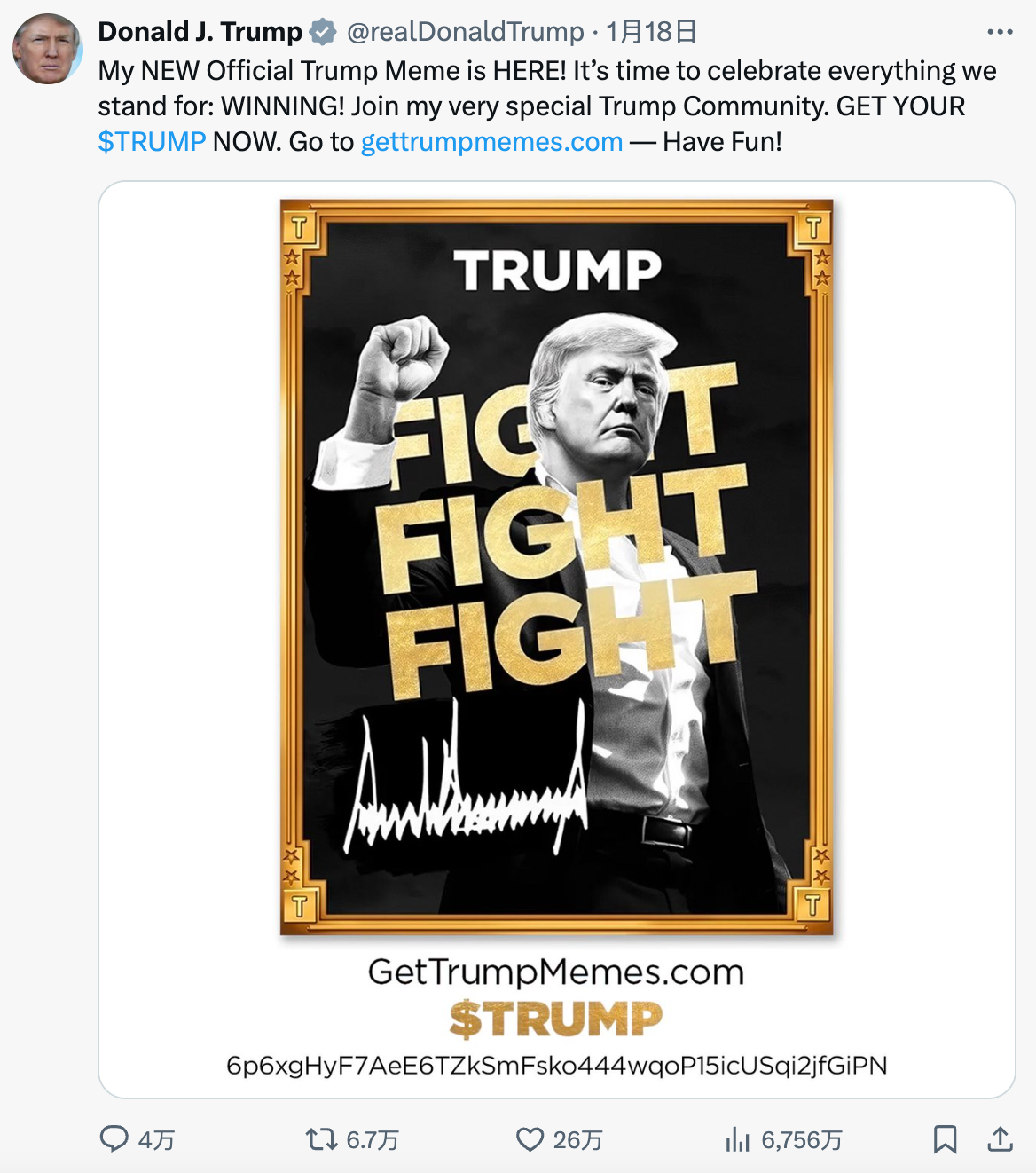

At the beginning of 2025, the biggest tipping point project in the industry is undoubtedly the MEME coin TRUMP, which was officially launched by Trump himself. Once the project was released, its market value exceeded 30 billion US dollars in one day, and it also once again achieved the industry's myth of sudden wealth.

The significance and value of Trump himself personally issuing coins is not limited to the addition of a celebrity MEME in the market. To some extent, it reflects that Trump’s support and depth of the encryption industry may exceed market expectations, especially if witnessed with his own eyes. The rapid explosion in the market value of TRUMP tokens may further become an important support for Trump and his cabinet departments to promote the rapid formalization and relaxation of regulation of the encryption industry, which is undoubtedly a major benefit to the encryption industry. In addition, a potential impact behind Trump’s currency issuance is that on-chain transaction volume and the myth of instant wealth will directly put competitive pressure on centralized exchanges, which will make competition in the entire industry more intense.

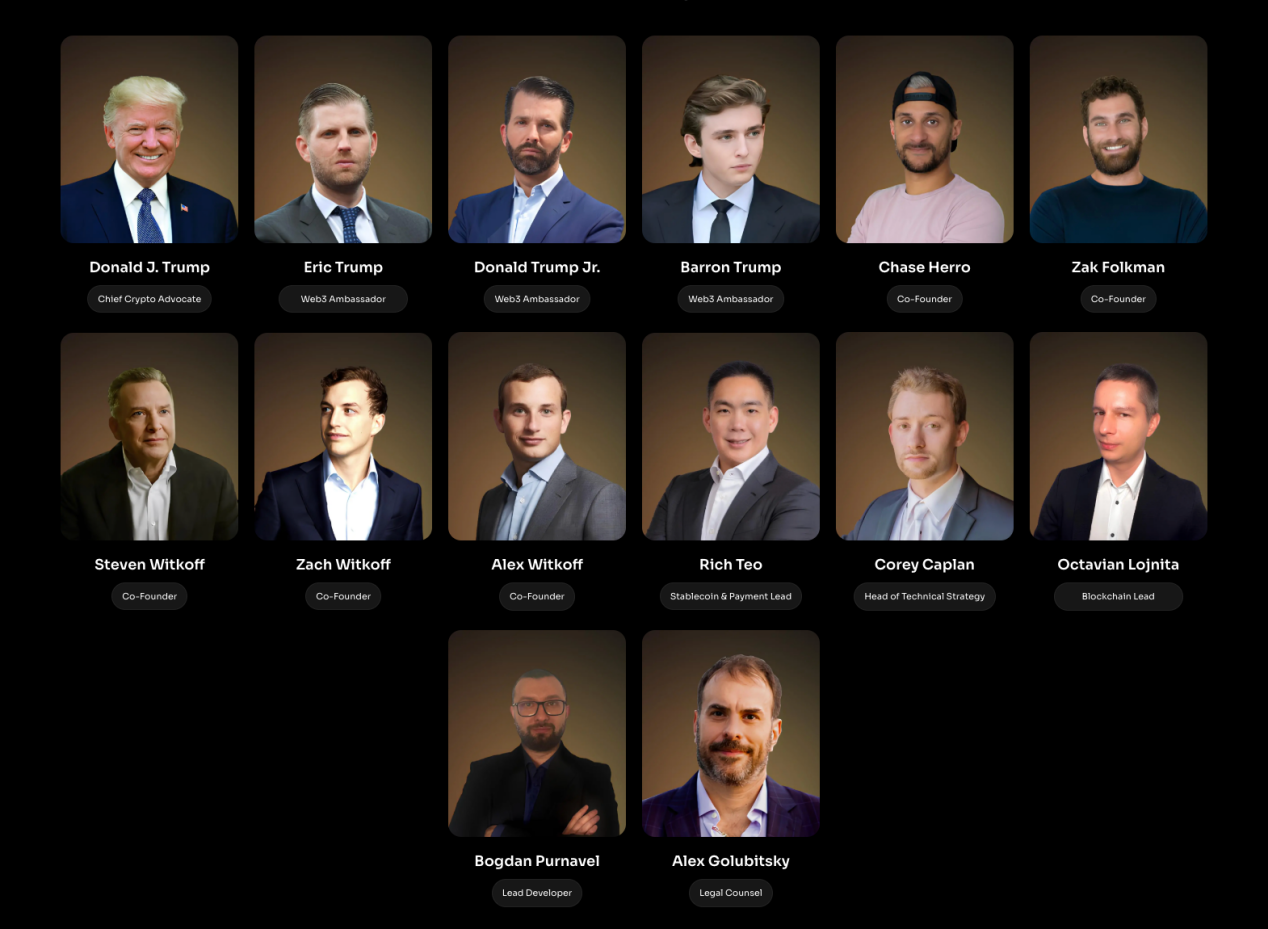

In addition to the MEME coin launched by Trump himself, the most important project of the Trump family at present is World Liberty Financial (hereinafter referred to as WLFI). Although the official website of the project states that Trump, his family members, and companies are not employees of the project, Trump’s three sons are all titled “ambassadors” in the project, and Trump’s close ally Steve Witkof (who was named Nominated as Special Envoy to the Middle East) and his son both serve as co-founders of the project. In addition, the advisory team also includes partners and CEOs from well-known investment institutions in the industry such as Polychain and Scroll.

The project is legally isolated from the Trump family, but this kind of publicity, including the efforts of several Trump sons to promote the project, makes it difficult for the market to interpret that this is a project of the Trump family.

The overall legal status of the WLFI project is relatively complete, and it has circumvented current regulations through various means, such as non-transferability of tokens, fundraising through Regulation D Rule 506(c) of the U.S. Securities and Exchange Commission (SEC), etc. These measures Minimize compliance risks for the entire project. The project is still raising funds publicly. At present, the total token scale is 20 billion, and 5.49 billion have been sold so far. Since the tokens are currently non-transferable, the overall progress is not as expected.

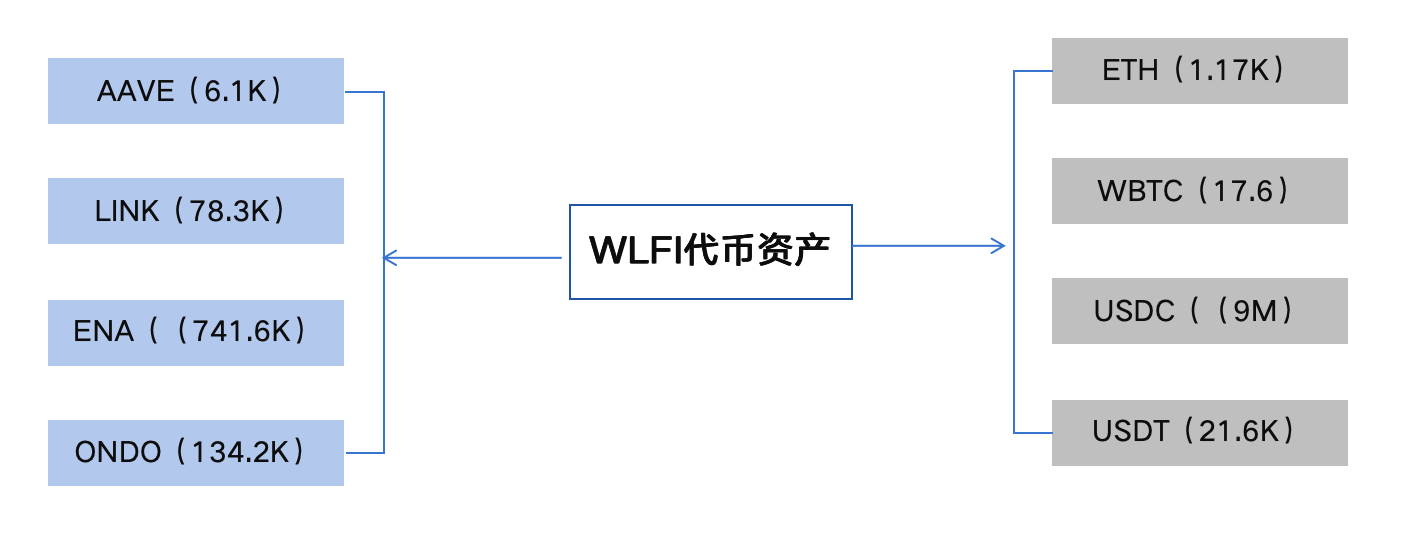

Regarding the specific operation of the project, the initial information given is that it is a Defi project, mainly building decentralized lending based on Aave. There is currently no relatively clear specific operation page. Another thing worthy of attention is that since the end of November, the WLFI project has begun to buy a large number of tokens. Due to its Trump-endorsed nature, this has also made the project’s token purchases a new market benchmark. Overall inventory, project The main areas and tracks involved are as shown in the figure below:

As can be seen from the tokens held in the picture above, the WLFI project as a whole due to its own Defi positioning, and after announcing its cooperation with ENA in December 2024, among the tokens it purchased, in addition to BTC, Ethereum and stablecoins In addition, it is mainly related to Defi. From a transaction perspective, except for Coinbase, other major operations are performed on CowSwap.

From the configuration of the entire team, it can also be seen that most of WLFI’s core team are from Defi. For example, the technical leader Corey Caplan, the Dolomite project he worked for earlier was also a Defi project, and the chief developer Bogdan Purnavel was previously a developer of the Defi project Dough Finance.

It can be seen from the recent series of actions that, whether it is staffing or the purchase of token assets, the Trump family’s WLFI project is still focused on Defi as a whole, which points to expectations that there may be some more relaxed policies surrounding the Defi field.

3. What impact does the Trump family project have on the Defi track?

Trump’s MEME coin has undoubtedly brought huge room for imagination to the market, and it is rare in history for the president to issue coins in person. Putting aside considerations of profit factors, at least the general tone points to the loosening of the development of the entire industry in the next four years. regulatory environment. If we further analyze the specific operation of the project, we can see that it is not a hasty issuance of coins on a temporary basis, but has made full preparations in terms of the entire legal framework, compliance, and institutional cooperation. The certainty and super narrative of the presidential currency issuance are unique, thus creating a unique on-chain market. However, support for the industry is currently limited to loose expectations. In the long run, sustainability has yet to be verified. Trump The Pu family hopes to build WLFI into a sustainable project.

Judging from the series of operations and subsequent investments of the WLFI project, it can be roughly sorted out that the project has made some early responses based on regulatory compliance. Combined with the end of December 2024, the US Taxation Bureau proposed new DeFi tax regulations, which can be roughly It is inferred that there may be a corresponding system for DeFI in 2025. Systematized legislative supervision has been introduced. Although it may not be as strict as the previous plans proposed by the US Taxation Bureau and other departments, it is foreseeable that DeFI compliance will become an important measure that may be implemented in 2025, such as KYC (WLFI project) KYC, anti-money laundering, anti-terrorist financing, etc. are also required.

However, looking at a more optimistic scenario, the WLFI project, as the first non-MEME project promoted by the Trump family, on the one hand shows its optimism for the DeFi track, especially the future growth space of DeFi; on the other hand, from a policy perspective, Its compliance structure was designed and considered relatively comprehensively from the beginning, which means that the project clearly knows that after Trump comes to power, regulatory relaxation and comprehensive compliance may be promoted in parallel, which will benefit the entire industry. DeFI enters the mainstream view.

Judging from Trump’s own actions such as issuing coins, the composition of his cabinet, and the DeFi projects launched by his family, at least Trump’s support for the entire encryption industry has been relatively clear. However, to what extent has its supervision been relaxed? There is still uncertainty, and the market will continue to adjust expectations around these new policies, but at least before the 2027 U.S. midterm elections, the resistance to the implementation of many of Trump's policies has been significantly reduced, which is relatively good for DeFi and the entire crypto industry. critical period.

chaincatcher

chaincatcher