Ten Thousand Words Report: An in-depth analysis of the Solana MEV ecosystem from the aspects of MEV types, data, and mitigation mechanisms.

Reprinted from panewslab

01/17/2025·16days agoWritten by: Lostin

Compiled by: Glendon, Techub News

Key insights

-

On Solana, MEV operates differently from other blockchain networks, primarily due to its unique architecture and lack of a global memory pool. Off-protocol mempools must be developed independently and require adoption by a majority of stake holders in the network to operate effectively, which poses high technical and social barriers.

-

Jito discontinued its public memory pool service in March 2024, resulting in a significant revenue decline. This move reduced harmful MEV behavior, but also led to the rise of alternative memory pools that lacked transparency and primarily benefited specific groups.

-

Memecoin traders are particularly vulnerable to sandwich attacks because they set high slippage tolerances when trading illiquid and highly volatile assets. This type of user is more inclined to use Telegram trading robots to pursue faster transaction execution speed and instant notification services, and is relatively insensitive to the situation of transactions being preempted to be executed.

-

Marinade Finance’s Stake Auction Market (SAM) uses a competitive auction mechanism where validators directly bid against each other for pledge allocation through a “pledge-to-pay” system. However, this mechanism has been controversial because it allows validators making sandwich transactions to bid high to obtain more collateral, thereby increasing their influence in the network.

-

Most of the sandwich transaction behavior on Solana originates from a private mempool operated by a single entity, DeezNode. A key validator (address starting with HM5 H6) operated by DeezNode currently holds a delegated stake of 811,604.73 SOL, worth approximately $168.5 million, and this delegated stake has experienced significant growth in the past few months.

-

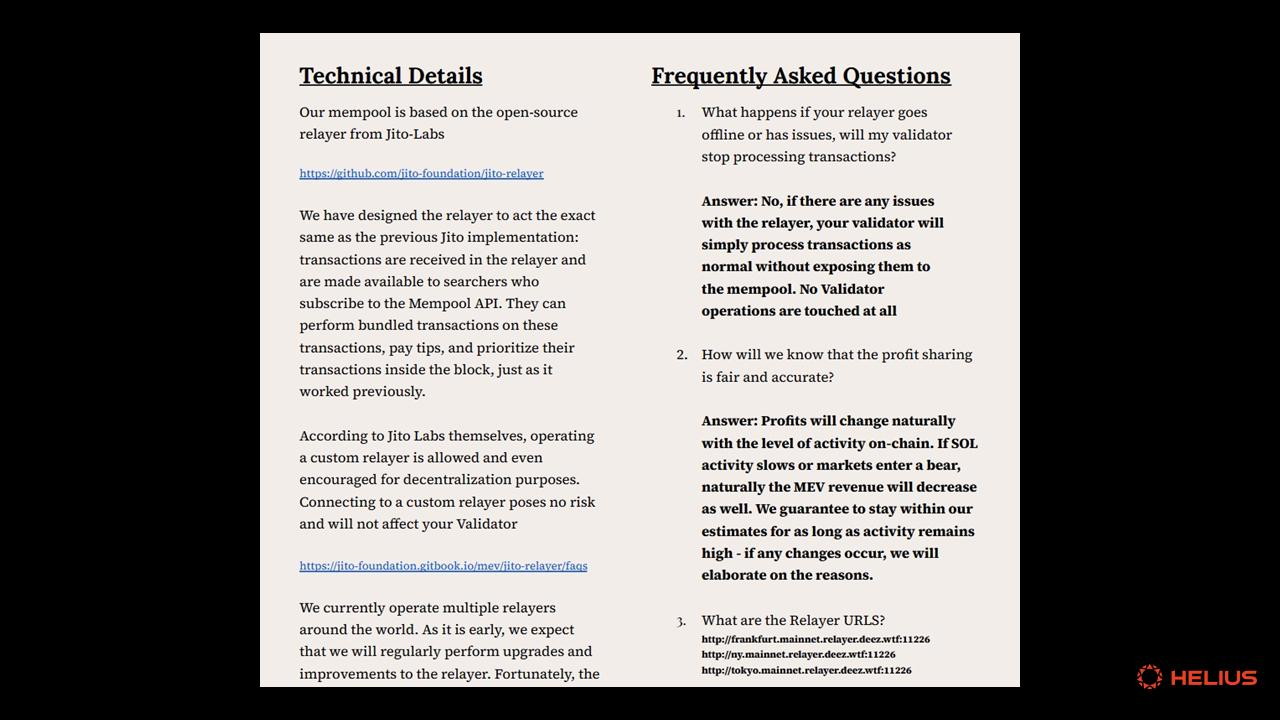

Multiple Solana validator operators reported receiving lucrative offers to participate in the private Mempool, including detailed documents outlining profit shares and expected earnings.

-

Jito bundles are the primary way for searchers to ensure that deal ranking is profitable. However, the Jito data does not cover the full scope of MEV activity; in particular, it does not capture searcher profits or activity through alternative memory pools. Additionally, many applications use Jito for non-MEV purposes, such as bypassing priority fees to ensure timely inclusion of transactions.

-

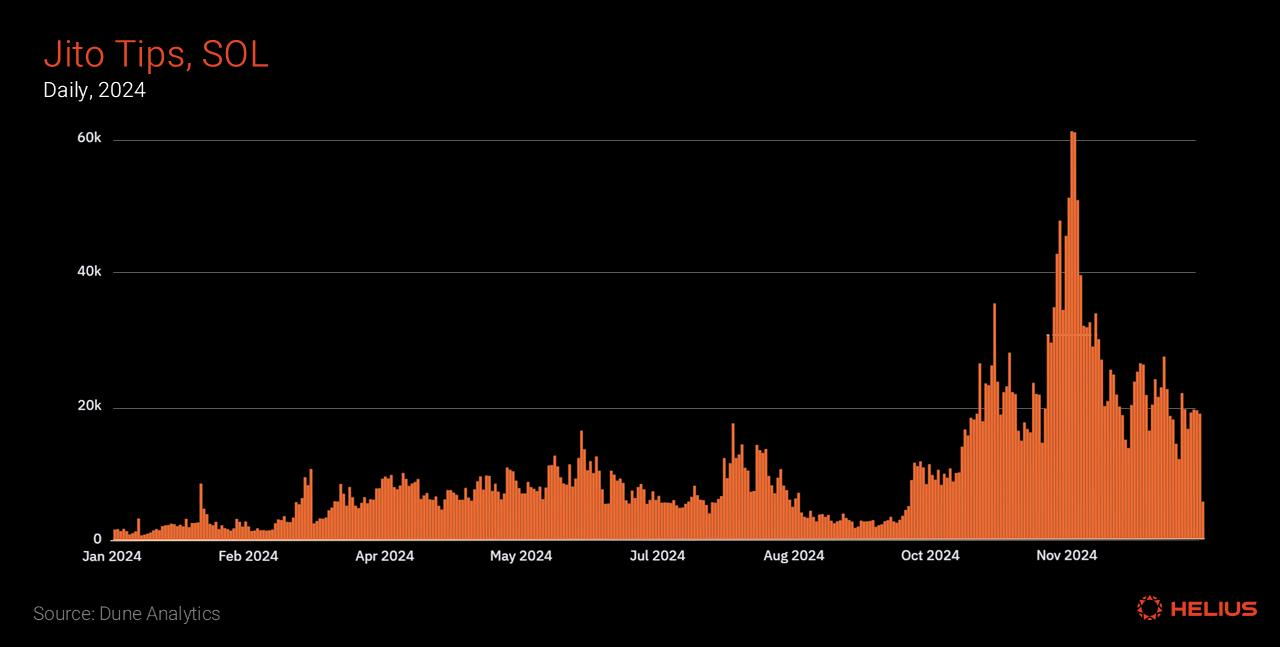

Over the past year, Jito has processed over 3 billion transaction bundles, generating a total of 3.75 million SOL in tips. This activity has shown a clear upward trend, growing from the tipping low of 781 SOL on January 11, 2024, to 60,801 SOL on November 19.

-

Jito's arbitrage detection algorithm analyzed all Solana trades, including those outside the Jito bundle, identifying more than 90.44 million successful arbitrage trades in the past year. The average profit per arbitrage trade was $1.58, while the single most profitable arbitrage trade generated a gain of $3.7 million, and these arbitrage trades generated a total profit of $142.8 million.

-

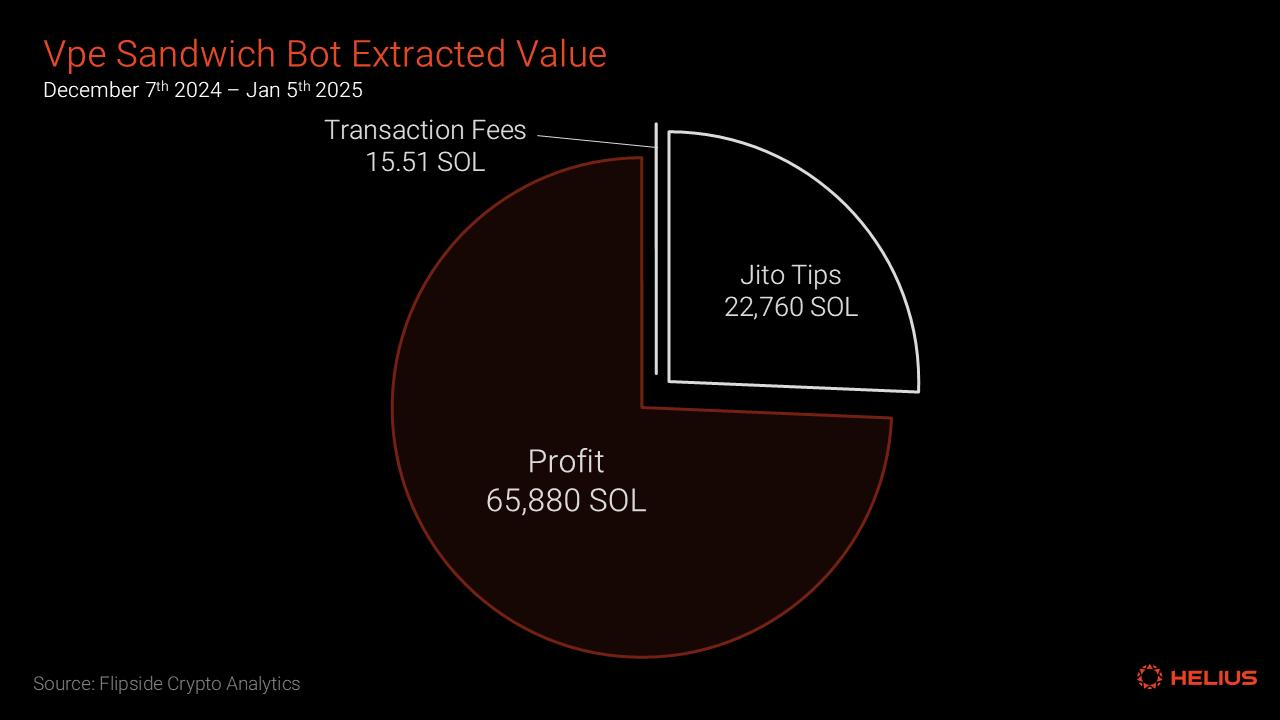

DeezNode runs a sandwich trading bot on the address starting with vpeNAL. Jito's internal analysis shows that almost half of the sandwich attacks against Solana can be attributed to this program. During a 30-day period (December 7 to January 5), the program executed 1.55 million sandwich transactions and made a profit of 65,880 SOL (approximately $13.43 million). The average profit per sandwich transaction was 0.0425 SOL ($8.67). On an annual basis, the program will generate profits of more than 801,500 SOL per year.

-

Whitelisting is widely seen as a last resort to combat bad actors, but it risks creating a semi-permissioned and censorship environment that is in direct conflict with the blockchain industry’s philosophy of decentralization. In some cases, this approach may also delay transaction processing, impacting the user experience.

-

Multiple Concurrent Leaders (MCL) systems offer a promising long-term solution to the pernicious MEV problem by allowing users to choose between leaders without incurring latency. If leader A acts maliciously, users can redirect their transactions to leader B, who is honest. However, it is expected that implementing MCL will require several years of development time.

Maximum Extractable Value (MEV) refers to the value that can be extracted by manipulating the ordering of transactions. This includes adding, removing, or reordering transactions within a block. Although the various manifestations of MEV are different, they all have one thing in common: they all rely on transaction ordering. Seekers (traders who monitor on-chain activity) attempt to strategically place their transactions before or after other transactions to capture value.

On Solana, MEV operates differently and uniquely from other blockchain networks, primarily due to its unique architecture and lack of a global memory pool. Features such as Turbine (for propagating status updates) and stake-weighted quality of service (SWQoS) for transaction forwarding, together shape Solana's approach to MEV. Its characteristics of fast streaming block production do not require reliance on external plug-ins or out-of-protocol auction mechanisms, which to a certain extent limits the application scope of traditional methods on certain types of MEV (such as front-running). To gain a competitive advantage, searchers run their own nodes or partner with high-stake validators to gain real-time access to the latest state of the blockchain.

Today, the term MEV is overused, and opinions vary on its exact definition. In fact, not all MEVs have negative effects. Due to the distributed and transparent nature of blockchain, it is generally believed in the industry that it is almost impossible to completely eliminate MEV. Networks that claim to have eradicated MEV either lack sufficient user activity to attract searchers or employ techniques such as random block packing, which may appear to mitigate the impact of MEV but may also trigger a surge in spam.

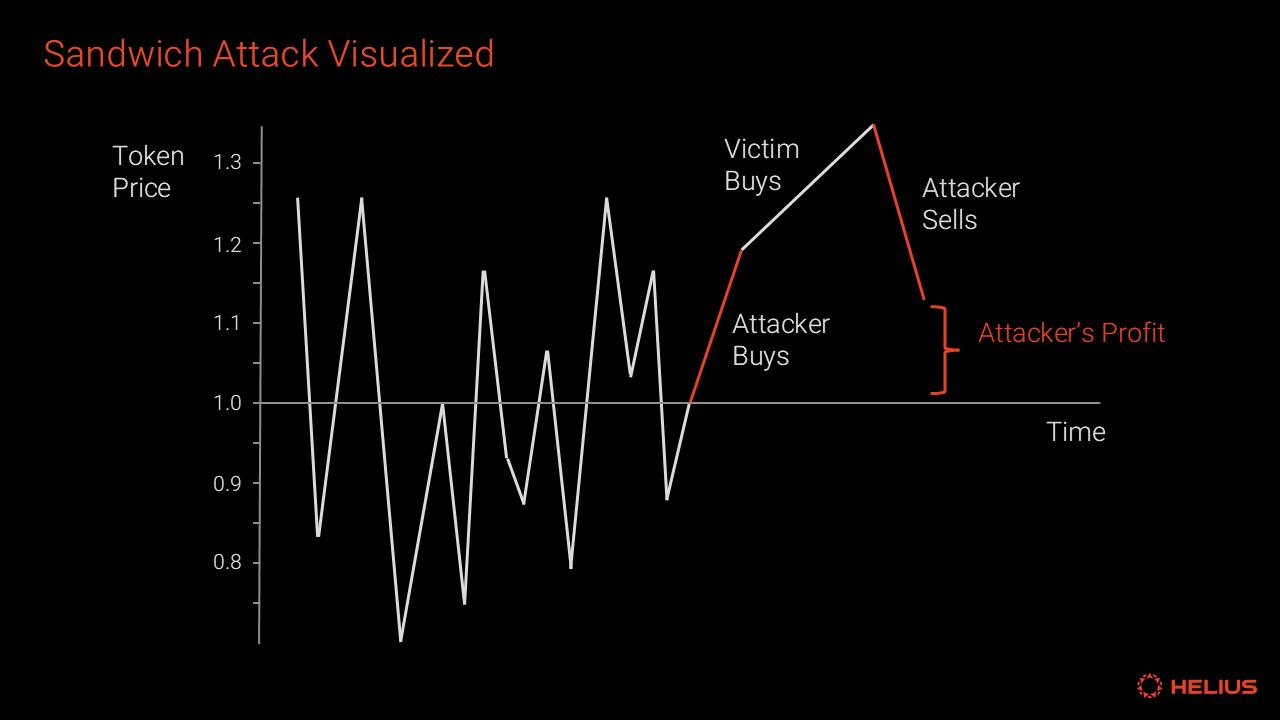

Among them, “Sandwiching” is one of the MEV types that has attracted the most attention, and it is extremely detrimental to users. In this strategy, the searcher inserts a trade before and after the target trade in order to profit from it. Sandwich trading is naturally profitable for searchers, but it increases transaction costs and lowers trade execution prices for ordinary users. A detailed discussion of this MEV type will follow.

Above: A visualization of a typical sandwich attack. The attacker conducts front-running and trailing trades before and after the victim\'s buy transaction to make a profit.

In this report, we will analyze Solana's current MEV landscape, which is divided into four parts:

1.Solana MEV Timeline : Outlines a series of key events arranged in chronological order, providing valuable background information for readers who are not familiar with the rapid development of MEV on Solana;

2. Types of MEV : Discuss the various MEV types currently observed on Solana through specific and detailed examples;

3.Solana MEV data: Provide relevant, quantifiable, and contextual data to illustrate the current scope and impact of MEV in Solana;

4.MEV Mitigation Mechanisms : Research is considering strategies and mechanisms for reducing or eliminating harmful forms of MEV.

Solana MEV Timeline

The following is a timeline of key events related to Solana MEV.

September 2021 to April 2022: Spam and DDoS attacks

NFT was the first area to gain significant attention on Solana. MEV in the NFT space mainly occurs during public events, where participants compete to acquire rare or valuable assets. There is no doubt that these activities create sudden profit opportunities for searchers, with no MEV potential in blocks minted before this and huge MEV potential in blocks minted subsequently. The NFT minting mechanism was one of the earliest causes of massive congestion spikes on Solana caused by spammy transactions sent by bots, which overwhelmed the network and caused block production to be temporarily halted.

Mid-2022: Introducing priority fees

Solana implements optional Priority Fees that users can specify in the Calculate Budget directive to prioritize their transactions. This mechanism enhances the network's economic model by enabling users to pay for accelerated processing during peak activity periods to alleviate network congestion and establishes a more efficient framework for the fee market.

Additionally, priority fees help curb spam by changing the playing field. Bots that previously relied on brute volume to gain an advantage are no longer able to dominate through spam alone. Instead, priority also depends on what the user is willing to pay.

August 2022: Jito-Solana client launched

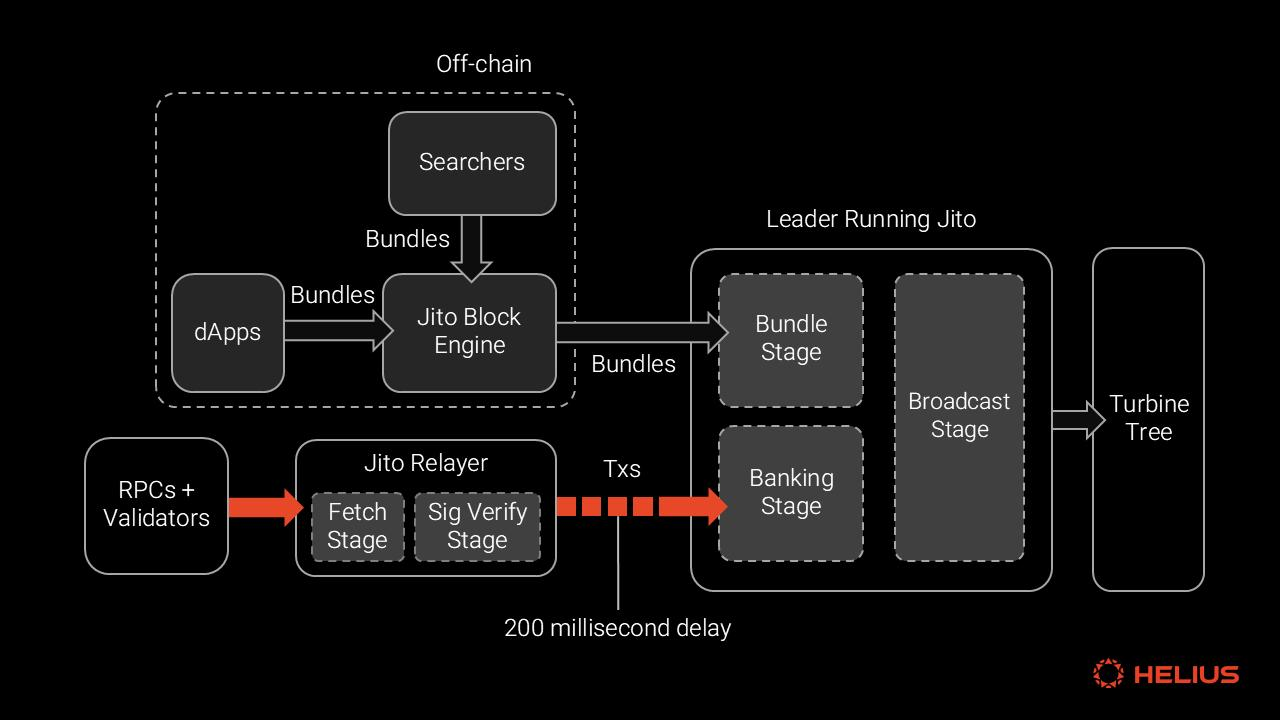

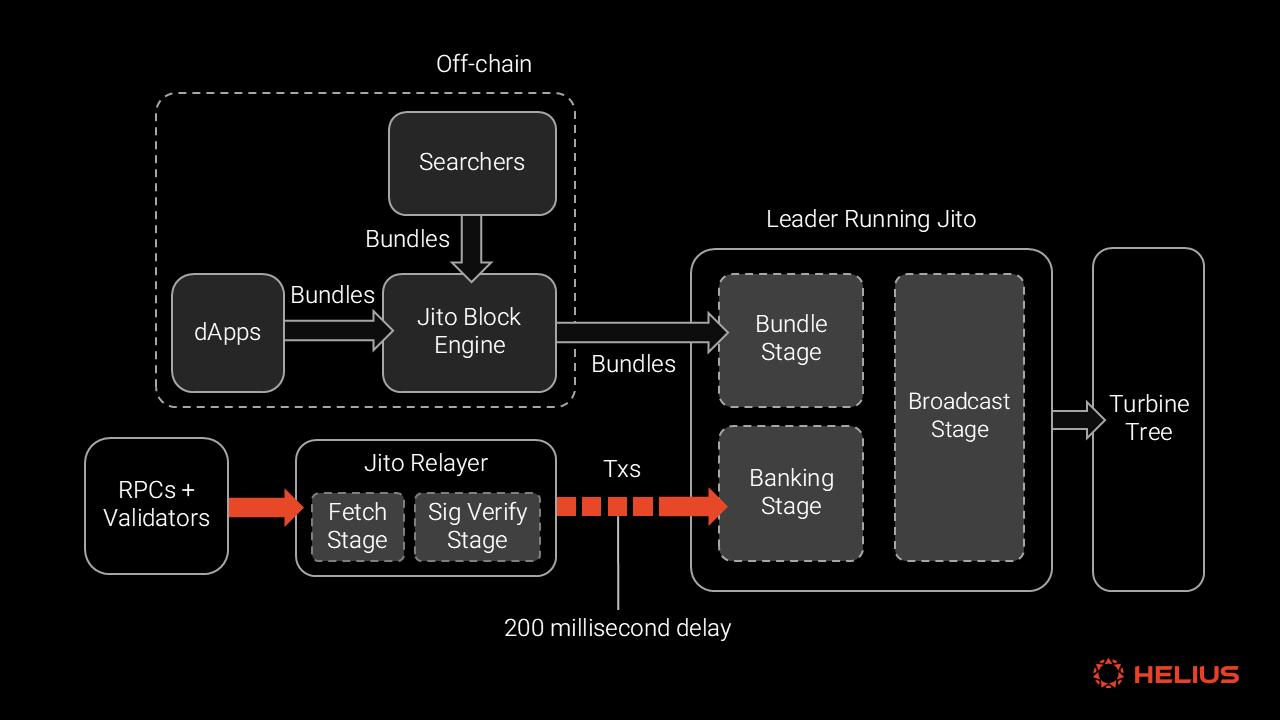

Jito has become the default Solana MEV infrastructure . This client aims to democratize MEV capture, ensuring a fairer distribution of rewards across the network. When leaders use Jito client validators, their transactions are initially directed to Jito relayers, which act as transaction proxy routers. The relay holds transactions for 200 milliseconds before forwarding them to the leader. This speed buffer delays incoming transaction messages, providing a window for off-chain auctions via the Jito block engine. Searchers and applications submit atomically executed transaction bundles with SOL-based tips. Jito charges 5% on all tips, with a minimum tip of 10,000 lamports. (Bundles can be inspected through the Jito bundle browser .)

Above: The current Jito architecture consists of a block engine that accepts searcher-submitted bundles and a relay that delays incoming transactions to the leader

This approach reduces spam and increases the efficiency of Solana's computing resources by conducting the auction off-chain and publishing only a single winner into a block. This is especially important considering that unsuccessful transactions consume a significant portion of the network's computing resources.

In its first nine months, Jito-Solana client adoption has been below 10% as network activity remains low and MEV rewards are small. Starting in late 2023, the adoption rate accelerated significantly, reaching 50% by January 2024. Today, over 92% of Solana validators (weighted by stake) use the Jito-Solana client.

January 2024: Memecoin Season Begins

Early 2024 saw a surge in online activity. Memecoins such as Bonk and DogWifHat gained popularity, sparking high interest from searchers and resulting in a significant increase in MEV activity. This period marked a significant shift in user behavior: Memecoin traders preferred Telegram trading bots such as BonkBot, Trojan and Photon to traditional decentralized exchanges or aggregators. These bots offer faster trading speeds, real-time notifications, and an intuitive user interface that appeals to retail speculators. It is worth noting that these traders are often willing to set higher slippage rates to ensure that time-sensitive transactions can be processed first, and are relatively less concerned about their transactions being preempted.

March 2024: Jito suspends its flagship Mempool feature

Jito's Mempool provides a 200 millisecond window for searchers to preview all incoming leader transactions. During its operation, the system was often used for Sandwich Attacks, which seriously degraded the user experience. In order to prioritize the long-term growth and stability of the network, Jito made the controversial decision to suspend its Mempool, sacrificing significant revenue in the process. While the move received widespread support, it was criticized by several prominent figures including Mert Mumtaz and Jon Charbonneau.

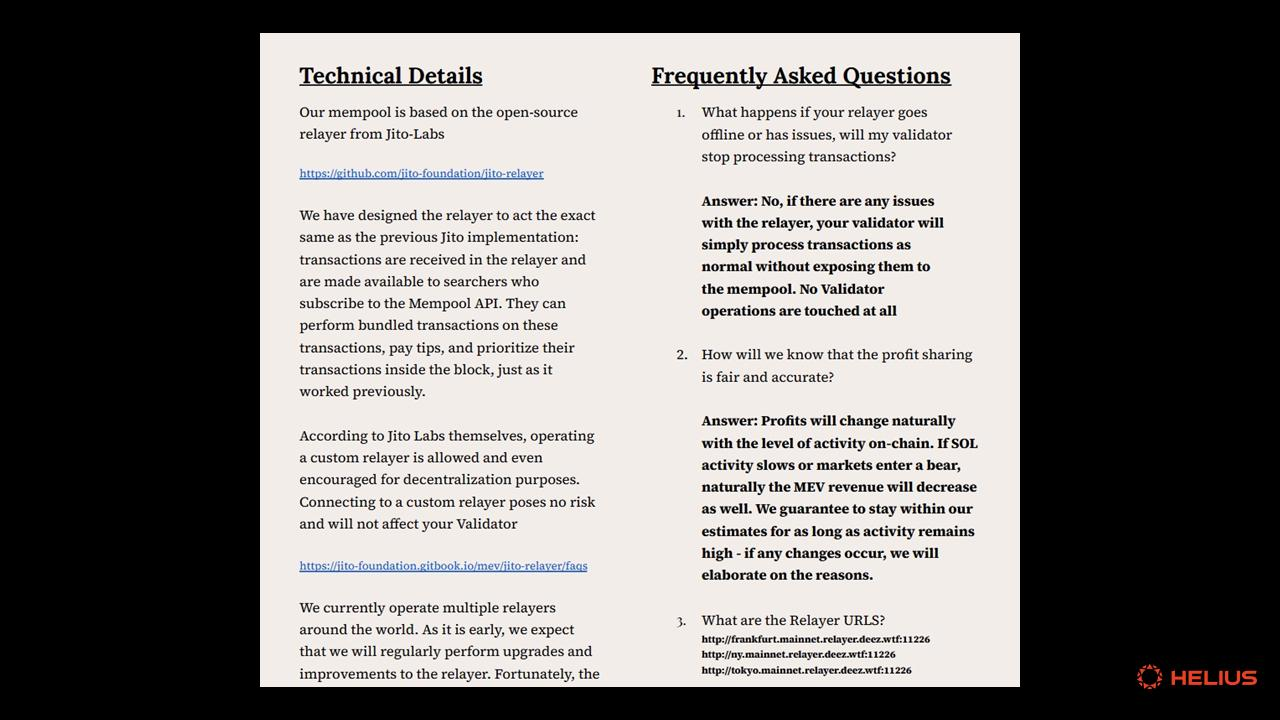

The main risk of this decision is that alternative memory pools may emerge that replicate Jito's functionality, allowing more harmful forms of MEV to emerge. Because unlike public memory pools, which facilitate a fairer distribution of MEV opportunities and mitigate power imbalances within the network, private permissioned memory pools lack transparency and benefit only a select few with access.

Above: _[Part of the DeezNode MEV proposal regarding\"DeezMempool\"](https://drive.google.com/file/d/1SaOBWQ-nkE2i7-2MJ-hIsjJpGA4fpNQM/view?pli=1)_ . Shortly after Jito Mempool was suspended, multiple validators reported receiving DeezNode MEV proposals.

Multiple Solana validator operators reported receiving lucrative offers to participate in the private Mempool .

May 2024: New transaction scheduler

As part of the Agave-Solana 1.18 update , a new scheduler significantly improves Solana’s ability to order transactions in a deterministic manner. The improved scheduler can better prioritize transactions with higher fees to increase their likelihood of being included in a block. The central scheduler builds a dependency graph called a "prio-graph" to optimize the processing and prioritization of conflicting transactions across multiple threads.

Previously, bots engaged in arbitrage and other MEV activities were incentivized to increase their chances of successful execution by spamming leaders. The randomness of the old scheduler resulted in variability in transaction positions within blocks. However, new deterministic methods reduce this randomness, suppressing spam and improving the overall efficiency of the network.

June 2024: Marinade launches Staking Auction Market (SAM)

Marinade Finance's Staking Auction Market (SAM) uses a bidding auction mechanism in which validators directly bid against each other to obtain pledge allocations through a "pledge-to-pay" system. This structure incentivizes validators to bid to the highest rate they believe is profitable. However, this mechanism has been controversial because it allows validators making sandwich transactions to bid high to obtain more collateral, thereby increasing their influence in the network. Marinade Labs recently proposed the creation of a public committee to oversee delegation practices . After Jito, Marinade Finance’s mSOL has become the second largest liquid staking token and staking pool on Solana.

Above: Pledge bidding in _[the Marinade Finance pledge auction market](https://psr.marinade.finance/)_ (December 27, 2024)

As of epoch 717, validators with 0% staking commission and 0% MEV commission typically provide stakers with an APY (annualized yield) of approximately 9.4%. Validators that use off-protocol methods to redistribute block rewards typically offer 10% APY or less. In comparison, Marinade's SAM auction showed a winning APY of 13.73%, with the top ten validators bidding a whopping 18.27% APY.

This discrepancy suggests that these validators are either bidding unreasonably and suffering losses as a result (they may be subsidizing their bids through staking delegation from the Solana Foundation), or supplementing their income through other sources such as MEV extracted from user sandwich transactions .

December 2024: Concerns grow over new private mempools

Solana MEV became a controversial topic after Solana research firm Temporal publicly expressed concerns about the potential centralization of staking on the network , sparking widespread discussion and once again prompting ecosystem teams to address the challenges posed by Solana MEV.

Validators who perform harmful MEV withdrawals receive a disproportionate amount of value for their contributions, causing their stake to grow much faster than other validators. This allows validators to accumulate greater network influence over time, thereby introducing centralization risks to Solana's validator economy. These higher-yield validators can also offer higher rewards to stakers, thereby attracting more pledges and further expanding their advantageous position.

It should be noted that most of Solana's sandwich transaction behavior originates from a private mempool operated by a single entity, DeezNode. A key validator (address starting with HM5H6) operated by DeezNode currently holds 811,604.73 SOL delegated pledges, worth approximately US$168.5 million. The validator's delegated staking has experienced significant growth, from 307,900 SOL on November 13 (the 697th epoch) to 802,500 SOL on December 9 (the 709th epoch). The growth has since stabilized. . It is worth mentioning that 19.89% of the pledges come from Marinade’s mSOL liquid pledge pool and Marinade’s native delegation. This validator currently holds 0.2% of the total staked volume (currently 392.5 million SOL), ranking 93rd by staked volume among the broader set of validators.

Jito’s internal analysis shows that an increasing number of sandwich attacks are occurring outside of Jito’s auction mechanism, suggesting the existence of additional block engines or modified validator clients conducting such transactions.

Type of MEV

Next, let's take a look at the various MEV types on Solana and illustrate each type with specific examples of actual transactions. The following are the most common MEV transaction types currently observed on Solana.

liquidation

When a borrower fails to maintain the collateralization ratio required for its loan under the lending agreement, its position becomes eligible for liquidation. Seekers monitor these undercollateralized positions on the blockchain and perform liquidations by paying off some or all of the debt in exchange for a portion of the collateral as a reward. Liquidation is considered a benign MEV type. They are critical to maintaining protocol solvency and promoting the stability of the broader DeFi ecosystem.

Clearing Transaction Example

This liquidation event occurred on December 10 and involved Kamino, the largest lending protocol on Solana by liquidity and user base. The transaction consists of three steps:

-

The searcher initiated the liquidation by transferring 10.642 USDC to Kamino reserves to cover the user's debt position.

-

In exchange, Kamino Reserve transfers 0.05479 of the user’s SOL collateral to the seeker.

-

The searcher paid the protocol fee of 0.0013 SOL.

In addition, the searcher paid a priority fee of 0.001317 SOL for this transaction, resulting in a net profit of $0.0492.

Above: Example of a clearing transaction on Solana’s Kamino currency market

arbitrage

Arbitrage uses price differences of the same asset to improve market efficiency and make profits by adjusting prices in different trading venues. These opportunities may occur on-chain, cross-chain, or between centralized exchanges and decentralized exchanges (CEX/DEX arbitrage). Among them, on-chain arbitrage guarantees atomicity because both parts of the transaction can be executed together in a single Solana transaction. In contrast, cross-chain and cross-platform arbitrage introduce additional trust assumptions.

Atomic arbitrage is the main form of MEV on Solana. The simplest example of atomic arbitrage occurs when two DEXs list different prices for the same trading pair. This typically involves leveraging outdated price information on a constant product model (xy=k) automated market maker (AMM) and executing hedging trades on an on-chain capped order book, at which point the market maker has adjusted for off-chain price movements Got a quote.

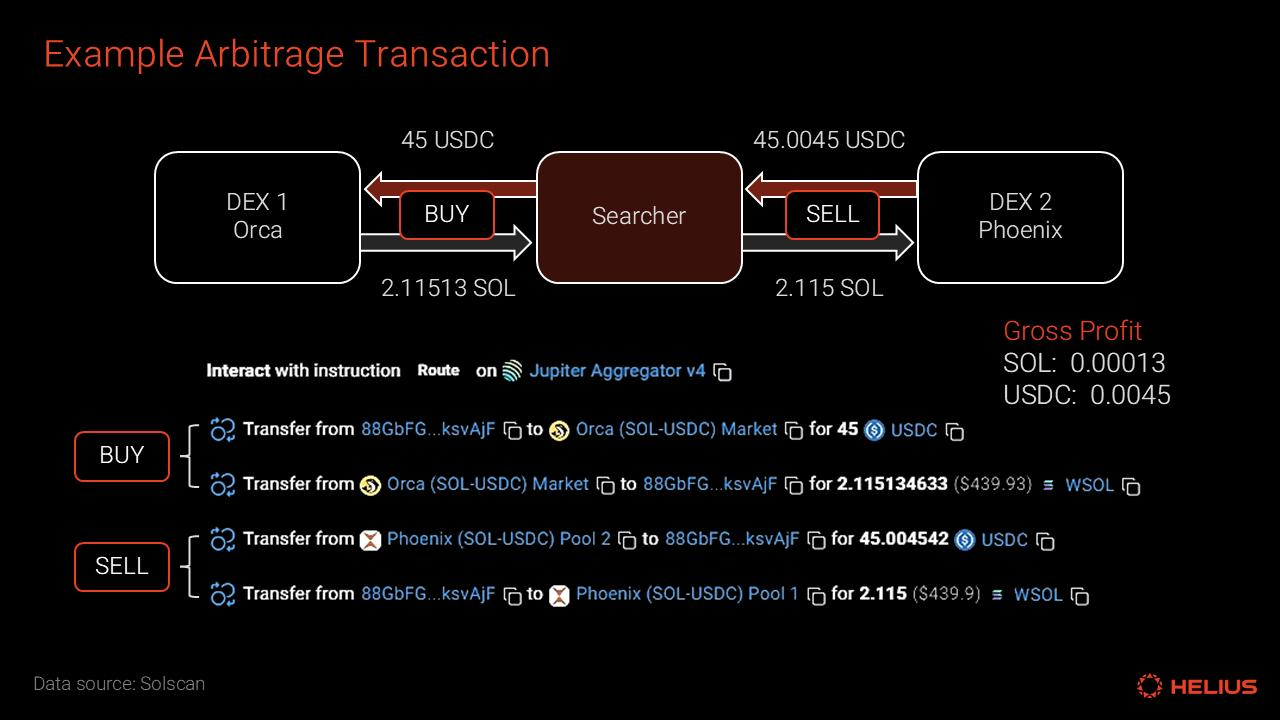

Arbitrage trade example

Above: Example of arbitrage trade between two decentralized exchanges

In this case, the price of the SOL/USDC trading pair has changed off-chain, prompting Phoenix market makers to update their quotes accordingly. Meanwhile, Orca AMM still bases its quotes on outdated prices, creating arbitrage opportunities for searchers. The searcher purchased 2.11513 SOL on Orca for 45 USDC, and then sold 2.115 SOL on Phoenix for 45.0045 USDC, making a profit of 0.00013 SOL (approximately US$0.026). Arbitrage trades are executed atomically and do not require the searcher to hold inventory. The only risk is that there may be fees if the transaction is reversed.

front-running

Front Running is when an MEV searcher identifies another trader's buy or sell order in the mempool and places the same order before that trader, profiting from the price impact of the victim's trade. .

Front-running occurs when an observer notices an unconfirmed transaction that could affect the token price and acts on this information before the original transaction is processed. This strategy is simple and straightforward and does not involve the complexity of other methods such as sandwich attacks.

The searcher realizes that there is a pending buy transaction that will have a positive impact on the price of the target token, so it bundles its buy transaction with the target transaction. Their order will be processed at a price below the target, and they will make a profit once the target trade is completed. In the process, the target trader suffered a loss due to the influence of the MEV searcher's buy trade, which caused him to buy at a higher price.

trailing trade

Back Running, the counterpart to front-running, is a specific MEV strategy that takes advantage of a temporary price imbalance caused by another trade, often due to improper routing. Once a user's trade is executed, trailing trade seekers balance the prices across pools by trading the same asset and ensure a profit. In theory, users could have captured this profit through more efficient trade execution.

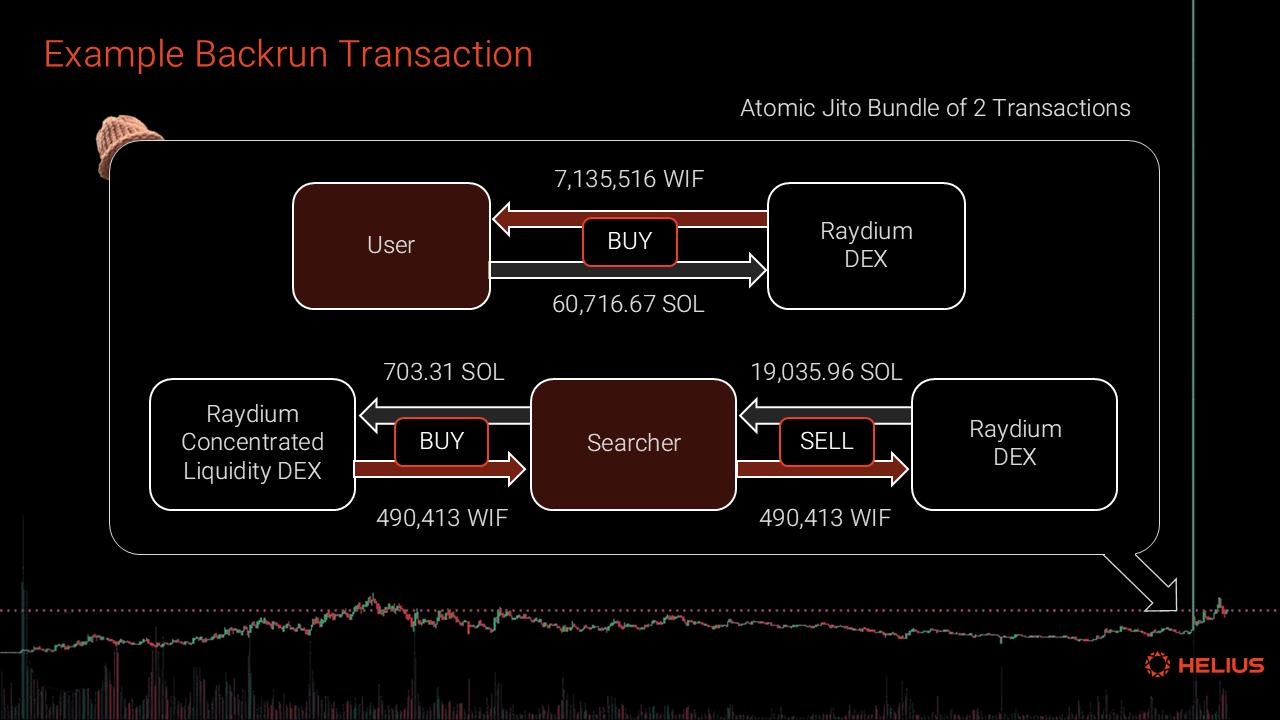

Trailing trade example

This famous tailgating transaction occurred on January 10, 2024, when a user purchased $8.9 million worth of DogWifHat token WIF in one transaction. At the time, the WIF token was trading at $0.20, and liquidity across all on-chain trading venues combined was only a few million dollars. The Jupiter aggregator executed the trade through three pools with limited liquidity, causing the price to surge to $3.

The searcher executed a trailing trade using the Jito Bundle and provided a generous Jito tip of up to 890.42 SOL ($91,621). They first exchanged 703.31 SOL ($72,368) for 490,143.90 WIF tokens through a Raydium centralized liquidity pool. They then exchanged these WIF tokens for 19035.97 SOL ($1,958,733) through the Raydium V4 liquidity pool. This series of operations resulted in a net profit of 17442.24 SOL ($1,794,746) in a single transaction. All dollar values reflect prices at the time of transaction.

Above: Trailing trades following a large purchase of WIF tokens in January 2024

sandwich attack

Sandwich Attacks are one of the most destructive types of MEV, specifically targeting traders who set high slippage tolerances on automated market makers (AMMs) or bonding curves. These traders increase their slippage tolerance not to accept worse prices, but to ensure that orders are executed quickly. Among them, Memecoin traders are particularly vulnerable to sandwich attacks because they tend to set a high slippage tolerance when trading illiquid and highly volatile assets, which ultimately leads them to trade at extremely unfavorable prices.

A typical sandwich attack involves three transactions atomically bundled together. First, the attacker executes an unprofitable front-running trade, purchasing an asset to drive its price to the worst execution level allowed by the victim's slippage settings. Next, the victim's trade occurs, and since it is executed at an unfavorable price level, the price increases further. Finally, the attacker completes a profitable trailing transaction, selling the asset at an inflated price, thereby offsetting his initial loss and making a net profit.

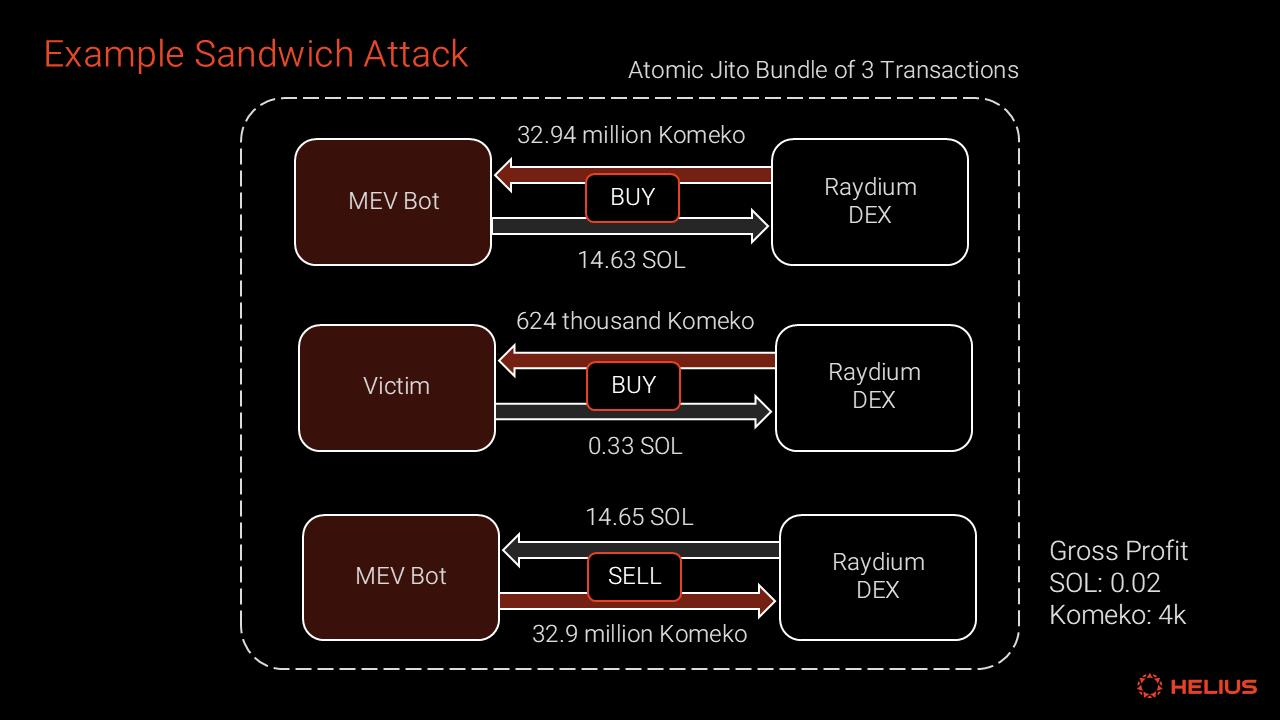

Sandwich Attack Transaction Example

The attack occurred on December 16, 2024, through a well-known sandwich attack program (vpeNALD... Noax38b). Searchers submitted these transactions as atomic Jito bundles and were tipped 0.000148 SOL (approximately $0.03 USD).

-

Pre-emptive transaction: The searcher paid 14.63 SOL to purchase 32.9 million Komeko tokens, a newly launched Memecoin on the Pump Fun platform;

-

Victim transaction: purchased 624,000 Komeko tokens with 0.33 SOL;

-

Trailing transaction: Seeker sells 32.9 million Komeko tokens for 14.65 SOL.

Above: An example of a sandwich attack bundling three transactions together

Characteristics that indicate this is a sandwich attack:

-

The signers of the intermediate transactions are different from the signers of the first and last transactions.

-

The tokens purchased in the first two transactions are the same tokens sold in the third transaction.

-

The token being traded is a newly minted, illiquid and highly volatile Pump Fun token.

The searcher made a net profit of 0.01678 SOL, which was approximately equivalent to $3.35 at the time of the transaction.

Solana MEV data

This section evaluates the current MEV profile of Solana using available public data. Start by analyzing Jito's performance metrics, then drill down into the number of Reverted Transactions and the breakdown of arbitrage profitability. It ends with a case study detailing the behavior and profitability of a well-known sandwich trading robot.

Jito

Jito bundles are the primary way for searchers to ensure that deal ranking is profitable. Most Jito tips come from demand at the top of the block from users who want to be among the first to buy the token or take advantage of the opportunity. However, the Jito data does not cover the full scope of MEV activity; in particular, it does not capture searcher profits or activity through alternative memory pools. Additionally, many applications use Jito for non-MEV purposes, bypassing priority fees to ensure timely inclusion in transactions.

Data from transfers to eight designated Jito tip accounts shows that over the past year, Jito processed more than 3 billion transaction bundles, generating a total of 3.75 million SOL in tips. This activity shows a clear upward trend, from the tip low of 781 SOL on January 11, 2024, to tips as high as 60,801 SOL and 60,636 SOL on November 19 and 20, respectively. Looking at the chart, there was a clear slowdown in the third quarter, with tips falling to a low of 1,661 SOL on September 7. Additionally, the value of tips through December 2023 is minuscule compared to the substantial increase through 2024 as a whole.

Above: _[Daily amount of Jito tips in SOL](https://dune.com/queries/3272756/5525700)_ (data source: Dune Analytics, 21co)

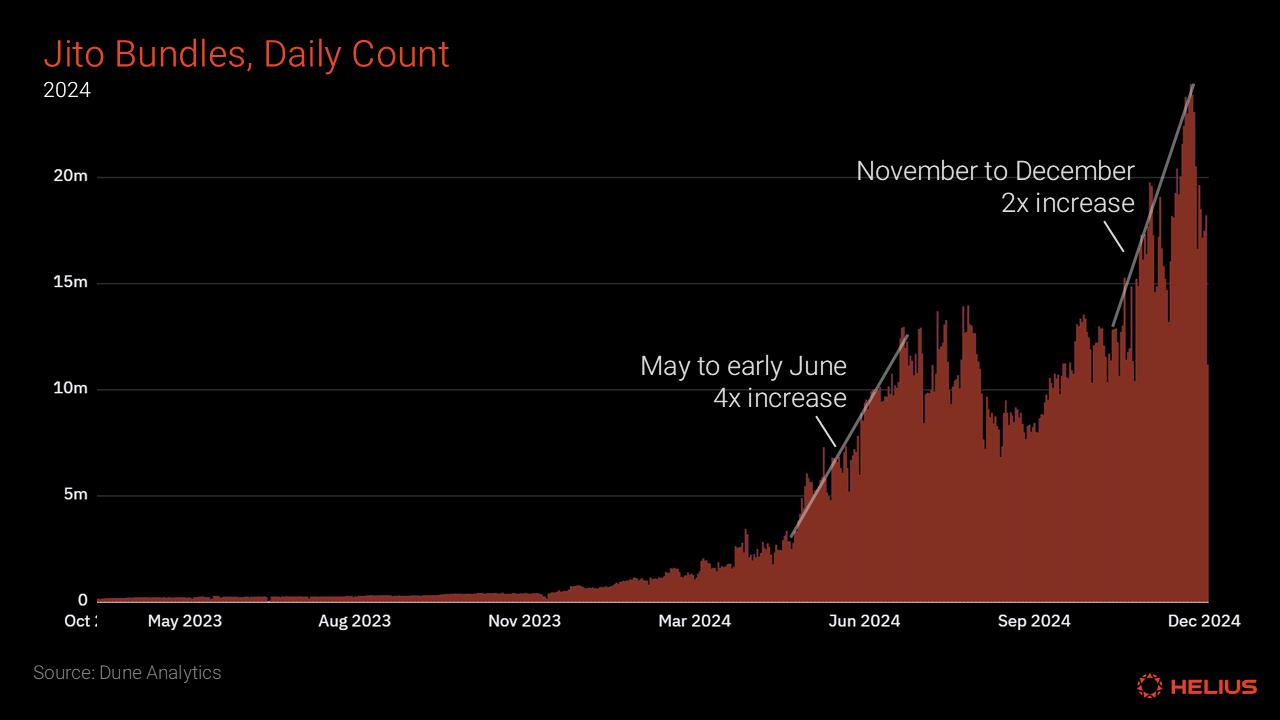

The number of bundles processed through Jito continued to grow throughout 2024, eventually reaching a peak of 24.4 million bundles on December 21. This increase included two significant surges. The first surge occurred between May and early July, with the number of daily bundles increasing from approximately 3 million to 12 million, possibly in response to network congestion issues. The second surge occurred between November and December, with the number of daily bundles doubling from approximately 12 million to a peak of 24 million.

Above: _[Daily volume of daily Jito tips (bundles) throughout 2024](https://dune.com/queries/3034383/5044506)_ (Data source: Dune Analytics, Andrew Hong)

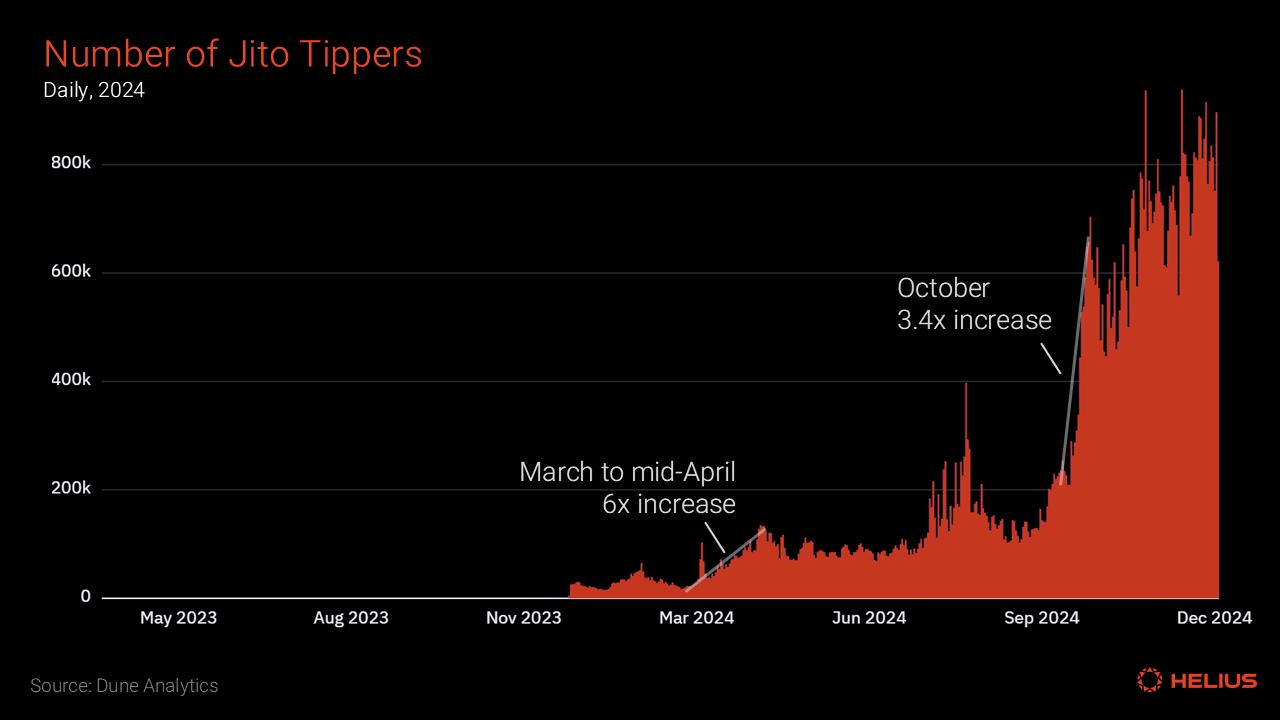

During this period, the number of accounts using Jito also showed a parallel upward trend. At the beginning of the year, there were approximately 20,000 tippers per day, reaching a peak of nearly 938,000 on December 10. Periods of significant growth include an increase from 21,000 in early March to 135,000 in mid-April (a 6-fold increase), and a significant increase from 208,000 in October to 703,000 at the end of the month (a 3.4-fold increase).

Above: _[Number of daily tippers on Jito](https://dune.com/queries/3034383/5046648)_ (data source: Dune Analytics, Andrew Hong)

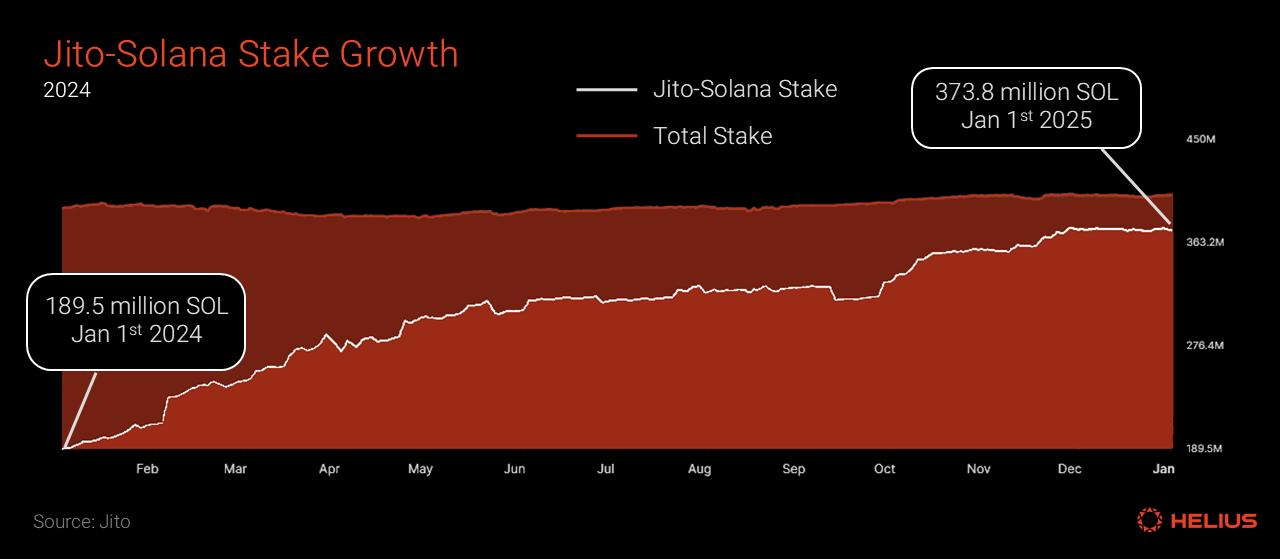

Adoption of the Jito-Solana client among validators has steadily increased throughout 2024, reinforcing the effectiveness of the Jito bundle for fast transaction inclusion. At the beginning of the year, validators using the Jito-Solana client staked 189.5 million SOL, accounting for 48% of the total pledged volume on the network. By early 2025, this number had increased to 373.8 million SOL, accounting for 92% of the total pledged volume.

Above: _[Jito-Solana validator adoption growth by staking volume in 2024](https://explorer.jito.wtf/fee-stats)_ (data source: Jito)

Undo transaction

A large portion of transactions on Solana are related to MEV extraction related spam. By examining the ratio of Reverted Transactions to successful transactions, we can identify patterns that indicate MEV bots competing to capture arbitrage opportunities.

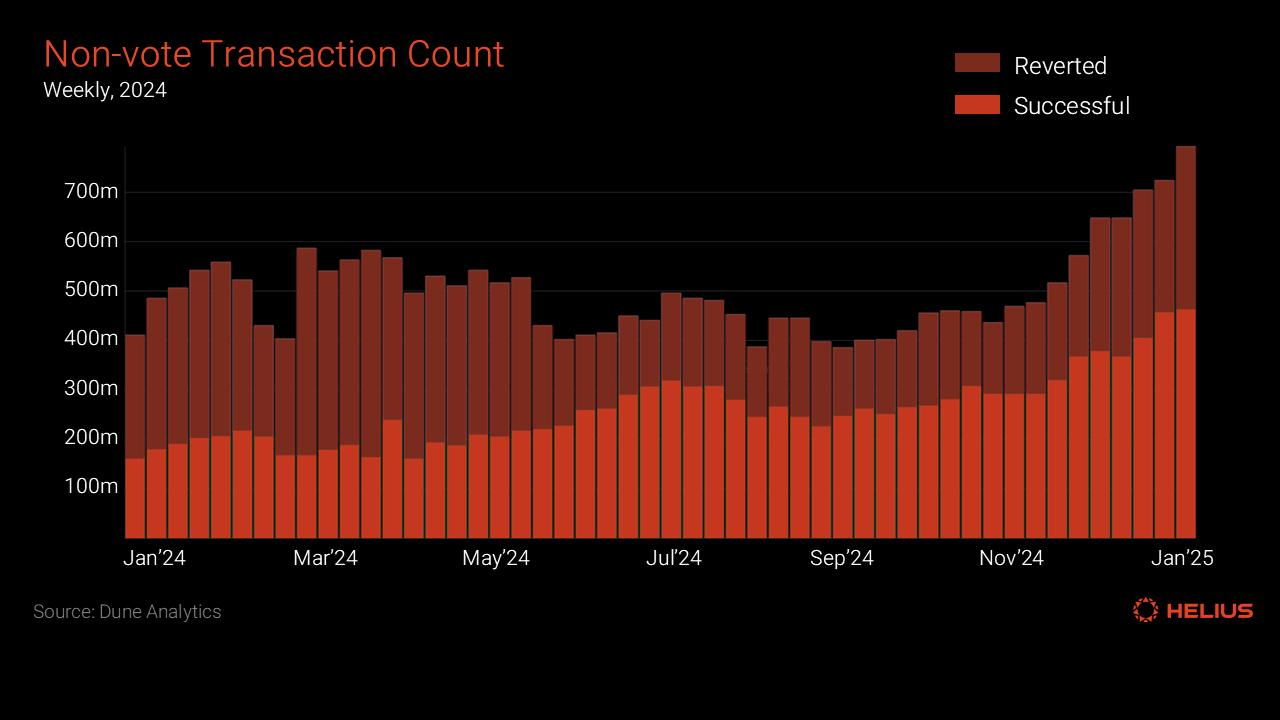

Above: _[Number of weekly reversals and successful non-voting transactions in 2024](https://solana.blockworksresearch.com/?dashboard=sol-onchain-activity¤cy=USD&interval=weekly)_ (Data source: Blockworks Research)

Spam poses a huge challenge as it causes many transactions to be reversed. Under the winner-take-all nature of MEV, only one trade can take advantage of a given opportunity. However, even after the opportunity is captured, the leader still handles other transactions trying to exploit the same opportunity. These reversed transactions still consume valuable computing resources and network bandwidth. Competitive latency races among searchers further exacerbate the problem, flooding the network with duplicate transactions and, in extreme cases, leading to congestion and degraded user experience. Due to Solana's low transaction costs, the canceled arbitrage spam still has a positive expected value. Over time, traders can achieve profitability by executing these trades on a large scale (although individual trades may fail).

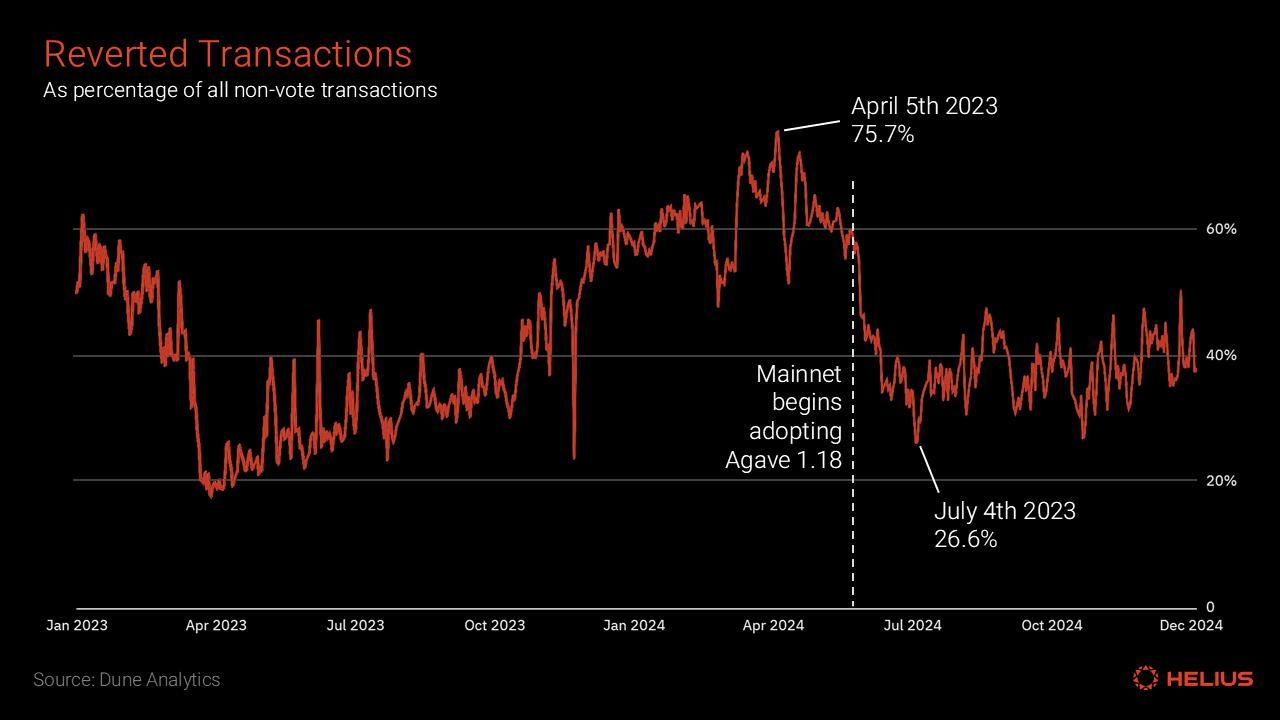

Reversal transactions peaked in April 2024, accounting for 75.7% of all non-voting transactions. That percentage dropped significantly after the rollout of key updates including the Agave 1.18 central scheduler. The new scheduler improves deterministic transaction ordering within the "Banking Stage", thereby suppressing the effectiveness of spam.

Above: _[Reversed transactions as a percentage of all non-voting transactions](https://dune.com/queries/3537204/5951285)_ (Data source: Dune Analytics, 21co)

Arbitrage Profitability

Jito's arbitrage detection algorithm analyzed all Solana trades, including those outside the Jito bundle, identifying 90,445,905 successful arbitrage trades over the past year. The average profit per arbitrage trade was $1.58, with the single most profitable arbitrage trade generating $3.7 million. These arbitrage trades generated a total profit of $142.8 million, of which $126.7 million (88.7%) was denominated in SOL.

Above: _[Arbitrage trading profits by token in 2024](https://explorer.jito.wtf/arbitrage-overview)_ (Data source: Jito)

Case Study: Vpe Sandwich Trading Program

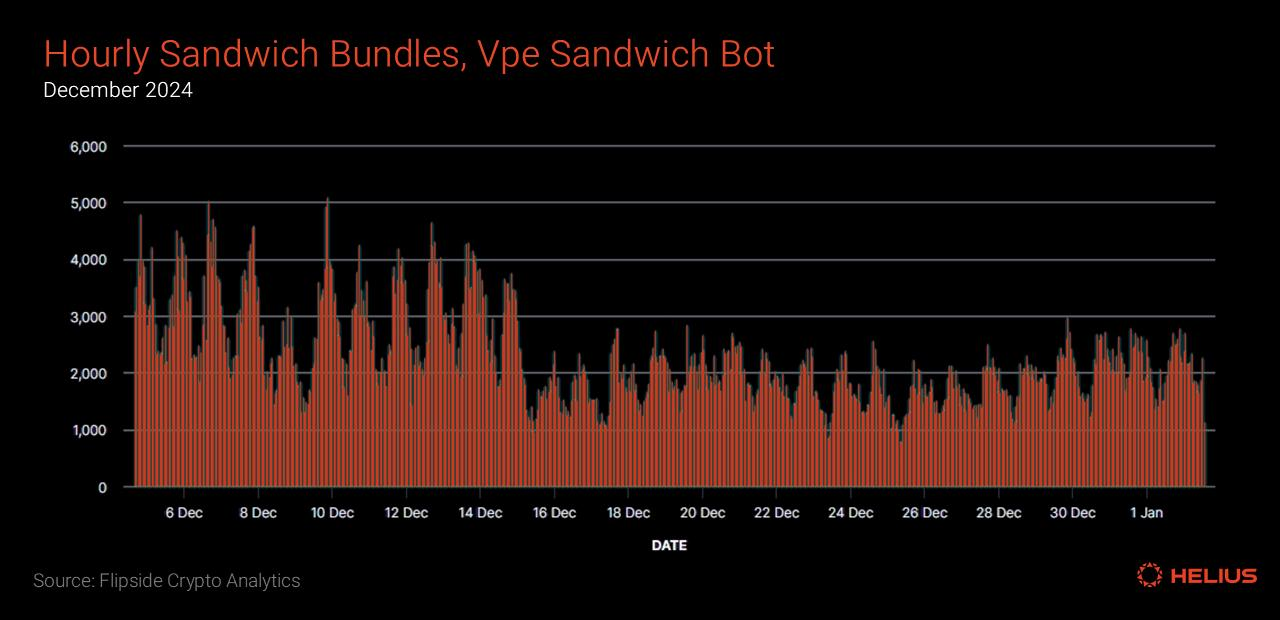

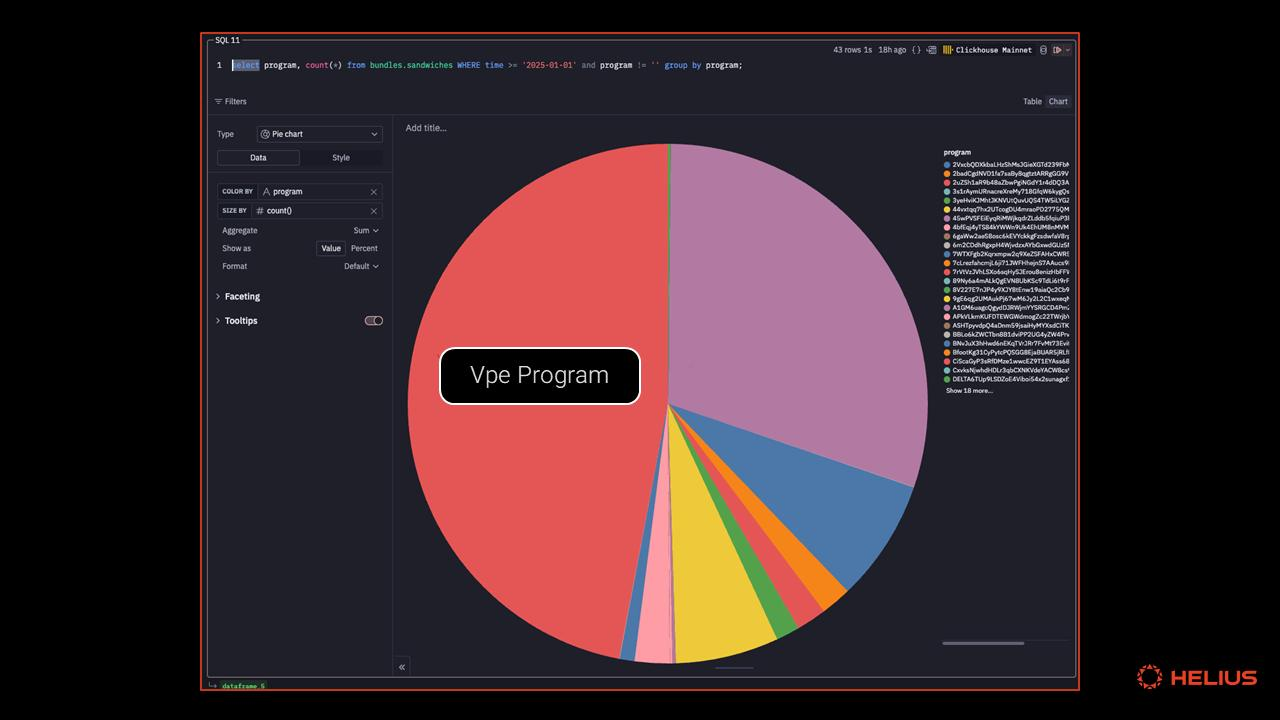

DeezNode runs a sandwich trading bot on an address starting with vpeNAL as part of its replacement mempool operation. This highly active program has recently gained notoriety for executing large-scale user sandwich attacks.

Above: _[Number of sandwich trade bundles initiated per hour by the Vpe sandwich trading program](https://flipsidecrypto.xyz/marqu/solana-mev---sandwich-bot-vpe-Sv-6sy)_ (data source: Flipside crypto analytics, Marqu)

Jito's internal analysis shows that almost half of the sandwich attacks against Solana can be attributed to this program.

Above: The Vpe program is the source of nearly half of Solana sandwich attacks (Source: Jito Internal)

During a 30-day period (December 7 to January 5), the program executed 1.55 million sandwich transactions, averaging about 51,600 transactions per day, with a success rate of 88.9%. The program generated a profit of 65,880 SOL ($13.43 million), equivalent to approximately 2,200 SOL earned per day. Jito tips paid by the program totaled 22,760 SOL ($4.63 million), an average of about 758 SOL per day, and the average profit per sandwich transaction was 0.0425 SOL ($8.67).

Above: Value extracted by the Vpe Sandwich trading bot from December 7, 2024 to January 5, 2025

Most victimized transactions involved exchanges through Raydium. Of the top 20 sandwich-attacked tokens, 16 were created on Pump Fun and can be identified by their token minting addresses ending in “pump.”

The Vpe sandwich trading bot is one of many on-chain programs that performs sandwich attacks. Click to visit Sandwiched.me to view sandwich attacks detected on Solana in real time.

Annualizing the December profit data, the program is expected to generate an annual profit of 801,540 SOL. In a worst-case scenario of network centralization, if these profits were all reinvested in validators that replaced the mempool, their network stake share would increase by 0.2%, assuming the overall network stake amount remained the same.

However, this worst-case scenario is unlikely for several reasons. First, the network's current activity levels are near all-time highs, and second, it's reasonable to assume that mempool searchers and operators will cash out some of their profits rather than reinvest all of the proceeds.

MEV Mitigation Mechanisms

Significant resources have been invested in researching and exploring various mechanisms to mitigate or redistribute MEV. Generic, off-protocol solutions are increasingly being integrated into applications and infrastructure to minimize the reach of on-chain MEV, and these mechanisms are detailed below.

Validator whitelist

One proposal is that stakers, RPC node providers, and other validators could exclude validators found to be conducting sandwich attacks by ignoring their leadership slots. However, whitelisting is widely viewed as a last resort. Assuming a leader is assigned four consecutive slots, this approach may delay transaction processing by several seconds, resulting in a poor user experience. What’s more, whitelisting has the potential to create a semi-permissioned and censorship environment, which is in direct conflict with the blockchain industry’s philosophy of decentralization. Additionally, such a system carries the inherent risk of incorrectly excluding honest validators, which could erode trust and participation in the network.

It is worth mentioning that some independent developers and applications are free to build their own validator allow or deny lists, such as the sendTransaction method in the Helius Node.js SDK.

Dynamic Slippage and MEV Protection

Traditionally, managing slippage has been a challenging and cumbersome process for users, who were required to make manual adjustments based on the token they were trading. This approach is particularly cumbersome when dealing with volatile or illiquid tokens, as the slippage settings suitable for stable assets such as liquid collateral tokens or stablecoins are significantly different from those suitable for Memecoins .

In August 2024, Jupiter Aggregator, the most popular retail trading platform on Solana, introduced Dynamic Slippage to solve this complexity. This algorithmic mechanism optimizes slippage settings in real time using a set of heuristics to calculate the ideal slippage threshold for each trade. Factors considered by these heuristics include:

-

Current market conditions

-

Type of token traded (e.g. stablecoin pair vs. volatile Memecoin)

-

The fund pool or order book through which the trade passes

-

User’s maximum slippage tolerance

These heuristics ensure that trades are optimized for success with minimal slippage, thereby reducing the scope for MEV withdrawals.

MEV protection mode is increasingly common among decentralized exchanges and Telegram trading bots. When enabled, user transactions will only be routed to the Jito block engine, significantly reducing the risk of sandwich attacks. However, this protection comes at the cost of slightly higher transaction fees, so even if MEV protection is offered, many Telegram bots will not choose to enable it. Because they focus more on rapid incorporation of transactions, prioritizing speed over reducing the risk of sandwich attacks.

quote request system

RFQ (request for quote) systems are gaining traction on Solana, allowing professional market makers to fulfill orders rather than on-chain automated market makers (AMMs) or order books. These systems employ signature-based pricing, allowing for off-chain calculations and the price discovery process to occur off-chain, while only the final transaction is recorded on-chain. Here are some examples:

Kamino Swap: An intent-based trading platform designed to eliminate slippage and MEV. Kamino uses the Pyth Express Relay to broadcast exchange requests to the searcher network, and the searchers participate in bidding to complete the transaction. The winning searcher provides the best execution price and tips the user. In the event of an arbitrage opportunity, a searcher may execute a trade at a better price than requested, resulting in a trade "surplus". Users benefit by retaining any surplus from their trades, thereby increasing their overall execution value.

JupiterZ (Jupiter RFQ): Starting in December, all exchanges on Jupiter will have JupiterZ enabled by default. This feature allows the exchange to automatically select the best price between Jupiter's standard on-chain routing engine and the RFQ system. With RFQ, users benefit from no slippage or MEV as trades are executed directly with off-chain market makers. Additionally, market makers bear transaction priority fees and there is no need for complex routing logic.

The RFQ system performs well with tokens that are widely traded on CEX. However, they are less effective for newer, less liquid, and more volatile on-chain assets. Unfortunately, these transactions are the ones most vulnerable to MEV attacks. Another disadvantage is that liquidity is moved off-chain, reducing composability.

AMM to prevent sandwich attacks

The anti-sandwich attack AMM (sr-AMM) is an experimental design based on the traditional constant product model (xy=k) AMM. Its core is to use geometric formulas to automatically adjust the token price in the fund pool.

sr-AMM uses slot windows to manage transactions. Trades within a slot window have an asymmetric impact on the buy and sell order pools:

-

When a buy order is executed, the selling price on the pool rises along the xy=k curve, while the buying price remains unchanged, effectively increasing the liquidity of the buying side;

-

Conversely, sell orders consume this buy-side liquidity, thereby reducing the quote determined by the xy=k curve.

At the beginning of each new slot window, sr-AMM is reset to the equivalent xy=k state, recalibrating the bid and ask prices. By decoupling these resets from individual transactions and maintaining consistent pricing within each slot window, sr-AMM breaks the atomic execution required for sandwich attacks, rendering them ineffective.

However, sandwich attacks are still possible at the boundaries between slot windows. If the leader controls consecutive slot windows, they can perform a front-running and target trade at the end of the first slot window, and then perform a trailing run at the beginning of the next slot window.

In November of this year, Ellipsis Labs released Plasma , an audited reference implementation of a sandwich-attack-resistant AMM design.

Conditional Liquidity and Order Flow Segmentation

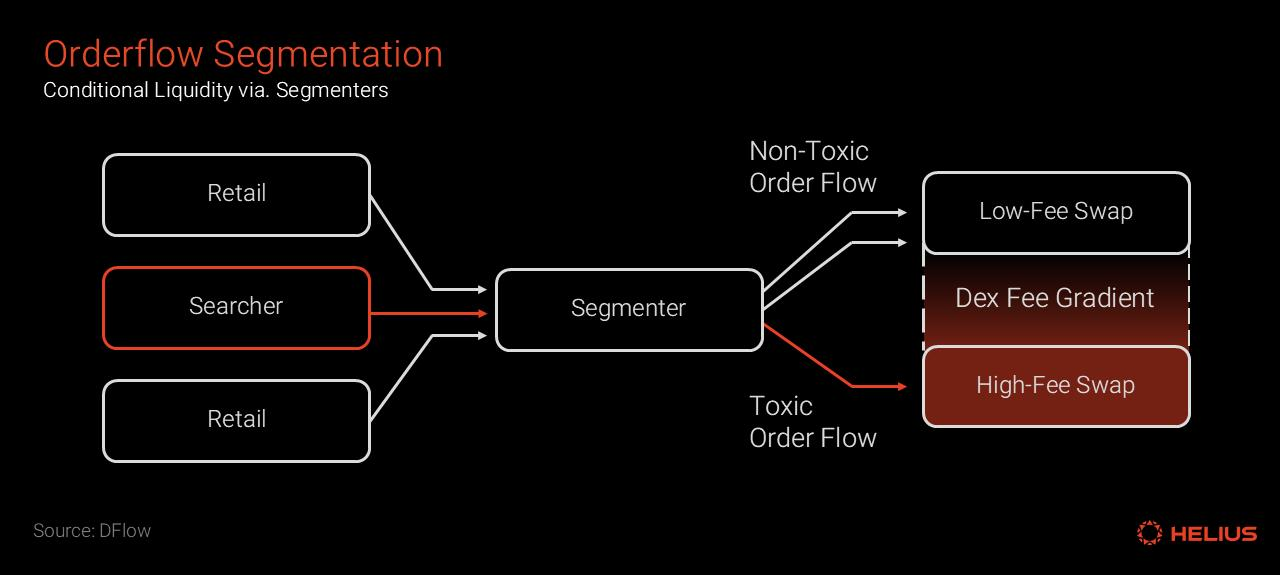

Decentralized exchanges (DEX) currently lack mechanisms to apply variable pricing to different types of market participants. This limitation stems from DEX's inability to accurately identify the cost of order flow to the DEX protocol. By narrowing price spreads to attract order flow, DEXs inadvertently increase their risk of adverse selection from sophisticated buyers.

Conditional liquidity introduces a new mechanism that allows DEXs to dynamically adjust spreads based on the “expected toxicity” (anticipated malicious behavior or potential harmful effects) of incoming order flow. This enables DEXs to express a wider range of on-chain real-time preferences. Rather than offering a single spread to all participants, conditional liquidity enables a DEX to present a gradient of spreads that is calibrated based on the perceived likelihood of adverse selection by a specific recipient.

This process relies on a new class of market participants, namely “segmenters”. Segmenters specialize in assessing the “toxicity” of order flow and adjusting spreads accordingly. They take a portion of the adjusted spread as compensation while passing the remainder to the wallet or trader. By setting accountability for managing spreads, segmenters enable DEXs to better compete for non-toxic order flow. Segments compete with each other to minimize the risk of adverse selection of liquidity providers. The most restrictive offers are reserved for traffic deemed least likely to harm liquidity providers. In its simplest form, a wallet or application can act as a segmenter for its own order flow. Alternatively, it could delegate responsibility for traffic segmentation to the market.

Users take advantage of this through "declarative exchanges," which allow them to declare exchange intentions and leverage segmenters for execution. These exchanges interact with existing Solana liquidity sources and DEXs that enable conditional liquidity. Declarative exchanges built with the Jito bundle provide traders with guaranteed quotes at signature time, while recalculating the best route before a transaction enters the network, ensuring compliance with the initial quote.

This approach significantly reduces the delay between route calculation and transaction finalization, thereby mitigating slippage. Additionally, declarative exchanges minimize the possibility of sandwich attacks when routed through a DEX with conditional liquidity enabled. These DEXs improve trading conditions for Solana users by providing tighter spreads for non-toxic traffic. As a result, declarative exchanges provide traders with the ability to reduce slippage, reduce latency, and increase protection against sandwich attacks, resulting in a more efficient and secure trading experience.

Paladin

Paladin-Solana is an improved version of the Jito-Solana validator client that includes Paladin Priority Port (P3) transactions during the bundle stage by introducing a minimal code patch (~2000 lines of code). The Paladin Priority Port (P3) facilitates high-priority fee transactions. Validators act as leaders to open this fast lane, allowing them to process valuable transactions in a timely manner. Each P3 transaction meets the minimum fee threshold (10 lambors per compute unit) and is passed directly to the packaging stage, where it is processed in the order in which it was received.

Paladin prioritizes high-priority fee transactions and proactively identifies and discards sandwich transaction bundles based on transaction patterns. While this may initially seem detrimental to validator rewards, Paladin validators can be compensated through a trust-based mechanism. Validators that avoid sandwich attacks can attract direct transactions, creating an ecosystem of trust and increasing yields.

Validators are incentivized by the prospect of receiving additional rewards and relying on the trust of P3 fast lane users. However, if they include a sandwich transaction bundle in the block, they may lose P3 transaction revenue. This trust is collateralized by PAL tokens.

The PAL token is designed to align the interests of validators, users, and the broader Solana community. It has a fixed supply of 1 billion tokens, 65% of which will be allocated to validators and stakers, and the remainder will be divided between Solana builders, the Paladin team, and a development fund. Validators can enable P3 transactions on their nodes by locking PAL, creating a decentralized, permissionless, and token-controlled mechanism for MEV withdrawal and transaction prioritization.

The project is still in its early stages and has not yet reached critical scale for widespread adoption. Currently, there are 80 validators running Paladin, accounting for 6% of the network's stake. Paladin claims to increase block rewards by 12.5%.

Multiple concurrent leaders system

Block producers maintain a monopoly on transaction inclusion within their allocated slots. Even if the current leader is known to maliciously perform a sandwich attack, users will be unaware, submit transactions and expect them to be processed immediately. Users cannot choose which node processes and orders transactions, making them vulnerable to manipulation.

The Multiple Concurrent Leaders (MCL) system introduces competition between block producers within the same period. Users gain the ability to select a leader without causing latency. If leader A is malicious and known to perform a sandwich attack, the user or application can choose to submit the transaction to leader B, which behaves honestly.

Maximizing competition among leaders in the long term involves shortening the duration, limiting the number of consecutive slots a single leader is assigned, and increasing the number of concurrent leaders per slot. By dispatching more leaders per second, users gain greater flexibility, allowing them to select the most favorable quotes from available leaders for trading.

Although MCL provides a compelling long-term solution to address MEV, its implementation is complex and may require years of development time.

Asynchronous execution (AE) is another potential method to reduce MEV. Under AE, blocks are constructed without executing or evaluating the outcome of each transaction. This speed poses a significant challenge to algorithms in calculating profit opportunities and executing effective sandwich strategies in a timely manner.

in conclusion

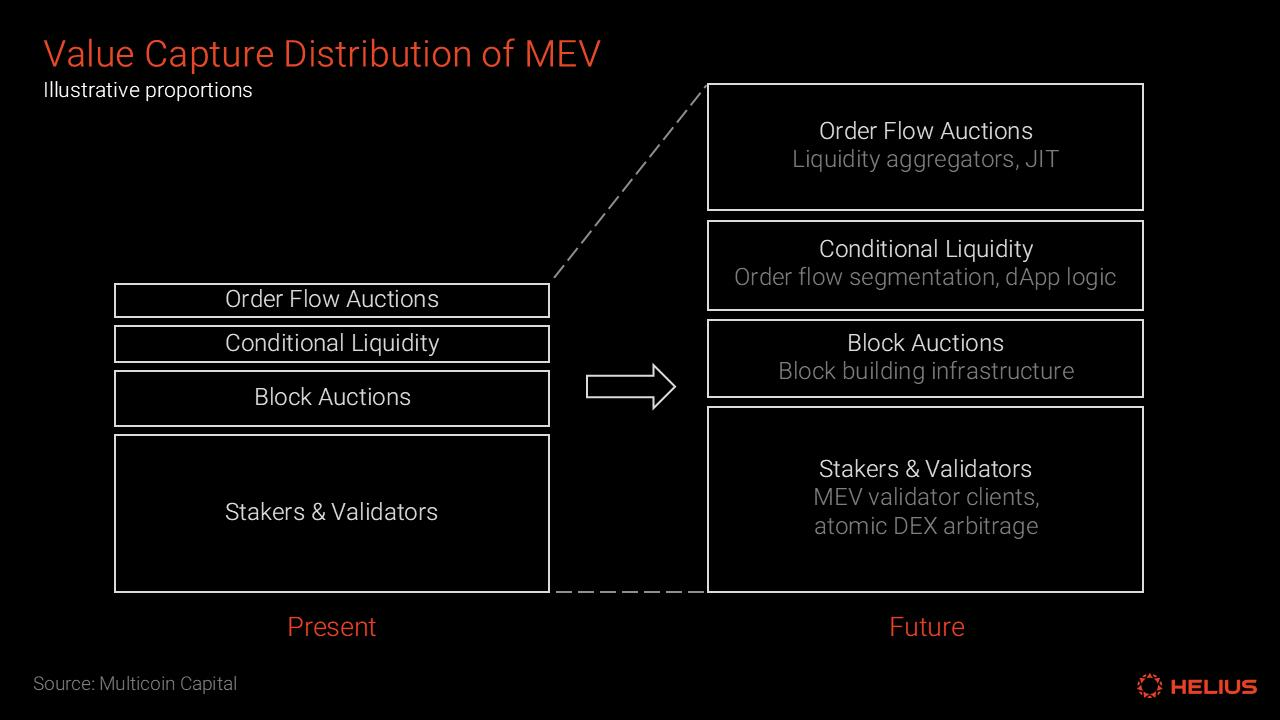

Solana's MEV landscape is rapidly evolving and is far from reaching a stable competitive equilibrium. Searchers continue to explore more complex strategies to capture value, while ecosystems deploy diverse infrastructure and mechanisms to mitigate the effects of harmful MEVs. Ecosystem investors with forward-looking vision, such as Multicoin Capital, are actively deploying funds. They believe that the value obtained by the ecosystem team from Solana MEV will increase significantly, and the pattern of this value distribution will change significantly in the next few years.

Above: _[MEV’s value capture distribution](https://youtu.be/NY_4W03VmFI?si=t-o0hKucRuax1syE)_ (Source: Multicoin Capital, Tushar Jain)

MEV is an inevitable challenge for any blockchain hosting significant financial activities. Properly addressing and managing this "MEV demon" is critical to the long-term success of the network. After emerging from the difficulties of 2023, Solana has definitely emerged stronger and is now a blockchain with high activity and growing user adoption. However, new challenges lie ahead. To achieve wider adoption, the ecosystem must address these challenges head-on. Currently, Solana is at a critical point in its development, which presents both challenges and valuable opportunities that will define its future.

jinse

jinse

chaincatcher

chaincatcher