The data comprehensively analyzes the flow of funds behind the growth of stablecoins by 100 billion. Altcoins have not increased, where has the money gone?

Reprinted from panewslab

04/07/2025·23DAuthor: Frank, PANews

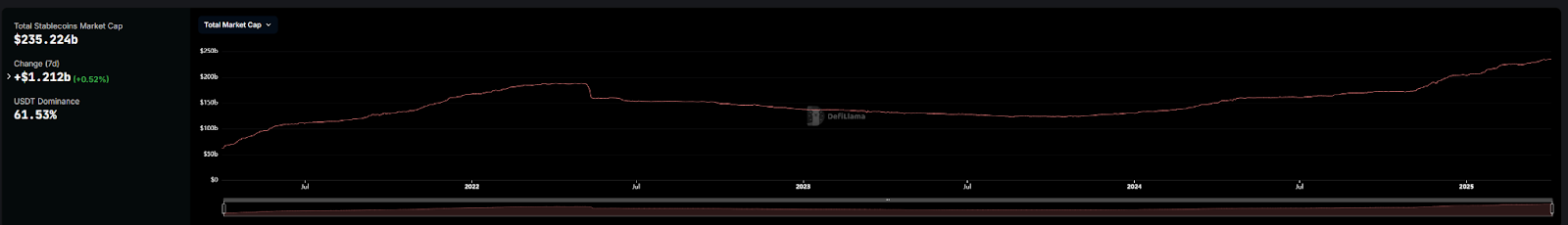

Since 2024, the global stablecoin market has exceeded US$235 billion with a growth rate of 80.7%, and the two USDT and USDC continue to dominate the market with an 86% growth contribution rate. But what is puzzling is that the 100 billion US dollars of incremental funds accumulated on the Ethereum and Tron chains have not driven the altcoin market to explode simultaneously like in the past cycle. Data shows that for every $1 new stablecoin added in this round, the market value growth of the altcoin is only leveraging the growth of the market value of US$1.5, a shrinkage of 82% from the previous bull market.

This article PANews will interpret the ultimate crypto problem brought about by the growth of stablecoins through comprehensive data analysis of stablecoins: Where has the money gone? While exchange balances soar and the amount of DeFi protocol pledges has increased, the over-the-counter transactions of traditional financial institutions, the penetration of cross-border payment scenarios, and the demand for currency substitution in emerging markets are quietly reshaping the capital flow map of the cryptocurrency world.

Stablecoins market value has increased by 100 billion US dollars, and

Ethereum and Tron still contribute 80% of their growth

According to defilama data, overall, from 2024 to the present, the number of stablecoins issuances has increased from US$130 billion to US$235 billion, with an overall increase of 80.7%. Among them, the main growth still comes from the two stablecoins UDST and USDC.

On January 1, 2024, the issuance of USDT was US$91 billion. As of March 31, 2025, the issuance of US$144.6 billion, an increase of approximately US$53.6 billion, accounting for 51% of the growth rate. USDC's issuance volume increased from US$23.8 billion to US$60.6 billion during the same period, accounting for about 35%. These two stablecoins not only account for 87% of the market share, but also contributed 86% of the share on the growth side.

According to the on-chain data, Ethereum and Tron are still the two public chains with the largest issuance of stablecoins. Among them, Ethereum's stablecoin issuance volume accounts for 53.62%, while Tron accounts for about 28.37%, accounting for a total of 81.99%.

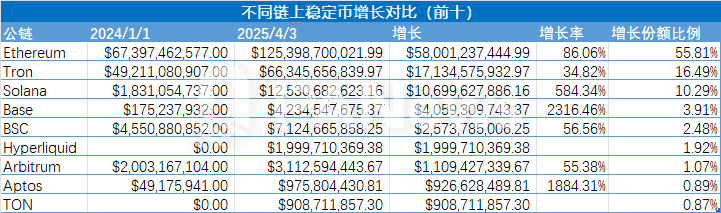

Among them, Ethereum's stablecoin growth from January 1, 2024 to April 3, 2025 was about US$58 billion, with a growth rate of 86%, which is basically the same as the issuance growth rates of USDT and UDSC. Tron's growth rate is about 34%, which is less than the overall growth rate of stablecoins.

The third-ranked public chain is Solana, which increased by US$12.5 billion in the same period, with a growth rate of 584.34%. The fourth is Base, which increased by US$4 billion in issuance, with a growth rate of 2316.46%.

Among the top ten, Hyperliquid, TON, and Berachain have only started issuing stablecoins in the past year. The three companies added about US$3.8 billion in stablecoin issuance, contributing a 3.6% share of stablecoin growth. Overall, Ethereum and Tron are still the main markets of stablecoins.

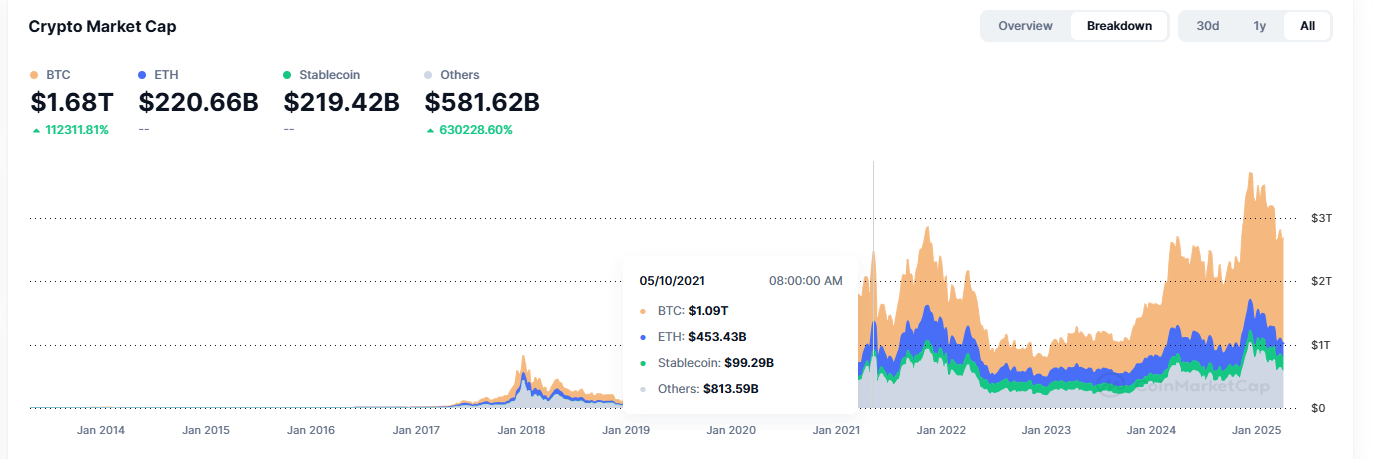

Every $1 new fund leverages the market value of altcoins

Although the on-chain growth of stablecoins is rapid, the market value growth of altcoins during the same period is not ideal.

For comparison, in March 2020, the overall altcoin market value was approximately US$39.8 billion (except BTC and ETH), and by May 2021, the altcoin market value rose to US$813.5 billion. The increase was about 19.43 times. The growth of stablecoin data during the same period increased from 6.14 billion to 99.2 billion US dollars, an increase of about 15 times, which is basically synchronous. The increase is basically synchronized.

During this bull market, the overall market value of stablecoins increased by 80%, but the overall market value of altcoins increased by only 38.3%, with an increase of about US$159.9 billion.

To review, for every USD increase in stablecoins from 2020 to 2021, the overall market value of altcoins rose by USD 8.3 for every USD increase in stablecoins. But in the 2024-2025 cycle, for every dollar increase in stablecoins, the market value of altcoins will only increase by $1.5. This proportion has shrunk significantly, which means that the newly added stablecoins do not seem to be used to purchase altcoins.

Where did the money go? This is a key question.

Public chain pattern reshuffle: Ethereum and Tron defend the country,

Solana and Base break the stage of growth

Intuitively speaking, the MEME boom on Solana during this cycle has always led to this bull market. However, during the hype process of MEME, SOL trading pairs are basically used, and there is not much room for stablecoins to participate. According to the results analyzed in the previous article, the growth of stablecoins is still mainly on Ethereum.

Therefore, to discover where the growth of stablecoins has gone, we may still need to analyze the trends of major stablecoins such as Ethereum or USDT and USDC.

Before the analysis, you may be able to list several possible directions, which is also a common speculation in the market about where stablecoins are going. For example, stablecoins are more used in payment scenarios, pledge income, value storage, etc.

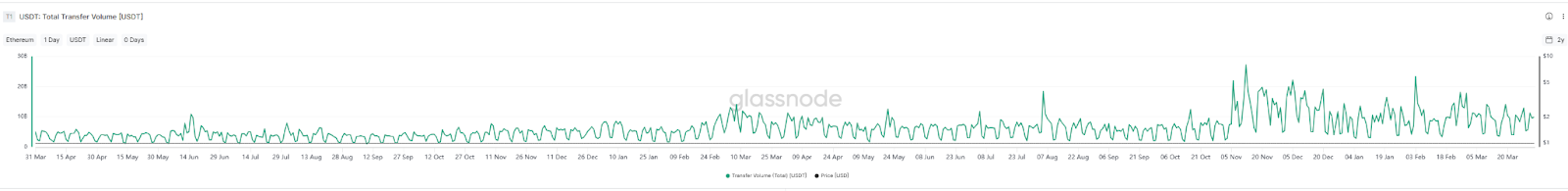

Let’s first look at the stablecoin trading situation of Ethereum. From the figure below, we can find that the trading volume of stablecoin shows regular fluctuations like heartbeats. Behind this fluctuation, there may be the usage rules of stablecoins.

When the cycle is shortened, you can significantly see that the fluctuation is a 5+2 fluctuation, that is, a 2-day sluggishness and a 5-day peak. After observation, we can see that the trough periods are all weekends, and the peak periods are basically gradually rising from Monday to Wednesday, and gradually falling on Thursday and Friday. This obvious volatility law seems to at least show that the initiators of these stablecoins mainly come from institutions or enterprises. After all, if it is dominated by consumer payment scenarios, this volatility should not be shown.

In addition, in terms of single-day transaction frequency, the highest peak USDT on Ethereum’s single-day transfers does not exceed 300,000, and the average transfer frequency and average transfer amount on weekends are usually much lower than those on weekdays. The above inference is further confirmed.

USDT pours into exchanges, USDC precipitates DeFi protocol

Judging from the distribution of positions, the exchange balance of USDT has increased significantly in the past year. The balance of the exchange was 15.2 billion on January 1, 2024. By April 2, 2025, this figure increased to 40.9 billion, an increase of US$25.7 billion, an increase of 169%. This increase is much higher than the overall issuance of stablecoins of 80.7%, and accounts for 48% of the increase in USDT's issuance in the same period.

In other words, in the past year or so, about half of the new issuance of USDT has flowed into the exchange.

However, the USDC situation during the same period was very different. On January 1, 2024, USDC's exchange holdings were about 2.06 billion, and by April 2, 2025, this number increased to 4.98 billion. During the same period, USDC issuances were issued 36.8 billion pieces, and only 7.9% of the new issuances flowed into the exchange. The overall balance of the exchange is only 8.5%, which is a big gap compared with USDT's 28.4%.

Most of the new issuances of USDT flowed into the exchange, but the new trade volume of USDC did not enter the exchange.

So where is the new USDC traffic going? This may explain to some extent the question of where the funds flow in the market.

From the perspective of coin holding addresses, the top coin holding addresses in USDC are basically from the DeFi protocol. Taking Ethereum as an example, USDC's largest coin holding address is the address of Sky (MakerDAO), with 4.8 billion coins, accounting for about 11.9%. In July 2024, the number of holdings of this address was only 20 million, an increase of 229 times in less than a year. Sky's USDC is mainly used as collateral assets for its stablecoins DAI and USDS. The USDC growth of this address, as a whole, still represents the demand for stablecoins by the growth of the DeFi protocol TVL.

AAVE is USDC's fourth largest coin holding address on Ethereum. On January 1, 2024, AAVE's USDC holdings were about 45 million, and by the highest point on March 12, 2025, the USDC holdings at this address increased to 1.32 billion, an increase of about 1.275 billion US dollars, accounting for 7.5% of the new USDC issuance on Ethereum.

From this perspective, the new USDC on Ethereum is mainly due to the growth of pledged products. At the beginning of 2024, Ethereum's total TVL volume was about US$29.7 billion. Although it has suffered a decline recently, it still has a stock of US$49 billion (the TVL volume at its highest point reached US$76 billion). Based on 49 billion, the TVL growth rate on Ethereum can also reach 64.9%, which is much greater than the growth rate of altcoins last year and is also close to the overall growth rate of stablecoins.

However, in terms of scale, although TVL on Ethereum has increased by US$19.3 billion, there is still a big gap compared with the 58 billion growth of Ethereum stablecoin. Except for some of the new issuances contributed by the exchange, pledge agreements do not absorb all the increments of these stablecoins.

New scenarios rise: paradigm migration from cross-border payments to

institutional transactions

In addition to the demand for stablecoins by DeFi growth, consumer payments, cross-border remittances, and over-the-counter trading of financial institutions may also be new demands for stablecoins growth.

According to multiple official information from Circle, the stablecoin scenarios gradually show energy in cross-border remittances, consumer payments and other scenarios. According to a report by Rise, about 30% of global remittances are made through stablecoins. This ratio is particularly significant in Latin America and sub-Saharan Africa. Retail and professional-grade stablecoin transfers in Latin America and sub-Saharan Africa grew by more than 40% year-on-year between July 2023 and June 2024

According to a report released by Circle, the net USDC minted by Zodia Markets, a subsidiary of Standard Chartered Bank, has reached US$4 billion in 2024 (Zodia Markets is an institutional digital asset brokerage company that provides global clients with services including over-the-counter trading and on-chain forex).

Customers of another Latin American retail payment company, Lemon, hold more than $137 million in USD, and users of the platform mainly use retail payments through stablecoins.

In addition to the new demand caused by scene differences. The different ecological structures of each chain have also created different demands for stablecoins. For example, the MEME boom on the Solana chain has stimulated the transaction demand of DEX. According to incomplete statistics from PANews, the trading pair TVL volume of USDC (top 100) on the Solana chain is about US$2.2 billion, calculated according to the rule that USDC accounts for half of the volume. The amount of funds deposited in this part is about USDC 1.1 billion. It accounts for 8.8% of USDC's Solana chain circulation.

The crypto market shifts from "speculative bubble" to "new financial

products"

After disassembly and analyzing the stablecoins, PANews found it seemed difficult to find a direction that was the main driving force for the growth of stablecoins. It is impossible to explain the question of where the money in the market goes. But looking back, what we can get may be a series of complex conclusions.

1. The market value of stablecoins is growing, but obviously these funds have not flowed into the altcoin market on a large scale, becoming the initial driving force for the arrival of the copycat season.

2. From the perspective of Ethereum market, the growth of USDT in this part of the major stablecoins is still half the growth of the exchange, but it seems more likely to be used to purchase BTC (because the altcoins and Ethereum markets have not increased significantly), or financial products within the exchange. The remaining growth demand may be digested by the DeFi protocol. Overall, funds flowing to Ethereum focus more on the stable returns of pledge and lending agreements. The attractiveness of the crypto market to traditional funds may be no longer a crazy rise and fall, but a new type of financial management product.

3. Changes in new scenarios, traditional financial institutions such as Standard Chartered Bank have entered the crypto market, and have also become one of the new demands for stablecoins. In addition, there are more and more scenarios in underdeveloped regions that choose to adopt stablecoins due to backward infrastructure and unstable domestic currency exchange rates. However, there are still no complete statistics in this part of the data, and we do not know the specific share.

4. Stablecoins have different narrative needs on different chains. For example, Solana's growth demand may come from the rise of trading popularity of MEME. The growth popularity of new public chains such as Hyperliquid, Berachain, and TON has also brought about certain capital demand.

Overall, the undercurrent of this capital migration reveals that the crypto market is undergoing a paradigm shift, and stablecoins have broken through the boundaries of pure trading media and become a value pipeline connecting the traditional finance and the crypto world. On the one hand, altcoins failed to receive a large-scale blood transfusion due to the growth of stablecoins. On the other hand, the financial management needs of institutional funds, the urgent need for payment in emerging markets, and the maturity of on-chain financial infrastructure are pushing stablecoins to a broader stage of value carrying. This may indicate that the cryptocurrency market is quietly moving from a historic turning point from "speculation-driven" to "value precipitation".