The driving force behind Trump's extreme tariff policy: "non-mainstream" economist Navarro

Reprinted from panewslab

04/08/2025·21DThe global financial market is being swept by a sudden cold wave.

The panic in the global capital market reached its peak after Trump's extreme policy of imposing "reciprocal tariffs" on almost all trading partners:

On April 7, as of 10 p.m. ET, the S&P 500 futures fell 5.98%, while the Nasdaq 100 futures fell 6.2%. Dow futures fell 5.5%.

The Asian market is full of risk aversion, with the Nikkei falling 8.9% in the early trading. Taiwan's weighted index plummeted nearly 10% after a two-day holiday, and circuit breakers of major stocks such as TSMC and Foxconn.

The crypto market is not spared either.

Investors watched as assets shrank, and the red lines on the crypto trading screen were like alarms, heralding a greater turmoil.

According to CoinGlass, the liquidation of cryptocurrencies has soared to about $892 million, including more than $300 million in Bitcoin long and short positions.

BTC has fallen to around $77,000, while ETH has even reached $1,500.

The clarion call of the trade war sounded again, and at the forefront was Trump's senior trade adviser Peter Navarro.

On April 6, Navarro appeared in an interview with Fox News.

He tried to calm investors' emotions and played ridiculous language art in the face of interviews:

"The first principle, especially for small investors, is that you won't lose money unless you sell the stock now. The wise strategy is not to panic and hold on."

Floating losses are not losses, not selling them means not losing.

It is hard to imagine that this ineffective comfort approaching spiritual victory came from a senior presidential senior trade adviser and university economics professor.

This statement obviously cannot calm the anxiety of the market, but instead makes people focus on him - this Harvard Ph.D., who is nicknamed "non-mainstream economist" by the outside world, seems to be not only the spokesperson of policy, but also the driving force behind extreme trade protectionism.

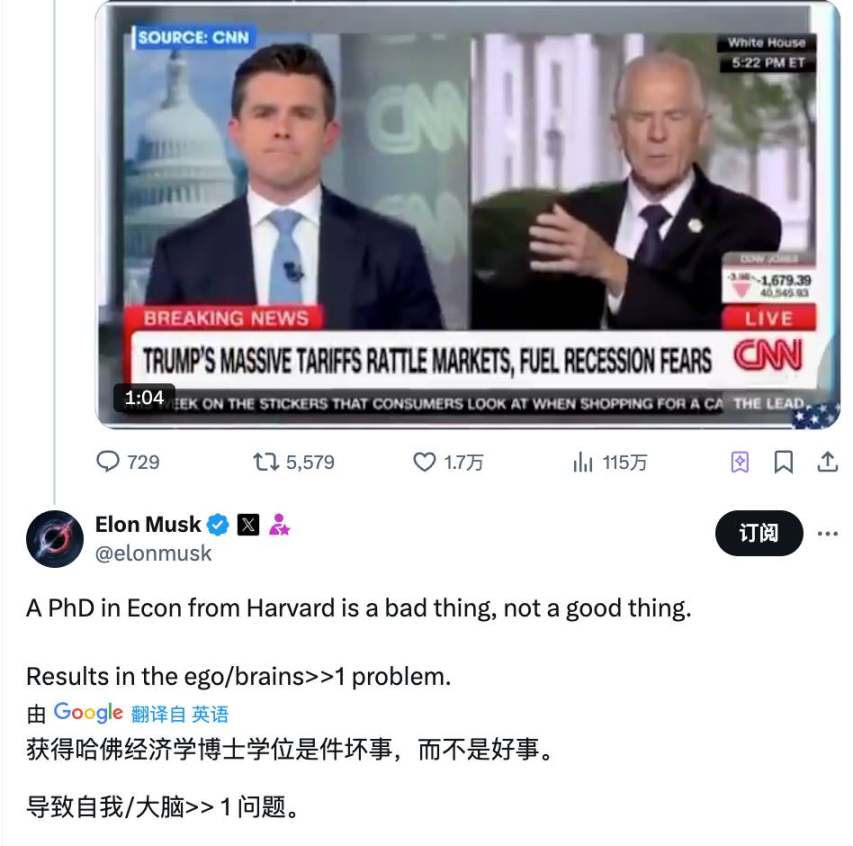

Even Musk, who is very close to President Trump, publicly expressed criticism and sarcasm of the presidential adviser on social media a few days ago, bluntly saying that "obtaining a Harvard Ph.D. in economics is not a good thing, and it may lead to decision-making mistakes due to excessive self-conceit"; and questioned that Navarro had never created any substantial results with his own hands.

Who is this economist standing behind Trump? How did he drive this tariff policy storm that swept the world?

From the edge of academia to the core of decision-making in the White House, Navarro's life intersected with Trump's protectionist ideas, which may have led to this crisis together.

Fringe figures from academic to politics

The story of Peter Navarro began on July 15, 1959, a common family in Cambridge, Massachusetts.

His father, Albert "Al" Navarro, was a saxophone and clarinetist, and his mother, Evelyn Little John, was a secretary on Saxophone Fifth Avenue.

However, the family time was short and turbulent, with his parents divorced when he was 9 or 10, leaving Navarro to travel to Palm Beach, Florida and Bethesda, Maryland.

The growth experience of a single-parent family may have planted his desire for stability and independence, and finally sprouted quietly when he completed his studies at Bethesda-Chevechase High School in Maryland.

In 1972, Navarro entered Tufts University with an academic scholarship and obtained his bachelor's degree. In the same year, he joined the American Peace Corps and went to Thailand for three years. This experience made him first exposed to the complexity of the international community, and may have laid the groundwork for his future attention to global trade imbalances.

In 1979, he received his Master of Public Administration from Harvard University, and then won his Ph.D. in 1986 under the guidance of economics master Richard E. Kevs. With a degree in hand, he chose to stay in academia, and since 1989 he has been a professor of economics and public policy at the University of California, Irvine, for decades until he became an honorary professor.

However, Navarro was not satisfied with the study. He devoted himself to politics five times, trying to put his ideas into practice.

In 1992, he ran for Mayor of San Diego, leading the primaries with 38.2% of the votes, but lost 48% in the runoffs;

Since then, he has competed for seats in the city council, county supervisory board and congressional seats, all of which have failed - in the 1996 congressional election, he received 41.9% of the votes, and in the 2001 city council special election, he received only 7.85%. These failures did not make him retreat, but instead highlighted his persistence and marginalization.

He repeatedly emphasized economic protectionism and employment priority in the campaign, which echoed Trump's "America First" in the future, but failed to win the favor of voters at that time.

From a teenager in a single-parent family, to a PhD in economics at Harvard, to a political marginal figure who has been defeated repeatedly, Navarro's trajectory is full of contradictions.

He seemed to be both a rigorous scholar and a radical activist; he left footprints in the academic world and suffered repeated setbacks in politics.

As the academic and political circles move, trade protection and tough attitude towards China seem to have already planted the seeds.

The Chinese threat theory has long been traced

From the moment Peter Navarro received his PhD in Economics from Harvard University, he was destined not to be content with the peace inside the ivory tower.

Its subsequent trajectory shows that the new doctor has developed a strong interest in the global economic landscape.

When he joined the University of California, Irvine in 1989, he began to transform his academic enthusiasm into sharp criticism. His goal is directly aimed at a rising force - China.

What really makes him noticeable is a series of works that promote the theory of China's threat.

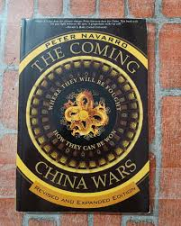

In 2006, he published The Coming China Wars, warning in an almost prophetic tone that China's economic expansion is not only a business competition, but also an existential threat to the US manufacturing industry.

The book reveals a kind of nearly prejudiced stubbornness, such as "China's development is a threat to mankind and will bring more conflicts and instability to the world."

At that time, most readers' book reviews on Amazon believed that the book was suspected of intentional hype and sensation.

Although this book did not resonate widely in the mainstream economics community, it caused ripples in some conservative circles.

Five years later, 2011's Death by China pushed Navarro's criticism to a climax. This book is not only an academic analysis, but also a complaint.

He radically accused China of systematically destroying the foundation of the US economic foundation through illegal export subsidies, production subsidies, currency manipulation and intellectual property theft...

However, these views of Navarro are not without controversy.

Mainstream economists, such as Simon Johnson of MIT, have publicly criticized his analysis for being "too one-sided and ignoring the complexity of global supply chains"; and Navarro's tough wording in the book is in sharp contrast to the general sense of elegant academic image, which also makes him labeled as "alien" in the economics community.

However, Navarro has built a set of trade confrontation theory against China through more than ten years of academic accumulation. The United States must use tough measures to reverse the trade deficit and protect local industries. This theory also laid the groundwork for him to enter Trump's decision-making circle in the future.

His pen has already pointed to China, and fate will open a bigger door for him in 2016.

Getting the support of Trump's son-in-law and entering the core circle

The book "Deadly China" did not cause any turmoil in the mainstream economics community, but unexpectedly knocked on the door to Trump's campaign.

It was reported that during Trump's campaign ahead of his first term in 2016, his son-in-law Jared Kushner stumbled on Amazon and was attracted by his sharp criticism of China's trade behavior, and immediately recommended the book to Donald Trump.

After reading it, Trump praised it very much and said bluntly: "This guy understands my thoughts."

Navarro later recalled that his role was from the outset to “providing analytical support for Trump’s trade intuition.” Trump, who was a businessman, was well versed in the way of trade. Their ideas might coincide with the underlying logic, and fate was ignited.

On January 20, 2017, the same day Trump was sworn in, Navarro officially entered the White House as director of the newly established National Trade Commission.

His first mission is not surprising: targeting China. He quickly promoted a proposal to impose a 43% tariff on Chinese goods and dominated the policy of imposing a 25% surcharge on steel and aluminum imports.

When the Sino-US trade war began in 2018, Navarro was everywhere. "China must pay for its unfair trade," he declared at a White House briefing.

This year, he also helped draft Trump's tariff order on global steel and aluminum imports, which directly led to trade frictions with the EU and Canada. Navarro's toughness not only caters to Trump's "America First", but also allows him to gain a foothold in the White House.

However, Navarro's life in the core circle was not smooth either.

In 2020, he published a report accusing election fraud and participated in the "Green Bay Sweep" program on January 6, 2021, which ultimately resulted in a four-month prison sentence for contempt of Congress in 2023. Despite this, Trump's trust in him has not diminished, and he even called him a "loyal warrior" in prison.

On January 20, 2025, Trump returned to the White House, and Navarro also returned as a senior trade and manufacturing consultant. This time, his goal is even more radical.

In February, he and Stephen Miller led the tariff economic discussions on Canada, China and Mexico, driving the first-day trade policy memorandum signed by Trump.

Navarro-led "reciprocal tariffs" scheme - calculating additional tax rates based on trade deficits, such as 46% in Vietnam and 20% in the EU - has become the cornerstone of the new policy. "These are not bargaining chips, but necessities for a national emergency," he defended in an interview with CNBC.

This position is in line with his academic propositions more than ten years ago.

From a book in 2016 to the 2025 trade war brain, Navarro’s connection with Trump is no accident.

His protectionist philosophy is highly consistent with Trump's disgust of the trade deficit; his tough character perfectly matches Trump's policy style.

Despite being controversial and even being imprisoned for a while, Navarro has always been the soul of Trump's trade strategy. He walked from the academic edge into the center of power, not only by luck, but also by his obsession with trade confrontation.

The superiors attacked the city, and the subordinates attacked the city

The results of this intersection between Trump and Navarro are about to face the most severe test in the global market in 2025.

Going back to what Navarro said at the beginning, "If you don't sell stocks, you won't lose money." Does this non-mainstream economist really understand the context of economic operation?

Navarro may be proficient in tariff data, but he seems to have not understood the essence of military tactics.

"The Art of War" says: "The superior army attacks the plan, and then attacks the diplomatic relations, and then attacks the troops, and then attacks the city." A war that defeats others without fighting is the top.

The wisdom of our ancestors is to win through strategy and diplomacy, rather than to start a war directly.

However, Navarro and Trump declare war on tariffs is exactly the opposite -choosing to conflict head-on, in exchange for so-called "fairness" at a high economic cost.

This head-on approach not only failed to weaken the opponent, but also left American companies and consumers the first to bear the brunt. Economists estimate that 60% of tariffs on China will push up prices of imported goods, and the Americans will eventually pay for it.

Reality is far from being a paper talk.

Drag the global economy into a melee. His role as a pusher is undisputed, but whether the price of this war is worth it is still unknown.

chaincatcher

chaincatcher