The influence of Trump coin and internal and external problems of Ethereum

Reprinted from panewslab

02/05/2025·24DForeword

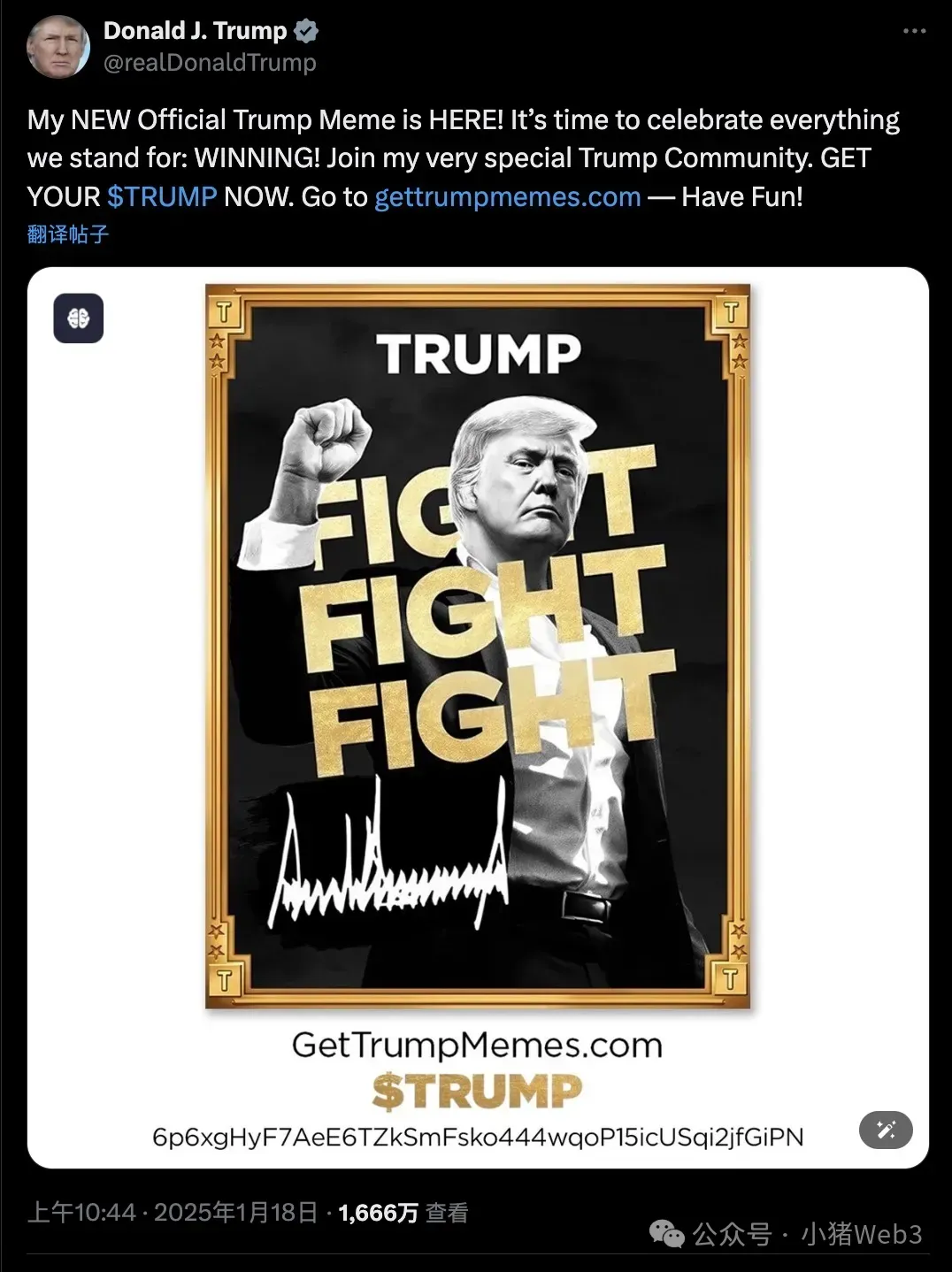

On the morning of January 8th, Trump posted on Twitter and its social media Truth Social, and published a MEME currency Trump with the same name with his own name in Solana. In just four hours, Trump's market value was 16 billion yuan quickly, 16 billion, The US dollar has become the second largest market value MEME coin after dog coins. On January 9th, Trump's price continued to soar, and the market value once reached 80 billion US dollars. Not only did the dog coins become the largest market value MEME coin, the gap between the market value of SOL at the time. The road of currency 11 years.

Solana's native currency SOL continues to rise. In fact, on January 16, according to the New York Post, Trump's idea of digital currency (such as SOL, USDC, and XRP) in the United States holds "SOL, USDC, and XRP) as a strategic reserve. Open attitude. SOL and XRP (Ripple) are expected to launch the existing goods ETF this year. The price has risen by more than 40% in the past week. The sound of FLIP in the community has gradually risen.

In December last year, ETH (Ethereum) and its ecological DEFI (LINK, AAVE, ENA, etc.) in the "Trump Quotes" and its ecological DEFI (LINK, AAVE, ENA, etc.), especially Ethereum, used as Ethereum, as a pince The market value is second only to Bitcoin and the only available ETF cryptocurrencies, not only far less than BTC, SOL, and XRP, but the foundation has recently been blamed by the founders of many well -known projects and trapped in trouble.

The influence of Trump issuance

First of all, Trump is not a MEME coin issued on the largest MEME currency distribution platform Pump.fun on Solana. "The collaborative operation can be said to be a VC coin wearing a MEME coin. The partners include Jupiter, the largest DEX polymer on Solana, METEORA, liquidity protocol, and Moonshot. The market merchant behind it is Wintermute. It is worth mentioning that Wintermute is also the main marketor of many high -market MEME coins. I used to be a well -known MEME coin PEPE.

Secondly, in the short term, the distribution of Trump has caused a huge "blood -sucking effect", and the liquidity of the market has caused the price of cryptocurrencies other than the Solana ecology. Trump is deployed on the Solana chain, which will further strengthen the market identity of the Solana ecosystem. The MEME coins and AI coins in the Solana ecosystem have also obtained more liquidity, increasing the revenue of the DEFI protocol on the Solana. The encryption market also ushered in a wave of new users. Moonshot said that they had attracted more than 400,000 new users within 24 hours. In addition, tools on GMGN and other chains have also become beneficiaries, and their income exceeds the largest DEFI protocol Uniswap in the short term.

Finally, in the long run, Trump is fulfilling his promise of encrypted policy. Combined with Trump, he plans to build the United States into the "world capital of AI and cryptocurrencies." In fact, Trump's own coin issuance shows the loose position of the supervision of the encryption industry. The World Liberty Financial of the Trump family not only involved in the DEFI field, but also actively deployed RWA (real world assets). It may promote more traditional financial institutions to get involved DEFI field. In addition, the United States cryptocurrencies will also usher in policies, such as Solana, Ripple, and SUI, and the first two are dawn in the approval process of ETF.

Here we will further introduce Solana and RIPPLE, as well as the difference between them and Ethereum.

Ethereum was born in November 2013. The Russian Canadian programmer Vitalik Buterin released a white paper "Ethereum: Next Generation Smart Contract and Decentralization Application Platform". Compared with the function of Bitcoin's single cash system, Ethereum is a decentralized global computer platform that can run any smart contract with any complexity. ETH (Ethereum's native cryptocurrency) is the second largest market value of Bitcoin, which is the second largest market value of Bitcoin, and is currently the only cryptocurrency with spot ETFs. Ethereum is the beginning of Web3. It created the era of smart contracts for blockchain. It catalyzed the outbreak of the DEFI project on Ethereum in the summer of 2020. For example, UNISWAP, as the largest DEX on Ethereum, 2023 UNISWAP transactions exceeded 450 billion The US dollar surpasses the spot trading volume of COINBASE, the largest exchange in the United States.

Ripple was born in September 2012. It was earlier than Ethereum. The predecessor was the RipplePay project. It was created by Jed McCaleb, Christ Larsen and Arthur Britto. The establishment of Ripple is to innovate the global remittance industry to replace old systems like Swift. Ripple is not a public blockchain, but a licensed blockchain, because it uses a consensus mechanism for POA (Proof of Authority). The UNL list) is verified, so compared with the traditional blockchain (such as Bitcoin and Ethereum), it is more centralized, but it also shows better scalability. In addition, Ripple donated $ 5 million XRP to support Trump's presidential inauguration ceremony.

Solana was born in November 2017. Former Qualcomm engineer Anatoly Yakovenko released a white paper, which introduced "Proof of History" -s a mechanism that maintains time between unwanted computers. With POH, Anatoly started to build a Solana blockchain, which aims to match the performance of a single machine and overcomes the scalability constraints of traditional blockchain (such as Ethereum). , To achieve a high -performance Layer1 expanded at the speed of hardware at the speed of hardware. Solana has a lot of technical advantages that it is the defect of Ethereum, such as super fast speed. The maximum daily daily execution of transactions can reach 1000, and Ethereum can only reach 20; followed by ultra -low expenses Compared with Ethereum, Solana's transaction fee is only one percent of Ethereum.

Ethereum internal and external troubles

If the predicament of Ethereum is expressed in four words, it is "internal and external problems."

Internal worry

The Ethereum Foundation has recently become the target of public criticism. It is mainly the inaction of the Ethereum Foundation, constantly selling ETH on the chain, lacking connection with the community and Layer2 strategic issues. Kain Warwick, the founder of Synthetix and Infinex, believes that it is necessary to pressure Layer2 to repurchase ETH, and the founder of CURVE Michael Egorov more radically believes that he wants to abandon Layer2 Layer1. reform.

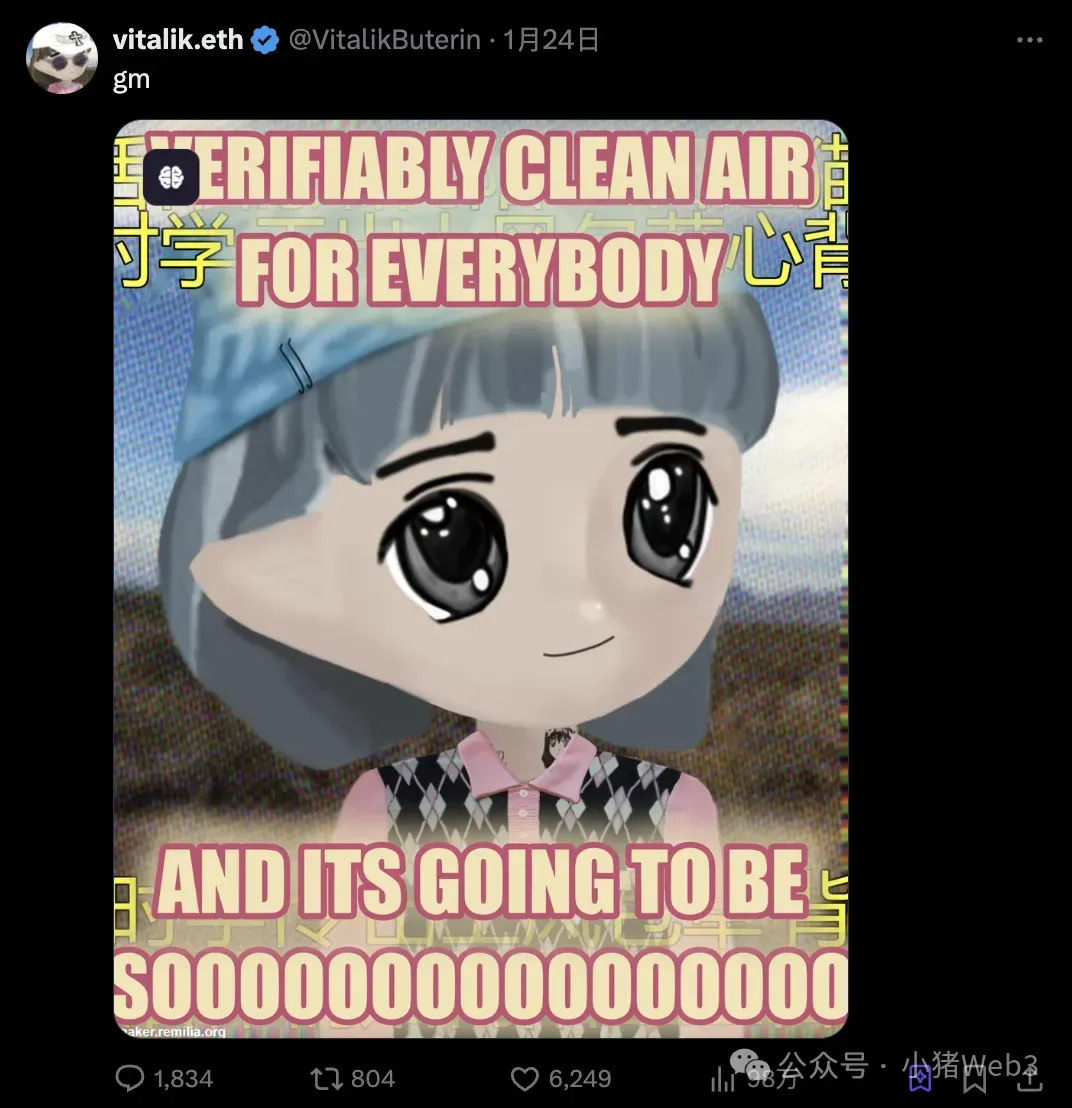

On January 18, Vitalik said that after the Ethereum Foundation was criticized for the lack of the Ethereum ecosystem's participation, the leading structure of the foundation, communication with the network developer community, and support for them will occur. "Major changes". For the problem of selling ETH on the chain, on January 21, the Ethereum Foundation announced the establishment of a wallet address and began to participate in Defi. The organization plans to inject ETH worth about $ 150 million into the wallet, but it may take a few days to complete the settings.

On January 22, Konstantin Lomashuk, co -founder of Lido, forwarded a post, implying that the "Second Foundation (Second Foundation)" was established. He said: "Ethereum is the ultimate world computer, and every Ethereum enthusiast can help it grow, evolve and succeed. If the second foundation is really established, it must have a clear goal to supplement the current contribution The huge job of the person.

On January 24th, Vitalik published an article to explore the unique advantages of Ethereum 2025 and future expansion strategies, emphasizing that Ethereum's unique advantages in decentralized concepts and actual application value, and said that Layer2's success confirmed the Ethereum ecosystem of the Ethereum ecosystem. The development concept emphasizes that it will continue to adhere to the Layer2 strategy. Vitalik pointed out that the current two major challenges are facing the scale of capacity expansion and heterogeneity. The specific plans include: improving data block capacity, strengthening interoperability and ZK-EVM, security construction, and optimizing economic models.

foreign aggression

The two cryptocurrencies with a market value are Ripple and Solana. But in fact, Ripple is not an opponent. I also introduced it in the previous chapter. Ripple is a licensed blockchain. Because the main customers of Ripple are international banks and investment companies. The blockchain is also understandable. Therefore, the main competitors of Ethereum are Solana, which is also a public blockchain. We throw away the "Trump factor", comparing the two blockchains can be decentralized, scalability and ecological aspects.

Generally, the degree of decentralization of Ethereum is higher than that of Solana. Why is it that it is generally believed that decentralization itself is an abstract concept and it is difficult to measure. General indicators include the number of nodes and node distribution, token holders distribution, client diversity, Satoshi coefficient and governance process. Avoid disputes here. The author only represents personal opinions. If Ethereum has 100 points decentralized, Solana is about 70 ~ 80 points, and other POS blockchains are below 60 points.

However, if it is scored according to scalability, Solana can score 90 points, and Ethereum is less than 10 points. However, Ethereum solves the problem of scalability. Layer2 is used. By building an additional network layer on the Ethereum chain, it allows handling more transactions while maintaining security and decentralized characteristics. At present, Base is the largest Layer2 on Ethereum. It is developed by the cryptocurrency trading platform Coinbase and Optimism. The maximum TPS can reach 300, but it is also significantly lower than Solana.

Ecology is the biggest advantage of Ethereum. Ethereum's main online online time is 6 years earlier than Solana. It has accumulated a lot of developers and users. There are a lot of infrastructure and long -term applications. But since 2024, the number of new developers in Solana has exceeded Ethereum. For users, most of them are traded in the DEX on the chain. Due to the wealth effect of MEME coins and AI coins on Solana, in recent months, active users have surpassed Ethereum.

Summarize

The author is not so pessimistic about the future development of Ethereum. The author joined the Web3 industry in 2020 and was also attracted by the innovation of Ethereum. In addition, he was a contributor to LXDAO and ETHPANDA. He also saw Vitalik on many occasions and heard his sharing.

From an emotional perspective, I believe that Vitalik is a leader with an excellent "computer culture" temperament. Although there is no exaggerated marketing speech, he can listen to information, respond to problems, and make decisions. So I also believe that the Ethereum Foundation can reform under the leadership of Vitalik.

From a technical perspective, I believe that Ethereum has formulated a long -term and detailed technical route in order to implement the concept of decentralization. In the future, Ethereum can reach TPS with more than 100,000 through Layer2 in the future. It can be delivered in a timely manner according to the roadmap.

Besides, as the opponent, Solana, Solana's current positioning is a consumer -level public blockchain, which has gradually occupied the user's mind in the field of TOC. After all, users are not so concerned about decentralization. speed. Ethereum may take three to five years of technical implementation in high performance, so this cycle is not great.

However, Ethereum can take a completely different route to position a financial -level public blockchain, that is, Layer1 focuses on the direction of TOB, attracting traditional financial institutions to do Web3 business expansion. Typical is RWA. The financial business of the real world itself is a conservative system that requires higher stability, low risk, low maintenance, etc. Ethereum has never been downtime. The decentralization of Ethereum is still stronger than Solana. The ecology of Ethereum is significantly stronger than Solana. Ethereum still has the most developers. The prosperity has also accumulated a large number of financial security use constraints and contract examples. These are bait that attracts traditional financial institutions.

In the end, what I want to say is that Ethereum must act immediately to deal with the management problems of internal foundation and the competitive pressure of external Solana. They cannot talk about technology and ideals, and ignore users and markets. But in general, Ethereum has been ten years. Any company has reached ten years. Due to the external environment changes, internal interest distribution, etc., it is necessary to change. "Hugging" is the best way to Ethereum to the future of light.

chaincatcher

chaincatcher

jinse

jinse