The macro market changes suddenly, and a look at the perspective of BTC's future market trend

Reprinted from panewslab

04/08/2025·22DIn the past 24 hours, the market trend has fluctuated violently with the news. With the repeated sway of Trump's tariff policy details - from the rumor of "90-day suspended" to "false news of refuting rumors", Bitcoin fluctuated violently within 24 hours, reaching a low of $74,436 and then rapidly rising to $81,200, with an intraday amplitude of up to 9%.

As of this writing, Bitcoin has temporarily held the key support level of $79,000, and Ethereum struggled to recover lost ground after falling below $1,500, with XRP at $1.92.

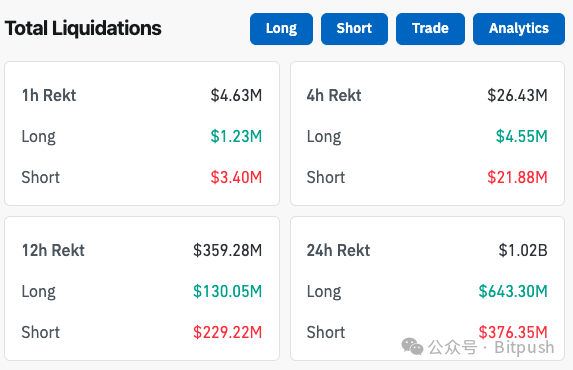

The derivatives market has a strong risk aversion sentiment, with open contracts across the network falling by 10% to US$91.19 billion. Coinglass data shows that the amount of liquidated positions exceeded US$1 billion in the past 24 hours, and the proportion of Bitcoin's market value rose slightly to 62.6%.

Expert opinion: What should we do next?

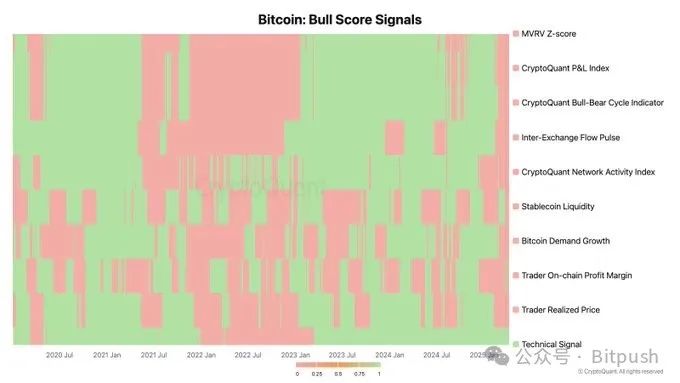

Julio Moreno, head of research at CryptoQuant, believes:

"Current buying at the bottom is like receiving a flying knife! The situation of Bitcoin has not improved yet. There is only one bull market signal in the bull market rating index."

Cosmo Jiang, general partner of Pantera Capital, told Bloomberg:

"The current market trend is mainly driven by macro factors. The pullback caused by this tariff is a specific event-driven decline rather than a deep economic problem. Just as tariff policies are artificially injected variables, these measures can also be withdrawn when the Trump administration believes that it has obtained enough concessions from other countries."

The latest report from Binance Research Institute believes that ongoing geopolitical and economic uncertainty may continue to dominate the market:

"The most radical tariffs since the 1930s are having a ripple effect in the macroeconomic and cryptocurrency markets. In the short term, cryptocurrencies may still fluctuate, and market sentiment will fluctuate as the trade war continues to develop. If macro conditions stabilize, new narratives dominate, or cryptocurrencies reestablish their role as a long-> term hedge tool, then new growth may follow. Until then, markets may remain range-volatile and react to macro news."

Stephen Wundke, Director of Strategy and Revenue at Algoz, a quantitative digital asset investment firm, said:

“As for now, the market hates uncertainty, so we can expect trading to be more volatile in the coming weeks/months and the next rise will be delayed (just [citation] anyway) – unless Trump makes another strong statement about the crypto industry. But the only thing we can be sure is that there is no certainty in the news released by the White House at the moment.”

Charlie Sherry, head of finance and cryptocurrency analyst at BTC Markets, said in his market update:

"Bitcoin has recently lost the key support level of $79,000 to $80,000 that it has successfully held in the past month. This support marks the bottom of the range after an all-time high correction. The next key support is around $72,000, the highest point before the U.S. election. A potential shift in Trump's position or the Fed's emergency intervention are two factors that could help Bitcoin price rebound to above $80,000."

Bitcoin researcher Axel Adler Jr. points out:

Short-term forecasts show that Bitcoin price will fluctuate and consolidate in the range of $81,600 to $88,700, of which the key "maximum pain point" level of $86,000 will become an important benchmark for the expiration of options on April 11. In the medium term, if macroeconomic uncertainty continues and Fed's expectation of interest rate cuts heats up, some traditional market funds may turn to Bitcoin to form support. However, we must be wary of the risk of severe pullbacks caused by investors' overall risk aversion.

Greg di Prisco, co-founder of centralized stablecoin development company M^0 Labs, commented on the long-term impact of the Trump administration on cryptocurrencies, saying:

Perhaps more important than Trump’s direct actions, his impact on the legislative process is the most important development in the industry. The stablecoin bill reviewed by state governments will put the United States in a favorable position in the competition.

Prisco shared his three major predictions for the crypto industry in 2025:

1. I think you'll see the GENIUS bill become the bill that the government finally agrees and passes, but that could happen in the second half of the year. 2. More traditional financial institutions will begin to launch tokenized products inspired by the success of BlackRock BUIDL. 3. Stablecoins will continue to prove themselves to be the killer use case for cryptocurrencies. They will begin to integrate into mainstream fintech applications.

chaincatcher

chaincatcher