The rise of re-staking on Solana – an in-depth analysis by Jito

Reprinted from jinse

01/08/2025·1MBy Paul Timofeev, Sitesh Kumar Sahoo, and Gabe Tramble

Source: Shoal Research Translation: Shan Oppa, Golden Finance

introduction

The rapid development of the Web3 field stems from its open source and decentralized nature. This characteristic brings about hyper-growth and scaling, what many refer to as cryptographic composability. This composability allows for the creation of modular technology stacks where components can be seamlessly inserted or removed, driving unprecedented innovation. At the core of this innovation is the basic process of blockchain transactions, whose core value depends on the distributed network's ability to coordinate and achieve a consistent system state.

When a transaction is sent on the blockchain, a distributed network of nodes must first verify the contents of the transaction and then vote on the order of transactions to form the next block to be added to the chain. When these nodes reach an agreement, a state called "consensus" is reached. Blockchain initially achieved consensus using a Proof-of-Work (PoW) mechanism, which involved professional nodes called miners competing to solve cryptographic puzzles in order to add new transactions and blocks to the chain.

Although Bitcoin and many blockchains still use PoW consensus, most blockchains today have moved to Proof-of-Stake (PoS), which ensures security through economic incentives rather than computing power. This concept was first proposed in the 2012 Peercoin white paper, which proposed a deterministic algorithm to select nodes based on the number of local network tokens pledged by node operators, favoring nodes with more capital.

Subsequently, Jae Kwon wrote the Tendermint BFT white paper in 2014, introducing a new consensus mechanism that can reach consensus as long as less than one-third of the nodes fail, and in 2019 with the Cosmos Hub mainnet started and put into use. In addition to consuming significantly less energy than PoW, a key advantage of PoS is that, like PoW, staking cannot be easily forged. Additionally, PoS incentivizes honest behavior through a process called slashing, whereby validators will suffer financial losses if they behave maliciously.

With the widespread adoption of PoS blockchains, participation in staking has given rise to new ideas for maximizing the utility of pledged capital, such as making pledged capital more liquid to provide security for new products and ecosystems.

Staking design overview

Original pledge

Staking is a mechanism in which token holders deposit tokens into a staking contract to participate in the security maintenance of the underlying protocol and receive rewards for their contributions. In this article, this mechanism may be referred to as “original staking” because its core utility is limited to remaining idle in a smart contract, while other forms of staking provide additional utility, which will be expanded upon further below. The stake size of a validator determines the possibility of being selected to produce blocks. The more staked capital, the greater the possibility of being selected. Technically, anyone can participate as an independent staker, but blockchains often impose certain financial and hardware requirements on stakers, which may not be easy for the average user or token holder to achieve. For example, participating Ethereum validators need to deposit 32 ETH and be equipped with at least 16GB RAM, multi-core CPU and 1TB SSD, while Solana requires paying 1.1 SOL per day to vote and be equipped with at least 256GB RAM, fast multi- core CPU and high-speed SSD storage.

Therefore, in order to lower the participation threshold, a delegation mechanism was formed, allowing token holders to participate in staking with less capital and without any hardware, while allowing node operators running validators to expand their staking allocation and thus increase their blocks award. The pledge can be delegated directly to the verifier or through a pledge pool, which is a smart contract that centrally entrusts funds to multiple verifiers. Staking pools can be hosted by a third party (such as CEX, a centralized exchange that provides staking services), or they can be operated non-custodially through decentralized on-chain protocols such as Rocket Pool on Ethereum or Jito on Solana.

Staking also exists at the application level, that is, application token holders can lock their tokens to ensure the security of the protocol (for example, to provide liquidity in the event of a deficit event in the lending protocol). Generally, this staking method can bring benefits to the stakers. rewards, and additional utility such as governance rights or revenue shares. This has even given rise to bribery markets in DeFi (such as Curve Wars), where protocols compete to accumulate more governance tokens and thereby obtain a higher proportion of reward returns.

Still, due to the simplicity of its design, Raw Staking has a key limitation: the capital locked up in the smart contract by staking is illiquid, reducing the liquidity of the token and its ecosystem. The lack of underlying staking utility hinders the adoption of staking services, as the rewards distributed to token holders need to compensate for the price exposure risk of locked tokens. Large amounts of network activity may generate enough fees to provide natural rewards to stakers, but this is often unsustainable and has not historically been the case in most PoS chains. Distributing rewards through native token issuance is a common alternative, but this is equally unsustainable in the longer term. This problem prompted the development of liquidity staking protocols.

Liquidity Staking

Liquidity staking emerged from the need to develop a new mechanism that would allow stakers to maintain the liquidity of their pledged assets without compromising the security of the underlying protocol. The process is largely similar to base staking, where stakers deposit assets into smart contracts and receive base returns for their contributions to the underlying system. Liquidity staking, however, goes a step further by distributing to stakers a voucher token called a Liquid Staking Token (LST), which is worth the same as the original deposit. This innovation demonstrates the importance of composability in the DeFi space, as LST can be used in a variety of applications (e.g. liquidity provision, lending), ultimately enabling stakers to earn higher returns on top of their pledged assets , while increasing the overall liquidity of the underlying network ecosystem.

Since the emergence of the first liquidity staking protocols at the end of 2020, liquidity staking has become the fastest growing area in DeFi. As of this writing, there are over $42.3 billion in assets in the space, about 60% of which belongs to Lido Finance’s stETH contract. Currently, Ethereum accounts for nearly 85% of the liquidity pledged assets in the DeFi field, while Solana is relatively small, with less than $4 billion locked in the liquidity pledge protocol, 45% of which comes from Jito.

Overall, liquidity staking brings great flexibility and capital efficiency to stakers, which in turn benefits the underlying blockchains they support and the ecosystem built on top of them. However, as blockchain evolves, the uses for pledged assets continue to evolve. The rise of modular infrastructure and services has given rise to a plethora of new application-specific blockchains, which often face difficulties in building their own validator networks due to a lack of activity and economic incentives. Therefore, new mechanisms are designed to expand the use of pledged assets to help secure and launch new blockchains. This mechanism is “Restaking”.

re-pledge

Re-staking refers to the expansion of one blockchain’s staking and validator network to provide security for any number of other blockchains. From a more formal perspective, restaking can be defined as a variant of shared security in a Proof-of-Stake (PoS) blockchain environment, where a security-providing chain services a security-consuming chain, typically through a so-called Implemented as an intermediary for the re-pledge agreement.

This mechanism enables new blockchains, whether application-specific or general-purpose, to leverage the economic and computational resources of large base layers such as Ethereum or Solana to initiate their security. Stakeholders can also increase capital efficiency by securing multiple blockchains rather than a single chain, thereby increasing returns on their pledged assets. However, it is important to note that securing multiple blockchains increases the risk of slashing of staked assets – a concept that will be explored further below.

As with running validator nodes directly on a proof-of-stake blockchain or depositing funds into a staking pool, anyone can participate in re-staking. Users can choose native restaking , which is running a validator node that promises to participate in the restaking module, or liquid restaking , which is staking through a protocol or service provider, who restakes on behalf of the user. Pledge. In addition, re-pledge can be limited to native layer 1 (L1) assets, or can be extended to support almost any asset. This approach is called "universal re-pledge" or "universal re-pledge".

early implementation

Although restaking is commonly associated with Eigenlayer today, the concept has been tested and implemented in application-specific blockchains where launch security is often one of the biggest challenges. Several different ecosystems and networks have implemented some form of shared security at different times, and while the specifics may vary, the core concept is often the same - enabling smaller protocols to leverage existing economies and computing resource pool to facilitate its early development while improving capital efficiency and returns for stakers.

• In the Polkadot ecosystem, validators participate in the security of the relay chain (Relay Chain) by staking DOT, and the relay chain in turn provides security for approved parallel chains (Parachains).

• In the Avalanche network, validators who protect the C chain (the main center of economic activity) can participate in subnets, which are a dynamic collection of validators that cooperate to protect multiple chains or reach consensus on their status. A subnet can secure multiple chains, but each chain can only be verified by one subnet.

• Cosmos takes a different approach. The top 95% of the pledge weights and validator sets of its ecological center Cosmos Hub are actually copied to all consumer chains. This mechanism is called "Replicated Security". Cosmos Hub validators must run nodes on all consumer chains, although different software and/or hardware can be used. If the validator performs poorly on the consumption chain (such as downtime or double signing), the Cosmos Hub validator will be punished.

In March 2023, replication security will be officially launched through the Prop 187 V9 Lambda upgrade. However, the trend is gradually towards providing greater flexibility to stakers and validators. ICS v2 introduces “opt-in security” that allows validators to choose whether to secure a specific consumption chain. Additionally, a proposal was made in early May 2024 that, if passed, would allow Cosmos Hub validators to receive BTC pledges through the Babylon Staking Protocol, allowing any asset to be used for economic security on Cosmos.

Mesh Security will eventually allow chains to provide and use security at the same time, rather than using the provider chain's validator set to protect the consumer chain. Operators can choose whether to run a Cosmos chain, and stakers can choose to re-stake their staked assets to secure another Cosmos chain. Finally, a proposal was released in early May 2024 that, if passed, would allow Cosmos Hub validators to receive BTC staking through the Babylon Staking Protocol, paving the way for economic security with any asset on Cosmos.

In June 2023, the Eigenlayer protocol introduced the re-staking function to Ethereum. The Eigenlayer protocol is a set of middleware smart contracts on Ethereum that supports re-staking ETH on the consensus layer, thereby providing a consumer platform called Active Verification Service (AVS). The blockchain provides security. Eigenlayer ultimately serves as an open marketplace designed to connect AVS looking to lease security (validator sets and/or staked assets) with stakers and node operators that provide said security. ETH and supported ETH LST can be staked through a set of smart contracts that represent AVS scaling or re-staking economic security.

By leasing security assets to AVS, operators and stakers can expand the utility of their assets, thereby increasing returns. However, this also comes with risks, as their staking is now subject to any slashing conditions that AVS may impose, in addition to being slashed by the underlying chain Ethereum. Eigenlayer is an out-of-protocol solution on Ethereum, meaning Beacon Chain validators can choose to participate as Eigenlayer node operators.

Currently, there are no slashing conditions or re-staking rewards enforced on Eigenlayer, but this will change once EIGEN tokens become transferable in late September 2024. Additionally, Eigenlayer recently announced permissionless token support to enable any ERC-20 token to be used as a re-staking asset.

Universal Redemption

Universal Restaking, or “Universal Restaking,” uses an asset- and chain- agnostic approach to allocate security resources from a set of providers to a set of consumers. This approach allows for the pooling of various staking assets across multiple chains, increasing participant accessibility and reducing reliance on a single base layer. Similar to Eigenlayer, the Universal Redemption Protocol acts as an intermediary layer between the security providing chain and the consuming chain (AVS).

Liquidity re-hypothecation

Liquidity re-pledge enables re-pledged assets to be expressed in the form of Liquid Restaking Tokens (LRT). The end goal of liquidity staking and liquidity re-staking protocols is similar: to provide re-stakers and stakers with a liquidity representation of their underlying positions. Therefore, LRT can be formally defined as a derivative asset that replenishes positions. The LRT provider is ultimately responsible for portfolio management on behalf of re- hypothecaters, managing the allocation of pledges across various yield positions to maximize returns and minimize risk to depositors. For a more detailed analysis of LRT, please refer to Shoal Research's previous report.

Current status of re-pledge

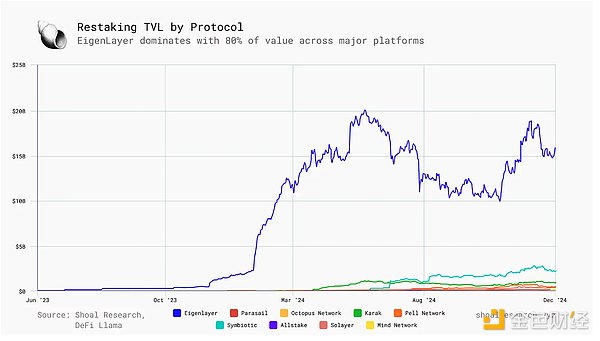

As of this writing, the total number of actively rehyped assets has reached $28.14 billion . Among them, Eigenlayer accounts for 60% of the total, and Ethereum as a whole accounts for about 80% of the total re-pledged TVL (total lock-up value). So far, only four re-pledge protocols , Eigenlayer, Babylon, Symbiotic and Karak , have exceeded $1 billion in TVL.

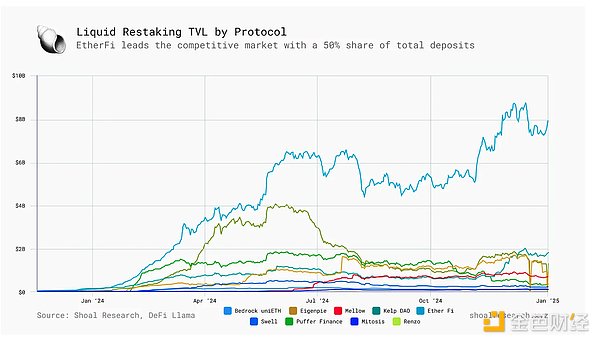

At the same time, the liquidity re-pledge agreement has also grown rapidly with the development of re-pledge, and its total TVL has reached approximately US$15.62 billion , accounting for approximately 57% of the total TVL of re-pledge.

Compared with re-hypothecation, the competition for liquidity re-hypothecation is more intense, and since June 2023, different protocols have taken turns to occupy the leading position in the market. As of this writing, EtherFi accounts for approximately 50% of all liquidity restaking deposits, and the majority of liquidity restaking’s TVL is concentrated in Ethereum, consistent with the overall trend of restaking.

On Solana, the development of re-pledge is slower: Picasso Network first launched the re-pledge vault (vault) on Solana at the end of January 2024, and has attracted deposits of 3,507 SOL (approximately US$729,000 ) so far. As of now, total restaking TVL on Solana is approximately $371 million , most of which has increased over the past few months with the launch of Solayer .

Currently, restaking on Solana is starting to heat up as Jito enters the market through its Jito (Re)staking protocol.

Restaking on Solana

Built from the ground up, Solana has a unique architecture optimized for fast execution speeds and low-cost trading at high transaction volumes. Solana is designed to maximize the developer and user experience by taking full advantage of hardware performance capabilities, ultimately making hardware the only long-term limiting factor in network performance. As the chain with the second highest TVL (Total Value Locked), the re-staking ecosystem on Solana has the potential for growth and change in the medium to long term. Jito is one of the teams looking to introduce restaking into the Solana ecosystem and leverage its history of successful product development.

Introduction to Jito

Founded in 2021 by Lucas Bruder and Zano Sherwani, Jito Labs is a US-based Solana infrastructure company that provides a suite of MEV (Maximum Extractable Value) products and services. Jito Labs is the core development team focused on product development and deployment, while Jito Foundation is responsible for JTO token governance and strategic oversight of Jito network products and services such as JitoSOL liquidity staking tokens and Jito (Re)staking re-staking protocols .

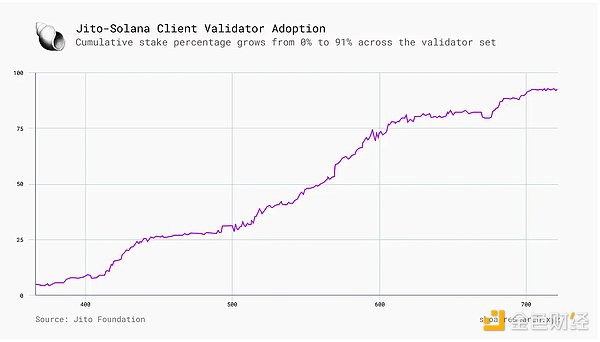

In July 2022, Jito Labs launched the MEV dashboard for the first time to help reveal the MEV ecosystem on Solana that had not yet been deeply explored at the time. A few months later, the team open-sourced Jito-Solana , the first validator client on Solana designed to capture and redistribute MEV profits to validators and stakers. Jito-Solana was ultimately forked based on the Solana Labs client, adding about 1,000 lines of code to enable validators to receive MEV rebates. Its broader goals are to combat spam and optimize Solana's performance.

In conjunction with the client, Jito Block Engine supports off-chain block space auctions, with searchers submitting transaction lists (i.e. transaction packages ) that are executed sequentially and atomically. After simulating each transaction combination in the submitted package, the engine forwards the highest paying transaction package to the leader for inclusion in the block. Jito Relayer acts as a Transaction Processing Unit (TPU) agent, filters and verifies transactions off-chain, and submits verified transactions to the block engine and validator.

It should be noted that in March 2024, Jito Labs announced the suspension of the memory pool function of Jito Block Engine because the Solana ecosystem expressed concerns about some users running MEV robots using the memory pool to conduct sandwich attacks. Currently, the Block Engine is still running and continues to process and forward transactions while conducting transaction package simulation, but the memory pool component has been removed.

This mechanism ultimately imposes costs on the network for spam transactions and performance impediments. Validators running Jito-Solana capture MEV profits generated in transaction packages during their leadership period. The launch of JitoSOL’s liquid staking token enables stakers to delegate staking to validators running the Jito-Solana client, thereby increasing the validator’s staking volume and enabling stakers to earn MEV rewards while receiving base staking benefits. In December 2023, the Jito Foundation also launched StakeNet , a network composed of on-chain guardians and managers that provides two core functions:

1. Validator history program : stores the history of each validator in the entire network for up to 3 years;

2. Guardian program : Calculate scores based on validator performance and manage pledge distribution to ensure that pledges are delegated to the best- performing validators.

Building on its experience in MEV and liquidity staking infrastructure services, Jito is introducing a new framework that enables applications and networks to leverage any SPL token on Solana for security.

Jito (Re)staking

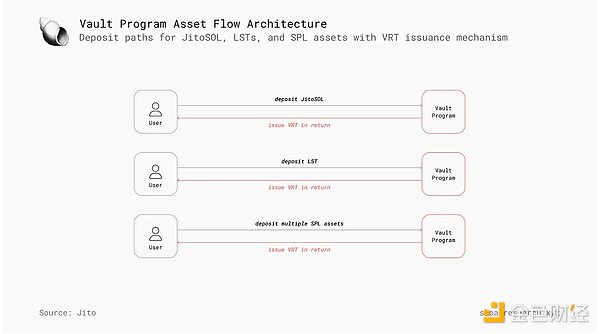

On July 25, 2024, the Jito Foundation released the Jito (Re)staking code, a hybrid multi-asset staking protocol on Solana that allows any new network or application to bootstrap its economic security. The protocol consists of two main components:

• Vault Program : used to create and manage pledged assets;

• (Re)staking Program : Coordinates activities and incentives among network participants.

Together, these two core programs provide developers with a modular, extensible framework for simplifying the staking mechanism of any SPL asset, becoming the first such protocol on Solana.

Before we dive in, here’s a brief explanation of some important terms:

• Node : refers to software that runs according to the specifications of its associated network.

• Node Consensus Network (NCN) : A group of distributed nodes that jointly achieve consensus and provide services for specific protocols or networks, including L1 public chains, application chains, cross-chain bridges, co- processor networks, DeFi applications, solver networks, and Oracle network.

• Operator : An entity that manages one or more nodes in the node consensus network.

• Vault Receipt Token (VRT) : A derivative token that represents the underlying re-pledged position, similar to LRT (Liquidity Re-pledged Token).

In short, Jito (Re)staking provides NCN with economic security and improves liquidity and composability by tokenizing staked SPL assets into VRT. NCN is able to configure staking parameters, penalty conditions, and other economic incentives according to its needs.

vault plan

The Vault Program manages the creation and operation of Vault Receipt Tokens (VRT). The core logic is: pledge a token and obtain a derivative token representing the pledged liquidity position, which can be used to protect the underlying NCN. Jito (Re)staking allows any SPL asset or a combination of multiple SPL assets to serve as the underlying asset, enabling stakers to more effectively diversify their VRT holdings, create a more balanced risk-reward portfolio, and use a wider range of assets within the Solana ecosystem. assets.

The Vault Program allows NCN to manage VRT operations (minting, burning, delegation) and enforce its own penalty conditions and deposit/withdrawal caps. This is particularly important because not all SPL assets are equally secure, and the security requirements and conditions of different NCNs can vary widely due to differences in underlying functionality. Additionally, the Vault Program allows NCN to implement custom VRT delegation strategies between multiple operators, DAOs, multi-signatures, or on-chain automation protocols such as the StakeNet Guardian Program.

Re-pledge procedure

While the Vault program is responsible for managing VRT, the Restaking Program is responsible for managing NCN and its corresponding operators. This includes implementing various opt-in mechanisms, as well as managing the distribution and enforcement of reduction conditions.

Together, the Vault program and the re-staking program create a modular framework that enables economic security to be initiated using any SPL asset. Jito (Re)staking further simplifies the process for developers and NCNs, providing a simple and customizable interface to manage VRTs and operators.

The main advantages of Jito (Re)staking

Jito (Re)staking aims to alleviate the cold start problem prevalent in the current on-chain economy by providing a modular, asset-agnostic framework for NCN to achieve consensus and gain economic security.

First, Jito (Re)staking allows anyone to create VRT using any SPL asset, simplifying the design process of token economics and token utility; any token can become a liquid pledge or re-stake asset while maintaining governance compatibility and implement necessary security parameters. Additionally, Jito (Re)staking allows for multi-asset staking, meaning NCN can also leverage existing assets with deeper liquidity and wider token distribution, as well as its native token, to achieve wider market accessibility.

Another core advantage is that Jito (Re)staking allows NCN to configure and fine-tune risk parameters. NCNs built on Jito (Re)staking can implement more complex risk management and security models to meet their specific needs, such as multi-layer slashing penalties or multi-asset slashing to achieve deeper economic security.

At the same time, vaults, operators and NCNs can choose who they integrate based on risk tolerance; vaults can choose which operators and NCNs to entrust, and operators and NCNs can choose which vaults and assets they want to support. Treasurys can also choose to participate in specific reduction conditions determined by the NCN to better manage the amount of assets at risk at a specific time. To ensure the safety of users and assets, all program funds are securely stored in the Vault program and can only be withdrawn through user actions or slash events.

Roadmap and Adoption

Since the launch of Jito (Re)staking, multiple teams and protocols have announced cooperation and integration plans:

• Switchboard - A decentralized oracle network on Solana, Switchboard plans to enhance the security of its economy with multi-layer slashing and customizable staking parameters to improve the quality and performance of its data feed. This will make Switchboard the first Node Consensus Network (NCN) to integrate Jito (Re)staking.

• Squads - Squads Protocol, the decentralized treasury management protocol on Solana, is integrating Jito (Re)staking into its upcoming Squads Policy Network (SPN) to coordinate and incentivize activity among network participants and improve reliability sex and performance. SPN will provide more advanced digital asset management security and flexibility by enabling granular and versatile trading strategies for smart accounts.

• Renzo - Renzo, the leading liquid re-staking protocol strategy manager on Ethereum, will launch its ezSOL as a VRT leveraging Jito (Re)staking. Anyone can mint ezSOL by staking JitoSOL and earn from a combination of staking rewards, re-staking rewards, and MEV tip income.

• Sonic - The first gaming SVM on Solana Sonic will integrate Jito (Re)staking in its upcoming HyperGrid shared state network and HyperGrid bridge. Jito (Re)staking’s NCN model will add an economic security layer for validators to securely prevent state conflicts in HSSN and enhance the core bridging infrastructure with multi-layer slashing and customizable staking parameters to enable atomic ized SVM ↔ Solana exchange.

• Fragmetric - Fragmetric has launched FragSOL, the first liquid re- staking token natively on Solana, as a VRT for Jito (Re)staking. FragSOL will leverage Solana’s token scaling capabilities to accurately distribute NCN rewards and introduce a standardized token process to efficiently manage multi-asset staking and slashing.

• Ping Network (formerly Twilight) - Twilight, the upcoming privacy DePIN project on Solana, will leverage Jito (Re)staking to enhance the decentralization and economic security of its validator network. Twilight will utilize multi-level slashing and customizable staking parameters to ensure strong protection of its privacy infrastructure.

• Kyros - kySOL combines staking, MEV and re-staking rewards into one token to optimize returns. Users can cast kySOL using JitoSOL or SOL. Kyros has also partnered with Jito, Kamino and Raydium to launch an incentivized liquidity pool, which will enhance kySOL’s liquidity and open up more opportunities for the DeFi ecosystem.

Key risks and considerations

Before laying out the rationale for restaking on Solana and assessing Jito’s positioning, it’s worth reviewing the key risks involved. Both re-staking and liquidity re-staking introduce a set of interrelated risks that impact different participants in the ecosystem.

Core Risks of Staking the Blockchain

The core of the Proof-of-Stake (PoS) blockchain is to provide security through the slashing mechanism. The reduction mechanism uses a penalty mechanism to penalize validators that violate protocol rules (such as censoring blocks) or perform poorly over a period of time (such as excessive downtime), confiscating part of their pledged assets. When this mechanism is applied to restaking protocols, the risk is further amplified, as operators bear the additional risk of slashing any application or Node Consensus Network (NCN) they protect.

While this risk is compensated by providing higher returns to stakers and operators, the economic impact cannot be ignored given greater scale federated security adoption. Slashing not only penalizes validators, but also affects stakers who delegate capital to them, resulting in less rewards due to less staking. In a re-hypothecation protocol, the more concentrated the staking distribution is (i.e., the majority of the staking is held by a small number of operators), the greater the overall haircut risk.

This situation may affect the security of the underlying chain used to protect NCN, especially if a large number of pledges in the network are re-staked and slashed, and the cost required to control the majority of pledges in the network may be reduced as a result. The price fluctuation of the underlying asset also plays an important role. The greater the price fluctuation, the higher the risk faced by the underlying protocol or NCN.

Lack of current reduction mechanisms

It is worth noting that currently most (if not all) re-staking protocols have not yet launched slashing mechanisms. Therefore, the lack of deterrence against malicious behavior or poor performance by operators instead poses greater risks to stakers and NCN, especially those with fewer capital resources and greater financial losses.

For example, some restaking protocols (such as Eigenlayer) have developed frameworks to address subjective failures—that is, problems that cannot be easily verified on-chain. Objective failures apply to violations that are mathematically and cryptographically provable on-chain (such as double-signing or lengthy outages), while subjective failures must be resolved off-chain through some kind of social consensus among network participants.

Transparency and trust issues

This raises questions about the transparency and trust assumptions of these systems, and off-chain solutions can be complex and time-consuming processes that can even lead to a base layer fork if there is enough controversy and disagreement around the correct state of NCN. Eigenlayer plans to mitigate this risk by using the EIGEN token, which enables validators to enforce slashing penalties for subjective failures, performing slashing by forking the token rather than the base layer.

The impact of market-driven incentives

The impact of market-driven incentives on operators and stakers needs to be considered. In order to enhance the economic security of NCN, pledged capital must be sticky, that is, remain stable over the long term. However, without some kind of long-term commitment enforced through mechanisms such as lock-up periods (which in turn poses risks to operators and stakers), operators may move their stake at any time in pursuit of the highest possible returns.

Incentivizing NCNs to compete for operators by offering higher returns (usually inflationary token issuance) is not beneficial to the broader ecosystem in the long term and may instead repeat past mistakes in the design of crypto protocol incentive mechanisms (such as liquidity Agreement income and expenditure imbalance in mining).

Key considerations for liquidity re-hypothecation

Shoal Research has explored some of the key risks in liquidity re- hypothecation in previous reports, including:

• Supported Deposit Asset Risk – Vault Receipt Tokens (VRT) bear the risk of their underlying assets. Local restaking tokens face different risks than Liquidity Staking Tokens (LST).

• Liquidity acquisition risk – Some re-hypothecation protocols have an escrow period when the pledged assets are cancelled (e.g. Eigenlayer’s 7 days). This mechanism raises concerns about term risk and potential liquidity issues. If the secondary market is illiquid, investors may have difficulty selling VRT at fair market price. The cool-down period for Jito (Re)staking to unstake is approximately 4-5 days (two epochs). The timing of asset redemptions and the liquidity of VRT providers play a key role in this risk.

• Smart contract risks - Risks of the VRT protocol architecture need to be assessed, including reward distribution mechanisms, fee structures and multi-signature permissions. These factors may affect asset transfers and withdrawals.

• Oracle risk – Reliable price data is critical to maintaining VRT pricing. Inaccurate oracle data may lead to mispricing of VRT, thereby creating systemic risks during redemptions or liquidations.

• Governance Risk – The mechanisms chosen to protect the NCN are critical in ensuring its long-term stability. A trade-off must be made between granting power to a large number of stakeholders (time consuming) and granting power to a small number of actors (like 5/3 multisig).

• Cross-chain bridging security risks - For cross-chain VRT, the risks introduced by the basic bridging mechanism need to be considered. Both native and third-party bridges have different trade-offs and risks.

• Cyclic risk – In the lending market, using VRT for recursive lending (cyclical) could lead to cascading liquidations in periods of high volatility, similar to the 2022 stETH unanchoring event. However, this risk is mainly for the lending market and does not pose a significant risk without large-scale adoption.

Reasons to Stake Again on Solana

Since the launch of Eigenlayer on Ethereum, R&D work in the restaking space has accelerated significantly. Currently, Eigenlayer ranks third in total volume locked (TVL) on the Ethereum network. At the same time, Solana re- established its leading position as the foundation layer for application development, second only to Ethereum’s TVL. While much of the growth momentum in Q4 2023, driven largely by a surge in meme coin trading activity, has gradually slowed down, there are many new products and services being developed on Solana, including several key infrastructure projects. In addition, the new SVM API launched by Anza enables developers to build SVM- based projects on the Solana mainnet beta, paving the way for a new era of SVM L2 and application chains. These L2 and application chains may become important sources of demand for Jito (Re)staking.

Comparison of Ethereum and Solana re-staking

1. Liquidity gap

Ethereum's liquidity is far greater than Solana's (TVL is about 9-10 times that of Solana), making it a powerful base layer for greater economic security.

2. Room for growth

Solana currently has greater development potential and room for growth, and the re-staking incentive mechanism can play an important role in improving network TVL.

3. Capital efficiency

Liquidity re-hypothecation strategy management requires constant reallocation of capital and ongoing gas fees. The cost of managing re-staking on Solana is significantly lower than on Ethereum, making it more capital efficient.

4. Differences in ecological needs

More teams in the Solana ecosystem are focused on application development rather than infrastructure building. This raises questions about the origin of the requirements for the restaking protocol, as the application's requirements structure may be different from NCN. For example, AMMs like Raydium do not need to launch their own set of validators in their current state.

Nonetheless, the rise of SVM-L2 and AppChain has brought about a new stream of economic security requirements, providing a significant opportunity for re- staking solutions to meet this need.

Jito 's role

As of now, about 93% of Solana validators are running the Jito-Solana client, and a total of 2.5k SOL tips have been distributed, involving 6.5 million transaction packages.

JitoSOL's deposits have grown to 14.5 million SOL (approximately $3.14 billion) and it has incurred $644 million in fees to date. JitoSOL has steadily grown its position in the Solana liquidity staking space and currently accounts for approximately 45% of total TVL.

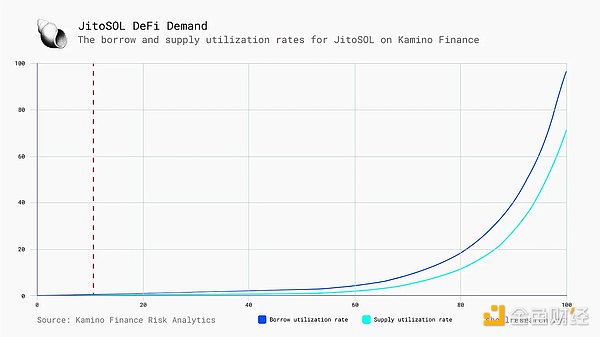

Demand for lending JitoSOL on Kamino Finance continues to grow, with utilization rates approaching 100%.

Jito (Re)staking’s competitive landscape

Despite Jito's widespread presence in Solana, there are a number of key catalysts and protocols that pose credible challenges to the adoption of Jito (Re) staking. First, there is already another re-staking protocol on Solana, Solayer, which launched in June 2024 and has accumulated a whopping $168 million in deposits. Solayer features a re-staking architecture and shared validator network designed to provide Solana applications with enhanced capabilities to protect block space and prioritize transaction inclusion.

Second, Solana also faces competition from other native teams, especially liquidity staking protocols, who may be well-positioned and incentivized to build their own re-staking products. For example, Sanctum positions itself as the unified liquidity layer for Solana LSTs, enabling all LSTs (regardless of size) to share a deep liquidity pool and operate with minimal liquidity restrictions. To date, Sanctum's Reserve, Infinity and Validator LSTs have attracted over $1 billion in TVL. Helius, the core RPC provider on Solana, launched their hSOL LST together with Sanctum, with more than 13 million SOL currently staked. Binance’s BNSOL is currently in the lead, with 6.77 million SOL staked on the platform. Another notable Solana native competitor is Marinade Finance. Marinade launched its liquidity staking protocol back in 2021 and currently has a TVL of just over $1.8 billion and lifetime fees of $181 million. While neither team has mentioned re-staking at the moment, it’s not far-fetched to imagine these teams developing their own competitive re- staking products. The launch of Karak seems to have opened the floodgates for restaking competitors on Ethereum, and a similar effect will likely play out on Solana.

Finally, universal recollateralization protocols such as Symbiotic and Karak will face competition if they choose to adopt a chain-neutral approach that supports SOL and SPL/Token2022 assets. Even Eigenlayer is changing tack, launching permissionless token support that will make any ERC-20 asset available for rehypothecation. Thinking beyond Ethereum, though, Eigenlayer ultimately positions itself as an “innovative orchestration engine.” If application development and value accumulation on Solana one day exceeds that of Ethereum, then there is no reason for Eigenlayer not to respond to the demand and set up shop on Solana in this case. However, this is a long-term hypothetical scenario and there is no guarantee that Eigenlayer will always be the leading re-mortgage protocol, so it is unclear how much of a threat it will pose to Jito (re)mortgage.

In this context, Jito needs to rely on its successful record in the Solana ecosystem and ensure that the Jito Foundation continues to optimize the re- staking protocol and respond promptly to the needs and feedback of NCN, operators and other protocol participants.

Application scenarios of Jito (Re)staking

Re-staking protocols benefit from the increase in middleware solutions that require coordination mechanisms to meet business needs. The development of NCN is still in its early stages and may span multiple areas. The following are potential application scenarios for Jito (Re)staking:

• Decentralized solver network :

DEX and liquidity platforms using solver architecture can launch their own decentralized solver network, distribute revenue and impose slashing penalties on solvers to incentivize them to execute transactions at the best price.

• SVM L2 :

As demand for faster block confirmation times and customized economic incentives increases for Solana applications, SVM L2 is emerging, driving the need for economic security, where Jito (Re)staking can meet the demand.

• Order flow auction and MEV redistribution protocol :

Solana DEX can implement order flow auctions and distribute the value obtained through MEV to traders or token holders, similar to CoWSwap on Ethereum.

in conclusion

Although there are still significant gaps in the re-staking field from conception to reality, it is generally believed that re-staking will be a key development direction to promote the vigorous development of on-chain applications, helping to enhance their economic security and capital efficiency. This can be compared to the impact of Amazon Cloud Service (AWS): by providing a cloud computing platform that rents computing resources on demand, AWS has promoted the rapid rise of Web application development.

By outsourcing computing resources and infrastructure, web developers can devote more time and resources to creating valuable products and services and better understand user needs. Likewise, the Redemption Protocol enables blockchain-native applications and networks to outsource economic security concerns and thereby focus on developing valuable products and services while inheriting the key features and benefits of blockchain.

Re-staking on Solana is on the rise, and Jito (Re)staking is well-positioned to become the protocol of choice to drive the launch of new innovative products and services.

panewslab

panewslab

chaincatcher

chaincatcher