There are so many opportunities in the Bitcoin bull market, why do some people still lose money?

Reprinted from panewslab

01/14/2025·24days agoAuthor | @resdegen

Compilation | Vernacular Blockchain

Financial management is not only a combination of skill and luck, but also a comprehensive test of personal psychological quality and discipline. Only by keeping this in mind can you remain invincible in the long-term market game.

In the current fast-changing and fiercely competitive market, how traders stay calm, rational and develop sound strategies has become the key to whether they can gain a foothold in the market and continue to make profits.

The following are 8 psychological frameworks that combine market practice and psychological principles to help you penetrate market noise, improve your decision-making capabilities, and become a more sharp, focused and logical investor.

01. Conduct the “100% cash test”

What is the "100% Cash Test"? The "100% cash test" means assuming that all your allocations are converted into cash (for example, 100% into USDT), and then ask yourself: If you reallocate funds now, will you still buy the current assets in the same proportion?

If the answer is no, it means your configuration may need to be adjusted.

So, ask yourself: If all your allocations became 100% USDT today, would you still choose to reallocate funds to the exact same position?

For most people, the answer is probably no. However, many people struggle to take action. Why? Because it is affected by the following psychological factors:

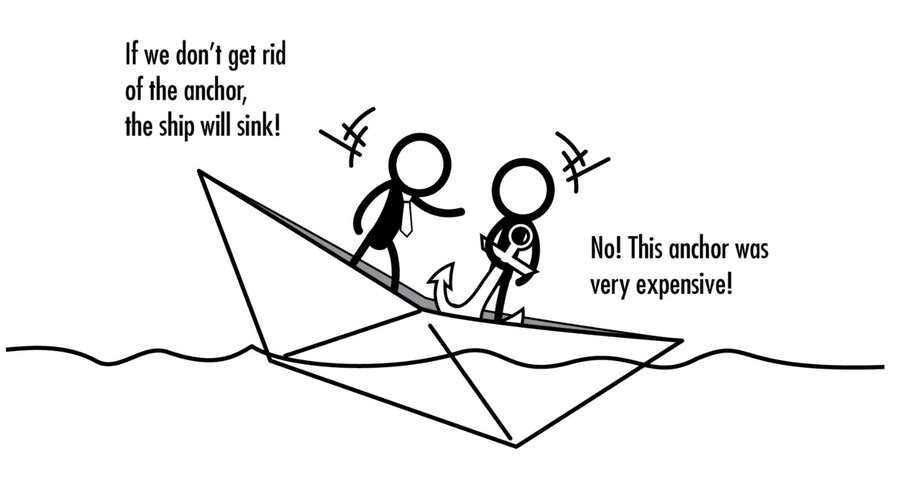

· Sunk cost fallacy

·Emotional dependence

·Afraid of admitting mistakes

The sunk cost fallacy is a cognitive bias in which people continue to invest time, money, or energy even though it no longer makes logical sense (the same applies to relationships, projects, etc.) because they have already invested time, money, or energy. In trading, this means holding on to an underperforming position because "too much has been invested" (either financially or emotionally), rather than cutting losses and reallocating to better opportunities.

Going back to the original question, if the answer is no, you need to take action.

It may feel overwhelming at first, but you can start small, such as choosing a position and asking yourself: If it were today, would I buy this Token in the same amount? Then, move on to evaluate the second position.

While selling is an emotionally difficult thing to do, it can feel like closing the door on some potential possibility. But holding on to a position based on hope or fear will only lead to stagnation and poor decision-making.

Face the problem head-on bravely, adjust configurations decisively, and avoid the misunderstanding of sunk costs. Remember, sunk costs do not participate in decision-making.

02. Maintain a structured configuration

Achieve more efficient management through clear classification:

1) Core position

Core positions refer to high-conviction investments, which means you can withstand severe price fluctuations in the token and hold it for a long time.

This doesn't necessarily require you to hold for the long term, as opportunity costs are very high in this market and rotations are frequent. But if you think you can nail every market move, you're kidding yourself, or you need to believe in the long-term value of something.

2) Trading position

This is a short to medium term opportunity to capture a specific trend or price movement.

This position offers more flexibility, allowing for faster rotations and tighter stops. Everyone’s trading style may be different, and this is not limited to perpetual contracts accounts.

For example, I could buy an on-chain opportunity, do a 4x swing trade (from $5 million to $20 million), and then exit. Even if its price continues to rise later, I won't care because I already know what type of transaction I am doing before trading.

If I think it could reach $1 billion (e.g. due to the uniqueness of the project), it will be classified as a core position. I can accept a 50% retracement because I know that this volatility is the price of excess returns.

3) Clear classification to avoid confusion

Confusing core positions with trading positions often leads to confusing and emotional decision-making. By separating them, you can more clearly understand the purpose of each position, thereby reducing unnecessary regret.

Therefore, classified management not only helps you stay rational, but also improves the overall efficiency of configuration and confidence in decision-making.

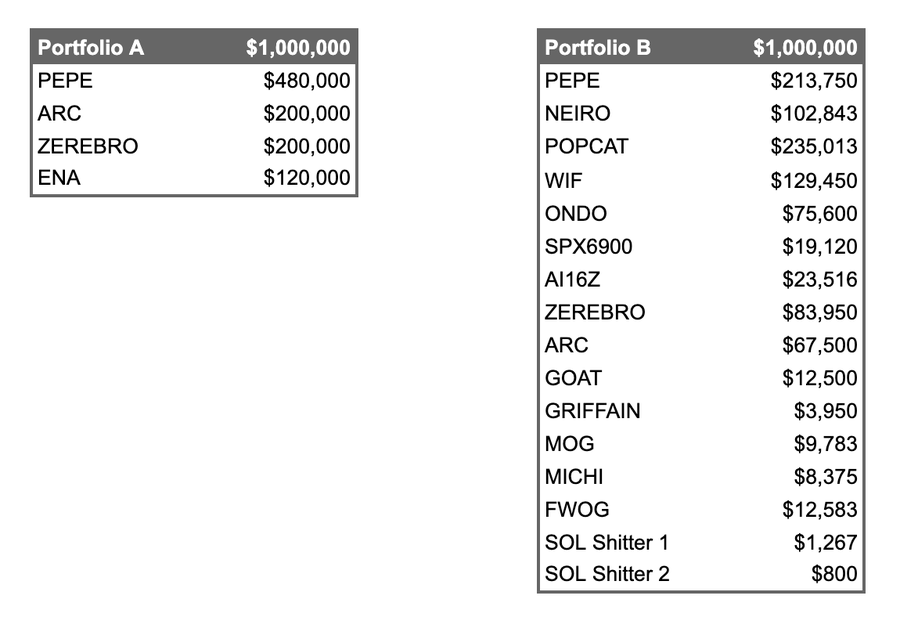

03. Fewer and more concentrated layouts

This is an underrated skill that only the best traders can truly master. Perhaps, this is the secret of promotion from one level (such as 6 figures) to another level (such as 7 figures).

1) Core points

Facts have proven that increasing positions with conviction and achieving growth through compound interest can help people retain wealth for a long time and become real millionaires than just speculating on a Memecoin. Every trade should have a valuable impact on your allocation, otherwise it's not worth taking.

2) Reduce layout and optimize management

Having fewer targets helps manage allocations more efficiently while avoiding the biggest enemy in trading – indecision.

When you need to handle 15 different positions at the same time, the mental load can make you feel exhausted. However, if you limit your holdings to a small number of targets (for example, up to 5), you will be more cautious and start to think seriously: "Is this casually recommended Token really worth allocating?"

Of course, there will also be some opportunities that are highly asymmetric bets (for example, taking 1-2% risk may bring 20-40% portfolio return). The key is not to diversify your funds randomly, but to stay focused and focused can bring greater returns.

3) Less is more

A few people have achieved wealth growth by streamlining their layout, while others are addicted to "collecting" meaningless short-term increases. I call these people "increase collectors."

In short: either choose a highly asymmetric bet, or decisively increase your position based on conviction and take advantage of compound interest growth. Strategies that stray between the two are unlikely to achieve real success.

04. Build your configuration according to your goals

Your allocation should always be centered around your financial goals.

If your goal is to grow your assets from $200,000 to $2 million during this bull market (while $2 million may not be enough to retire, it is still a goal worth pursuing for most people), then every time Decisions should bring you closer to this goal. Ask yourself:

· Will this deal materially help achieve my goals?

· Or am I just chasing the rise blindly because I am afraid of missing out?

1) Stay focused and avoid errors in judgment

Lack of focus impairs your judgment. It may seem tempting to throw $5,000 at every opportunity, but consider the following costs:

· This investment will likely have minimal impact on your overall configuration.

· It consumes a disproportionate amount of your time and energy (e.g., using 20% of your attention to manage only 1% of your investments).

2) Abandon unrealistic fantasies

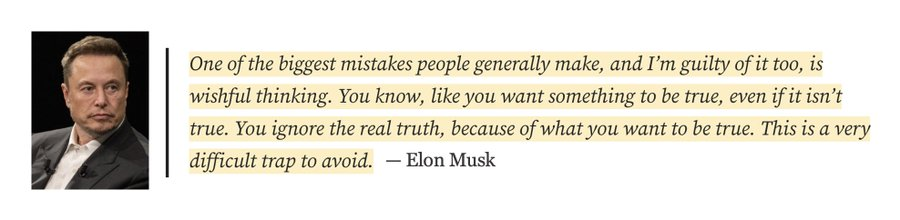

After most people buy, they just expect a certain token to reach the "magic number" in their minds: "I need this token to increase 10 times." This kind of wishful thinking will only hinder your judgment and will not help you achieve your goals. .

Instead, you need to identify your goals and determine whether you are working toward them. This point is crucial and deserves to be emphasized again and again.

In summary, before investing, clarify your goals first and ensure that every decision is serving the goals and not being led by market sentiment.

Translation: One of the biggest mistakes people make, and one I've experienced

myself, is wishful thinking. You know, that mentality of wanting something to

be true even if it isn't actually true. You choose to ignore the fact simply

because you prefer to believe that it meets your expectations. This is a

difficult trap to avoid. ——Elon Musk

Translation: One of the biggest mistakes people make, and one I've experienced

myself, is wishful thinking. You know, that mentality of wanting something to

be true even if it isn't actually true. You choose to ignore the fact simply

because you prefer to believe that it meets your expectations. This is a

difficult trap to avoid. ——Elon Musk

05. Focus on your strengths

You’ve made it this far because you’ve been leveraging your strengths—persisting.

For example, through several successful on-chain configurations and with the help of compound interest growth, my configuration has been greatly improved. Liquidity may become a challenge as portfolio size increases, but moving to higher market capitalization assets is not necessarily the best solution.

1) Maintain your core advantages

As you advance in the market, you may find yourself facing off against competitors who have sharper, more specialized strengths in the larger market. Don’t think that having a larger allocation automatically makes you a master at trading perpetual contracts.

If your success comes from on-chain configuration, then continue to delve into this area. Liquidity usually won't be an issue unless your allocation size reaches a very high level (say $5 million to $10 million+), such as a 7-8 figure liquidity pool and a 7-8 figure 24 The hourly trading volume can fully support your operations.

Likewise, if you are doing well with Memecoin or AI themes on the Solana and Base chains, there is no need to move to liquidity staking on the Sui chain. Only by focusing on your strengths can you achieve growth more steadily.

2) Avoid deviating from familiar areas

Assuming that the market trend is still continuing without an obvious turning point, rashly entering an unfamiliar area will often bring about the following problems:

Low Conviction: Without sufficient understanding of the new field, you will tend to be risk-averse, thereby allocating less capital and reducing potential returns.

Costly: Exploring a new territory requires learning its rules and how it works, which takes a lot of time and energy and distracts you.

Not only will these issues undermine your efficiency, they may also reduce your overall return.

The next key is how to focus more on your own areas of advantage and use your existing successful experience to further enhance your competitiveness and achieve more robust asset growth.

06. Don’t try to trade in reverse direction

What makes contrarian trading attractive is that those who can successfully seize market turning points often gain a high reputation, such as accurately judging the high point of LUNA, the top of the market cycle, or the bottom of SOL. However, contrarian trading only pays dividends at critical turning points.

In a bull market, the market momentum is strong, and what you need to do is increase your position to help the market, rather than trying to "douse the flames."

Unless you're George Soros or GCR - but obviously, you don't know it yourself.

1) Why is it difficult for reverse trading to work?

Trying to seize every market turning point will not only make you physically and mentally exhausted, but may also backfire. Statistically speaking, the probability of success in such an attempt is extremely low. Let’s be realistic – otherwise you wouldn’t be here reading this article.

Instead of getting too hung up on predicting every turn, focus on market trends, move steadily, and magnify your results through compound interest.

2) In a bull market, it is wise to go with the trend

In a bull market, it's wise to go with the flow. Trend is your friend, don't try to fight it. Follow the trend and exit decisively with profits when the trend ends. The market is not designed to create heroes, but to allow rational people to achieve steady growth in assets. Your goal is not to become what people call a “market prophet,” but to continually increase your profits.

In other words: Instead of trying to accurately predict every turning point, go with the flow. Even if you occasionally suffer some retracement, you can still confirm the trend and seize the opportunity.

The cost of missing out on huge gains in a bull market is often much higher than short-term fluctuations. The best strategy is to let go of your obsession with contrarian trading, follow the trend, and focus on achieving your goals.

Translation: It is actually easy to be a contrarian. The difficult thing is to be a contrarian who can make money.

07. Develop trading logic, set stop loss standards, and maintain

emotional calm

Tokens are just tools for financial growth. They are neither loyal nor "care" about you. When evaluating new opportunities, be sure to document your trading logic and strategy.

1) Transaction logic

Make it clear why you bought this Token:

·Why did you buy it?

· Is this a deal based on some kind of catalyst?

· Are you betting on information asymmetry, or do you think the market is pricing it fundamentally wrong?

· Or is it just FOMO because your favorite KOL is promoting it?

2) Stop loss standard

Clearly set an exit criterion, whether it's a price target, timing, or a change in market conditions.

Key: Take the emotion out of it. Remember, this isn't a personal battle, it's business.

Imagine this scenario:

You bought XXX Token for $50,000. It once rose to $200,000, but then fell back to $50,000. At this time, your trading logic has been negated. Your allocation also shrinks from $500,000 to $350,000 (assuming the local top in December).

At this point, you face two choices:

· Continue to hold losing positions, hoping for a rebound without clear basis, just to recover the capital;

· Decisively stop losses, reallocate funds to more potential opportunities, and seek new growth points.

3) The goal is to let the configuration grow, rather than being loyal to a certain Token

If you find a better opportunity, adjust your position decisively. Even if you feel sorry for the previous Token, if the new configuration achieves 2 times the income, the regret will soon disappear.

The key is the result, not "loyalty" to a certain token.

Let go of promises, hopes and unrealistic fantasies. Selling a crypto asset doesn’t mean it’s over – you can always buy back in when the time is right.

4) Calm trading is the key to success

It sounds simple, but the crypto market is a place where people can become extremely emotionally attached. If you can take advantage of this, you can have an advantage. But at the same time, you must always act around the goal: to keep the allocation growing.

No matter which token the income comes from, what matters is the increase in total assets. Remember: Profit Maximization > Community Feeling.

08. Remove emotions from trading results and avoid self-blame.

The quality of a transaction cannot be measured purely by the results. A good trade is made based on the best information available at the time and a well-thought-out decision, rather than simply being defined by whether it is ultimately profitable.

Suppose your trade is not a gamble, but follows the following elements:

· Have clear transaction logic

·Set clear stop loss standards

·Have appropriate risk management and clarify whether it is a core position or a short-term trade

· Proceed under favorable conditions, such as a good risk-reward ratio or asymmetric potential

So no matter what the final result is, this is a reasonable trading decision.

Also remember to avoid excessive self-blame or internal friction due to trading results. After experiencing losses, people tend to fall into a vicious cycle of self-criticism, but this mentality usually ignores the importance of rationality in the trading process.

Loss is an inevitable part of trading. Even well-planned trades are bound to fail sometimes, and conversely, some unthinking trades may succeed by luck.

I myself beat myself up too much for my failure, but later realized that the trade actually made sense and fit my strategy. However, this excessive self-blame will only bring unnecessary pressure, lead to errors in judgment, indecision, and even trigger emotional trading. Eventually, you may get stuck in a downward spiral and start to wonder if you’re “always making a mistake” or that others are always doing it better than you.

09. Summary

Writing this after reflecting on my mistakes countless times is also a summary and warning for myself. The past is past, the only thing that can be looked forward to is the future. Past decisions, whether successful or unsuccessful, are designed to allow you to do better next time, rather than letting them eat away at you.

If you're doing well so far, that's great. If it doesn’t go your way, that’s okay—in this market, growth is impossible without failure. Behind every success story, there is a price that must be paid.

Remember: The meaning of trading is not about how many waves you have caught up with, or even who makes the most money. What really matters is how you respond to each trade, whether you achieve your goals, and whether you can hold on to your wealth when the market crashes.

jinse

jinse

chaincatcher

chaincatcher