Token Economic Report: The unlocked amount reached US$82 billion in 2024, with a high return rate of MEME but 97% eventually "death"

Reprinted from panewslab

02/06/2025·2MOriginal text: " Tokenomist Annual Report 2024 "

Compiled: Nancy, PANews

At the end of January this year, Tokenomist released the Tokenomist Annual Report 2024, covering key trends such as token unlocking, low-circuit high-FDV tokens, Memecoin and AI proxy, and revealed their market liquidity, investor sentiment, and the long-term The impact of value capture.

The report pointed out that 2024 began with the issuance of some important projects with low circulation and high FDV (complete dilution value), setting the tone for the industry's development trajectory. However, market sentiment changed in the middle of the year. From short-term, low-market tokens and lock-in attribution plans to fully unlocked, community-driven meme coins, reflect the divergence of investor preferences. By the end of the year, the "Super MEME Cycle" became the dominant narrative and attracted widespread attention.

Key points:

More than $150 billion in tokens are expected to be unlocked from 2024 to 2025, of which approximately $82 billion was absorbed in 2024 alone.

· By the end of 2024, the average circulation/FDV ratio at the time of token issuance has increased to 35%;

· The return rate of MEME track in 2024 is as high as 536%, far exceeding the performance of Bitcoin and Ethereum.

· Memecoin has a very low long-term success rate, with 97% eventually "death" and an average lifespan of about 1 year, and many tokens will disappear in a shorter time;

· Combining autonomous entities with MEME, AI and social media emerged as a new crypto trend, frameworks such as Virtuals and ai16z led innovation.

The first five unlocking events in 2024

Token unlocking events are a key milestone in the crypto market. Release of locked tokens into circulation under a predetermined vesting plan may affect prices and capital rates, especially in the short term. Therefore, this section analyzes the five largest unlocking events in 2024, focusing on price impact and fund rate trends over the 60-day window (-30 to +30 days). By analyzing the relationship between capital rates and price changes, we can evaluate whether market expectations (such as reflected by derivative positions) are consistent with the actual price trend. This provides valuable insight into market sentiment, especially in key events like token unlocking.

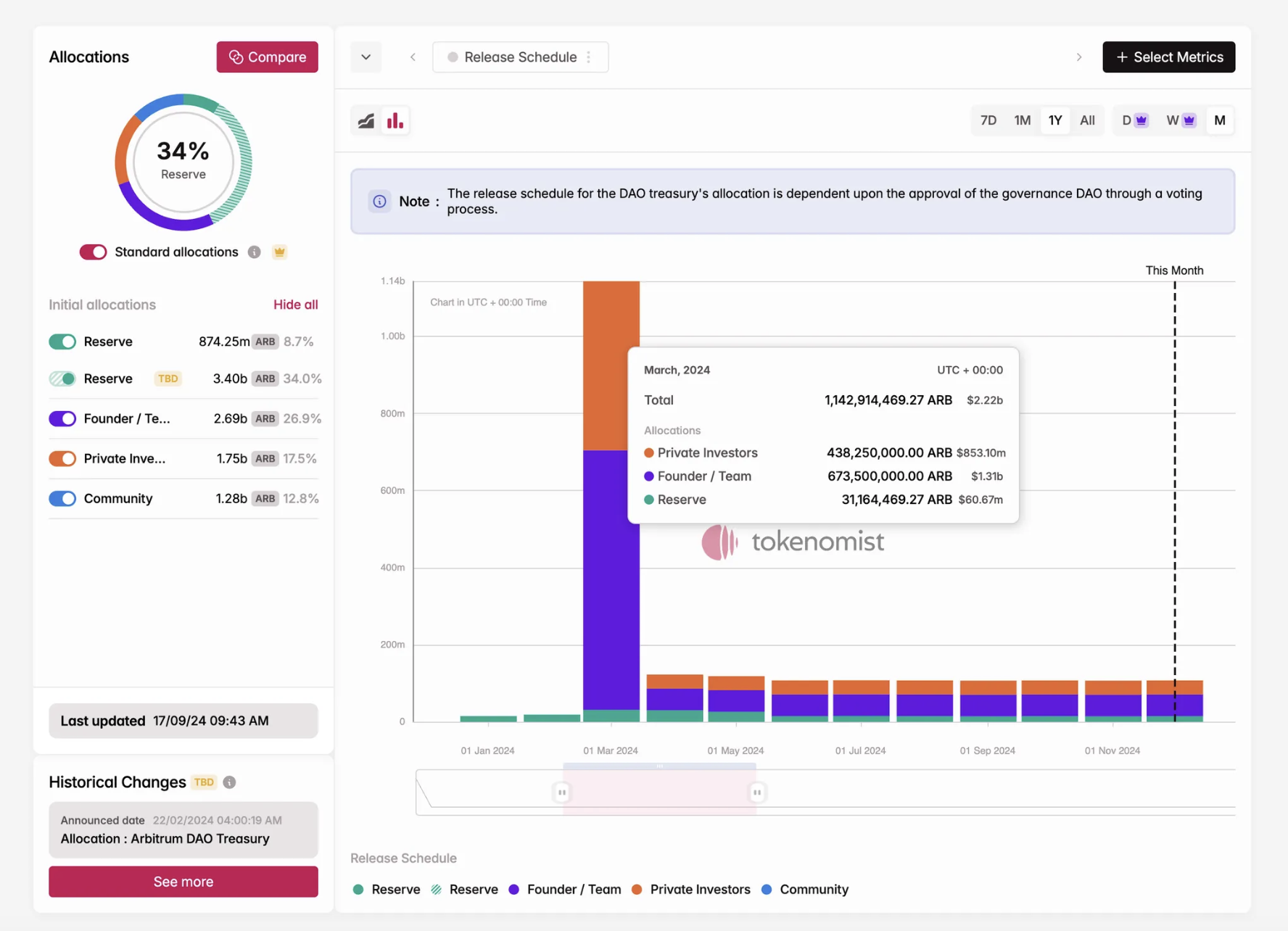

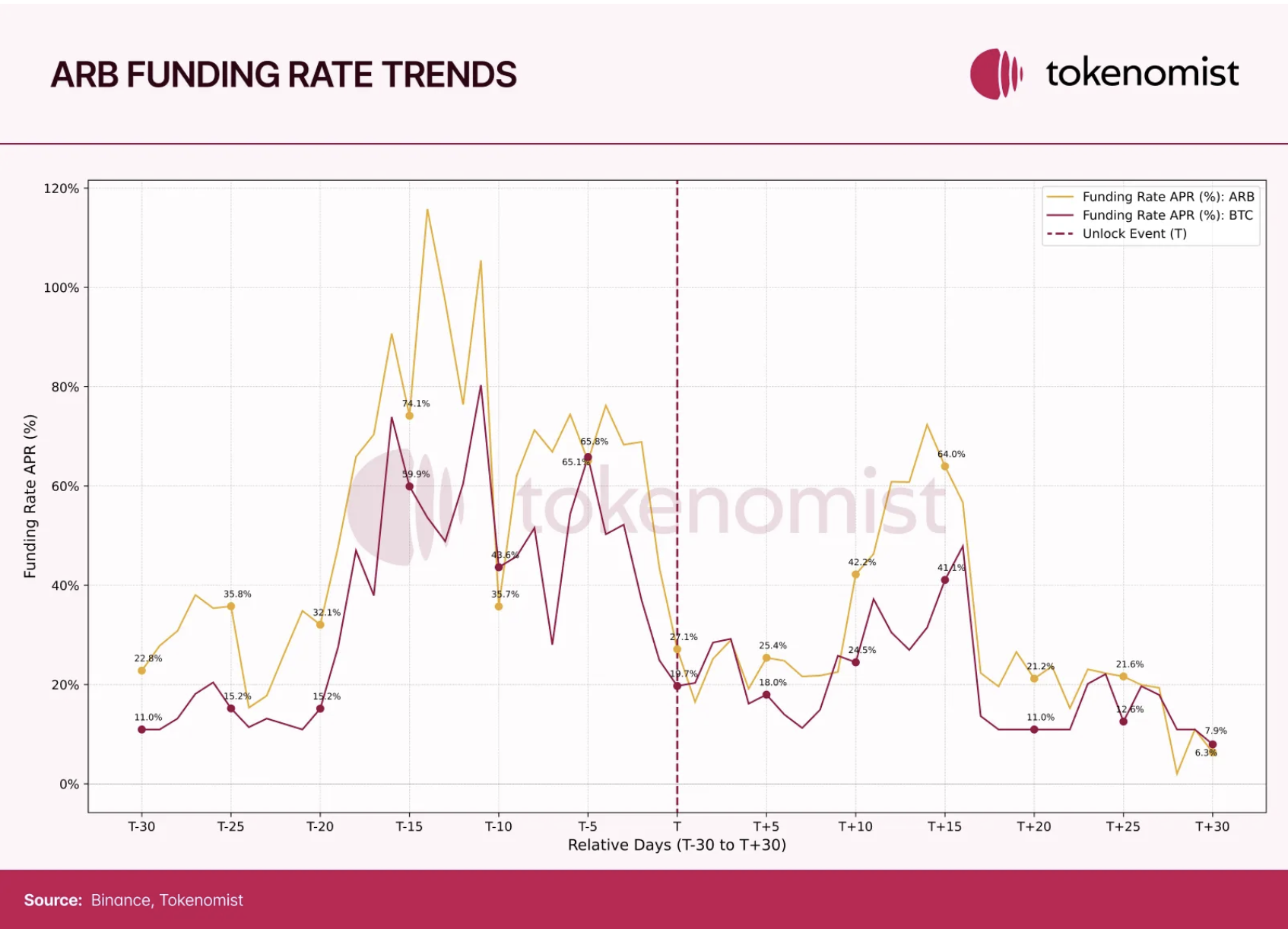

1. Arbitrum (ARB) : Unlock $2.22 billion worth

When Bitcoin hit a new all-time high of $74,000 in March 2024, Arbitrum (ARB) opened the largest token unlocking event of the month, with an unlock value of $2.22 billion. This is the first time that Arbitrum’s private investors and founders/teams have unlocked, introducing a large number of new token supplies to the market.

In terms of price impact, the ARB price impact has fallen steadily before the unlock date, which may reflect cautious trading practices on expected increase in supply. Within 30 days of unlocking, the price impact of ARB continued to drop by 33.8%, which may be related to the market entering more supply.

Regarding funding rates, ARB's funding rates closely match BTC's funding rates within 60 days, but are always higher than BTC, which reflects the high demand for leveraged positions during that period.

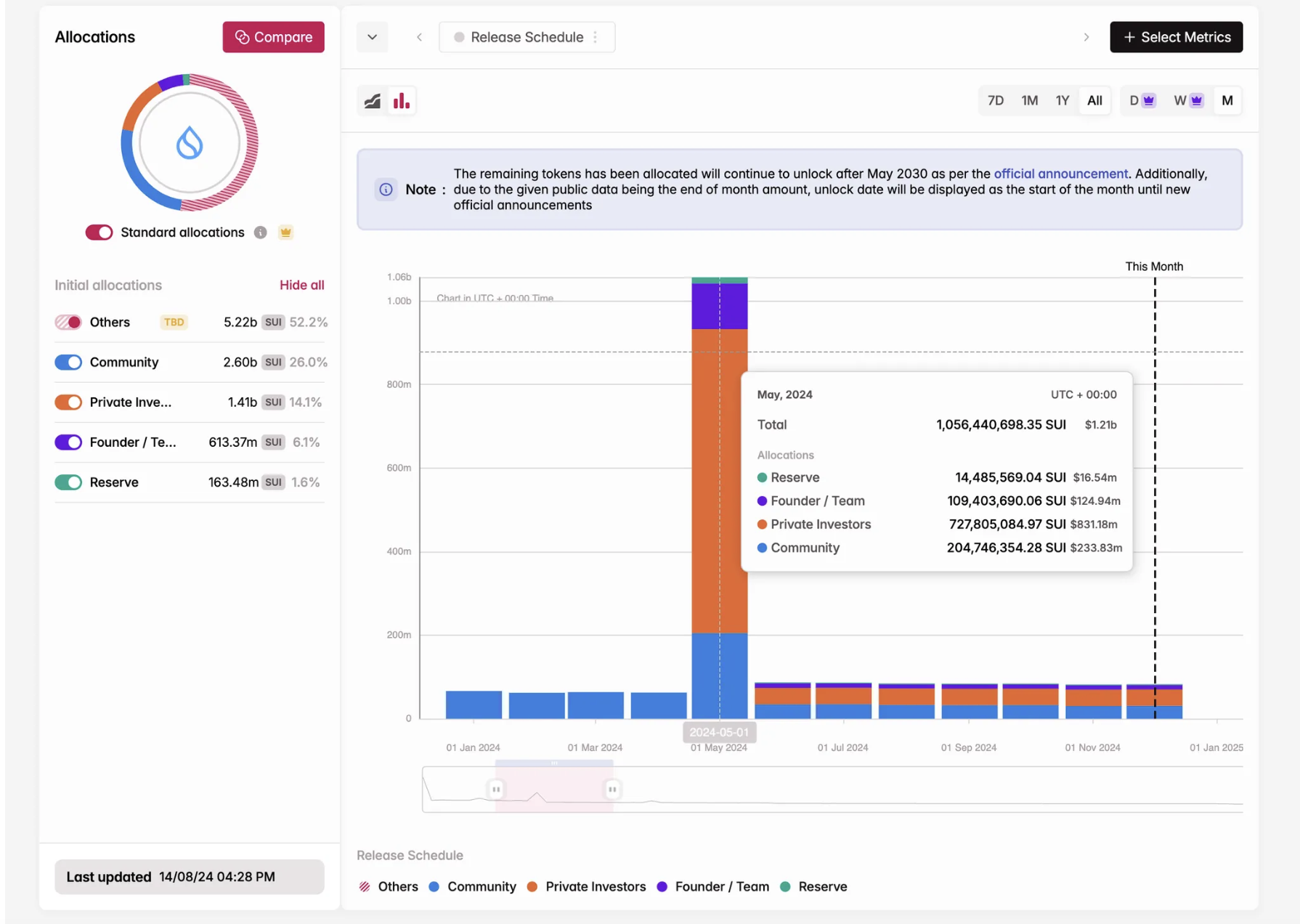

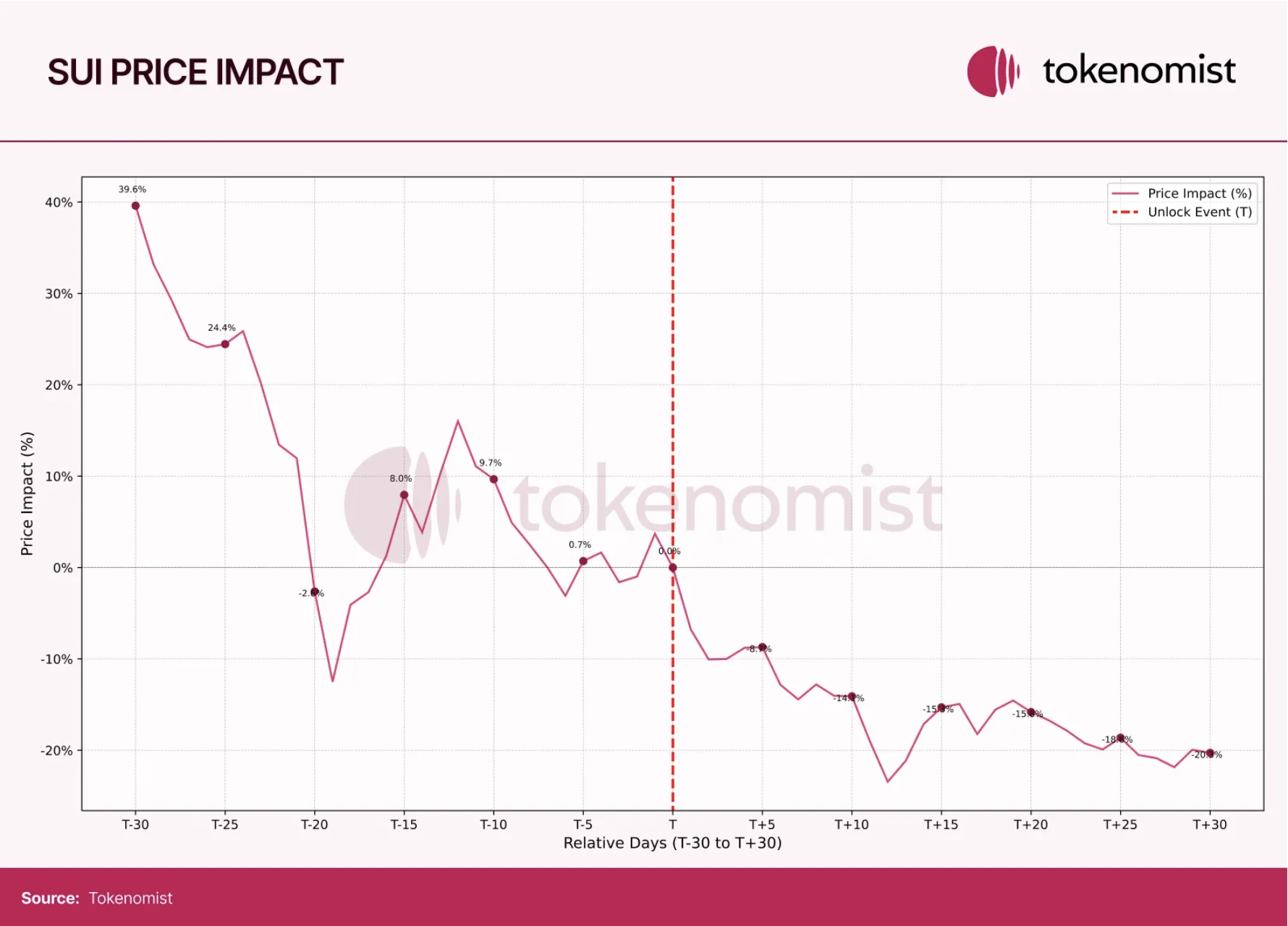

2. Sui (SUI) : Unlock $1.21 billion worth

In May 2024, Sui (SUI) was the second largest unlock event of the year, with an unlock value of US$1.21 billion. The unlocking released a large supply of tokens, and most of them were allocated to private investors.

Analyzing the price impact, the price of SUI rose 39.6% in the 30 days before unlocking, but fell 20.3% in the 30 days after unlocking.

In terms of funding rates, the (SUI) funding rates enter the negative range 20 days before unlocking and reach -34.1% on the day of unlocking, showing pessimism before the unlocking event. About 20 days after unlocking, (SUI) funding rates rebound and are consistent with BTC's funding rates (approximately 11.0%).

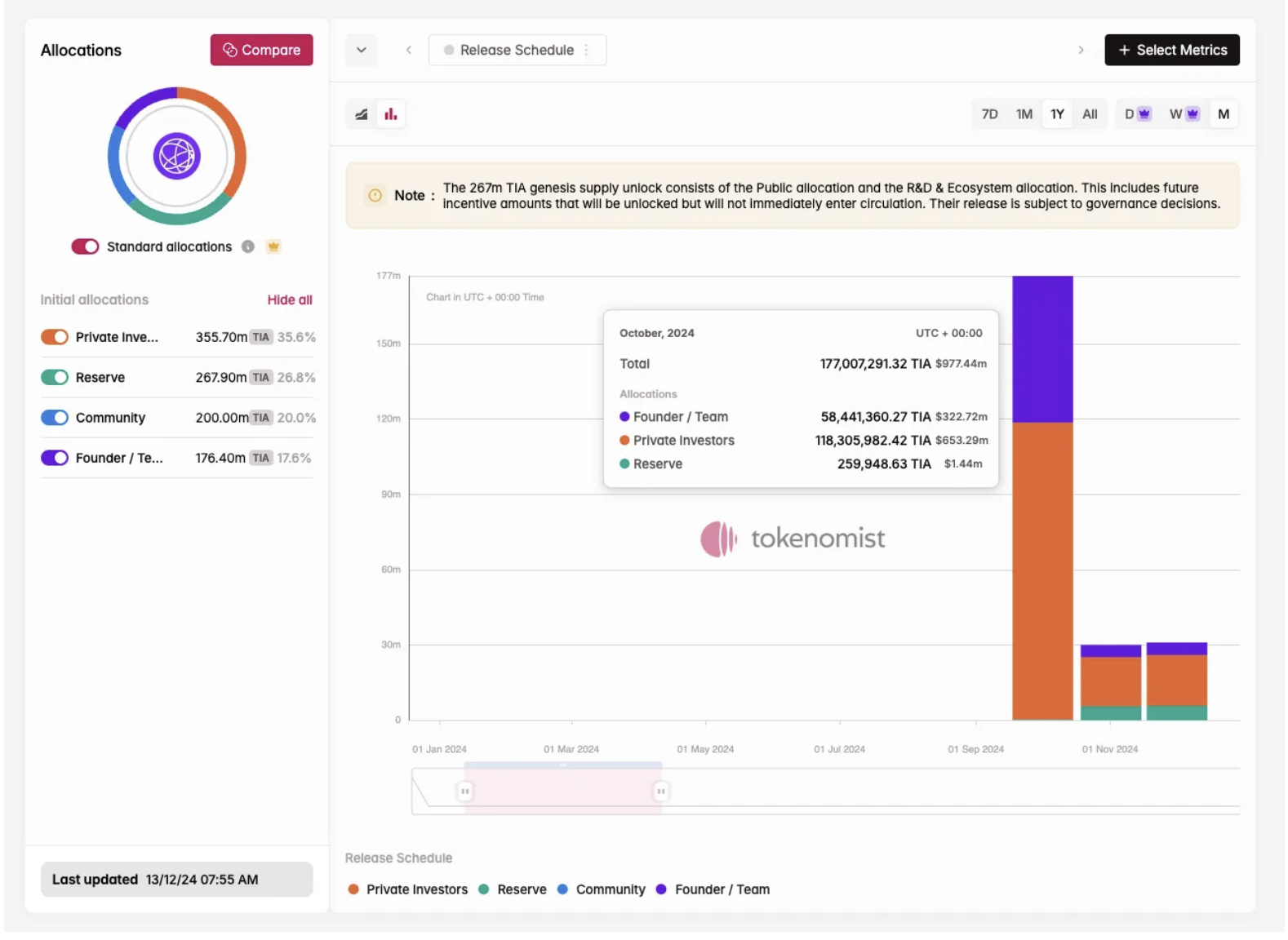

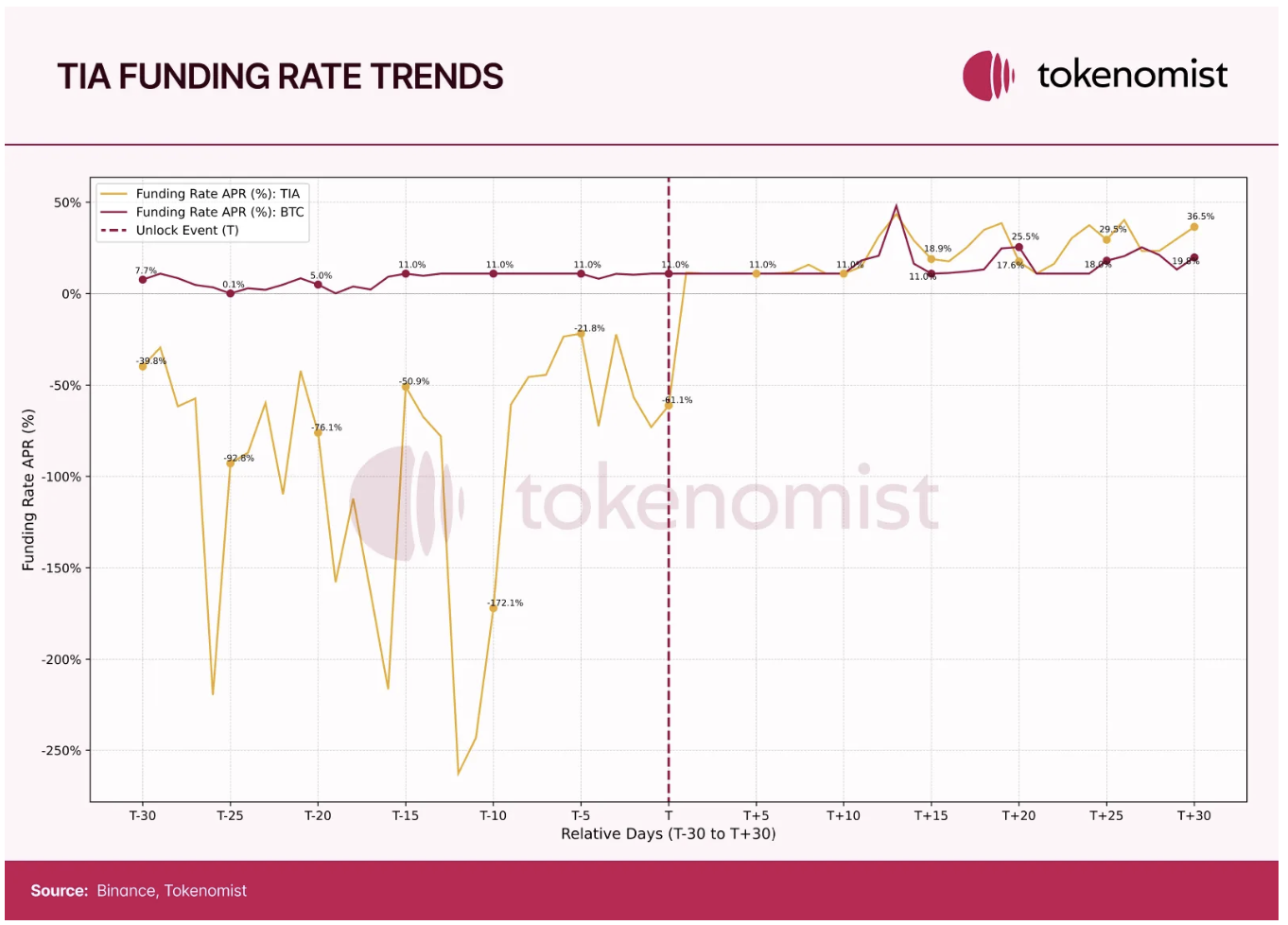

3. Celestia (TIA): Unlock $977.44 million

In October 2024, Celestia (TIA) launched an important unlocking event worth $977.44 million. This is the first major unlocking of TIA since the TGE incident, becoming one of the largest token unlocks of the year, and the vast majority are allocated to private investors and founders/teams. Unlocking of private investors and founders/teams dominates, ensuring a continuous incentive for long-term contributors and early supporters.

Regarding price impact, TIA's price continued to fall before unlocking and fell by 25% within 20 days after unlocking. However, it quickly rebounded, surpassing BTC at 19.2% 30 days after unlocking.

TIA's fund rate chart is more volatile than other tokens. On the day of unlocking, TIA's funding rate remained in the negative area (-61.1%), but it returned to a positive value a few days after unlocking, quickly staying consistent with BTC's funding rate.

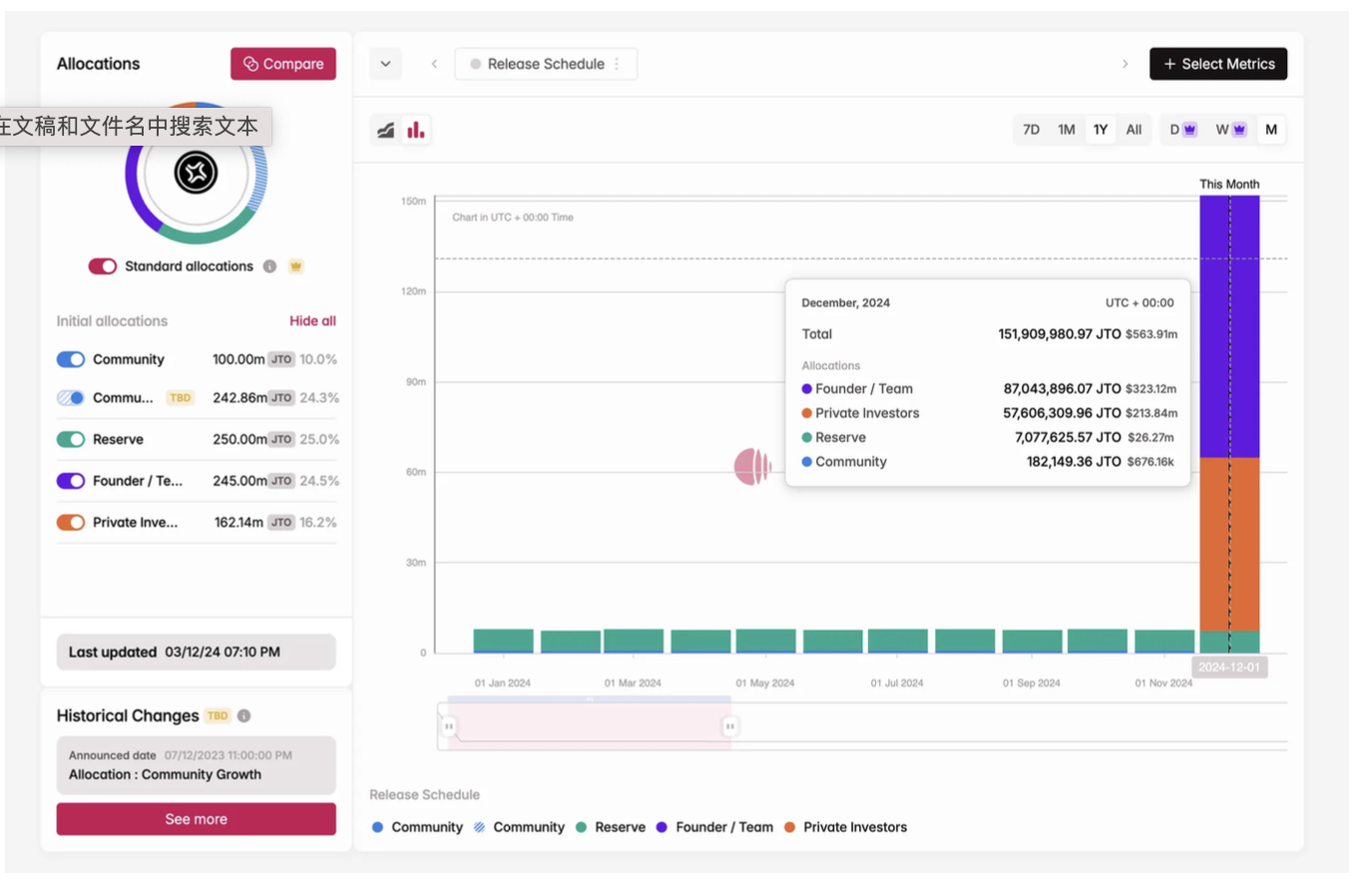

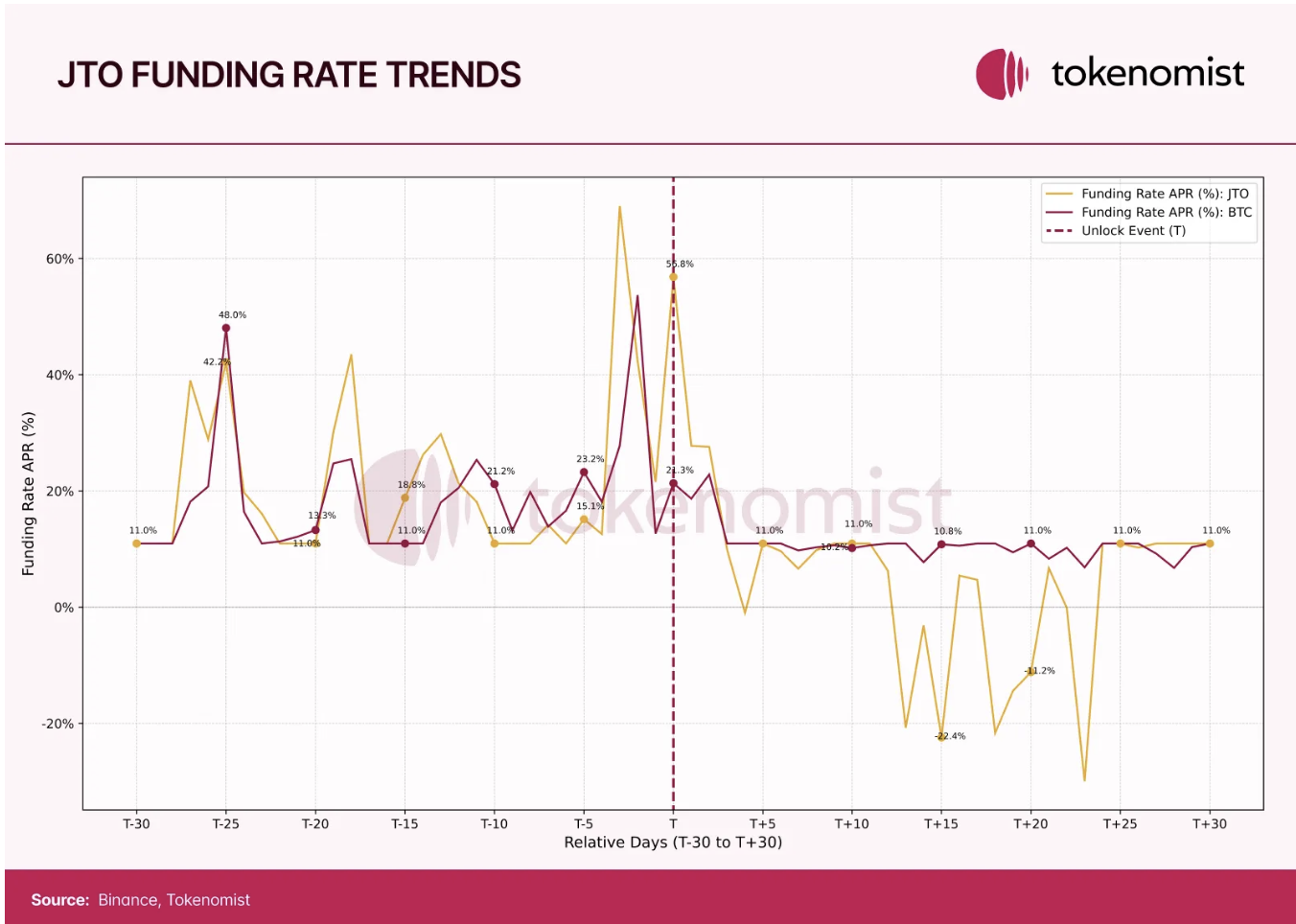

4. Jito (JTO): Unlock $563.91 million

In December 2024, JTO ended the year with a major unlocking event worth $563.91 million, releasing 151,909,981 JTOs into circulation. The founding team led the unlocking, accounting for 57.3%, followed by private equity investors, accounting for 37.9%. This is not surprising.

Due to the huge market fluctuations at that time, when observing the price impact, we saw that the price impact of JTO turned from negative to positive twice before unlocking. After unlocking, the price impact continues to rise and then drops sharply to about -15%. At the end of 30 days, it turns from positive to negative again.

The fund rate trend also reflects this volatility. 30 days before unlocking, JTO's funding rate roughly matches BTC, sometimes exceeding it, and sometimes below it. However, within 30 days of unlocking, we can observe that the funding rate of JTO continues to fluctuate while BTC remains relatively calm.

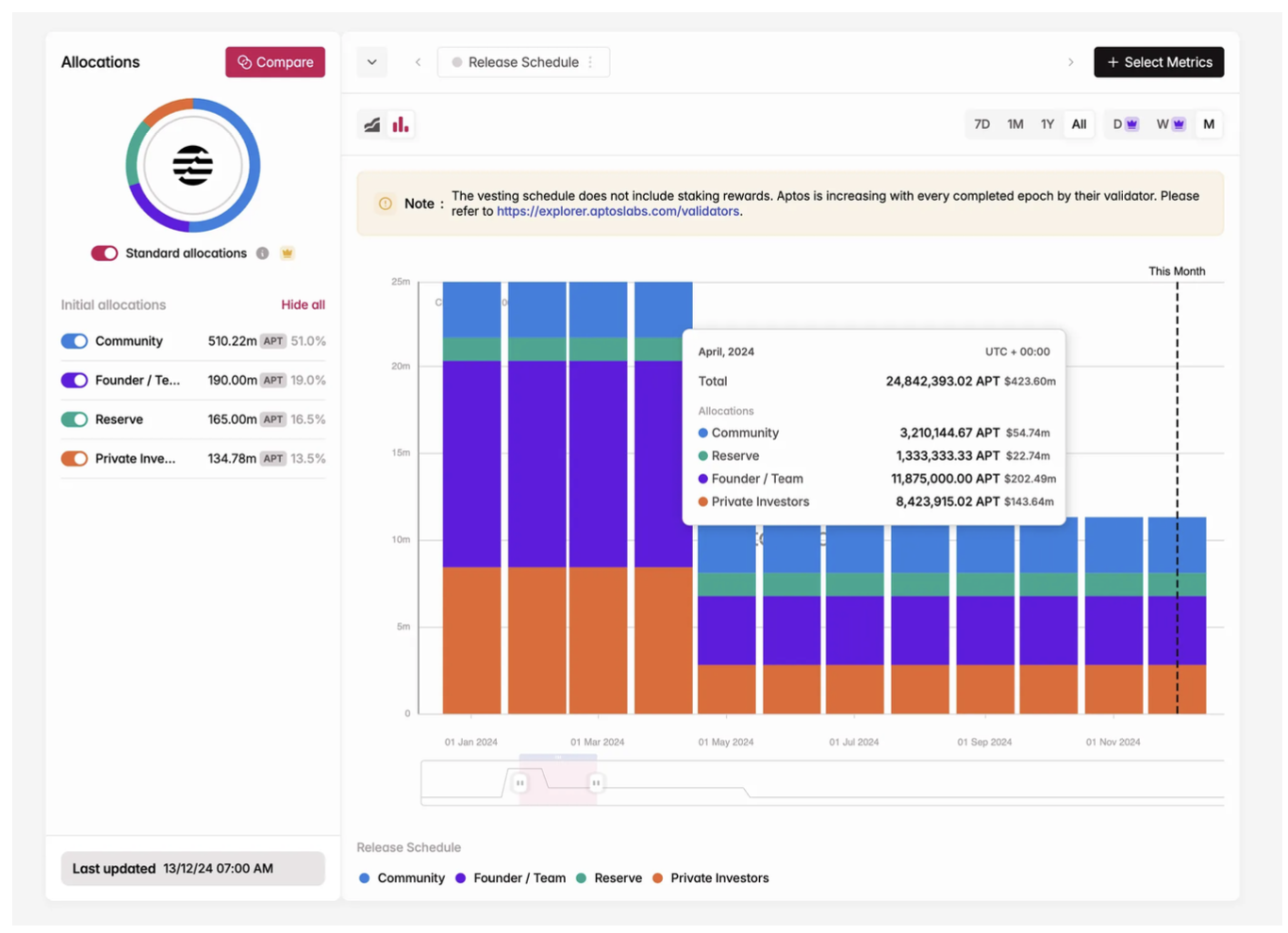

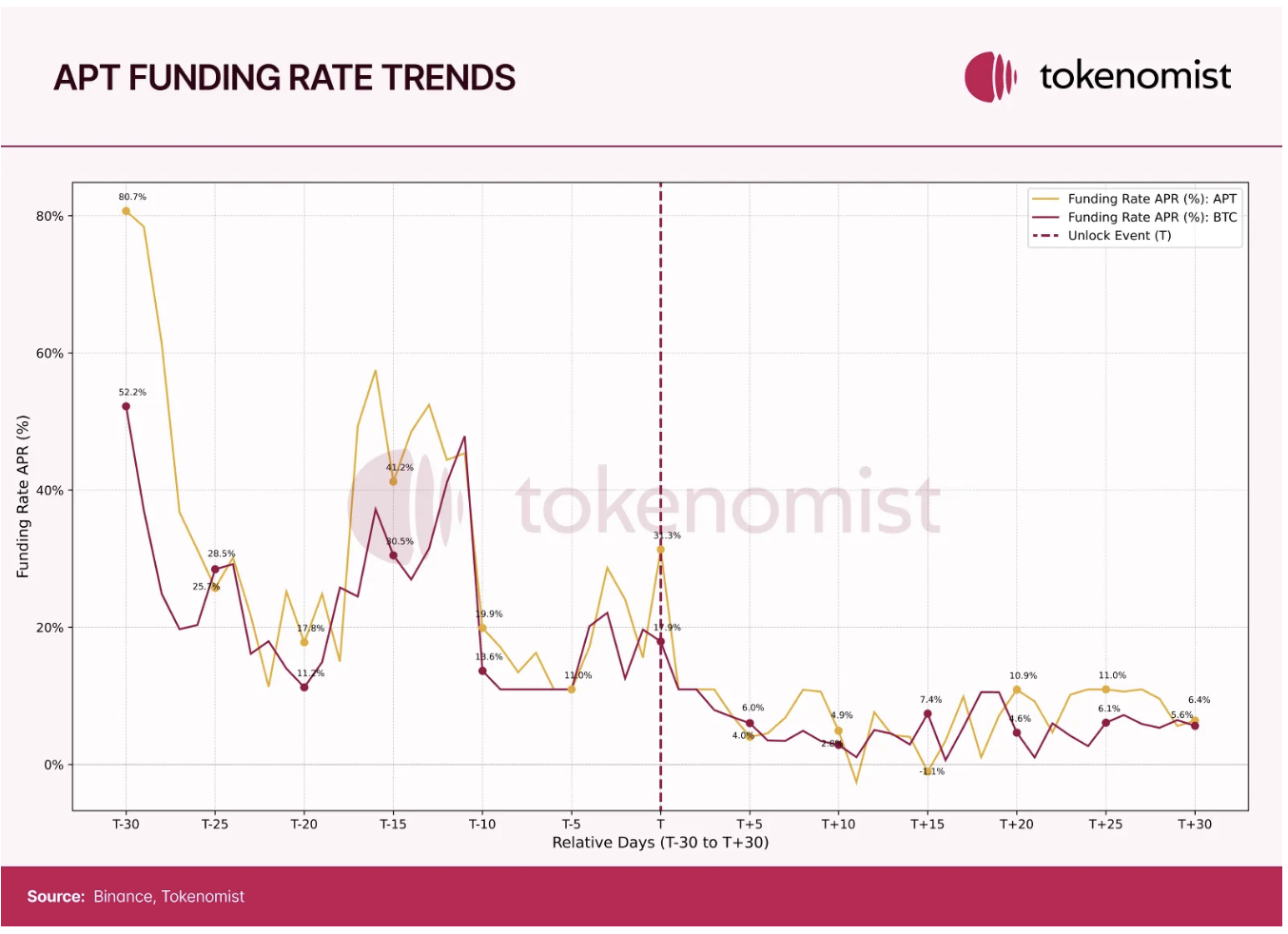

5. Aptos (APT): Unlock $423.6 million

The fifth largest unlocking event this year occurred in April 2024, with Aptos (APT) conducting a $423.6 million unlocking campaign in April. Founders/teams and private investors hold the largest share of the unlock, but about 13% of that is allocated to the community.

The price impact of APT surged by about 51.7% within the five days before unlocking (from day 20 to day 15 before unlocking), driven by high trading activity and speculation. However, starting from the 15th day before unlocking, the price impact began to steadily decline. During the unlocked period, the price effect becomes negative and remains this way for the next 30 days. During this period, the entire crypto market also showed a downward trend.

The funding rate trend of APT is very similar to BTC, similar to the funding rate trend of ARB. This suggests that price impact may be more due to macro factors that affect the overall market.

analyze

By analyzing these token unlocking events, it is obvious that the market sentiment before and after unlocking will vary depending on the scale of unlocking, market expectations, macroeconomic conditions and other factors. Prediction based on these factors is complex in nature, but they provide some observations that help us understand how key drivers influence market behavior during unlocking events.

As these unlocking events approach, it is important to analyze market expectations and can be observed by price impact and funding rates. A price drop before unlocking may reflect market concerns about increasing supply, while a price increase may indicate market optimism or speculation. Before SUI's May 2024 unlock and TIA's October 2024 unlock, we observed that their price impact and funding rates showed quite pessimism. This is consistent with the view that unlocking events are usually bearish, as they dilute supply and increase selling pressure. However, the opposite happens sometimes; unlocking can be a bullish signal, releasing more supply to the market for buyers to snap up. We saw from the ARB case that the capital rate before unlocking once reached +115.8%, indicating that the leverage demand for long positions has increased and market sentiment is optimistic.

Although these factors provide valuable insights, we must also consider the situation of the market as a whole. During a period of market downturn, there may be greater factors that dominate the price trend of a certain token, as shown in the case of JITO and APT. The funding rates of these two tokens are closely related to changes in BTC, or there are large fluctuations when the funding rates of BTC remain relatively stable.

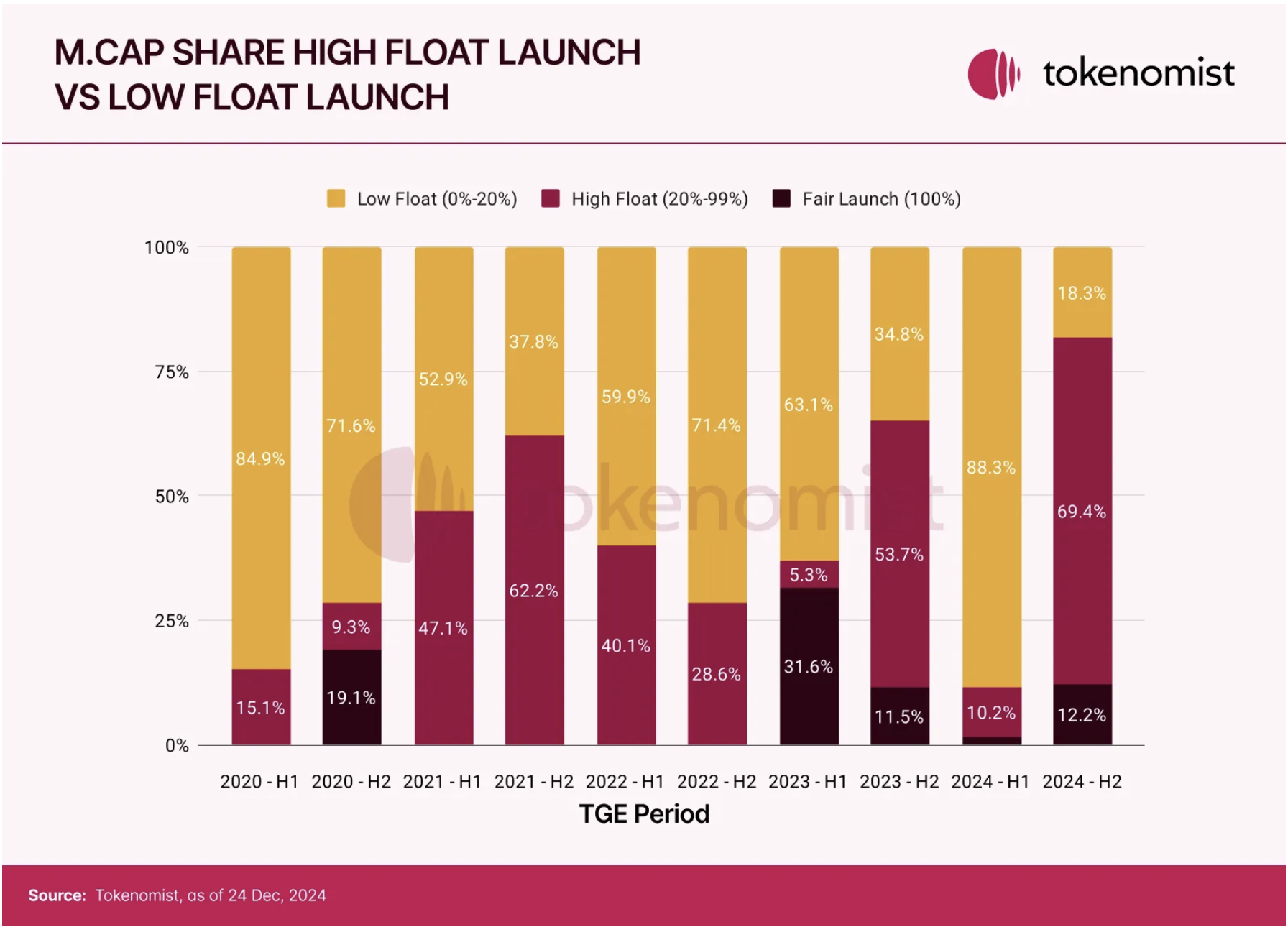

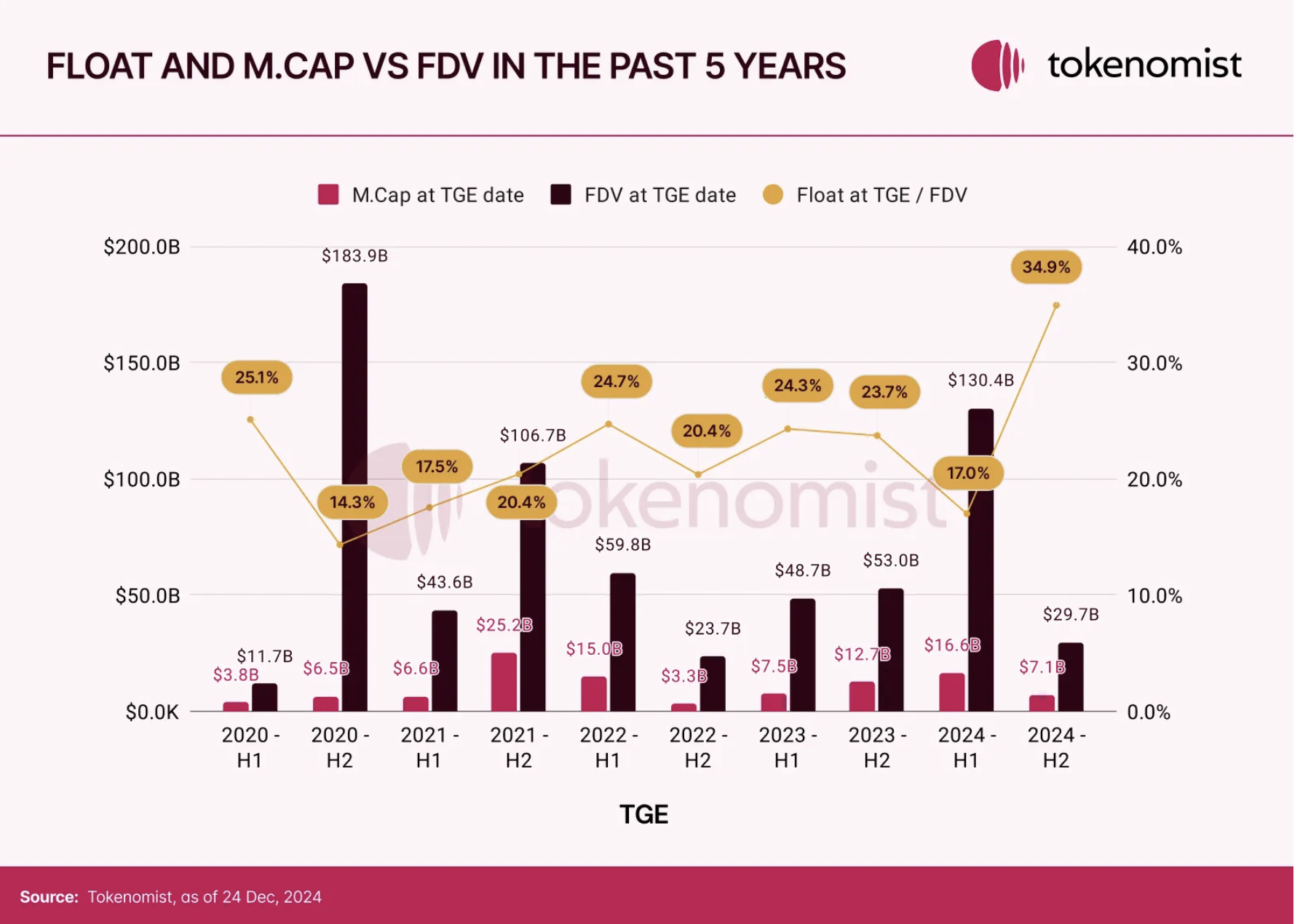

Low circulation high FDV tokens

Fluidity is defined as the ratio of circulating supply to maximum supply, and it has become an increasingly important indicator when considering supply data. Low circulation high FDV (full dilution valuation) tokens, characterized by low circulation supply at the time of issuance but high overall valuation, has become increasingly prominent in recent years. This model has caused prices to appreciate rapidly due to limited liquidity, but has been criticized for long-term sustainability because subsequent token unlocking often puts downward pressure on the market. This section aims to examine the historical context, trends and impacts of this token economic model and provide a data-driven perspective to evaluate its feasibility.

Despite the recent surge in popularity of low-circuit high-FDV tokens, this model is not new. It received significant attention for the first time in the bull market in 2020-2021. A notable example is Curve (CRV), which was released in August 2020, and famous crypto investor Jason Choi uses CRV to highlight the risks of this model. Within seven hours of trading, the market value of CRV increased from $2 million to $6 million. However, the FDV of the token at the time of issuance was almost half the market capitalization of Bitcoin, which proves that this valuation is unsustainable. Early investors faced huge losses, with prices falling 50% shortly after the issuance due to dilution caused by inflation and early sellers’ exit from positions.

The CRV case reveals a key problem: The initial price trend of low-circuit high-FDV tokens may mislead investors who ignore future dilution long-term effects. Although CRV has its exaggerated inflation mechanism, it laid the foundation for a broader trend that has evolved thereafter.

Analysis of token issuance from 2020 to 2024 shows that the adoption of low circulation and high FDV models shows an obvious pattern. These tokens were particularly common in late 2020 and early 2024, ahead of the Bitcoin halving and subsequent bull markets.

Over time, the crypto community has become increasingly aware of the risks posed by this model, prompting recent projects to adapt to token economics. A clear trend is the change in circulation/FDV ratio at issuance. By the end of 2024, the average ratio had risen to about 35%, reflecting greater prudence among investors. For example, Binance has introduced listing standards that consider TGE (Token Generation Event) circulation, encouraging projects to prioritize sustainable token economics.

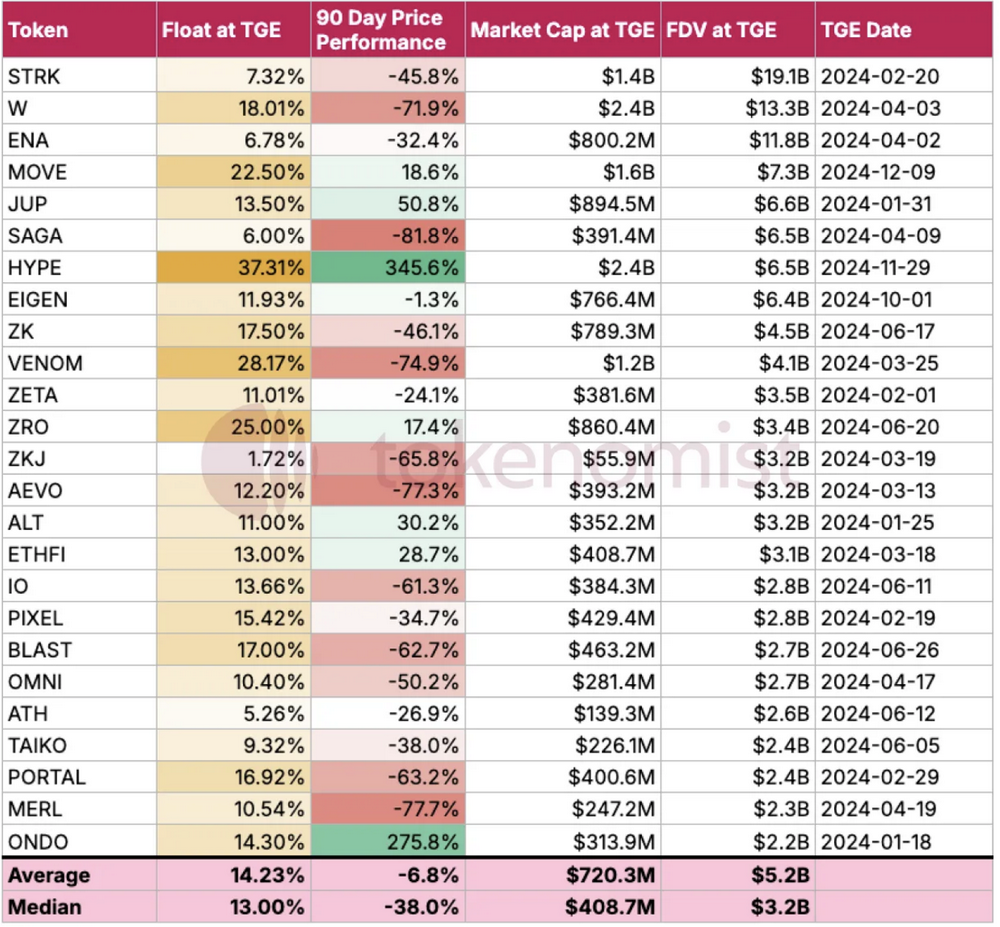

To further understand the impact of the low-flow high-FDV model, we analyzed the performance of altcoins issued in 2024. We summarize key indicators, including FDV, market capitalization, circulation at TGE, price performance, and price changes, for the top 25 altcoins by FDV on TGE dates.

After excluding outliers like Hyperliquid and Ondo Finance, there is no strong correlation between the flow rate at TGE and the price performance this year, which can be visualized in the scatter plot below. There are many reasons for this. Most notably, the increase in demand and liquidity, and the greater focus on hype-driven/emotion-related narratives in the recent bull cycle, may reduce the correlation between circulation volume and price performance. On the other hand, for some tokens, the evolution of token economics includes new dimensions, such as token economics of inflation or deflation, as well as staking mechanisms, which may also dilute the impact of circulation during TGE.

Scatter plot of 90-day price performance to the circulation/FDV ratio on the first pricing date. Outliers such as HYPE and ONDO were excluded.

As mentioned above, there are exceptions. Hyperliquid issuing without VC unlocking, allocating 33% of its token supply to community airdrops. This approach promotes decentralization and community engagement, setting a benchmark for fair token issuance.

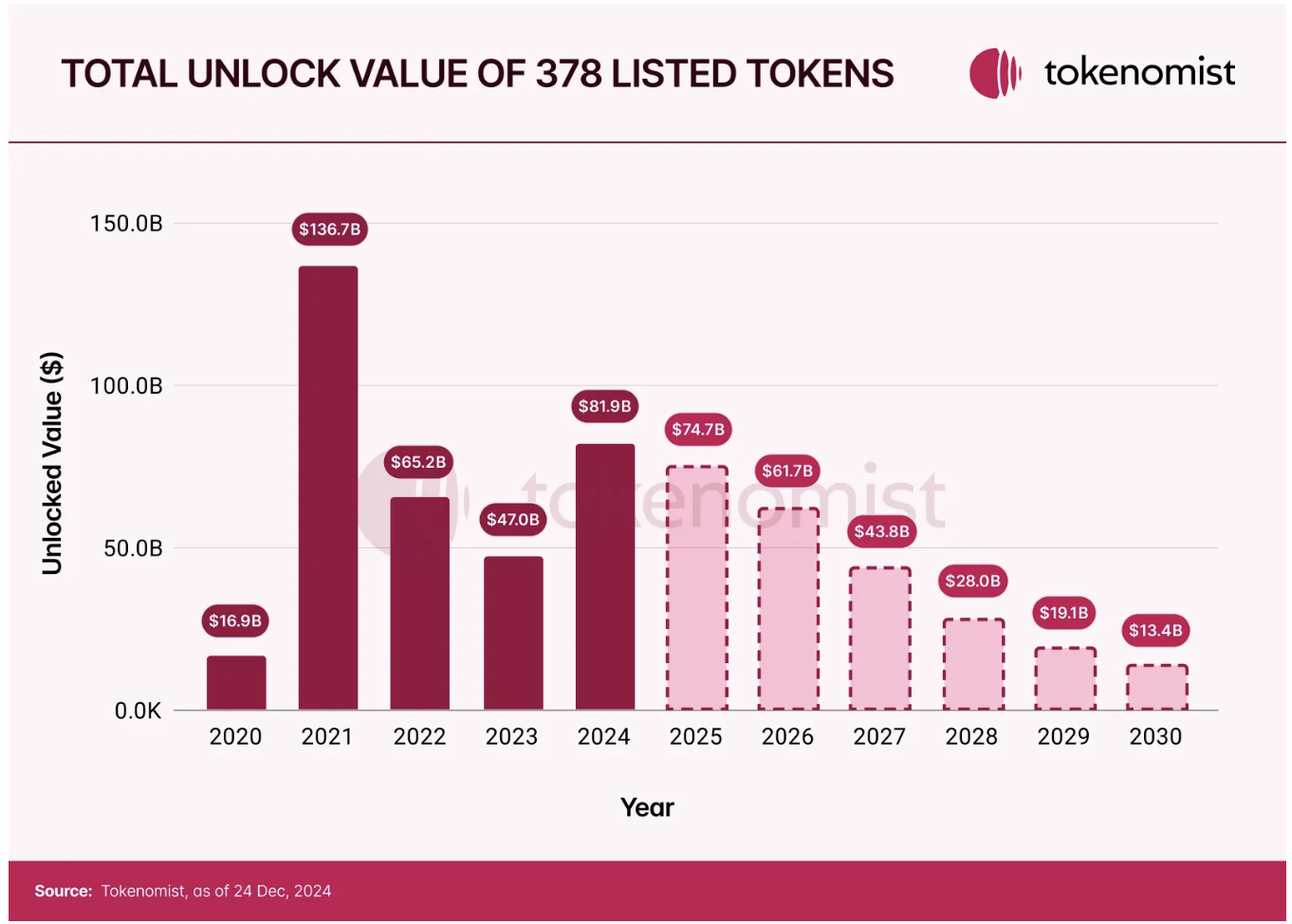

The chart below shows the total value of token unlocked from 2020 to 2030, revealing some significant patterns in the past two bull cycles. The total unlocked value peaked at $136.7 billion in 2021, more than eight times that of 2020 ($16.9 billion). While the growth isn't that big, the total unlock value in 2024 ($82 billion) is about twice the previous year ($47 billion). This peak coincides with the peak of the last bull market, when many projects were issued locked in large amounts of token allocations for future release.

Looking ahead, the market will face huge pressure to unlock. From 2024 to 2025, more than $150 billion of tokens are expected to be unlocked, of which approximately $82 billion was absorbed alone in 2024. This poses a short-term risk to market stability. However, as lockout plans are completed, a reduction in unlocking pressure may help long-term market stability.

The token model with low circulation and high FDV has proven to be a double-edged sword. While it can drive price appreciation quickly, it also brings significant risks due to future dilution and unsustainable valuations. As the crypto market matures, both investors and project parties must carefully evaluate token economics to ensure that it is consistent with the long-term goals. The evolution of token allocation mechanisms like Hyperliquid provides promising alternatives that focus on fairness and sustainability.

It should be noted that these predictions are based on data from 378 tokens tracked by Tokenomist, representing a part of the market. Changes in the issuance of new tokens and existing token economics, such as relocking or destruction mechanisms, may change these dynamics.

MEME and AI Agents

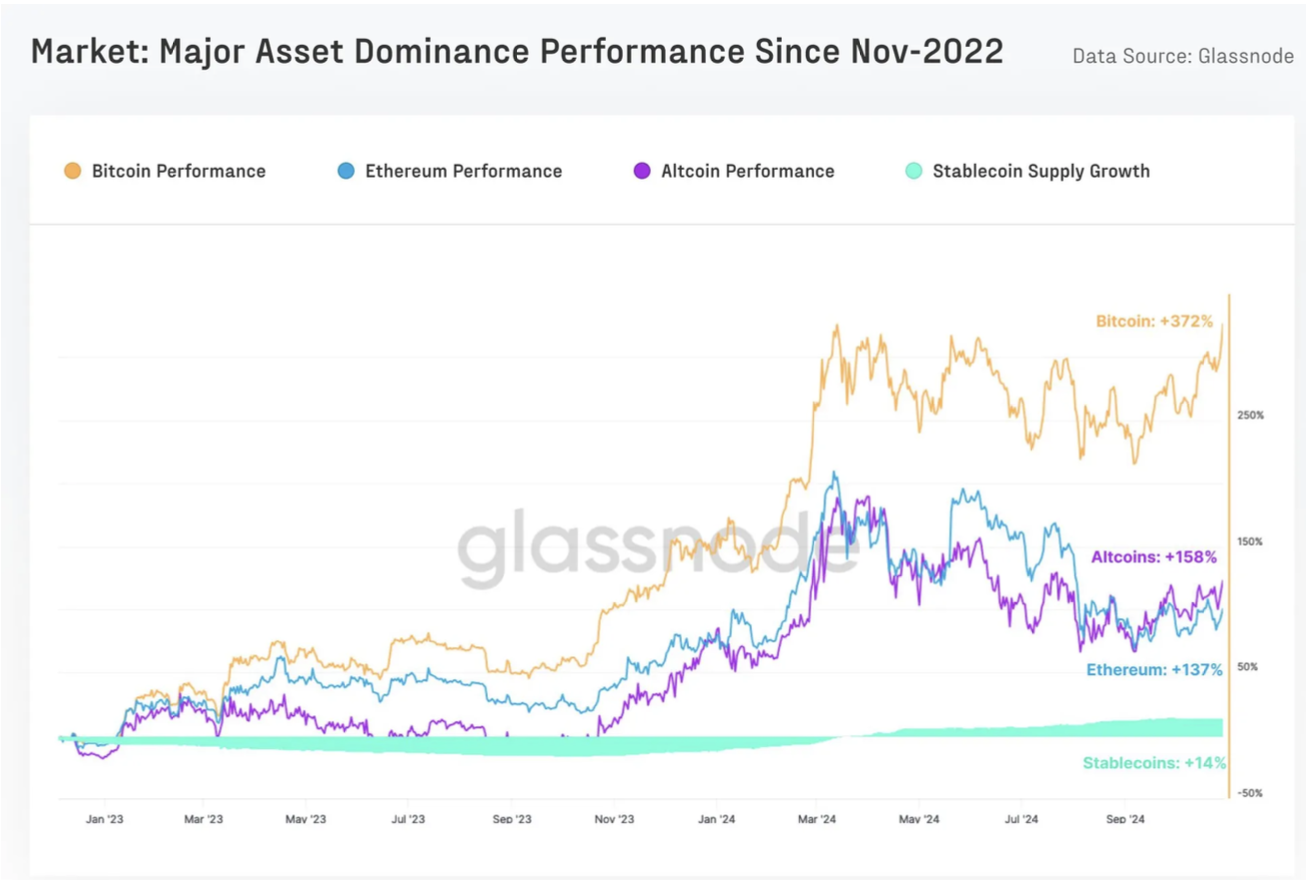

Throughout 2024, Bitcoin has maintained its dominance in the cryptocurrency market, attracting increasing investment from the traditional financial sector. However, sentiment about poor performance of altcoins is also growing. Despite the surge in growth at the end of the year, many altcoins failed to follow in Bitcoin’s footsteps.

Source: Glassnode x Fasanara_Digital Assets Report Q4 2024

Analysis data shows that among the top 250 altcoins by market value, only 28.1% outperformed Bitcoin, while 45.5% outperformed Ethereum's performance.

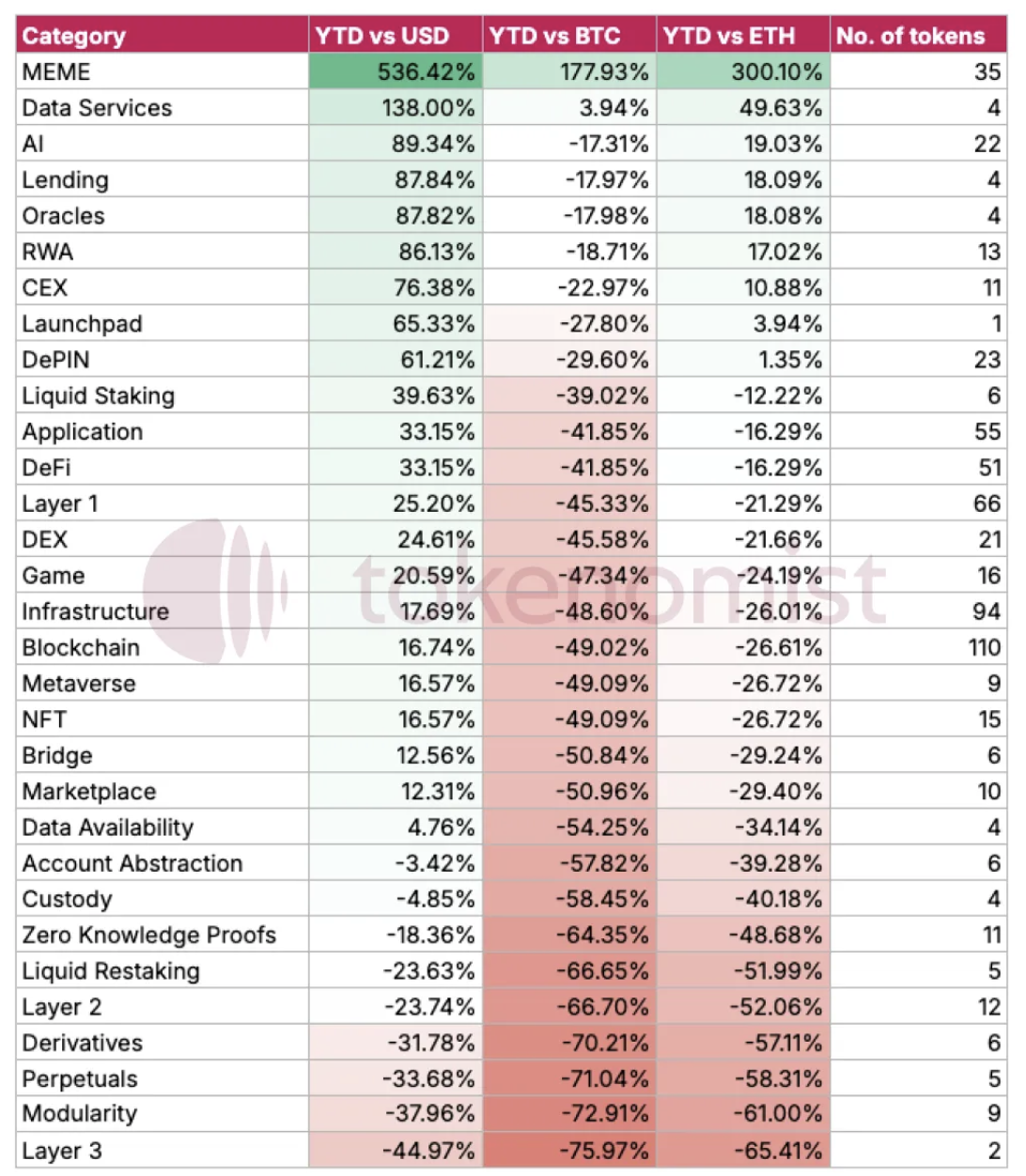

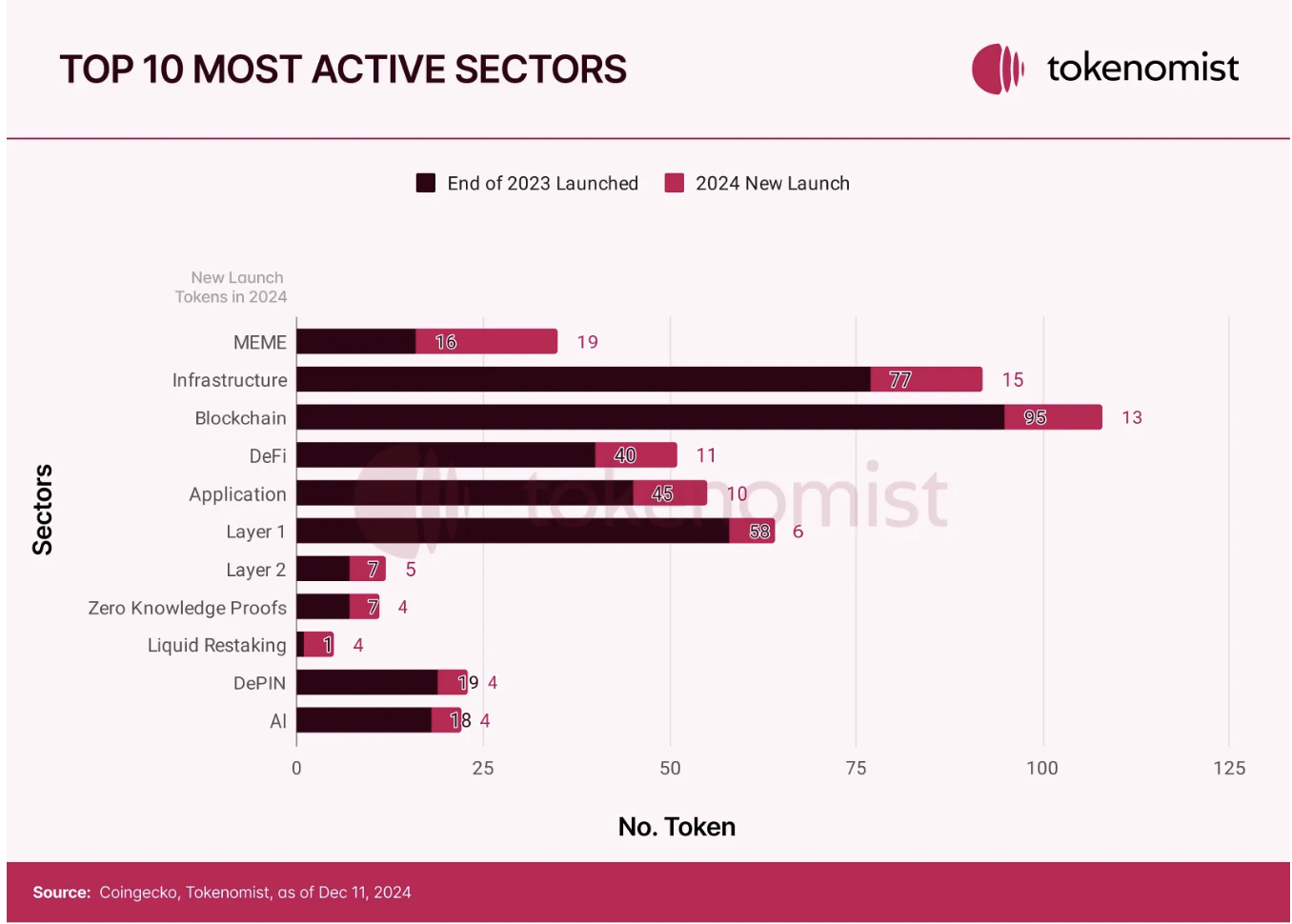

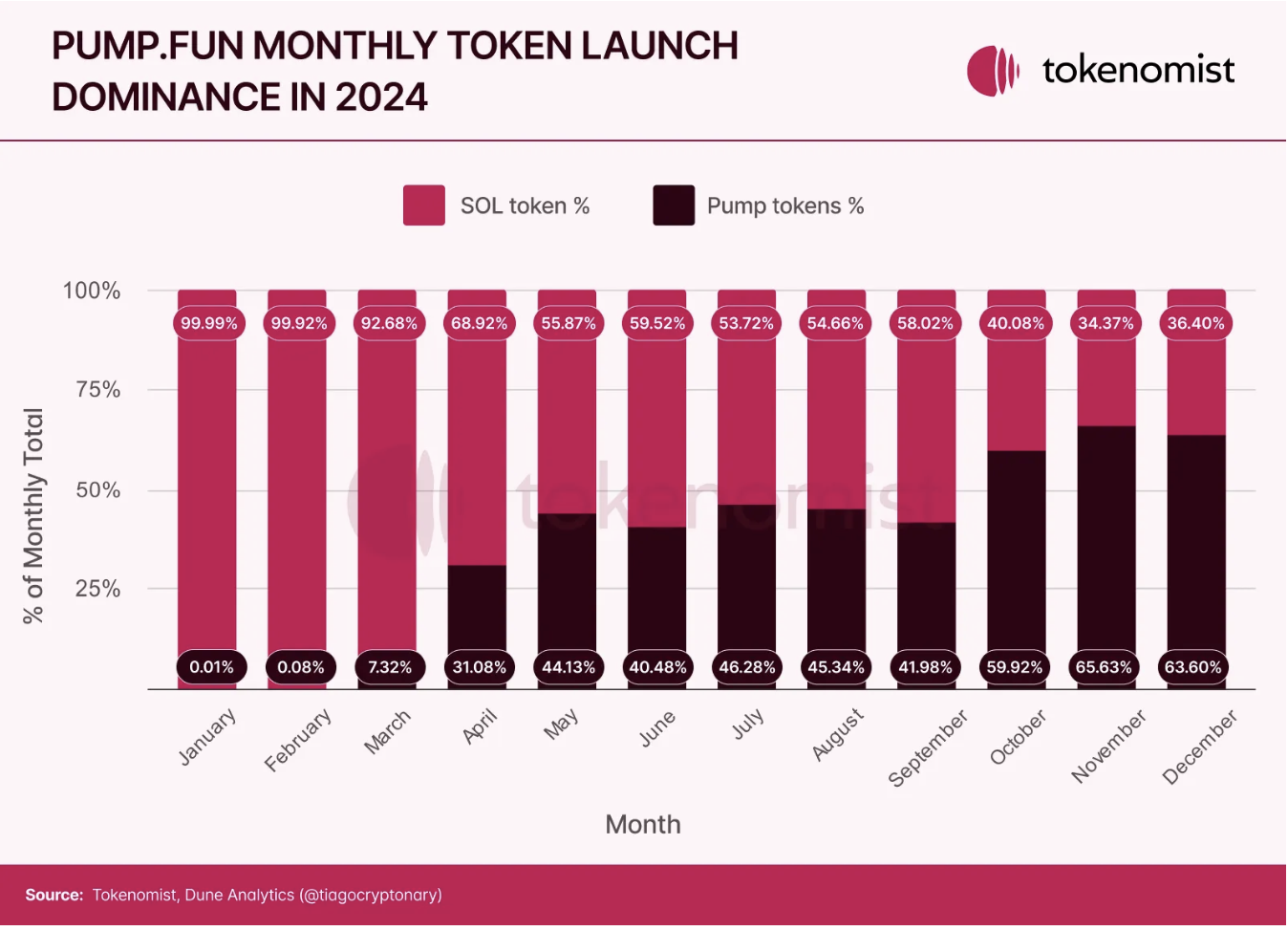

In contrast to the wider altcoin market, one field has performed significantly better than its peers: Memecoin. This field showed extraordinary growth in 2024, achieving a year-to-date return of 536% - a performance that surpassed Bitcoin and Ethereum by 177% and 300% respectively. It is worth noting that 19 of the top 54 tokens issued this year are Memecoin.

Memecoin 's Attraction

Memecoin’s amazing success raises important questions about the reasons for its appeal and continued popularity. This section explores the data and motivations behind this unique phenomenon.

· Fair issuance model

One of the main factors driving Memecoin’s appeal is its fair issuance model, providing its entire token supply to the community from day one. This approach ensures 100% circulation, in line with the core principles of cryptocurrencies: fairness, transparency and decentralization. Unlike many other projects, Memecoin avoids too much team allocation or early investor privileges, promoting fair participation.

This fair issuance model resonates strongly with investors, especially when dissatisfaction with venture-backed projects grows. Such projects are sometimes criticized for having complex token economics and distribution structures that may appear to be biased towards early stakeholders.

Additionally, Memecoin offers simpler and easier to understand narratives than other altcoins, which often require a lot of technical expertise to evaluate. Memecoin focuses on community engagement and cultural relevance, making it an effective tool to attract new users of cryptocurrencies.

· Community long-term motivational alignment

The traditional approach to Web3 community building relies primarily on token airdrops to inspire early contributors. These rewards are usually directed to individuals who create content, participate in Discord, or engage in agreement-specific activities. While this model effectively stimulated initial interest, our analysis revealed significant shortcomings in long-term community retention. Research shows that airdrop hunters tend to sell immediately after receiving tokens, especially when the distribution does not meet expectations, which leads to a decline in community engagement and may create negative sentiment for the protocol.

Our research shows that the Memecoin project has shown significant success in building sustainable communities through an innovative incentive alignment approach. These projects effectively blend the interests of the team and the community, creating what market participants describe as “the best marketing is price increase”. Drawing on Murad’s framework, successful crypto communities often exhibit traits similar to fanatical followers, with loyal supporters and unique shared beliefs. This phenomenon creates a strong shared enthusiasm among participants, thereby increasing retention and driving organic growth through community-driven initiatives. This approach creates a gamified environment where users feel directly related to the success of the project and motivates them to stay engaged for a long time.

Community Takeover: A New Paradigm

An emerging trend in protocol governance is community takeover (CTO). When the original developer of a project abandons the project, community users and token holders will take over the future direction and management of the project, and community takeover occurs. When the project moves to community ownership, the token holder is both the owner and the operator. This dual role fundamentally changes their relationship with the project. Community members must actively participate in governance, development, and marketing to maintain and enhance the value of their tokens.

· Growth Catalyst

In 2024, a major catalyst for the Memecoin phenomenon is pump.fun, which aims to enable more people to easily create and trade their own tokens, greatly lowering the barrier to entry. Since its launch in January 2024, as of January 6, 2025, more than 5,581,665 tokens have been created on pump.fun. As shown in the figure below, most Solana-based tokens are now issued via pump.fun instead of traditional methods. The success of pump.fun has also sparked competition, with other blockchain ecosystems exploring similar platforms to capitalize on the growing focus on fair issuance of tokens.

· Risks and limitations

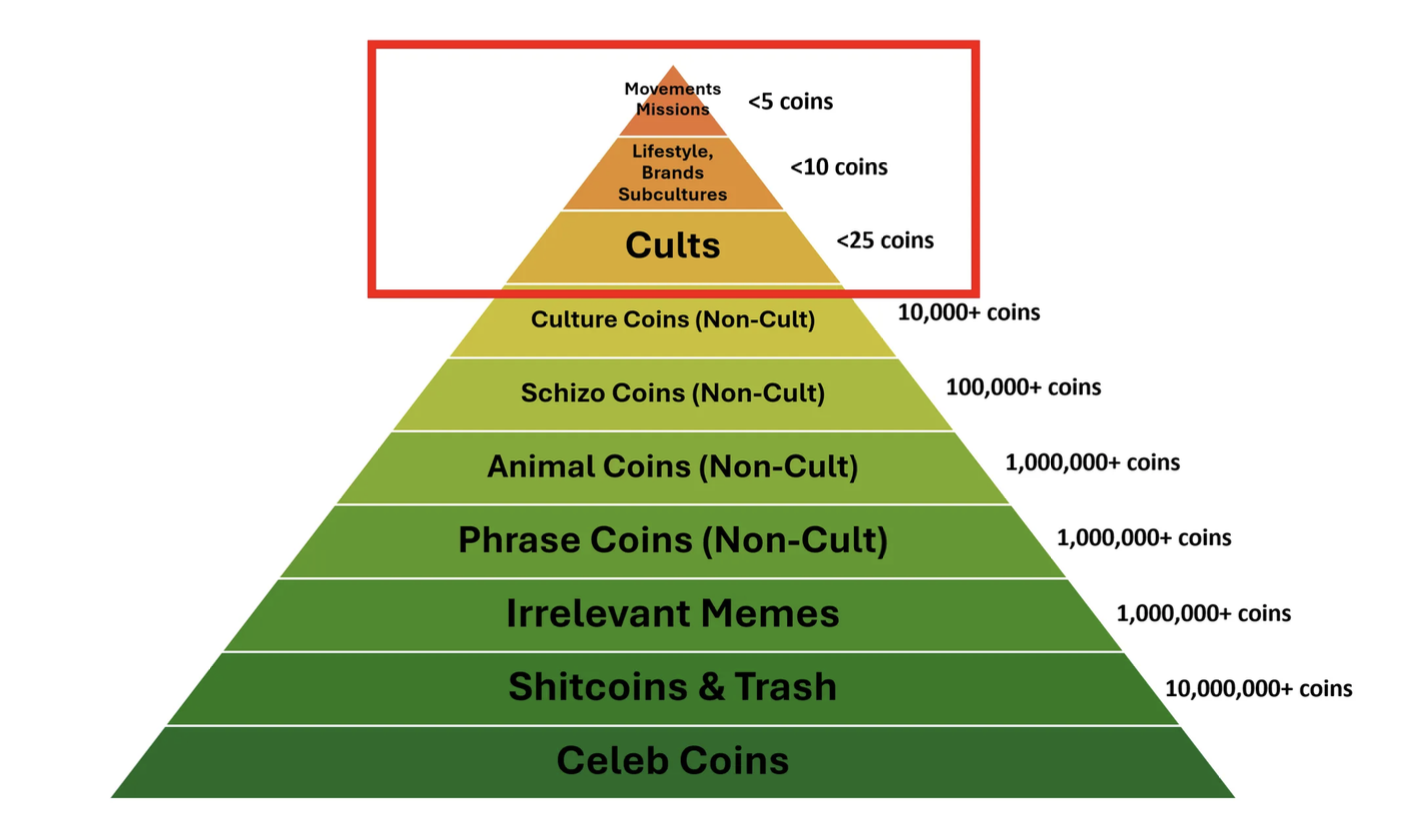

Despite their popularity in 2024, they still carry inherent risks. Like unissued tokens, Memecoin is essentially a trend, often experiencing a rapid popularity and an equally rapid recession. Similarly, duplicate Memecoin oversaturation may weaken its influence, as Murad's "Memecoin Pyramid" shows, successful Memecoin accounts for a small proportion compared to those gradually disappearing Memecoin.

Murad\'s Memecoin Pyramid Source: Memecoin Super Cycle - TOKEN2049

Memecoin has significantly lower long-term success rates. According to Chainplay's "2024 Memecoin Status" report, the average life span of Memecoin is one year, with 97% of the Memecoin ultimately considered "death" (defined as 24-hour trading volume is less than $1,000 and liquidity is less than $50,000). , and it has not been updated in three months on Twitter). Currently, there is only one pump.fun with a market value of more than $1 billion and eight with a market value of more than $100 million.

Another key risk is possible malicious activity. Despite being fair issuance, insiders or developers may still control most of the tokens, undermining the principles of decentralization, and allowing pull-ups. Although pump.fun fights this through its bond curve mechanism and token "graduate" to Raydium's approach, the scam may still be undetected. Even for fairly issued Memecoin, there are cases involving teams or insiders using virtual wallets to snipe meme coins. It is worth checking websites like gmgn.ai to get metrics for risk analyzing, such as the top 10 token holders, blacklists, developer activity and bubble charts.

AI Agent

Another prominent area in 2024 is AI Agents. AI agents are essentially autonomous entities that can perform tasks and interact with other users/agents, using blockchain technology to perform on-chain operations. They are likened to enhanced versions of Memecoin because they combine memes, AI and social media elements to create autonomous entities that interact with users and communicate themselves. In 2024, we saw the emergence of major players like Virtuals and ai16z, providing a framework for developing and deploying AI agents.

In an article on crypto forecasts for 2025, Dragonfly Capital managing partner Haseeb Qureshi predicts that AI agent-related tokens will surpass Memecoin in the coming year. He believes that unlike KOLs and internet celebrities, AI agents never rest, obey most opinions, and are less out of their own interests. They also perform well in aggregation and amplification of real-time information. Currently, agents like Aixbt create alpha information flows by crawling social media data, showing possible gradual improvements in the next one or two years.

Nevertheless, Qureshi predicts that the innovativeness of these agents may diminish over time. Excessive AI proxy may lead to a reversal of emotions, and crypto communities may return to support human preferences. Of course, this is also a natural change in the trend. However, Qureshi suggests that the real transformative impact of this field will come from software engineering agents that have the potential to fundamentally change the development and security of blockchain projects.

Wide impact

In addition, it is worth noting that the DeFi field has continued to innovate in the past year. OG projects like Aave have maintained strong performance, hitting record deposits this year. At the same time, new projects such as Ethena have also attracted increasing attention from traditional financial sectors. RWA projects like Ondo Finance also exceeded expectations this year, possibly driven by increased demand for tokenization of financial products.

Memecoin’s success and its community-driven token economic model have inspired other areas to adopt similar fair issuance practices. For example, DeSci tokens. Another obvious trend is that during the token issuance process, more and more projects allocate a larger proportion to the community.

Another potential trend worth looking forward to is the fusion of Memecoin and practicality. User @hmalivya9 proposed the concept of "community cluster" on X. The model suggests that through a staking system, Memecoin project collaborates with utility token projects, where Memecoin holders can pledge tokens to earn rewards from multiple utility token projects. The system will enhance the effect by requiring active social media engagement, essentially gamification of brand awareness for practical tokens. hmalivya9 envisions this symbiotic relationship as a blueprint for future crypto community structures, with entertainment intertwined with utility, and this concept is not entirely new. For example, holders of Hyperliquid and its native spot token $PURR can receive airdrops from other spot tokens within the Hyperliquid ecosystem and earn Hyperliquid points. $PURR can only be traded within Hyperliquid, which greatly increases its user base.

In the next year, AI agents will also continue to develop. ai16z proposes a token economics model where token staking serves as a verification system that provides platform access, enables governance participation, and establishes accountability through possible penalties. In this evolutionary staking model, the economic interests of stakeholders are directly linked to their contribution to ecosystem quality and growth.

2025 will undoubtedly be an exciting year, whether it is the evolution of existing trends or the emergence of emerging trends.

chaincatcher

chaincatcher

jinse

jinse