Trading moment: BTC loses independence, analysts recommend cautious trading and strict stop loss

Reprinted from panewslab

04/16/2025·5D

1. Market Observation

Keywords: OM, ETH, BTC

The Solana chain market is gradually recovering, and Meme currency trading volume returns to the level in early February. Institutional investors have also begun to increase their layout in SOL. US listed company Janover announced that it would purchase 80,567 SOLs worth about US$10.5 million. The total number of SOLs currently held has reached 163,000, worth about US$21.2 million. Meanwhile, Multicoin Capital partners also seem to be quietly increasing their holdings, with signs that they have transferred $7 million USDC to Coinbase and may be preparing for the future of SOL.

In addition, Bitcoin's recent performance has made many industry OGs feel confused and disappointed. Jeff Dorman, chief investment officer of Arca, admitted that he left Wall Street to devote himself to the crypto field in order to escape the market environment completely dominated by macro factors, but now Bitcoin has become an after-hours trading tool for large funds, almost synchronizing with the Nasdaq's trend and losing its independence. In the days of recent sharp fluctuations in the stock market, the high correlation between Bitcoin and the S&P 500 and the Nasdaq 100 is particularly obvious. Crypto analyst Eugene also admitted that as the crypto market is increasingly affected by macro factors, his trading strategy has to turn to be more cautious, keeping trading volumes low and setting strict stop loss until the market direction is clear again. But Arete Capital's McKenna pointed out that the market often bottoms out in the worst news, with the panic when Bitcoin falls to $74,000. Unless Sino-US relations further deteriorate, future news may only cause market volatility rather than trend changes. Despite significant short-term volatility, institutional interest in Bitcoin is still growing steadily. According to Bitwise, in the first quarter of 2025, listed companies purchased 95,000 Bitcoins, a month-on-month increase of 16%, and the number of coin holding companies reached 79, accounting for 3.28% of the total supply of Bitcoin. In addition to Janover, companies such as CleanSpark, Value Creation, Metaplanet and Semler Scientific have also announced their Bitcoin investment plans.

Although institutions are constantly increasing their holdings of BTC, the central bank's attitude towards BTC has not yet been clarified. The latest survey results of the Bank for International Settlements are not so optimistic. The proportion of central banks considering investing in digital assets in the next 5-10 years has dropped sharply from 15.9% last year to 2.1% this year. Among the 91 central banks that manage $7 trillion reserves, none currently holds digital assets. However, 11.6% of central banks still believe that cryptocurrencies are becoming a more credible investment option, and 50 (59.5%) of central banks are opposed to whether to establish a strategic reserve of Bitcoin. In addition, Google announced that it would implement MiCA encrypted advertising rules in the EU from April 23, indicating that large tech companies are adapting to the new regulatory environment.

In terms of the macroeconomic environment, although the recent Trump administration's tariff policy has triggered market shocks, ARK Invest founder Cathie Wood is optimistic, who believes this may be a "shock therapy" with the ultimate goal of lowering trade barriers and stimulating economic growth. Wood expects negative GDP growth in the first half of 2025, which will instead provide the government and the Federal Reserve with more room to stimulate the economy.

2. Key data (as of 12:00 HKT on April 16)

(Data source: Coinglass, Upbit, Coingecko, SoSoValue, GMGN, Tomars)

-

Bitcoin: $83,525.29 (-10.94% during the year), daily spot trading volume $26.17 billion

-

Ethereum: $1,579.83 (-53.06%), daily spot trading volume is $11.98 billion

-

Corruption Index: 29 (Pandemic)

-

Average GAS: BTC 1.05 sat/vB, ETH 0.35 Gwei

-

Market share: BTC 62.9%, ETH 7.3%

-

Upbit 24-hour trading volume ranking: AERGO, ARDR, XRP, SNT

-

24-hour BTC long-short ratio: 1.0088

-

Sector rise and fall: AI sector falls 5.23%, Meme sector falls 4.95%

-

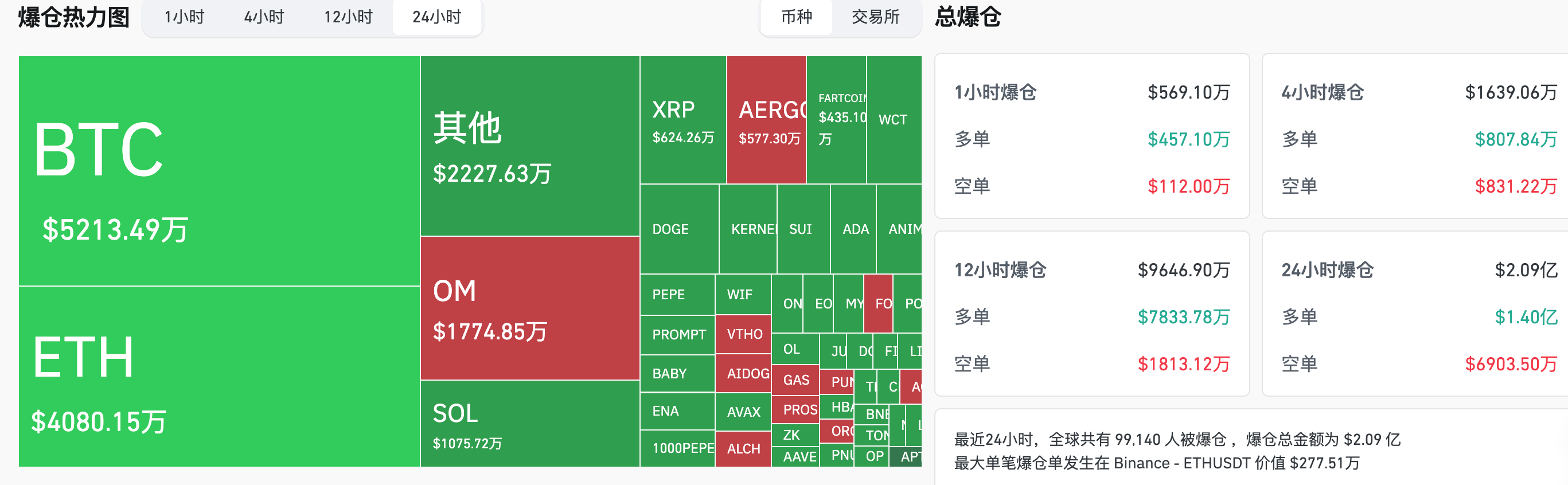

24-hour liquidation data: 99,140 people around the world were exposed, with a total liquidation amount of US$209 million. Its BTC liquidation is US$52.13 million, ETH liquidation is US$40.8 million, and OM liquidation is US$17.74 million.

-

BTC medium- and long-term trend channel: upper line ($83721.28), lower line ($82063.44)

-

ETH medium and long-term trend channel: upper line ($1665.45), lower line ($1632.47)

*Note: When the price is higher than the upper and lower edges, it is a medium- and long-term bullish trend, and vice versa is a bearish trend. When the price passes through the cost range repeatedly in the range or in the short term, it is a bottom or top state.

3.ETF flow direction (EST as of April 15)

-

Bitcoin ETF: $76.4151 million

-

Ethereum ETF: -$14.1821 million

4. Looking forward today

-

Binance launches the second round of "voting removal" mechanism, and voting will last until April 17

-

Coinbase International Station will be launched on April 17th

-

Arbitrum (ARB) will unlock approximately 92.65 million tokens at 9 p.m. on April 16, with a ratio of 2.01% to the current circulation, and a value of approximately US$28.5 million;

-

deBridge (DBR) will unlock approximately 1.14 billion tokens at 8 a.m. on April 17, with a ratio of 63.24% to the current circulation and a value of approximately US$26.5 million;

-

Omni Network (OMNI) will unlock approximately 8.21 million tokens at 8 a.m. on April 17, with a ratio of 42.89% to the current circulation and a value of approximately US$1,630;

-

ApeCoin (APE) will unlock approximately 15.6 million tokens at 8:30 pm on April 17, with a ratio of 1.95% to the current circulation and a value of approximately US$680;

The number of people who requested initial unemployment benefits in the United States to April 12 (10,000) (20:30 on April 17)

- Actual: To be announced/Previous value: 22.3/Expected: 22.6

The biggest increase in the top 500 market value today: ARDR rose 125.22%, FUEL rose 35.88%, SNT rose 35.06%, GFI rose 31.67%, and OM rose 29.40%.

5. Hot News

-

Japanese listed company Value Creation plans to spend 100 million yen to buy Bitcoin again

-

Metaplanet announces issuance of $10 million bonds to increase Bitcoin

-

Towns will launch TOWNS tokens in Q2, with an initial airdrop ratio of 10%.

-

Semler Scientific Applies to Issue $500 Million in Securities to Buy More Bitcoin

-

US listed company Janover announces an increase in holdings of about $10.5 million in SOL

-

Multicoin Capital partner lends $7 million USD to Coinbase, may increase its holdings in SOL

-

A certain address deposited 710,000 AVAX into Coinbase, with an estimated loss of US$12.19 million

-

Terra: The time to file a loss claim with Terraform liquidation trust funds ends until May 17

-

Google will implement MiCA crypto advertising rules in the EU starting April 23

-

CoinShares: Net outflow of digital asset investment products last week was $795 million

-

Canada approves spot Solana ETF, which will be launched this week and support pledge

jinse

jinse

chaincatcher

chaincatcher