Trading moment: European and American stock markets are closed today, gold hits a new high and triggers speculation on Bitcoin’s rise

Reprinted from panewslab

04/18/2025·11D

1. Market Observation

Keywords: sUSD, ETH, BTC

Affected by Good Friday and Easter holidays, US stocks, Hong Kong stocks, European stocks and Australian stocks will be closed today, with Hong Kong stocks, European stocks and Australian stocks continuing until next Monday. Meanwhile, gold prices soared to an all-time high of $3,357 per ounce yesterday, sparking speculation about whether Bitcoin will keep up. Historically, whenever gold rises, Bitcoin breaks past all-time highs months later. Joe Consorti, the head of growth of Theya, pointed out that Bitcoin will usually lag 100-150 days behind to follow the gold trend, and Bitcoin is expected to reach new all-time highs between Q3 and Q4. However, JPMorgan Chase’s latest report pointed out that in the context of the global trade war launched by Trump, investors are more inclined to invest their funds in gold rather than Bitcoin.

It is worth noting that transaction costs on the Ethereum network have fallen to their lowest level in five years, currently at around $0.168 per transaction, according to Santiment. Brian Quinlivan, marketing director at Santiment, explained that while the fees are reduced, the number of people sending ETH and interacting with smart contracts has also decreased, which is essentially a supply and demand system. When network activity decreases, users do not need to bid for high fees to speed up transaction confirmation, and the average fee decreases. From a trading perspective, low fees may hinder the price rebound, but traders seem to be patiently waiting for the global economic uncertainty to pass before increasing the frequency of Ethereum and altcoins trading. In addition, crypto analyst Ali Martinez said the TD Sequential (TD Sequential) sends a buy signal on the Bitcoin weekly chart. If the price of Bitcoin continues to close above $86,000, it may push its price to $90,000 or even $95,000.

In terms of regulation, Slovenia plans to impose a 25% tax on personal cryptocurrency profits starting from January 1, 2026, and the proposal is currently awaiting public feedback and parliamentary approval. The new rules will apply to the profits earned from converting cryptocurrencies into fiat currencies or for purchasing goods and services, while exchanges between cryptocurrencies will remain tax-free. Meanwhile, Panama City Mayor Mayer Mizrachi Matalon announced that the city government has approved the use of Bitcoin, Ethereum, USDC and USDT to pay taxes, fees, tickets and licenses, and by working with partner banks to convert cryptocurrencies into US dollars when they are paid. Meanwhile, Powell himself said at the Chicago Economic Club that banking related rules may be "relaxed" in the future, and that despite the wave of failures and fraud in the cryptocurrency space over the years, the space is becoming increasingly mainstream.

On the macro side, the Wall Street Journal reported that Trump is considering firing Fed Chairman Powell, but former Fed Director Wash and Treasury Secretary Bescent Bescent both opposed the move. Michael Gapen, chief economist at Morgan Stanley, pointed out that focusing on the monthly non-farm employment report is a reliable indicator of economic health, especially whether new jobs in the U.S. labor market are enough to keep wage growth higher than inflation. Although the Trump administration's tariffs and immigration policies may drag down the economy this year, Gapen believes the economy will continue to grow, but it will slow down. It is worth noting that Trump said on Thursday that tariff hikes between the United States and China may be about to end, suggesting that tariff levels may be sought. The news has pushed international oil and copper prices to rebound, and Asia-Pacific stocks have generally risen.

2. Key data (as of 12:00 HKT on April 18)

(Data source: Coinglass, Upbit, Coingecko, SoSoValue, Tomars)

-

Bitcoin : $84,600.27 (-9.56%), daily spot trading volume $18.584 billion

-

Ethereum : USD 1,579.14 (-52.59%), daily spot trading volume is USD 9.99 billion

-

Corruption Index : 33 (Panishment)

-

Average GAS : BTC 1.5 sat/vB, ETH 0.37 Gwei

-

Market share: BTC 63.1%, ETH 7.2%

-

Upbit 24-hour trading volume ranking : AERGO, XRP, IQ, STRAX, ARDR

-

24-hour BTC long-short ratio : 1.0358

-

Sector rises and falls : AI sector rises 4.12%, GameFi sector rises 2.98%

-

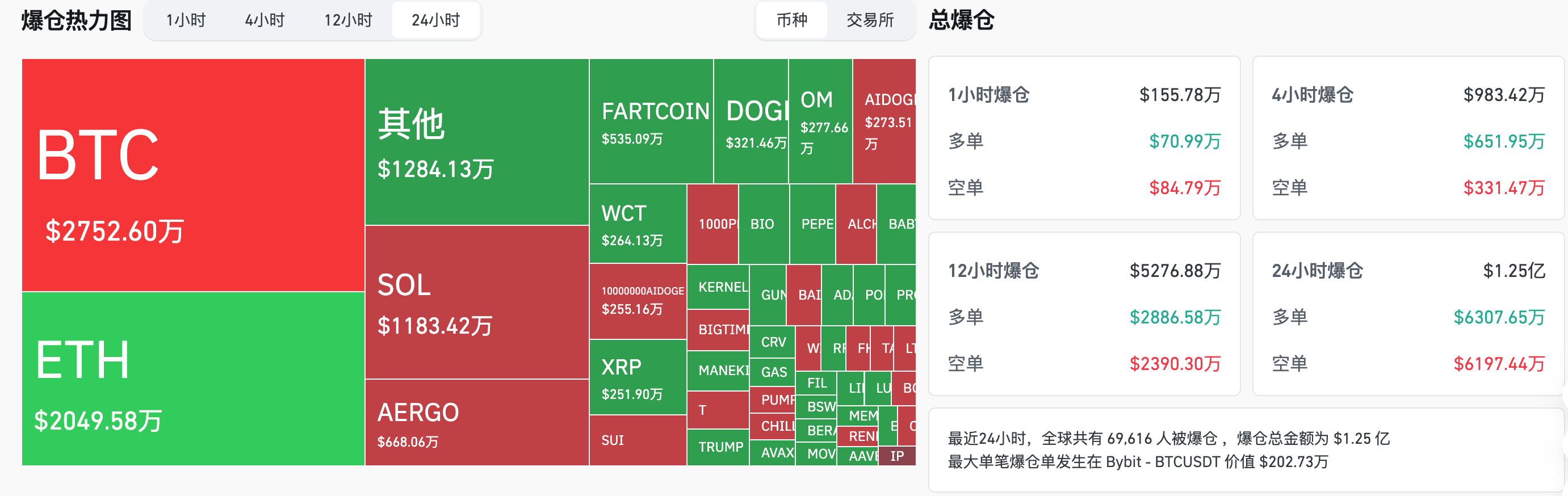

24-hour liquidation data : 69,616 people around the world were exposed, with a total liquidation amount of US$125 million. Its BTC liquidation was US$27.52 million, ETH liquidation was US$20.49 million, and SOL liquidation was US$11.83 million.

-

BTC medium and long-term trend channel : upper line ($84121.77), lower line ($82456.00)

-

ETH medium and long-term trend channel : upper line ($1647.69), lower line ($1615.06)

*Note: When the price is higher than the upper and lower edges, it is a medium- and long-term bullish trend, and vice versa is a bearish trend. When the price passes through the cost range repeatedly in the range or in the short term, it is a bottom or top state.

3.ETF flow direction (EST as of April 17)

-

Bitcoin ETF: $108 million

-

Ethereum ETF: USD 00,000

4. Looking forward today

-

TRUMP will unlock 4% total supply tokens on April 18, worth approximately $321 million

-

Immutable (IMX) will unlock approximately 24.52 million tokens at 8 a.m. on April 18, with a ratio of 1.37% to the current circulation and a value of approximately US$1,060;

-

Melania Meme (MELANIA) will unlock approximately 26.25 million tokens at 8 a.m. on April 18, with a ratio of 17.5% to the current circulation and a value of approximately US$1,310;

-

QuantixAI (QAI) will unlock approximately 566,000 tokens at 8 a.m. on April 18, with a ratio of 3960.24% to the current circulation, worth approximately US$49.9 million;

-

Fasttoken (FTN) will unlock approximately 20 million tokens on April 18, with a ratio of 4.65% to the current circulation, and a value of approximately $81 million

-

Polyhedra Network (ZKJ) will unlock approximately 15.53 million tokens at 8 a.m. on April 19, with a ratio of 25.72% to the current circulation and a value of approximately US$35.25 million;

The biggest increase in the top 500 market value today: KEEP rose 67.41%, AERGO rose 62.53%, T rose 52.24%, STIK rose 34.52%, and ZENT rose 26.05%.

5. Hot News

-

Arizona Cryptocurrency Reserves Act passed on House Committee to enter third reading stage

-

Binance Wallet will host Lorenzo Protocol (BANK) token generation event

-

sUSD deanstation intensified to $0.6825, a 24-hour decline of 16.5%

-

GOMBLE (GM) will launch Binance Alpha and launch airdrop activity

-

Family offices have almost five times the allocation share of spot Ethereum ETP than Bitcoin

-

US SEC will hold its third roundtable for crypto policy on April 25 to focus on hosting issues

-

Powell: Banks and cryptocurrencies related rules may be "relaxed" in the future

-

Raydium launches token issuance platform LaunchLab, with 25% repurchase at RAY

-

DWF Labs set up an office in the United States and spent $25 million to buy WLFI tokens

jinse

jinse

chaincatcher

chaincatcher