TRUMP surges 1250%, Bitcoin is a new era of global legal virtual economy

Reprinted from jinse

01/20/2025·3MAuthor: Bowen

Everyone knew that the market would fluctuate before Trump officially took office; but no one could have imagined that Trump would directly issue a coin himself.

Bai Lu believes that Trump’s currency issuance will have three impacts:

First, Bitcoin will be completely legalized globally and become part of the U.S. national reserve. The U.S. can legally use the Web3 financial revolution to harvest global wealth;

Second, the combination of Web3 and AI will promote the revolution in production relations and create new opportunities for the next generation of virtual economy. Small and medium-sized enterprises can directly open up the global marketing and capital chain by issuing Tokens without IPO;

Third, Trump’s currency issuance may accelerate the legalization process of China’s Web3. It is impossible for China to watch the United States take this opportunity to once again monopolize global dominance; Hong Kong has been piloting the legalization of virtual assets in the mainland for two years, and the relevant policy layout of the mainland is likely to accelerate in the future.

Quoting the views of Bai Lu’s friend VDX CEO Bian Zhiwei:

Quoting Bai Lu’s friend Chen Yuetian, a partner at Huofeng Capital, posted this on WeChat Moments today:

This is a historic moment comparable to the birth of the first publicly traded stock.

The new president of the United States takes the lead and declares to the world that issuance of currency is legal. Even personal issuance of currency is legal without fundamentals.

If it is illegal, legitimize it through presidential power legislation

Just to make money? No, he wants to promote new asset creation methods to help Americanize debt

The current Wall Street cannot save the United States; if we rebuild another one, we cannot build it without destroying it.

This is the Shanghai Stock Exchange in 1992. Each of us can be A Bao

The most dramatic person in the world, in the most dramatic way, started a carnival of the times that the world cannot miss.

Thunder on the ground

Look what Trump has done. At 10:00 am on January 18, Trump’s personal account suddenly posted on the social media Truth Social that a personal Meme token called TRUMP would be launched. Although the market reacted quickly, it was also very skeptical.

Then at 10:44, Trump once again announced the same content on his personal X account. The risk of account being stolen could no longer stop the enthusiasm of Trump fans. One hour later, TRUMP quoted 4.7 US dollars, and FDV had exceeded 4.7 billion US dollars; based on the circulation of 200 million coins, the corresponding circulating market value exceeded 900 million US dollars.

According to price data from CoinGecko, the TRUMP coin began trading at an opening price of $0.1824. Within 12 hours, it rose more than 15,000% to about $30, and the token market value rose to $30 billion. As of 9:30 pm on January 19, according to Coinbase data, the price of TRUMP coins rose again, reaching $71.65.

TRUMP price hits as high as $82

Based on a total supply of 1 billion coins and a circulation of 200 million coins, the total market value of TRUMP coins once exceeded US$71.65 billion. The most awesome MEME coin in history was born.

Get rich quickly

According to the GetTrumpMemes official website, 80% of TRUMP’s supply is held by CIC Digital, an affiliate of the Trump Organization, and Fight Fight Fight LLC, an entity jointly owned by CIC. The market value of the 800 million TRUMPs held by the Trump family once exceeded US$57.32 billion; Forbes valued Trump's net worth at US$5.6 billion in November 2024, which means that relying on the issuance of coins, Trump's net worth It rose more than 10 times in just two days .

For a time, major domestic media rarely put the news of "Trump issuing coins" on the front page.

No one could have imagined that something more dramatic has not yet begun. Trump came prepared this time. Not only did he go there, but he also took his wife with him to put on a good show.

Scored twice

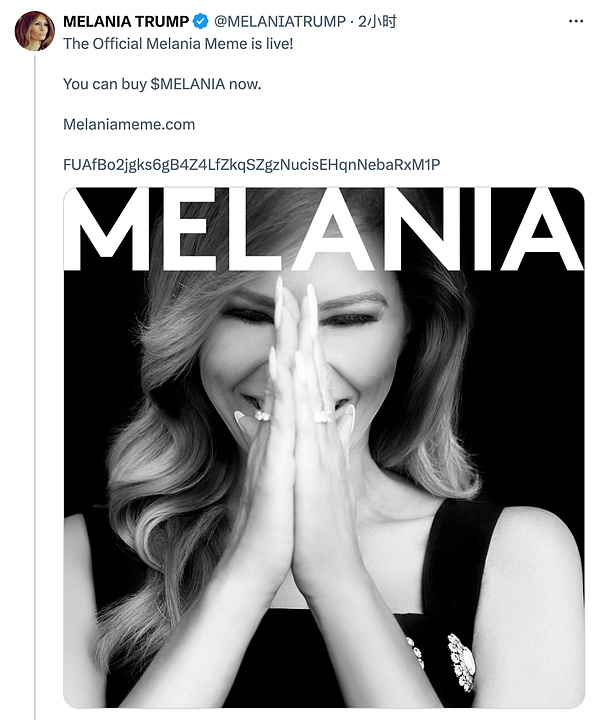

At 5:13 on January 20, Trump’s wife, Melania Trump, who is about to become the first lady again, posted a message on her personal Twitter account announcing the launch of her personal Meme token MELANIA. Users need to visit the domain name "Melaniameme.com" website to purchase.

With TRUMP's plot foreshadowing, MELANIA quickly became popular as soon as it went online. As of 7:45, MELANIA was temporarily quoted at US$8.4, corresponding to a full circulation valuation of US$8.4 billion.

However, suddenly, after the issuance of MELANIA, the market consolidation began to take a sharp turn. BTC once fell below the US$100,000 mark, ETH once fell below US$3,200, and SOL also experienced a sharp correction and fell below US$240. Not to mention the price of TRUMP, which increased by about 40,000% from a high of nearly 80 US dollars, and fell back to around 50 US dollars in a few hours .

I don’t know if the market has had enough of the couple’s continuous saucy operations, but the drama over the weekend suddenly cooled down with the pullback of TRUMP. But in more than ten hours, Trump himself will usher in the second most glorious moment of his life. By then, TRUMP will most likely usher in a new climax.

How will the market outlook change?

Whether TRUMP can mobilize the market again is still uncertain; what is certain is that Trump’s coming to power will bring about an unprecedented era in the crypto market.

Hashkey chief analyst Jeffrey Ding said: “In Trump’s entire cabinet system, the Office of Artificial Intelligence and Cryptocurrency Affairs has received the most attention. The information currently disclosed by this agency is mainly responsible for formulating the regulatory framework for the entire encryption industry, contacting the Securities Regulatory Commission, The Commodity Futures Commission, Congress, etc., the Crypto Advisory Committee under their jurisdiction claims to be composed of 24 CEOs of crypto companies to provide suggestions for policy formulation.

According to Trump’s promises, the following new policies require special attention:

-

Make the United States the global crypto capital

-

Stop cracking down on cryptocurrencies as soon as he takes office

-

Prevent the development of a central bank digital currency ( CBDC )

-

Build a strategic Bitcoin reserve

-

Fire the SEC Chairman

-

Block the sale of Bitcoin held by the U.S. government

-

Use Bitcoin to solve US debt

-

Establish a more comprehensive encryption policy

-

Establish an encryption advisory committee

Judging from Trump’s personnel appointments during the transition period, at least Articles 5 and 9 have been completed . For the encryption industry, at least from a regulatory perspective, on the one hand, the originally suppressed policies may be gradually relaxed, and on the other hand, more complete legislation is likely to further promote the industry to become mainstream. "

Trump's coming to power will continue to accelerate policy changes in Hong Kong and mainland China. In the past year, Hong Kong's 7 exchanges, 31 securities firms, and 36 asset managers have been fully prepared for the arrival of the new era; mainland Web3 practitioners are also waiting for the new dawn. Now, this day is no longer far away.

panewslab

panewslab