US Dollar Index Hits New Highs Is Bullish What Are Crypto BTC Short-Term Price Targets?

Reprinted from jinse

01/09/2025·1MAuthor: Big Smokey, CoinTelegraph; Compiler: Wu Baht, Golden Finance

Cryptocurrency markets plunged for a second day as the U.S. dollar index (DXY) chased new highs amid rising U.S. Treasury yields and investor concerns about the Federal Reserve 's monetary policy plans.

Although the U.S. dollar index opened the week down 0.92% before Bitcoin suddenly rebounded to $102,000, the index later reversed course and hit 109.37, its highest level since November 2022.

The market also reacted negatively to the surge in U.S. Treasury yields, with the 10-year Treasury yield exceeding 4.7% and the 30-year Treasury yield rising to 4.93%. While the catalysts for rising yields are diverse and complex, they essentially reflect market participants ' concerns that inflation will remain elevated as President-elect Donald Trump's economic policies threaten to widen the deficit.

In short, markets are beginning to price in the possibility of an increase in U.S. long-term debt, while the policies of the incoming Trump administration are expected to drive up inflation even as they boost economic growth.

As expected, Bitcoin prices reacted negatively to the strength in the U.S. dollar index, with analysts worried that yield curve control will become a hot topic again.

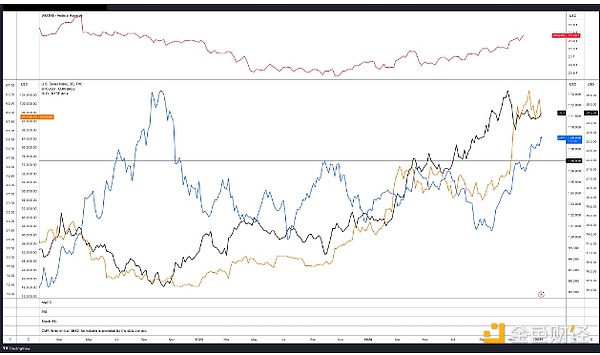

3-day chart of DXY vs BTC. Source: TradingView

BTC fell to an intraday low of $92,500, with analysts warning that if support at $90,000 fails to hold, prices could continue to fall in the short term.

Biyond co-founder Burkan Beyli noted:

“If Bitcoin falls below $94,000, the next target over the next five weeks is $81,000. To move to the downside, Bitcoin must close below $95,180 next week. Next week, we have CPI, so bears may Showing your cards. Overall, I am bearish on cryptocurrencies in the short term (4 to 5 weeks) and then very bullish as I expect a pullback in the U.S. dollar index after Trump takes office.”

Jamie Coutts, chief cryptocurrency analyst at Real Vision, appears to agree with Beyli, arguing that the recent strength in the U.S. dollar index is less important than expected liquidity expansion and the pro-crypto stance of the incoming Trump administration.

chaincatcher

chaincatcher

panewslab

panewslab