Web3 companies going overseas: Equity structure and tax optimization strategy

Reprinted from panewslab

04/17/2025·2DAuthors of this article: Crypto Miao, Liu Honglin

Due to its decentralized nature, Web3 companies face unique legal, tax and operational challenges in their international expansion. Choosing the right enterprise structure can not only help enterprises operate in compliance, but also optimize tax burdens, reduce risks and increase market flexibility to adapt to legal frameworks, technical infrastructure and market demands in different regions.

What is a sea-going architecture

Overseas architecture refers to the organizational structure and management model built by an enterprise in the process of globalization. The purpose is to coordinate global resources, adapt to the characteristics of different markets, and achieve efficient cross-border operations.

The design of overseas architecture directly affects the enterprise's global competitiveness and operational efficiency. Not only should we consider the equity structure, but we should also consider many aspects such as future structural adjustments, tax costs, intellectual property management, financing activities and overall maintenance costs.

Type selection of overseas architecture

Tax optimization is an important consideration in Web3 enterprise architecture selection, and the impact of the global tax framework on digital assets is increasingly significant. When companies go overseas to build holding companies, Hong Kong, Singapore and BVI are popular choices.

1. Single entity architecture

1. Hong Kong

Hong Kong implements a low-tax tax system, mainly including profit tax, salary tax and property tax, and does not impose taxes such as value-added tax and business tax. The tax rate for corporate income tax is 8.25% for the annual profit of not exceeding HK$2 million, and the tax rate for corporate income tax exceeding HK$2 million is 16.5%. When dividends are collected from Hong Kong overseas companies with a shareholding ratio of more than 5%, their overseas dividends are tax-free.

Hong Kong has signed a double taxation avoidance agreement (DTA) with about 45 countries and regions around the world, covering key markets such as mainland China, ASEAN and Europe. This extensive agreement network has created extremely broad tax planning space for enterprises, especially in reducing cross-border dividends and interest withholding taxes that cannot be ignored.

2. Singapore

Singapore's corporate income tax rate is 17%, slightly higher than that of Hong Kong. However, Singapore's tax system is relatively friendly to technology research and development companies, allowing companies to enjoy a number of tax exemptions and deduction policies. In addition, Singapore is exempt from overseas dividends and capital gains (meets relevant conditions).

In addition, Singapore also provides a series of tax preferential policies, such as regional headquarters (RHQ), Global Trader Program (GTP), etc., which provide companies with more tax planning possibilities.

Singapore has signed DTAs with more than 90 countries internationally, and this network covers major economies around the world, including China, India, the EU, etc. This provides enterprises with a very broad operating space in tax planning, especially in reducing cross-border dividends and interest withholding taxes.

3.BVI (British Virgin Islands)

With its zero-tax system, strong privacy and flexible structure, BVI is the first choice offshore jurisdiction for global cross-border investment, asset protection and tax optimization, and is especially suitable for business scenarios in holding companies and crypto industry.

BVI does not charge corporate income tax, capital gains tax, dividend tax or estate tax, and the tax burden is extremely low.

BVI Company does not disclose shareholders and directors information, and can further hide the actual controller through Nominee (nominee) service to ensure business privacy and asset security.

As an internationally recognized offshore entity, BVI has been widely recognized by major global financial centers (such as Hong Kong, Singapore, London, etc.), making it easier to open accounts in multinational banks and efficiently carry out international payments, trade settlement and capital operations.

Major tax rates comparison:

2. Multi-entity architecture

Adopting a multi-entity architecture can more effectively carry out tax planning. Domestic companies invest in the target investing country by establishing one or more intermediate holding companies in some low-tax countries (usually Hong Kong, Singapore, BVI or Cayman). Taking advantage of the low tax rate and confidentiality of offshore companies, the overall tax burden of the company can be reduced, while protecting corporate information and diversifying parent company risks, and also providing convenience for future equity restructuring, sale or listing financing.

- Case 1

Intermediate control: China → Singapore → Southeast Asian subsidiaries (such as Vietnam)

Chinese parent company invests in Vietnam through Singapore holding companies. Singapore has signed a bilateral tax agreement (DTA) with China and Vietnam respectively. The withholding rate of enterprise dividends can be reduced to as low as 5%. Compared with China's direct holding of Vietnamese subsidiaries, the tax rate can be reduced by 50% (the China-Vietnam DTA agreement is 10%).

As a middle-level company, Singapore companies usually do not impose capital gains tax on transferring equity of Singapore companies; if they directly transfer equity of Vietnamese subsidiary companies, they may face capital gains tax (20%) in Vietnam. The Singapore structure is more in line with the trading habits of European and American investors and improves asset sales liquidity.

In addition, Singapore companies can serve as regional headquarters and have multiple subsidiaries to manage businesses in different countries, so as to facilitate the subsequent introduction of international investors or split and listing. Singapore's financial market is well developed, and holding companies can issue bonds or obtain international bank loans to reduce financing costs.

- Case 2

VIE protocol control: BVI→Hong Kong→operating company

Because some regions have strict supervision of the Web3 industry, operational risks are high. The "VIE" protocol control framework (Variable Interest Entities, "variable interest entities") can be adopted to reinvest and operate companies (such as Alibaba, Tencent Music, New Oriental, etc.) through BVI holdings. Overseas holding companies can control the operating companies through a layered structure through VIE agreement.

As the top-level holding company, BVI Company will be exempt from capital gains tax in the future equity transfer, protecting the founder's privacy.

- Case 3

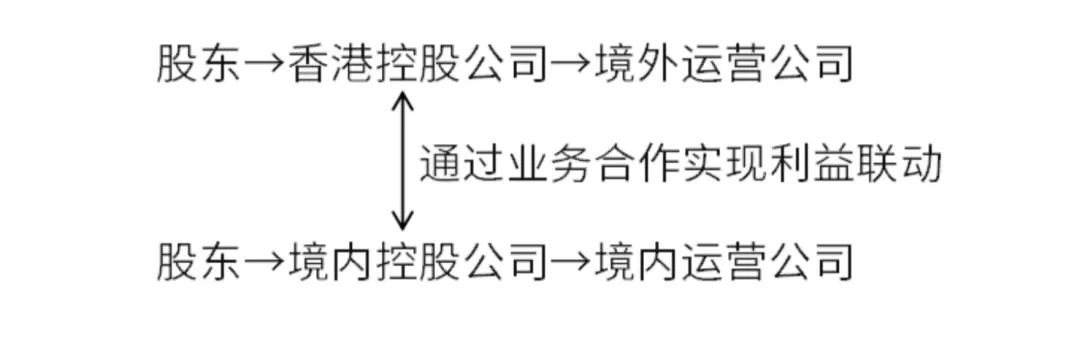

Parallel structure of domestic and foreign companies:

The parallel structure of domestic and foreign companies can be applicable to the situation where different companies at home and abroad need to divide the work and cooperation between different businesses due to market and regulatory uncertainty, or due to financing, geopolitics, qualifications, certificates, data security, etc. For example: Mankun Research | Web3 Entrepreneurship, can the "front store and back factory" model of Hong Kong + Shenzhen comply with the regulations?

The overall tax rate is lower. Overseas companies can choose to register in tax-preferred areas (such as Hong Kong, Singapore, Cayman Islands, etc.), which usually have lower corporate income tax rates or capital gains tax exemptions than domestic ones. And through business cooperation, Runliuo will be distributed reasonably, enjoy tax deductions from various places, and reduce the overall tax burden.

Operate independently at home and abroad. Under a parallel structure, domestic companies and overseas companies, as independent legal entities, are subject to tax jurisdictions in their respective locations. This means that the two companies can pay taxes separately according to their location’s tax laws to avoid the issue of global revenue merger taxation caused by equity associations.

Summary of Lawyer Mankun

Choosing the right enterprise architecture is crucial for Web3 companies to go overseas. It not only optimizes tax burdens, but also reduces risks and improves global operational flexibility. Whether it is using a single entity architecture to enjoy low tax rates or establishing a multi-entity architecture according to business needs, a reasonable design can significantly enhance the international competitiveness of the enterprise and help the enterprise flourish in the Web3 ecosystem.

chaincatcher

chaincatcher