Web3 Games 2024: Absentee in the bull market?

Reprinted from jinse

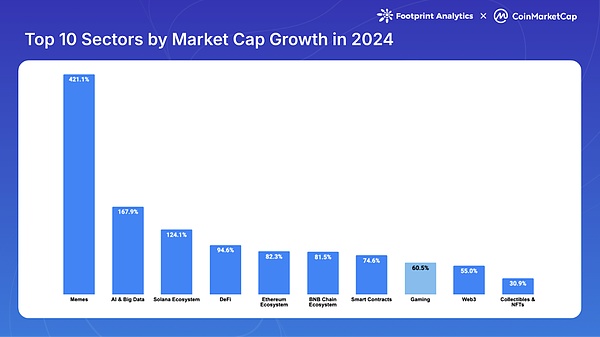

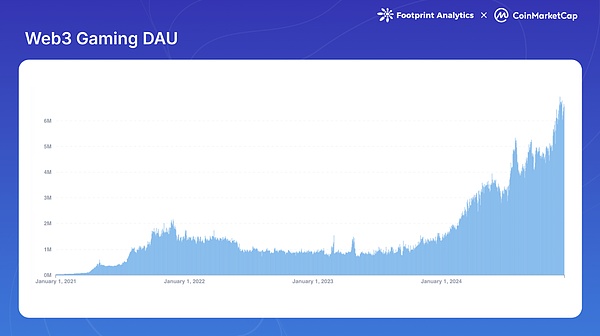

01/07/2025·2MIn 2024, the Web3 game industry will present a complex situation, making significant progress while also facing many challenges. Although the number of daily active users has surged by more than 300%, and traditional game companies have begun to make specific arrangements in this field, judging from market performance, the market value of this sector has only increased by 60.5%, significantly lagging behind the Meme currency and AI sectors. As Bitcoin reaches new all-time highs and various crypto sectors thrive, a key question emerges: "Have Web3 games missed the mark in this bull market?"

Yet behind the surface numbers, 2024 marks an important period of transformation for the industry. The industry has moved from a purely speculative stage to maturity. This report will analyze how Web3 games will evolve during the 2024 market cycle, exploring the sector's key indicators, technological advancements, and strategic shifts. From infrastructure development to user engagement models, we'll explore how the industry can build sustainable growth while addressing mainstream adoption challenges.

Note: Unless otherwise stated, all data in this report are as of December 15, 2024. Data sources are Footprint Analytics and CoinMarketCap.

Annual Key Metrics Overview

-

Market value: reached US$31.8 billion, an increase of 60.5%;

-

Transaction volume: $5.2 billion, up 18.5%

-

Number of transactions: 5.3 billion, down 30.3%

-

Daily active users: reached 6.6 million at the end of the year, an increase of 308.6% compared to the beginning of the year;

-

Active games: 1,361 of 3,602 games remain active (37.8%);

-

Annual financing: 220 financing events, totaling US$910 million;

-

Leading public chain:

-

Transaction volume proportion: BNB chain (23.1%), Ethereum (17.6%), Blast (9.2%);

-

Proportion of transactions: WAX (33.6%), Aptos (11.6%), Ronin (6.1%);

-

Daily active users: opBNB (2.2 million), Ronin (1.1 million), Nebula (458,000) (daily average in December).

Market performance analysis

Market capitalization performance

The Web3 gaming sector will achieve strong growth in 2024, but underperform compared to other crypto sectors. According to Footprint Analytics data, the market value of game tokens reached US$31.8 billion at the end of the year, an increase of 60.5% from the previous year. While the sector hit a yearly high of $47.4 billion in March, it was still significantly below the all-time high of $114.1 billion set in November 2021.

Although the overall crypto market performed strongly in the second half of 2024, especially the last two months of the year led by Bitcoin, gaming token performance lagged other sectors. CoinMarketCap data shows that Web3 games rank eighth among the top ten sectors in terms of market value growth, significantly lagging behind the leading sectors: Meme coin (421.1%), AI and big data (168.0%) and Solana ecosystem (124.1%).

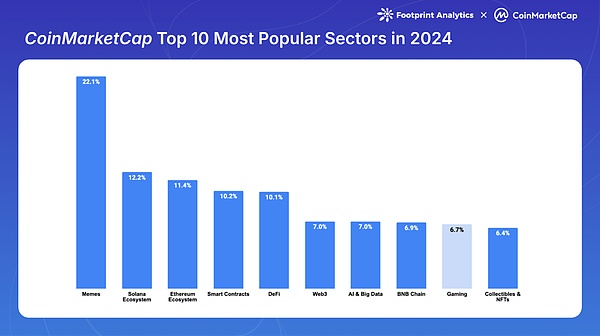

This poor performance also extends to community attention. Among the most watched sections on CoinMarketCap, Web3 games accounted for only 6.7% of the views of the top ten sections, ranking ninth, because the focus throughout the year was mainly on Meme currency-related projects.

Transaction volume analysis

The performance of key indicators of the Web3 game sector in 2024 is mixed, with transaction volume increasing, but the number of transactions continuing to decline.

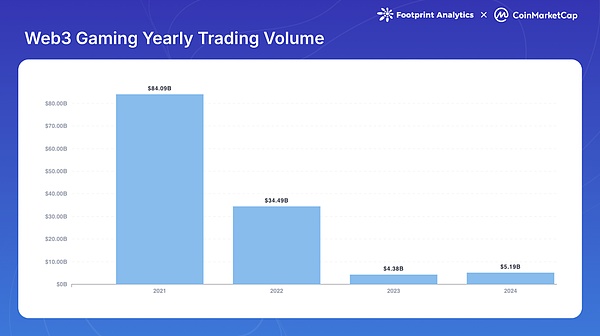

Volume Trend

The total transaction volume of Web3 games in 2024 will reach US$5.2 billion, an increase of 18.5% compared with 2023. While reversing the downward trend from 2021, trading volume remains significantly below the previous cycle high. The 2024 figure is only 6.2% of the 2021 peak ($84.1 billion) and 15.1% of the 2022 volume ($34.5 billion).

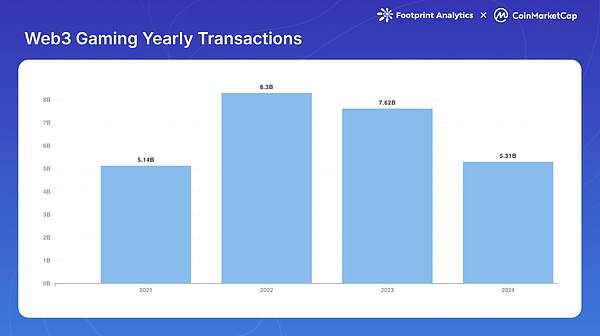

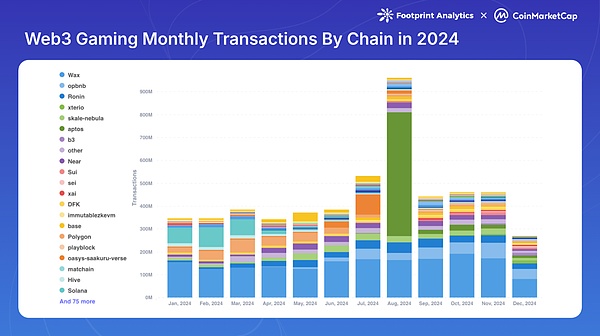

Transaction number trend

The total number of transactions in 2024 will reach 5.3 billion, a decrease of 30.3% from the previous year. Although this level is comparable to the 5.1 billion transactions in 2021, it fails to reverse the downward trend that began in 2022.

user engagement

Daily active users (DAU) achieved significant growth throughout 2024, from an average of 1.6 million daily users in January to 6.6 million in December, an increase of 308.6% during the year. This growth surpassed the previous cycle peak of 1.8 million DAU created in November 2021. While this data may include some bot activity, this increase still demonstrates significant user engagement in this industry.

ecosystem development

Public chain competition and evolution

Performance analysis of major public chains

In 2024, the dominance of different public chains in Web3 games will change significantly, with each chain showing different advantages in terms of transaction volume, number of transactions, and user participation.

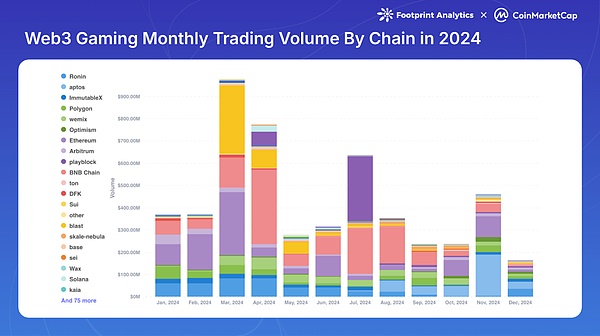

Transaction volume distribution of each chain

The BNB chain maintained its dominance in terms of transaction volume, achieving $1.2 billion in transaction volume (23.1% market share), followed by Ethereum with $920 million (17.6%). Blast and Ronin hold 9.2% and 9.0% market shares respectively.

Number of transactions on each chain

Although the overall number of transactions in the industry dropped by 30.3%, some public chains showed strong performance. WAX leads the way with 1.8 billion transactions (33.6% of the total). Aptos rose to prominence with its "tap-to-earn" Telegram game Tapos, reaching 620 million transactions (11.6%), including 540 million transactions in August alone. Ronin and opBNB maintain transaction numbers of 321 million and 318 million respectively.

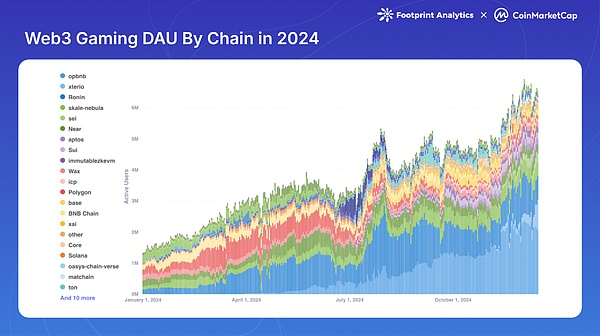

Number of users on each chain

User activity on each chain has shown significant growth, especially in the second half of 2024. opBNB has suddenly emerged in terms of user engagement, with average daily active users reaching 2.2 million in December, surpassing long-term leader Ronin (1.1 million). As SKALE Layer 2, Nebula ranks third with an average DAU of 458,000. Public chains such as NEAR, Sui and Sei are among the top ten in terms of DAU, demonstrating the expansion of the competitive landscape of the ecosystem and the willingness of users to try new platforms.

The trend of diversification in the use of various chains shows that the ecosystem is becoming increasingly mature, and different public chains are finding their own positioning for various game experiences and user preferences. Major networks have moved beyond simply providing basic blockchain facilities and have evolved into comprehensive platforms for game developers. The Arbitrum Foundation’s 2 billion ARB game catalyst program, the Starknet Foundation’s 50 million STRK token distribution program, and important Grant programs from Sui and Xai all demonstrate how each chain can attract and retain high-quality games through strategic incentives project.

Technology infrastructure improvements

Capacity increase

The processing capabilities of the blockchain have improved significantly, and the current transaction processing volume of the network per second has increased by more than 50 times compared with four years ago. This growth has been driven by the rise of Ethereum Layer 2 and Layer 3 networks, including Immutable zkEVM, game chains based on Avalanche L1, Oasys, SKALE, Arbitrum Orbit, and other high-throughput blockchains such as Solana, Sui, and Aptos.

Game-specific chains have also made significant progress. Ronin announced its Layer 2 plan Ronin zkEVM in June 2024, enabling Ronin developers to create their own zkEVM Layer 2. Immutable zkEVM takes a strategic step towards greater accessibility by removing deployment whitelisting and enabling permissionless deployment. In addition, Avalanche completed the most important "Avalanche9000" upgrade since the mainnet launch in 2020, focusing on solving the obstacles of customized L1 construction and improving interoperability.

Gas cost reduction

Ethereum's "Cancun" upgrade in March 2024 (also known as "Proto-Danksharding" or "EIP-4844") was a major milestone that significantly reduced the fees on the L2 network. The impact has been dramatic, with gas fees dropping from a few dollars to a few cents or even less, eliminating one of the biggest friction points facing blockchain game developers and players.

Improved cross-chain interoperability

The Chainlink Cross-Chain Interoperability Protocol (CCIP) gained significant momentum in 2024, enabling developers to create games that interact with multi-chain assets. This improvement significantly improves the interoperability of in-game items.

The adoption of standardized formats for digital assets, specifically ERC-721 and ERC-1155, has become more widespread. These standards ensure that in-game NFTs can be recognized and used across various games and platforms, simplifying asset transfer and interaction.

2024 will also see the significant rise of decentralized platforms that support cross-chain gaming. Platforms such as Portal, Fractal ID and Web3Games provide the necessary infrastructure for seamless asset transfer and interaction between different blockchain ecosystems.

Project development

2024 is an important year for the development of Web3 games. In addition to the entry of traditional gaming companies, the ecosystem has also witnessed several major game launches. Highly anticipated games like Off The Grid and MapleStory Universe enter early access, while Illuvium is finally officially live. Pirate Nation successfully completed its Token Generation Event (TGE) and launched its successful “play-to-airdrop” campaign.

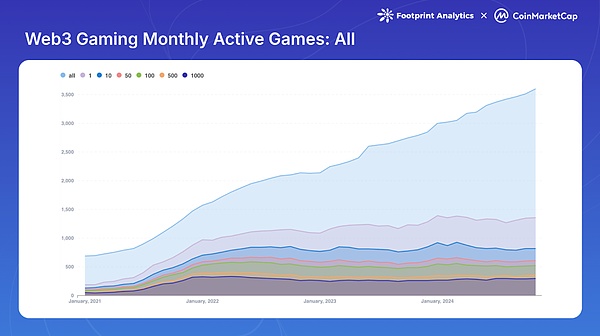

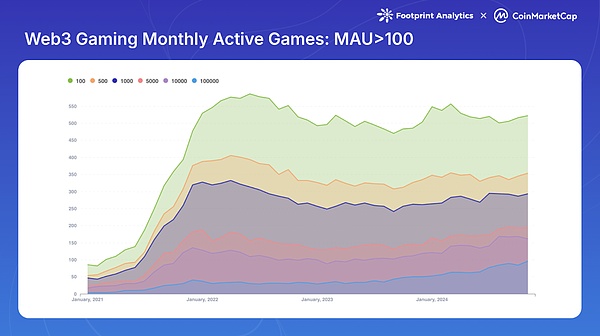

Active game analysis

As of November 30, 2024, the total number of blockchain games reached 3,602, an increase from 2,997 in January. However, the active games indicator shows some challenging trends. Among the total number of games, only 1,361 (37.8%) remain active on the chain, that is, 2,241 (62.2%) are inactive. In addition, although the total number of games increased, the number of active games actually dropped from 1,387 in January.

In-depth analysis of user engagement indicators shows further concentration in the market. The number of games with more than 100 monthly active users (MAU) dropped from 586 in June 2022 to 522 at the end of 2024. In November 2024, 161 games (4.5% of the total) achieved more than 10,000 MAU, of which 96 games (2.7% of the total) exceeded 100,000 MAU.

This user concentration trend indicates that the market is maturing and successful games are attracting larger audiences. This phenomenon is affected by multiple factors, including fierce competition, rapid iteration strategies, and the "head effect" formed by top games in the ecosystem.

Innovation pattern

Cross-platform gaming trends

Mobile gaming emphasizes accessibility and seamless user experience, establishing itself as the primary platform for Web3 gaming in 2024. A mobile- first approach has influenced the way developers design blockchain games, focusing on intuitive interfaces and streamlined onboarding processes. Among newly released Web3 games in 2024, mobile games account for 29.4%.

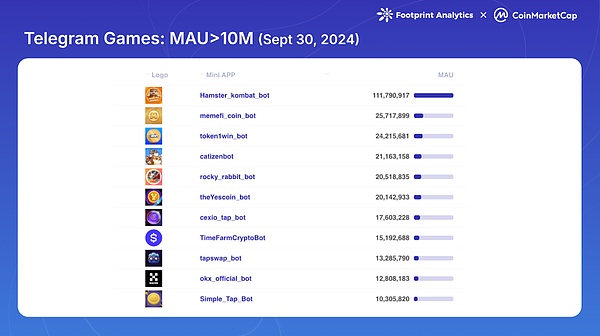

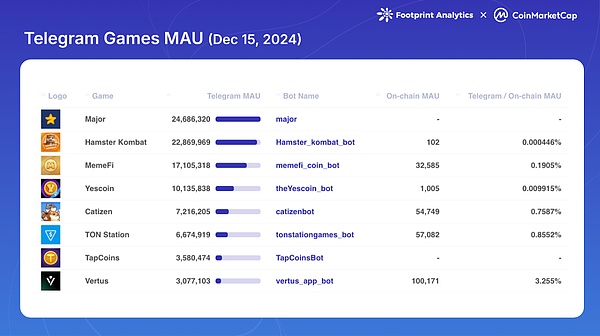

Social platforms, especially Telegram, have become powerful catalysts for Web3 game adoption, accounting for 20.9% of newly released Web3 games. Telegram's success stems from its large user base, streamlined in-app experience, and ability to bypass traditional app store restrictions. The platform's influence peaked in the third quarter of 2024, with 11 games exceeding 10 million MAU. It is worth noting that TON has successfully transformed this huge user base into on-chain participants, producing spillover effects in Web3 games, Meme coins and DeFi sectors. This success has prompted multiple blockchain networks outside of TON to compete for Telegram traffic. Aptos, Sui, Core, etc. have launched or supported games based on Telegram.

Similarly, Line announced plans to launch 20 mini-dApps in December 2024, signaling growing interest in blockchain gaming integration among mainstream messaging platforms.

The console gaming space remains relatively untapped in terms of Web3 gaming, with major manufacturers Microsoft and Sony maintaining a cautious stance. However, new approaches are beginning to emerge to bridge this gap. Some developers, such as Gunzilla Games' Off The Grid, choose to separate core gameplay from blockchain functionality to align with traditional console game expectations. At the same time, blockchain platforms have begun to develop their own Web3 game consoles, such as Sui's SuiPlay0X1 and Solana's Play Solana Gen1 (PSG1), which may create a new category of dedicated Web3 game devices.

The entry of traditional game companies

2024 marks a major shift in traditional game companies’ attitudes toward blockchain gaming, with major game studios moving from experimental moves to strategic developments.

Ubisoft released Champions Tactics: Grimoria Chronicles on the Oasys Layer 2 HOME Verse in October. This tactical RPG implements a series of NFT-based functions while maintaining traditional game elements.

Square Enix strengthens the development of its blockchain sector through strategic investments and partnerships. In addition to investing in gaming platforms Elixir Games and HyperPlay, the company also announced that it will bring its Symbiogenesis game to HyperPlay.

Sony Group’s involvement marks a major push into blockchain gaming, both through investment and infrastructure development. In conjunction with its support of double jump.tokyo Inc.'s $10 million Series D funding round, Sony also announced the launch of Soneium, a Layer 2 network designed to connect Web3 innovation to consumer applications in gaming and entertainment.

AI integration into game development

As artificial intelligence revolutionizes various industries in 2024, the Web3 gaming field has become an important beneficiary of AI innovation, opening up new opportunities for game development and player experience.

AI has revolutionized in-game interaction and content generation. Game studios are using AI to create more complex non-player characters (NPCs) that adapt to player behavior and generate personalized missions based on individual gaming history and preferences. This personalization enhances player engagement by making the gaming experience more relevant and personal.

On the development side, AI significantly simplifies the creative process. Developers are using AI tools to automatically generate game environments and assets, significantly reducing production time and costs. This gives small teams the opportunity to create high-quality games that can compete with larger studios.

AI also enhances the operational aspects of Web3 games. The technology is used to automate the game testing process and monitor on-chain transactions to prevent potential fraud or cheating, which is especially important in games with complex economic systems. Additionally, AI algorithms are helping to optimize game economies and token models, solving one of the major challenges in Web3 game design.

Investment pattern

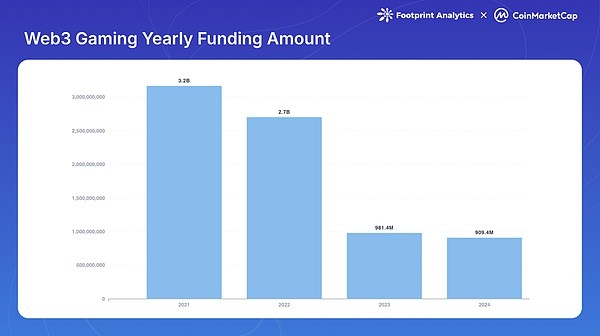

Overview of annual financing events

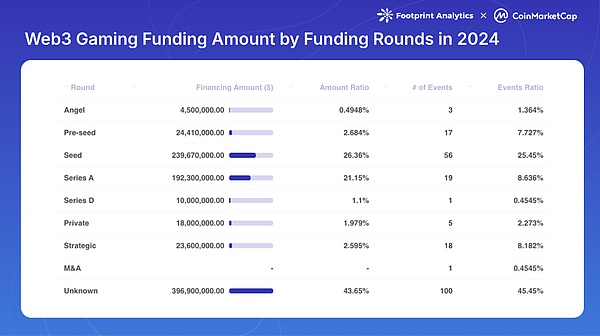

Web3 Games raised $910 million in 2024 across 220 funding events. Although the amount of financing is down 7.3% from 2023 and significantly lower than the 2021-2022 boom period (USD 3.2 billion and USD 2.7 billion respectively), the number of financing events increased by 48.7% from 2023, indicating continued investor interest. Although the size of a single transaction is reduced.

This year showed a clear trend towards early-stage investment, with 76 early- stage deals (accounting for 34.6% of total events) compared with only 20 Series A or later financing rounds (accounting for 9.1%). This trend shows that while new projects continue to attract initial funding, many projects in the 2021-2022 boom period face challenges in obtaining follow-on financing.

Among investors, Animoca Brands maintained its leading position, completing 38 investments, a 192.3% increase from 2023, and participating in 17.3% of all financing events in 2024. Spartan Group and Big Brain Holdings followed with 22 and 15 investments respectively, and the top ten investors completed a total of 152 investments.

Major financing events

Seven projects raised more than $20 million in a single event in 2024. Azra Games led the way with $42.7 million in Series A funding, focusing on bringing console-level gaming experiences to mobile platforms.

Judging from cumulative financing, Monkey Tilt raised US$51 million through two rounds of financing. They are a "game-entertainment-gambling" hybrid model platform. Gunzilla Games has demonstrated strong investor confidence by securing four rounds of funding from well-known investors including VanEck, Coinbase Ventures, Delphi Ventures, and Avalanche's Blizzard Fund.

strategic investment trends

As the industry matures from the heady period of 2021-2022, the focus has shifted to fewer but higher quality projects, and investors have become more selective in their approach.

Financing is increasingly targeting game infrastructure and development tools, not just the games themselves. Notable examples include NPC Labs' $18 million seed round for building Web3 games on Base, and Alliance Games' $5 million Series A for AI-powered decentralized infrastructure. The trend reflects growing investor interest in underlying technology capable of supporting multiple games and platforms.

Platform and multi-chain development have attracted a lot of attention, especially projects building cross-chain gaming ecosystems. Seeds Labs raised $12 million for Bladerite, its flagship product on Solana, while B3 launched Open Gaming Layer, demonstrating investor interest in expanding cross-chain gaming capabilities.

In addition, new gaming categories will gain significant investor attention in 2024, especially Telegram-based gaming and casino gaming projects, despite regulatory challenges.

Industry evolution and future prospects

The Web3 gaming industry has experienced significant evolution in gaming models in 2024. The play-to-earn model that dominated previous cycles gave way to more sustainable approaches. Telegram-based "tap-to-earn" games demonstrate unprecedented user acquisition capabilities, while Pirate Nation and Pixels' "play-to-airdrop" strategies provide new user acquisition methods. At the same time, mature projects are turning to a "play-and-earn" model that puts gameplay over financial incentives.

However, the field still faces ongoing challenges. Technical barriers remain significant, especially in achieving seamless blockchain integration without compromising the gaming experience. Regulatory uncertainty, particularly around gambling features and token classification, continues to impact development decisions.

Most critically, maintaining on-chain participation becomes a fundamental issue. This is particularly evident in the performance of Telegram games: Hamster Kombat’s monthly active users dropped from more than 100 million in September to 22.9 million in mid-December, with only 0.0004% of users participating in on-chain gaming activities. While other Telegram games show higher conversion rates, most are still below 1%. It is worth noting that these indicators specifically reflect on-chain gaming activity, as the core gameplay of most Telegram games remains off-chain, and users may be more active in other sectors such as Meme coins or DeFi. This highlights the ongoing challenge of converting platform users into active blockchain gamers.

Outlook 2025: Reinventing Relevance

As Web3 gaming seeks to re-establish its place in the crypto landscape, several key trends emerge as potential catalysts for transformation:

Social platform integration stands on the most promising path to mainstream relevance. The astonishing success of the Telegram game demonstrates the power of meeting users where they are, and platforms like Line and TikTok are poised to take off. This approach may ultimately solve the user acquisition challenges in this space, by leveraging existing social networks rather than building communities from scratch.

AI integration will evolve from a marketing feature to a fundamental driver of innovation. In addition to enhancing game development and NPC interaction, AI may solve the field's core challenges in economic design and user retention. These are areas where Web3 games have traditionally struggled to compete with traditional gaming experiences.

Achieving sustainable growth through consolidation may ultimately determine the field's relevance. Success may not come from competing with traditional gaming or other crypto sectors, but integrating seamlessly with them. This means focusing on how blockchain can enhance rather than define gaming experiences, developing more complex token economics, and prioritizing user experience over crypto-native features.

To sum up, the role of Web3 games in the crypto ecosystem may not be about dominance, but about integration. By cleverly connecting traditional games, social platforms and blockchain technology, Web3 games are expected to create truly innovative value. This evolution will not only help the industry break through the current limitations of "another crypto vertical", but may also become a key force in reshaping the future of the gaming industry.

This report is an annual report jointly produced by Footprint Analytics and CoinMarketCap Research.

panewslab

panewslab