Web3 Lawyer: How do cryptocurrency quantitative funds operate compliantly in Hong Kong?

Reprinted from panewslab

01/14/2025·25days ago"How do those investment tycoons in the crypto market lead the crypto market without relying on luck but only on strength? Crypto quantitative investment refers to achieving cryptocurrency investment returns through mathematical modeling, data analysis and automated trading strategies. . 24-hour trading, scientific and objective, and high efficiency. Based on these advantages of the crypto market, the quantitative team uses high-frequency trading and automated strategies to reduce the impact of human emotions on investment decisions and obtain profits safely and transparently.”

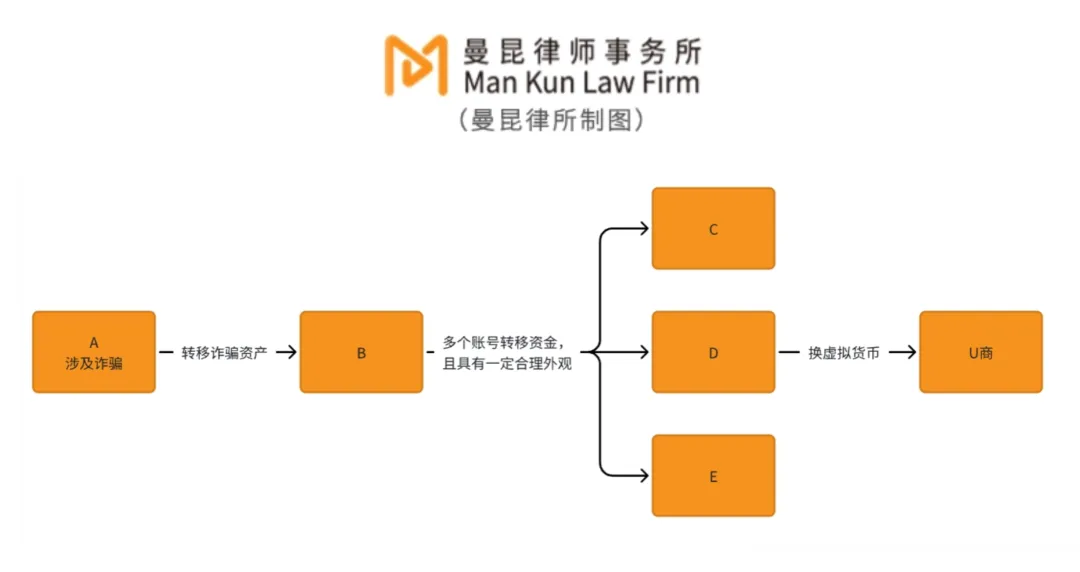

▲Development logic of quantitative system

As an international financial center, Hong Kong, China, occupies a pivotal position in the world with its open market environment, robust regulatory system and advanced infrastructure, and is also at the forefront of the development of the cryptocurrency field.

In 2017, the Hong Kong Securities and Futures Commission (SFC) issued the "Announcement on Initial Coin Offerings", clarifying that digital tokens involved in initial coin offerings (ICOs) may be classified as "securities" and that engaging in related activities requires applying for a license; and "To Hold The release of the "Circular on Bitcoin Futures Contracts and Cryptocurrency-Related Investment Products from Licensed Corporations and Registered Institutions" means that Hong Kong has begun to regulate cryptocurrencies.

In 2023, the Virtual Asset Service Provider (VASP) licensing system will be implemented. All centralized virtual asset exchanges that operate business in Hong Kong or promote services to Hong Kong investors must be licensed and regulated by the Hong Kong Securities and Futures Commission.

These policy changes have provided investors with a stable market foundation, making Hong Kong the first choice for the development of the global currency circle and blockchain technology.

These names may be familiar to many people: HashKey Group, OSL, MaiCapital, and the success of these leading virtual currency exchanges and funds in Asia is inseparable from the quantitative team.

In this city with unlimited potential, the crypto investment market may face unprecedented opportunities and challenges.

Next, let Lawyer Mankiw take you to have an in-depth understanding of why Hong Kong has become the first choice for crypto investment quantitative teams.

Common quantitative trading methods

Quantitative trading of crypto assets has specific structures and applicability according to its different characteristics, and has gradually become an important part of the crypto market. These trading strategies are algorithmically driven, reducing the impact of human emotions on trading, thereby improving trading efficiency and accuracy. The following are several main quantitative trading methods:

1.

Hedging transactions : refers to investors conducting two transactions related to different varieties, opposite directions, and with equivalent positions at the same time. To put it simply, it is to buy and sell highly correlated digital currencies in different markets at the same time. The transaction risk is small. It is more common for start-up companies to make venture capital or private equity investments to maintain the diversification of asset portfolios.

Legal and compliance considerations: Since hedging transactions involve multiple markets and trading platforms, fund managers need to ensure the qualifications and security of the trading platform, especially in compliance with anti-money laundering (AML) and know-your-customer (KYC) requirements in cross-border transactions.

2.

Trend trading: using market conditions and trend indicators to automatically determine buying and selling opportunities through computer programs. When there is a clear trend in the market, a buy or sell signal is automatically issued. This trading strategy is relatively complex, but it can help investors capture opportunities when the market rises or falls.

Legal and compliance considerations: Trend trading involves high-frequency trading (HFT). The Hong Kong Securities Regulatory Commission’s supervision of HFT mainly focuses on the traditional financial market, and there are few specific regulations on crypto asset transactions. However, fund managers need to ensure that algorithmic trading systems have adequate risk management and audit mechanisms to reduce potential compliance risks caused by operational errors.

3.

Hybrid model: combines the characteristics of multiple models, including trading in cryptocurrencies and their derivatives, as well as equity investments in related companies. Hong Kong fund management companies have established strict investment allocation and redemption mechanisms and conduct regular audits to ensure the safety and fairness of the funds. This structure provides managers with the flexibility to switch between different investment strategies based on market conditions and investment opportunities.

Legal and compliance considerations: Hybrid models involve different types of assets and trading methods, and managers need to comply with the regulatory requirements of the relevant fund types. For example, equity investments need to comply with Securities and Futures Ordinance (SFO) requirements, while crypto asset trading needs to comply with anti-money laundering (AML) and know-your-customer (KYC) regulations.

When determining the laws and regulations applicable to Hong Kong fund managers, we must also consider whether the fund vehicle is a private fund or an SFC authorized fund. For example, for hedge funds authorized by the SFC, there are specific hedge fund guidelines that must be followed. Under these guidelines, certain types of authorized hedge funds require a minimum subscription amount, such as $10,000 for a fund of funds and $50,000 for a single hedge fund, while hedge funds with a 100% capital guarantee feature have no subscription amount limit. In addition, the SFC sets higher standards for the risk management and internal control systems of authorized hedge funds.

Types of funding sources and compliance requirements

Under the supervision of the SFC, funds from different sources need to meet different compliance requirements to ensure legal and transparent transactions and protect operators and investors:

1. Own funds: Funds may come from the personal assets of team members, the team’s internal accumulation, or the team’s own profit accumulation. This type does not involve funds from external investors, so compliance requirements are relatively low, but internal risk management and internal control processes are still required.

2. Private equity funds: Private equity funds usually come from high net worth individuals, corporate professional investors or institutional investors. Compared with authorized retail funds, such funds usually have higher investment thresholds and are subject to relatively loose regulatory requirements. If fund management activities are carried out in Hong Kong, regardless of the nature of the fund, you need to apply for a Type 9 license. Under Hong Kong's open-ended fund company (OFC) framework, these funds need to be registered with the Hong Kong SFC. Private equity funds can be closed-end or open-end, depending on the overall investment structure and investment assets. Private equity funds are required to have licensed fund managers and external fund administration and auditors. Compliance requirements for such funds include compliance with AML and KYC procedures, as well as regular compliance audits and risk management reporting and other requirements.

3. Publicly raised funds: Some funds may come from cryptocurrency ETFs. These funds are open to public investors and have stricter supervision. They mostly adopt passive strategies, are hosted by a third party, and circulate in the secondary market. Their compliance requirements relate to the public offering and trading of funds, including information disclosure, investor protection and market conduct regulations.

No matter which type, you need to comply with the regulatory requirements of Hong Kong SFC, such as the independent storage of client funds, anti-money laundering and anti-terrorist financing compliance, risk management and network security measures. So, what is the regulatory framework in Hong Kong?

regulatory framework

**1. Compliance requirements of Hong Kong, Singapore, Switzerland, and

the United States**

In the global Chinese community, several popular countries and regions have some differences in their regulatory frameworks for crypto funds:

·Singapore : In 2024, the Monetary Authority of Singapore (MAS) launched stricter regulations on cryptocurrency and digital payment token (DPT) services, covering areas such as custody services and cross-border fund transfers. In November, it issued two new regulations An industry framework designed to promote the tokenization of funds and fixed income instruments.

Switzerland : The Swiss Financial Market Supervisory Authority (FINMA) is one of the first financial regulators in the world to develop a clear regulatory framework for cryptocurrency and blockchain technology. FINMA ensures the legality and transparency of cryptocurrency businesses through its Swiss Blockchain Law and Financial Market Infrastructures Act (FMIA).

· United States : The U.S. Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) play an important role in regulating crypto activities. However, due to the decentralized regulation of states in the United States, discussions need to be carried out by region.

· Hong Kong, China: The Hong Kong Securities and Futures Commission (SFC) provides a transparent and stable regulatory environment. It applies for different licenses according to the business it engages in. At least it needs to apply for No. 9 license. It mainly regulates fund managers and fund products.

All in all, Hong Kong ’s crypto policies tend to be flexible, with a stable regulatory environment and friendly tax policies, encouraging market innovation and strengthening cooperation with traditional financial institutions; Singapore is more attractive to digital asset companies, and its policies tend to be robust and focus on compliance and risk management. ; Switzerland has developed earlier at the regulatory level and is a pioneer and promoter of the global cryptocurrency market; while in the United States , due to inconsistent supervision, crypto fund managers are also subject to relative restrictions.

**2. The role of the Hong Kong Securities and Futures Commission

(SFC)**

In order to improve the public's understanding of the operation and functions of crypto funds, provide protection to the public who invest in or hold cryptocurrency products, and reduce illegal and criminal activities in the industry, Hong Kong regulatory authorities have proposed a series of compliance requirements for crypto fund teams.

The Hong Kong Securities and Futures Commission (SFC) is the main regulator of Hong Kong’s securities and futures markets, as well as the main regulator of cryptocurrency. The SFC regulates the cryptocurrency market by formulating and implementing relevant regulations, including the Securities and Futures Regulations, etc., ensuring that cryptocurrency funds operate under supervision and improving market transparency and standardization.

3. SFC regulatory principles

When choosing to do crypto quantification in Hong Kong, SFC has put forward at least four requirements:

·Compliance operations: The SFC regulates the cryptocurrency market by formulating and implementing the Securities and Futures Regulations and other guidelines and circulars related to virtual assets to ensure that the entire crypto market operates under the supervision of the SFC.

·Licensing system: All cryptocurrency exchanges and cryptocurrency platform operators operating in Hong Kong need to obtain licenses to raise the safety and soundness threshold of these platforms.

·Due Diligence : All cryptocurrency-related businesses comply with Hong Kong’s Anti-Money Laundering and Combating Terrorist Financing Regulations (AML/CTF), conduct customer due diligence (KYC), and report suspicious transaction activities.

·Regulatory Sandbox: The SFC and the Hong Kong Monetary Authority (HKMA) jointly established a fintech regulatory sandbox so that encryption-related companies can test their products and services in a controlled environment and make risk judgments in advance.

Compliance and risk management

So, if you want to run a crypto fund, what aspects of risk management need to be focused on?

1. Compliance framework : A complete compliance framework and effective risk management strategies must be established, including anti-money laundering (AML) and counter-terrorism financing (CFT) measures, to reduce virtual asset investment risks.

2. Asset separation : ensure that assets are independent of the assets of the manager and other related parties, and maintain the property safety of investors.

3. Customer Due Diligence ( KYC ) : All cryptocurrency-related businesses, including exchanges and wallet service providers, must practice customer due diligence and report suspicious trading activity.

4. Internal control and monitoring mechanism : It is necessary to establish an internal control and monitoring mechanism to regularly audit and report relevant activities to ensure compliance.

5. Cold storage solution : To prevent hacker attacks and asset theft, cold storage (offline storage) should be used.

6. Regular reports : Custodians are required to provide regular asset reports to management companies and investors to ensure the timeliness and transparency of information.

Therefore, it is not a trivial matter to avoid these risks and successfully establish a crypto quantitative team. It is very important to have reasonable planning and the support of a professional team.

jinse

jinse

chaincatcher

chaincatcher