Web3 Lawyer: The EU MiCA Act has officially come into effect. This article explains the new standards for Web3 enterprise development.

Reprinted from panewslab

01/04/2025·3MOn December 30, 2024, the European Union’s Crypto-Asset Market Supervision Act (hereinafter referred to as the “MiCA Act”) officially came into effect, marking a new era for the European crypto-asset compliance framework. In our previous series of articles, we have introduced the key definitions of the MiCA Act. Interested readers can click "Interpretation of the EU MiCA Act. How do virtual currency custody services comply?"丨Mankiw Web3 Law Popularization" View. For the majority of Web3 practitioners, especially those interested in the European market, how should they respond after the MiCA Act takes effect? Today, lawyer Mankiw will take you to find out.

Who must comply with MiCA?

Article 2 of the MiCA Act defines the scope of application of the Act, that is, natural persons, legal persons and other enterprises engaged in the following activities in the EU :

1. Issuance of crypto assets: Create new crypto assets.

2. Offer to the Public: Offer crypto assets to the public for subscription.

3. Admission to Trading: Allow crypto assets to be listed and traded on trading platforms (such as crypto asset exchanges).

4. Provide Services Related to Crypto-Assets: Involves various services provided for crypto-assets, including custody, purchase and sale matching, transaction execution, wallet management, etc.

The MiCA Act basically covers all crypto-asset-related activities. In short, any entity that wishes to carry out crypto-asset-related activities within the EU may fall within the scope of the MiCA Act. We have sorted out the scope of 10 different crypto-asset-related service businesses in previous articles. Readers can click on " Interpretation of Web3 | An article explaining why Web3 companies need EU MiCA and Dubai VARA licenses " to read.

It is worth noting that no matter where a virtual asset service provider (CASP) is registered or established, as long as its services involve European interests ( serving European interests ), it may fall within the scope of MiCA's regulations.

Who will enforce the MiCA Act?

According to relevant EU regulations, the execution entities of MiCA are divided into EU level and member state level:

1. EU level

There are two main regulators responsible for the enforcement of MiCA: the European Securities and Markets Authority (ESMA) and the European Banking Authority (EBA).

ESMA is the European Union's financial markets regulator. The role positioning is similar to that of the China Securities Regulatory Commission . According to the Financial Times, “ESMA wants to expand its powers to regulate major stock exchanges and other key parts of the EU’s financial infrastructure, striving to become a European version of the US Securities and Exchange Commission (SEC).” For the foreseeable future, ESMA will In European financial markets, it plays a more significant role.

The EBA is the European Union's banking regulator. The role positioning is similar to that of China’s former Banking Regulatory Commission . Develop harmonized supervisory standards for the European banking industry.

The differences between ESMA and EBA are as follows:

·Different regulatory fields: EBA is mainly responsible for the supervision of the banking industry, while ESMA is responsible for the supervision of the securities market.

·Different functional focuses: EBA focuses more on bank operations and depositor protection, while ESMA focuses on investor protection and the orderly operation of the market.

2. Member State Level

Originally, each EU member state independently designated its own national agency to formulate regulatory policies and implement penalties for crypto assets within its jurisdiction. The names and scope of powers of each EU member state's regulatory agency are different. For example, Poland's financial regulatory agency is called the Polish Financial Supervisory Authority (PFSA), and Malta's is the Malta Financial Services Authority (MFSA).

The MiCA Act encourages regulatory agencies among EU member states to cooperate with EU institutions to improve the efficiency of the implementation of the Act and closely monitor possible violations in the market. In the foreseeable future, the regulatory framework for crypto assets will be more unified and complete in the EU. So for Web3 practitioners who plan to or are already doing business in the EU, what are the core points of the MiCA Act?

Key Points of the MiCA Act

1. Unified framework and comprehensive compliance

If the license is compared to a passport, then the direct benefit brought by the MiCA bill is that Web3 practitioners can use the "Schengen visa" to travel throughout Europe.

In the past, the Web3 compliance systems of EU countries were fragmented and unable to form a unified regulatory framework; now, MiCA has developed a unified framework and standards for EU member states. In the foreseeable future, both issuers and operators of virtual currencies will Whether it is a crypto asset service provider, it will reduce repeated applications and improve compliance efficiency.

Compared with previous regulatory frameworks that differed from country to country, generally speaking, the provisions of the MiCA Act are more detailed and impose higher compliance requirements for Web3 businesses in Europe . For crypto asset service providers, MiCA has comprehensive rules covering everything from governance and capital requirements to custody and management. For example, to be authorized, a CASP must have at least one EU-based director and have a registered office within the EU. In terms of marketing, special attention is paid to regulating misrepresentations, complying with the rules of marketing communication and information activities , and conducting activities in a fair manner. Otherwise, regulatory agencies will issue corresponding warnings and penalties.

2. Sufficient capital and stable value

In order to prevent the occurrence of systemic financial risks in the crypto market, MiCA has formulated special requirements for the issuance of stable coins, stipulating that issuers must hold sufficient reserve assets to support their value stability to ensure the value stability of stable coins.

Therefore, stablecoin issuers need to maintain sufficient capital and liquidity reserves to cope with potential market fluctuations and redemption needs; in particular, stablecoin issuers need to ensure that there are sufficient reserves to support the tokens issued.

3. Fight crime and regulate the market

The MiCA Act attaches great importance to and prevents possible illegal and criminal activities in the encryption market, such as insider trading, market manipulation, etc. All crypto asset service providers are also required to implement anti-money laundering (AML) and counter-terrorist financing (CTF) measures, including strict KYC procedures and transaction monitoring, to prevent criminals from conducting illegal activities through the crypto market. Cryptoasset service providers must implement strict customer due diligence (CDD) procedures, monitor suspicious transactions, and report to relevant authorities to prevent money laundering and terrorist financing activities.

Possible penalties for breach of MiCA Act

For Web3 practitioners, what they are most concerned about is whether the project can be carried out normally . The reason why they pursue compliance is because the cost of non-compliance is high . After sorting it out, lawyer Mankiw summarized the penalties of the MiCA Act as follows Category 4:

1. Warning

Warnings serve as a warning and remind practitioners of the importance of compliance. The EBA will issue a formal warning stating that the issuer has failed to meet one or more of its obligations under the MiCA regulations.

·Nature: A warning is a formal administrative notice, which serves as a formal administrative record indicating that the regulatory agency has noticed a problem with the issuer.

·Applicable situations: Usually used when the violation is relatively minor, or occurs for the first time, and the issuer shows a cooperative attitude towards correction. For example, it may involve untimely information disclosure, minor non-compliance in marketing communications, minor flaws in internal management processes, etc.

Impact: The warning itself may not directly cause business disruption or financial loss, but it can have a negative impact on the issuer's reputation and may lead to greater regulatory scrutiny. If an issuer fails to take timely corrective measures after receiving a warning, it may face more severe penalties.

·Example: ESMA warns an issuer that the white paper it publishes lacks certain necessary information disclosures and requires it to supplement it within a specified period.

2. Fines and daily fines

Both fines and daily fines are economic sanctions, and their differences are as follows:

In short, Fines are retrospective , punishing past violations, while Periodic Penalty Payments are prospective , imposing daily fines to deter ongoing or future non-compliance. conduct until the obligation is fulfilled.

3. Suspend or prohibit activities

Suspension or banning of activities is a more severe penalty than a warning and will have a direct impact on the issuer's business operations.

·Suspending Activities: refers to temporarily prohibiting the issuer from conducting one or more specific activities within a certain period of time. For example, suspension of public offerings, suspension of trading platform transactions, suspension of marketing activities, etc.

Time limit: There is usually a clear time limit, such as "a maximum of 30 consecutive working days at a time" mentioned in Article 130.

When to use: Typically used when the violation is more serious, or when the issuer has failed to effectively correct the issues identified in previous warnings. For example, it involves misleading publicity, failure to manage reserve assets as required, and serious deficiencies in internal controls.

Impact: Suspension of activity can result in business interruption, lost revenue, customer churn, and significant damage to an issuer's reputation.

· Prohibiting Activities: refers to permanently prohibiting the issuer from performing one or more specific activities. For example, a permanent ban on the public issuance of a certain token, a permanent ban on trading on a specific platform, etc.

Nature: This is a very severe penalty that means the issuer will no longer be able to continue its business in this area.

Applicable situations: Usually used when the violation is very serious, or the issuer has repeatedly violated regulations and refuses to correct them. For example, it involves major illegal activities such as fraud and money laundering, or behaviors that seriously harm the interests of investors.

Impact: Prohibited activities will have a devastating impact on the issuer's business and increase the company's operating risks.

4. Removal or revocation of license

Delisting or revocation of license is the most severe penalty under the MiCA Act.

· Nature: Refers to the regulatory authority officially revoking the issuer’s operating license obtained under the MiCA Act, making it ineligible to provide related services in the EU.

·Applicable situations: Usually used when the most serious violations occur, such as:

Seriously violates the core provisions of the MiCA Act and causes significant harm to the stability of the financial market or the interests of investors.

Providing false information to obtain authorization to issue a license.

Persistent and repeated violations of regulations that remain unresolved despite repeated warnings and penalties.

The company becomes insolvent or faces bankruptcy liquidation.

·Impact: The revocation of authorization means that the issuer must immediately cease all related business in the EU and may face further legal proceedings and penalties. This is a fatal blow to the issuer, which will not only lead to the complete termination of the business, but also cause irreparable damage to its reputation and future development.

In summary, the four penalties constitute a multi-level penalty system for violations under the MiCA Act. Regulatory agencies can choose appropriate punishment measures based on the specific circumstances of the violation, or combine multiple measures to achieve the best regulatory effect. Of course, the four listed above are not a complete list. The MiCA Act imposes penalties on information disclosure and for Web3 practitioners. Understanding these penalties will help to better understand the compliance requirements of the MiCA Act and take necessary measures to avoid Violations occur.

Continuing Compliance: What’s Next for the MiCA Act

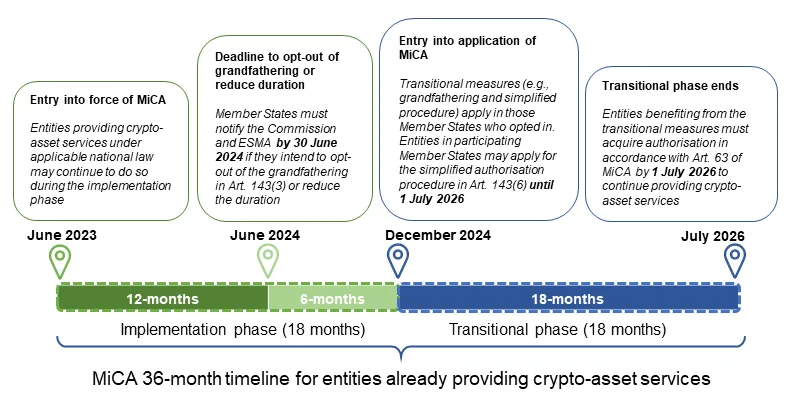

For virtual asset service providers (VASPs), the MiCA Act reserves a grace period for practitioners who have registered before it takes effect to transition to the time limit specified in the MiCA Act. Each country is different. Taking Poland as an example, if a company belongs to an already registered VASP (old license), it will be allowed to provide services under a VASP license during the grace period until June 30, 2025 (estimated date).

However, for virtual asset service providers who have never applied for a VASP license, they must apply for a CASP license before starting operations.

Regardless of the length of the grace period stipulated by EU countries, the MiCA Act currently stipulates that all crypto asset service providers (CASP) must complete their license applications before July 2026 .

Of course, the MiCA Act is not static. The regulatory agency will submit a publicly released report to the European Parliament and the Council every year based on market changes and the actual application of the Act, reporting on the revision of regulations and the direction of changes in regulations. At that time, Mankiw lawyers will continue to follow up and provide Web3 practitioners with the latest and most comprehensive compliance guidelines for major encryption regions around the world.

▲Picture source ESMA

Mankiw Lawyer Summary

While MiCA introduces strict regulatory standards, it also creates opportunities for companies to expand into the European market and gain competitive advantages. By proactively meeting compliance requirements, in the short term, Web3 practitioners can obtain official endorsements and seize opportunities ; in the long term , a more transparent and standardized business environment will also be conducive to the sustainable development of the project.

Mankiw Law Firm has rich practical experience and deep professional knowledge in the field of Web3, especially in crypto-asset compliance, international business expansion and cross-border legal support. We will not only continue to pay attention to the implementation progress of the MiCA Act, but also regularly release in-depth compliance interpretations and practical guidance based on industry trends and customer needs to help customers grasp the latest policy changes.

By closely combining industry trends and legal expertise, Mankiw lawyers are committed to designing customized compliance solutions for clients, helping clients to effectively respond to regulatory challenges, seize market opportunities, and ultimately take the lead in the rapidly developing crypto asset market. machine. Whether you are a crypto asset service provider, a token issuer, or other Web3 practitioners planning to launch global business, we can provide you with comprehensive support from business layout to risk prevention and control to help your business in the EU and achieved rapid development globally.

jinse

jinse

chaincatcher

chaincatcher