What huge negative impacts will TRUMP currency bring?

Reprinted from jinse

01/22/2025·3MAuthor: Stacy Muur, Web3 researcher; Translated by: Golden Finance xiaozou

1. TRUMP and MELANIA timeline

The TRUMP narrative began even before its contract was deployed to Solana, with Trump issuing a tweet confirming his association with the meme coin.

If we were to list a timeline of major events in TRUMP and MELANIA, it would probably look like this:

-

December 21, 2024: The domain name gettrumpmemes.com was purchased .

-

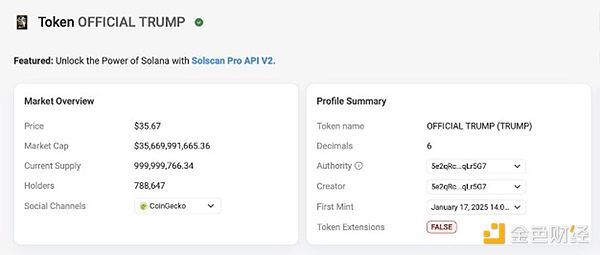

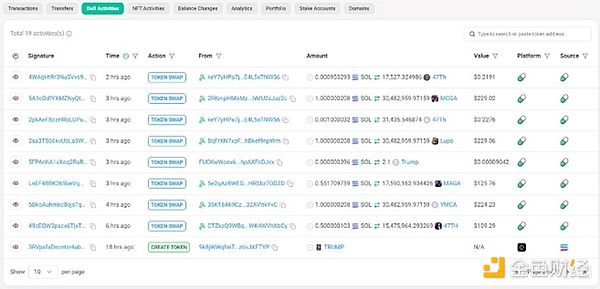

January 17, 2025: First minting of coins .

-

January 18, 2025: A DEX trading pair was created around 2 a.m. UTC time.

-

45 minutes later, Donald Trump issued an official tweet .

-

On the same day, the domain name melaniameme.com was purchased.

-

January 19, 2025: At 11:30 AM UTC, TRUMP reached an all-time high price of $76.

-

Ten hours later, the MELANIA DEX trading pair was released, triggering a massive sell-off from TRUMP holders.

-

40 minutes later, Melania Trump posted proof of ownership of her meme coin .

-

January 20, 2025: MELANIA reaches an all-time high price of $13.6.

In this area, there are some interesting patterns to watch:

-

The launch of TRUMP has been planned for a long time .

-

The release of MELANIA was spontaneous , and its domain name was purchased after the successful release of TRUMP.

-

Neither meme coin ownership proof is released immediately after the trading pair is created .

I don't want to delve too deeply into insider trading. They are just meme coins and reflect everything in this industry.

In theory, TRUMP's launch could have something to do with culture, while MELANIA appears to be primarily a money-making machine.

2. Expected and unexpected negative impacts

Bitcoin drains liquidity from the broader crypto market, reaching all-time highs, solidifying the "Ethereum for storing money, Solana for trading" view, and loosening regulations - all in the early days of the Trump meme coin craze The topic has been discussed in depth in many insightful articles. I intend to avoid repeating what others have already discussed.

I want to highlight here some of the less obvious potential negative impacts of the Trump meme coin, which for the most part have no solutions.

The legality of meme coins

If the President of the United States can officially release a meme coin that drops 45% on a 15-minute candlestick chart, anyone can do it.

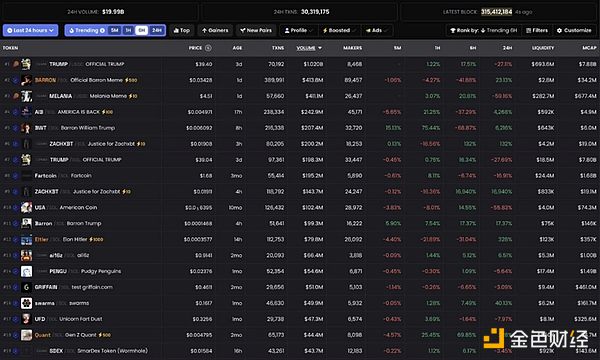

Prior to the release of TRUMP, several celebrity meme coins had been released, and the prices of most of them slowly dropped to zero. Many believe that one day the Wild West of DEXScreener will come to an end as the SEC finally focuses on the unregulated meme coin market, which is rife with scams and insider trading and where the only guaranteed winners are the developers .

Trump set a legal precedent: Anyone can secretly release a meme coin, then announce their meme coin 40 minutes later and enjoy the process.

This historic move could have several huge negative impacts:

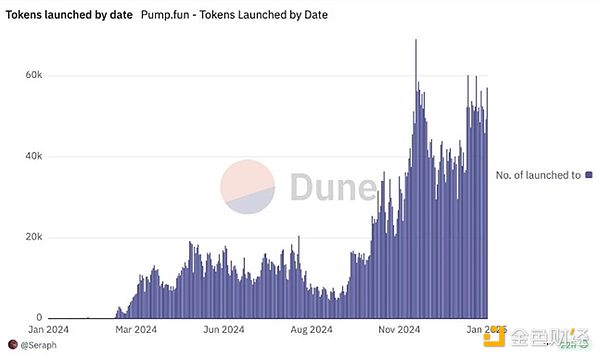

(1) There will be a new wave of meme currency craze , and celebrities, politicians and even companies will join this trend. The only rule? Disclaimer: “X tokens are intended to express support for and participation in the ideals and beliefs embodied by Y.” Therefore, the rich will get richer and the poor will get poorer – this is a common aspect of meme coin trading law.

(2) The number of Meme coins issued will increase exponentially . Many of my friends in the Web2 field are asking me whether we should all issue a meme coin. For me, the answer is always "no" - I'm not willing to risk my reputation for money.

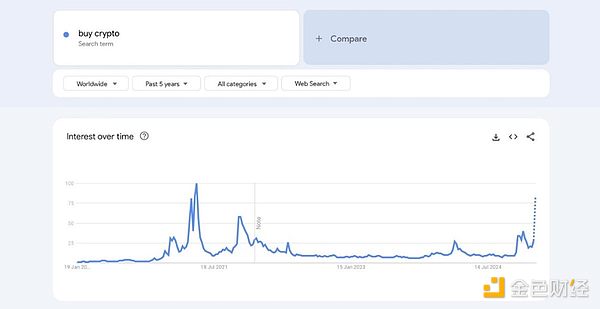

(3) The first step in attracting new users will be meme coins with Wild West rules; without previous experience to draw from, their chances of persisting are slim. In their view, all cryptocurrencies will be meme coins and in 90% of cases the experience will be negative.

(4) After several years of lax policies towards the cryptocurrency industry, there will be over-regulation to minimize fraud and “protect American citizens from crypto wolves.”

(5) Typical Web3 narratives —such as infrastructure, DeFi, and DePIN— will receive less and less attention . Over the past few years, the lack of altcoin popularity and the popularity of “low circulation and high FDV” issuances have created extremely challenging conditions for attracting capital and users. This problem is expected to get worse over time. Teams will need to prioritize a typical product revenue model that does not require tokens to sustain.

Is this the global cryptocurrency adoption path we’ve been eagerly anticipating?

This is a big problem.

But adoption is certain.

chaincatcher

chaincatcher

panewslab

panewslab