What made SOL fall 17% in five days?

Reprinted from jinse

02/19/2025·2MAuthor: Marcel Pechman, CoinTelegraph; Translated by: Tao Zhu, Golden Finance

Solana's native token SOL fell 17% between February 14 and February 18 and is currently trading at nearly $164. The decline coincides with the launch of Libra memecoin, with Argentina President Javier Milei also involved. Libra's price plummeted 83% after early investors sold their tokens.

However, it is too simplistic to blame memecoin 's gouging and selling-offs by $18 billion, especially given that Solana's decentralized finance (DeFi) application has already seen transaction volumes before major tokens are unlocked and Deposits are falling. In addition, memecoin roughly follows SOL 's price trend, weakening the claim that the industry is the main driver.

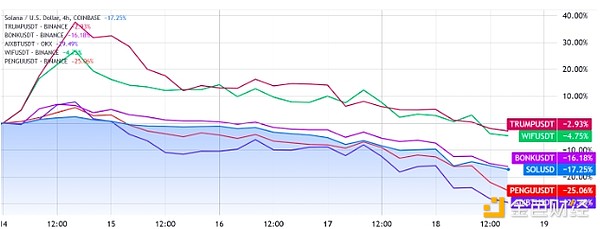

4 hour price for SOL/USD with Solana memecoins. Source: TradingView / Cointelegraph

While memecoin is not the direct cause of the decline in SOL prices, traders’ interest in decentralized exchanges and new project releases has declined. Reduced participants and reduced on-chain activity negatively impact SOL's price, as the demand for its native cryptocurrency is driven by the use of decentralized applications (DApps).

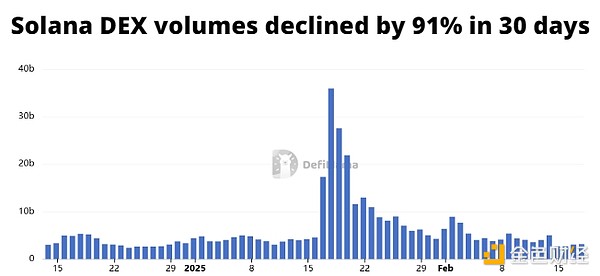

Daily DEX volume (USD) on Solana. Source: DefiLlama

After reaching a peak daily trading volume of $35.5 billion on January 17, Solana's on-chain trading volume dropped sharply to $3.1 billion on February 17. The surge was initially driven by hype about Trump’s official (TRUMP) memecoin, which has a market cap of $15 billion after U.S. President Donald Trump publicly supported it.

While Solana's DEX volume fell 20% per week, some competitors saw different results. For example, BNB Chain has risen 35% in the past week, surpassing Solana to become a market leader. Key contributors include Thena, which doubled its trading volume, Uniswap, which grew 61%, and DODO, which soared 53% between February 10 and February 17.

Solana TVL fell 19% in the two weeks before mass SOL unlock

Deposits on Solana’s decentralized apps (DApps) also underperformed their competitors by total lock-in value (TVL). It is worth noting that this indicator has nothing to do with memecoin trading and token issuance, because liquid staking, perpetual contracts and income platforms dominate the composition of TVL.

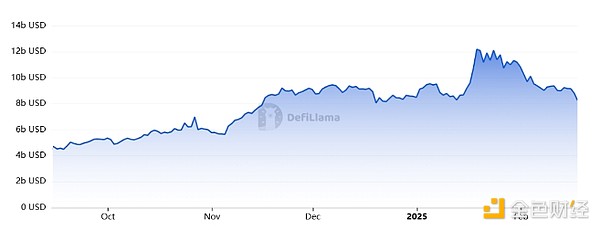

Solana Network Total Locked Value (TVL), USD. Source: DefiLlama

Deposits on Solana DApp fell 19% in two weeks, mainly due to net outflows from Jito, Kamino, Marinade Finance and Sanctum. During this period, only a few projects were able to increase their total locked value (TVL), such as liquidity-providing applications Meteora and Cross-margin Perpetual Futures DEX Drift.

By comparison, Ethereum’s TVL fell 2% during the same period, while BNB Chain grew 8%. Outstanding performances on BNB Chain include the lending platform Venus and the re-staking platform Kernel. If the launch of Libra memecoin is the main reason for the recent underperformance of SOL, one would expect the event to have a greater impact on Solana 's on-chain metrics. However, this is not the case.

Another reason SOL holders are concerned about is the massive unlocking plans for the first quarter of 2025. It is reported that more than 15 million SOLs (valued over US$2.5 billion) are expected to enter circulation supply during this period. While this incident is not surprising to investors, it is 12 times the number of unlocked SOLs in the last quarter.

Ultimately, SOL 's poor performance can be attributed to a decline in on- chain trading activity and a decline in DApps TVL, a trend that has already emerged within weeks before the launch of Libra memecoin on February 14.

Additionally, the looming large number of SOL unlocks fuel the FUD needed to create bearish sentiment, pushing the price of SOL to its lowest level since November 2024.

panewslab

panewslab

chaincatcher

chaincatcher