Why do you keep losing money when buying memes? A comprehensive analysis of the inside story of meme market trading

Reprinted from panewslab

01/07/2025·2MHave you ever encountered the meme of chasing prices and then returning to zero, and cutting off the meat and then taking off? How does the banker operate? Is there any inside information on the addresses of the Top 100 positions? How to operate to avoid being cut off by the dealer? This article will provide an in-depth analysis of banker addresses and transaction data through several types of coins.

What is the main purpose of trading?

Before analyzing trading techniques, we must first clarify what is the main purpose of pulling and smashing? The purpose of the dealer's pull is to prevent low-priced chips from falling into the hands of others, and to sell them at a higher price to obtain higher profits. There are several purposes of smashing. One is to wash away other low-priced chips and Collect the low-priced chips yourself and harvest the high-priced chips to ship quickly. The second is to simply "I'm done with it!" Take the money and run away.

Since this is the purpose, the rise must be extremely fast. How can we pull the market extremely quickly? Only large purchases can achieve rapid rise. Therefore, when pulling orders, there must be one or more unified addresses making relatively large purchases. If you see two addresses that are buying at least more than a thousand dollars and keep buying, this is called pulling. Therefore, when looking for the banker's address, you can filter the purchase order records larger than 1K dollars and go one by one. If the main transaction token of the address is this, you can know which address is the banker's pull address.

Similarly, how can the banker collect the initial bottom chips? It must be a quick sniper attack at the very beginning and the lowest point to remove most of the chips. So if you look at the earliest transaction records and read them one by one, you can basically see all the actions of the dealer in collecting the bottom chips.

Several types of Meme

After we know the main purpose of meme's pulling and smashing, we can distinguish different memes based on the dealer's thinking.

a wave of flow

It can be said that 90% of memes on the market fall into this category. The current market is different from a year ago. Due to the launch of Pump, issuing coins does not require high time and money costs. You only need to fill in the name of the coin, official website, Twitter, and pay 0.02sol, and you can issue it. Therefore, most people who issue coins just want to ride the popularity and get a feel for the market. In Pump, more than 10,000 tokens can be issued in a day. It is impossible to have the amount of funds to support each token to rise several times. So most memes will be a wave.

Just like the token "Birds" below, in less than 25 minutes after it was issued, its market value went from 2.2m to 100k. Until recently, the coin has never fluctuated.

DEV runs away, banker enters

Meme is an emotional market, and a good narrative is one of the essential conditions for 100x coins. When there is a wave of DEV cashing out, some bookmakers will secretly ambush, absorb these tokens with low chips, and then send out some good news to revitalize the tokens.

Just like this token, DEV left the market at the highest point. The market value of the token dropped from 2.4m to a minimum of 260k. During this period, the bookmaker continued to attract funds, established a CTO community, and continued to launch activities on Twitter, and finally the currency Revitalize.

Of course, don’t forget that the banker will activate a certain token in order to make money, so the token will definitely have the risk of being smashed. Just like the BOGGS and DEV in the picture below, they ran away on the first day. After a few days, the banker took over. We started to build a CTO community and raised it to a market capitalization of 4 million within a week, but then it suddenly crashed and ran away a week later.

DEV is the banker

Most of these coins are issued by big institutions or big Vs. They create their own tokens and play with them themselves. Just like PRO and ANTI, which have been popular on the Desci circuit all over the Internet, DEV does not ship goods by itself, but relies on work, narrative, and funds. Pull the plate.

Banker’s trading techniques

Now that we have a basic idea of the types of memes, we can look at the dealer's trading techniques.

A wave of trading techniques

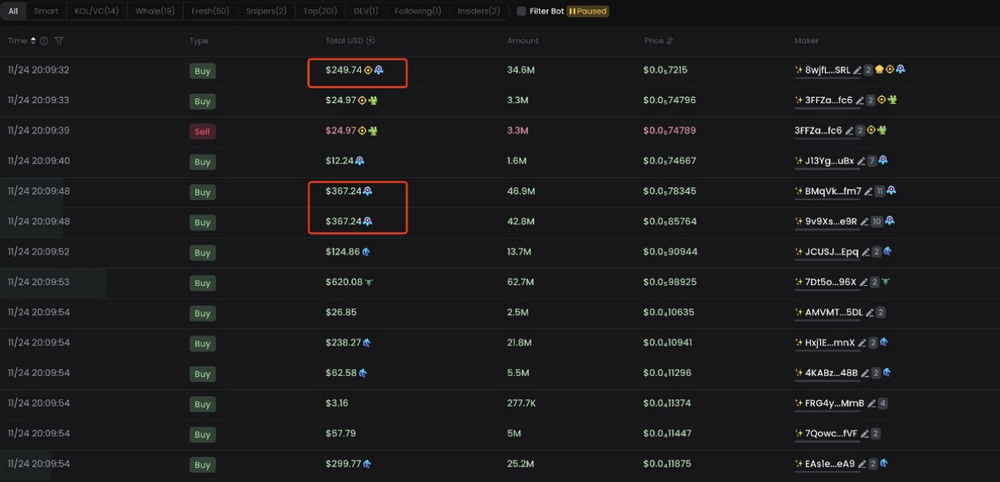

First, let’s take a look at Yiboliu’s trading techniques. Let’s take BOGGS as an example. In BOGGS, we can see that the dealer will sniper buy the token when the market opens. Some time after the coin was issued, two more addresses bought the coin at the same time, and the purchase value was both 367.24$.

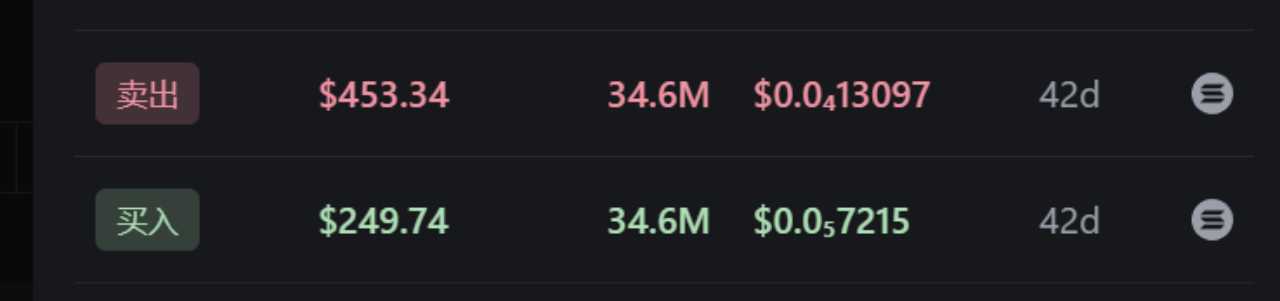

Following up on these addresses, we will find that the sniper purchase is the DEV address. When we check the DEV address, we find that it has only one buy and sell.

But when we focus on the following two addresses, we will find that these are the real addresses of the bankers. They buy as soon as possible after the opening and continue to buy and sell. They continue to accumulate funds at low points and at high points. Then he kept selling, and finally made a profit of 3000$.

At this time, we will find that DEV only made 200$ on the surface, but actually made 3000$.

At this time, if you use our meme-catcher analysis tool to analyze it, you will find that the three addresses are extremely related.

DEV trading techniques and secondary climb

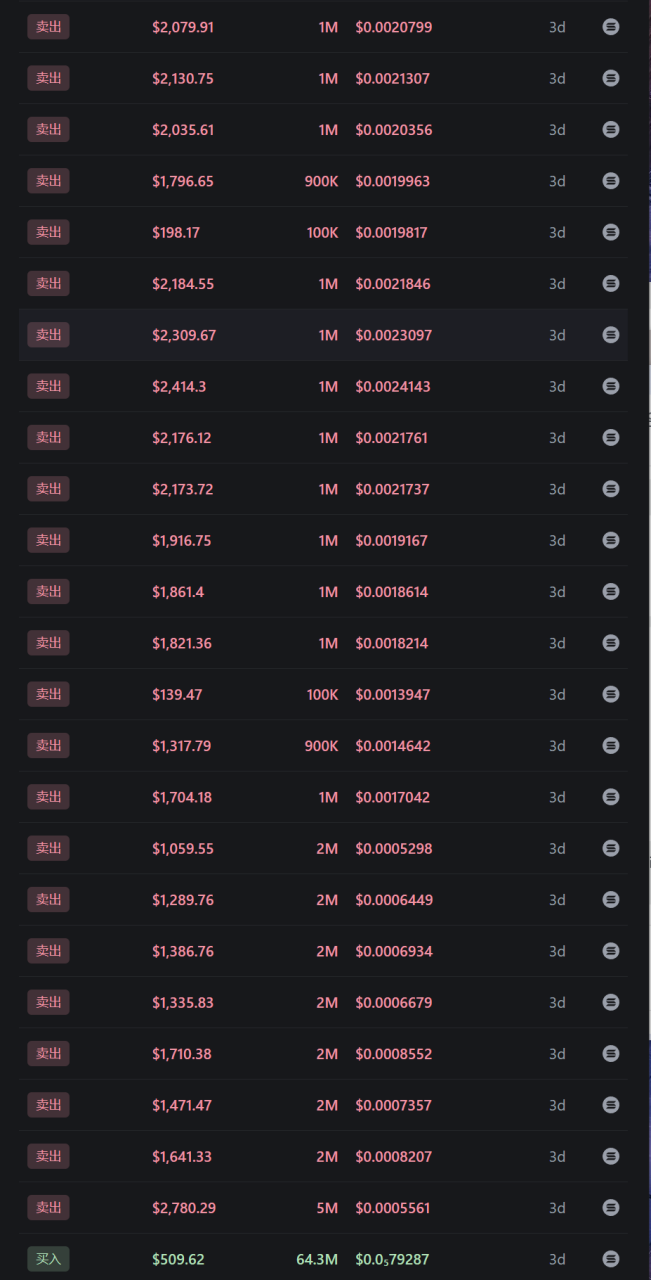

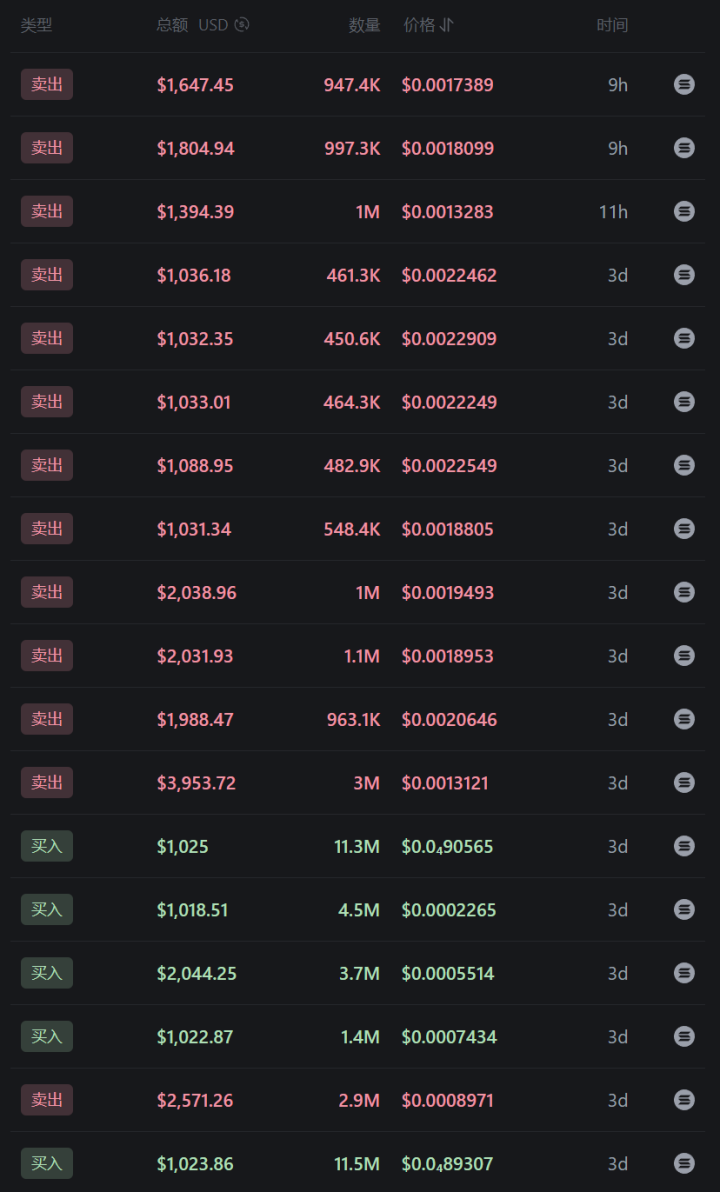

Let’s take qAI as an example for the second rise. On the surface, qAI’s DEV has not moved at all, but in fact it is fully operational. When we look at the traders with the top profits, we can easily find that the dealer's trumpet has been constantly shipping goods, from the first pull to the second pull.

And when the market hit the bottom for the first time, another address appeared. It kept buying when it made the bottom, and kept shipping when it reached a market value of 2m.

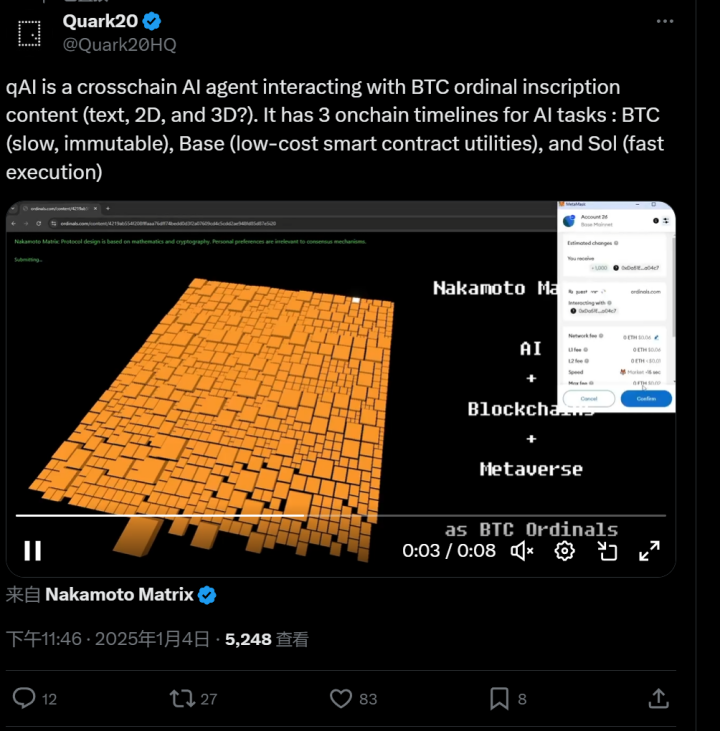

We can see that the market makers continued to build bottoms before 1.3 days, and on 1.4 days, qAI released a video roughly describing qAI's vision, so qAI stopped falling and began to rise slowly on 1.4 days. And the market was launched in the early morning of January 6th.

During the pull period, qAI's bookmakers also continued to ship, and finally the market value stabilized at around 1m from the peak of 2.3m.

It can be seen that the dealer's trading is not only to buy low and sell high, but also to trade in conjunction with the information. Release good news to attract funds.

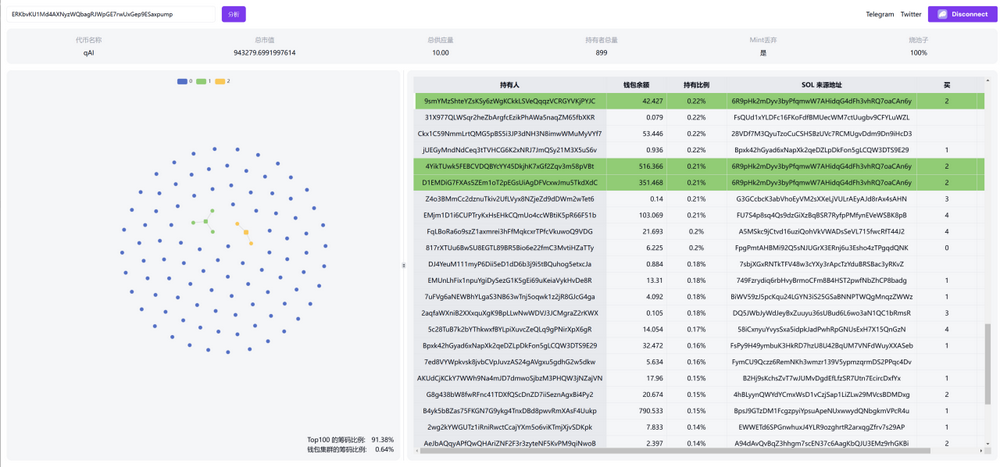

Through the meme-catcher analysis tool, we found that the associated addresses were 3 and 2 respectively, and the top100 accounted for 91.38%. It can be seen how terrifying the banker's fund-raising is.

at last

In the meme market, one thing needs to be remembered. Meme is always an emotional market. When emotions break out, it is very easy to chase the rise, but when panic occurs, it is easy to cut the meat. Bankers are anti-human. They will continue to ship at high points and accumulate funds at low points. When the chips are sufficient, the dealer will release favorable news and attract funds to enter the market with a new address. Finally, it will continue to repeat the process of selling high and buying low, and finally achieve considerable profits.

jinse

jinse

chaincatcher

chaincatcher