Will Bitcoin Price Plunge Again?

Reprinted from panewslab

01/09/2025·1M

Original text: Biraajmaan Tamuly , Cointelegraph

Compiled by: Yuliya, PANews

Bitcoin (BTC) prices fell again on January 8, forming a bearish engulfing candlestick pattern on the daily chart. This intraday drop is BTC’s second largest drop in the past 19 weeks.

Amid uncertainty surrounding market dynamics, Bitcoin traders and commentators offered their insights on a potential correction below $90,000.

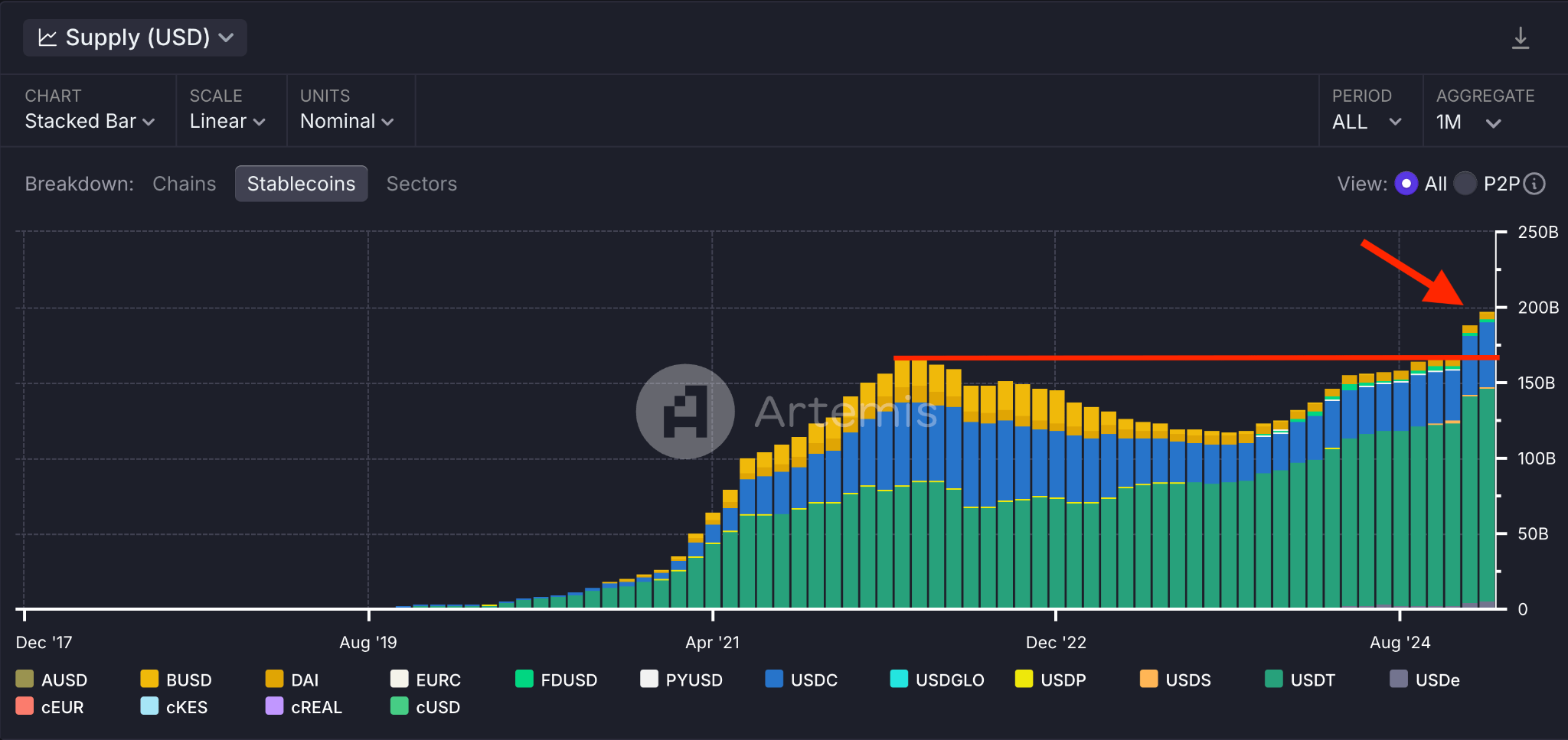

Stablecoin supply enters "price discovery" phase

Data from the U.S. Bureau of Labor Statistics showed that job creation reached 8.1 million at the end of November, higher than the 7.74 million expected. This data showed that the U.S. economy was improving, causing the stock and cryptocurrency markets to weaken, and Bitcoin subsequently flashed from $102,760 to $92,500.

While this development sparked broader bearish expectations, cryptocurrency analyst Miles Deutcher noted that stablecoin supply has entered a "price discovery" phase, meaning there is more liquidity available in the current crypto ecosystem. The increase in the supply of stablecoins indicates that there may be more inflows in the coming months.

Market analyst Jamie Coutts also holds a similar view, believing that more liquidity will pour in, which may lead to higher BTC prices in six months. Based on the strength of the U.S. dollar, Coutts said that Bitcoin could have fallen to $80,000, but the underlying strength of buying in the BTC market indicates that market expectations are still high.

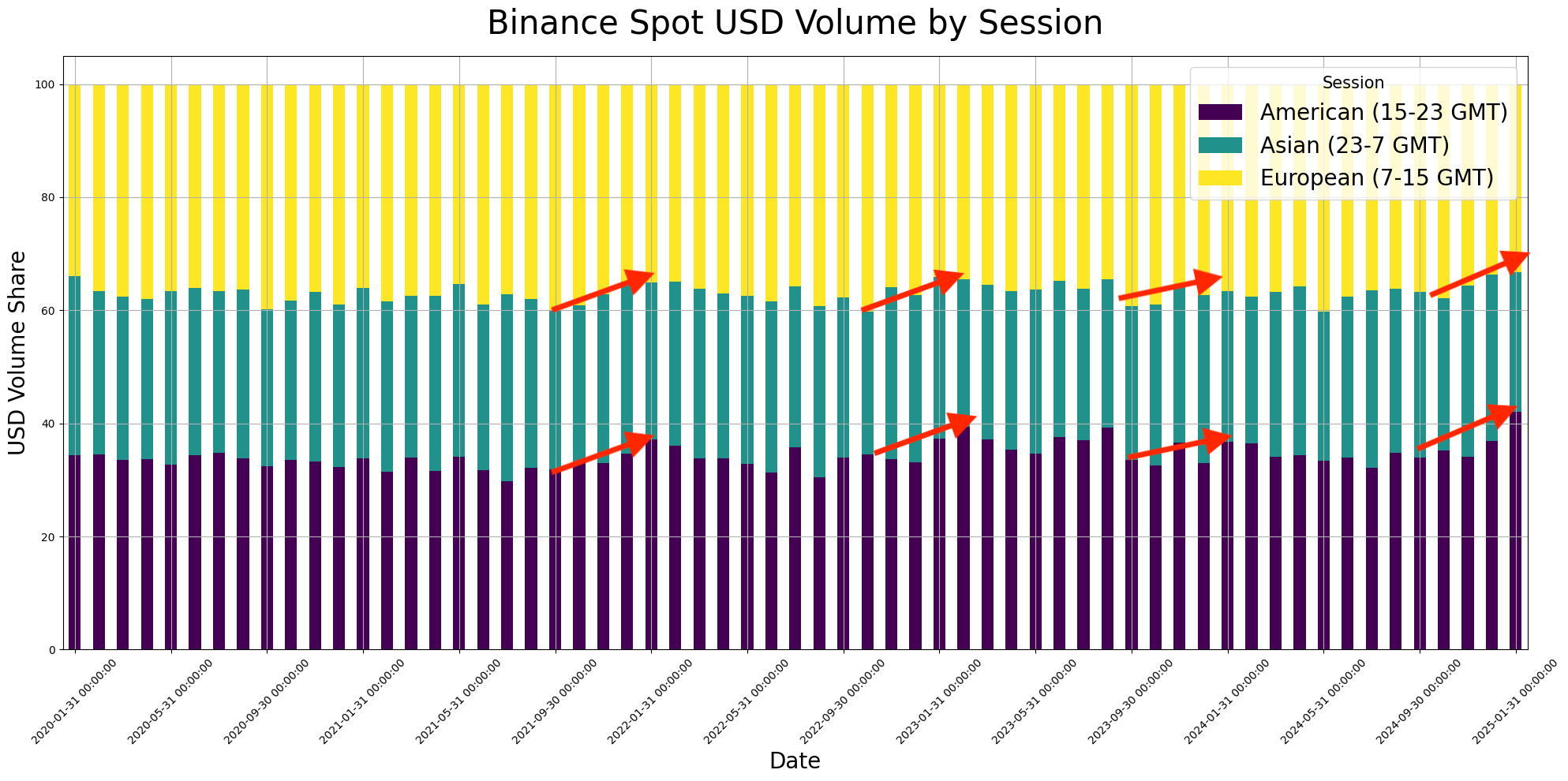

The current bull market has shown more liquidity than previous bull markets. Data analyst Roman Zinovyev recently highlighted that USD trading volume on the Binance spot market has gradually increased since 2020. As shown in the chart, the Americas market share reached an all-time high of 42% during 2024-2025.

Does on-chain data predict a Bitcoin rebound?

Strong on-chain development does not negate the fact that Bitcoin’s 5.15% drop wiped out the previous four days’ gains. The probability of an immediate rebound after a drop of greater than or equal to 5% is not optimistic either.

As the chart shows, Bitcoin has experienced 15 pullbacks of 5% or higher since January 2024. Among these 15 times, BTC only rebounded immediately three times, which is only a 20% probability. Therefore, from a probability perspective, it is unlikely that BTC will see a strong rise immediately.

Cryptocurrency trader Krillin mentioned that Bitcoin could accumulate between $92,000 and $90,000 in January before seeing a market rally in the coming month.

Cryptocurrency and stock investor Jelle echoed similar sentiments after market buying failed to keep BTC above $100,000. The investor expects lows near $90,000 to be hit and says: "Go back to the original plan; wait for the lows to be hit before making new highs."

If the daily close falls below $90,000, a deeper Bitcoin plunge could occur. Such levels would confirm an inverse head and shoulders pattern, which could have serious consequences. For example, BTC could drop a further 20% with a price target of $71,500.

jinse

jinse