Will Trump's trade war end the Bitcoin bull market ahead of schedule?

Reprinted from jinse

02/05/2025·2MAuthor: Marie Poteriaiev, CoinTelegraph; Translated by: Wuzhu, Golden Finance

On February 3, Bitcoin fell below $92,000, shocking the cryptocurrency market and triggering liquidation of up to $2.1 billion. Initially, investors seemed prepared for the economic hardships brought about by U.S. President Donald Trump’s announcement of the tariff war. However, concerns soon shifted to whether Bitcoin has peaked and is about to enter a downward trend.

Even more worrying, Bitcoin Archive noted that every BTC bull market in the past has peaked within 330 days after breaking the all-time highs of the previous cycle. February 4 is the 328th day.

However, Bitcoin rebounded quickly after falling. The announcement of a suspension of tariffs on Mexico and Canada on February 3, and President Trump's cryptocurrency Tsar David Sacks, is scheduled to speak on February 4, seems to reassure the market.

This raises the question: whether the market rebounds too quickly. Macroeconomic and geopolitical challenges remain, which poses risks for Bitcoin traders to fall into a bull trap.

Bitcoin demand remains strong

As the tariff war panic suggests, Bitcoin demand remains strong, with continued absorption pullbacks—even at all-time highs of over $90,000.

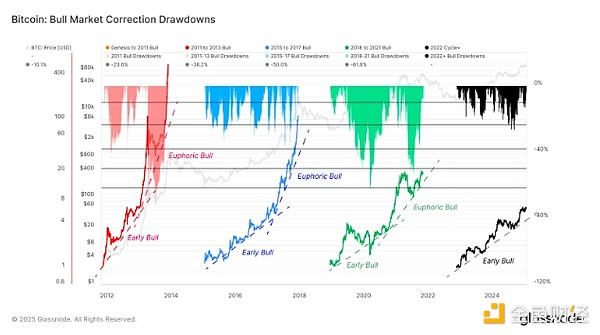

Glassnode's analysis of the bull market decline in Bitcoin shows that demand for BTC may rise, which may trigger a "second rising phase" in the market. Historical data shows that over the past three cycles (2011-2015, 2015-2018 and 2018-2022), the correction averaged about 25%, followed by accelerating price performance during the last third of the bull market. The current bull market has not yet experienced such acceleration.

Bitcoin bull market corrected the retracement. Source: Glassnode

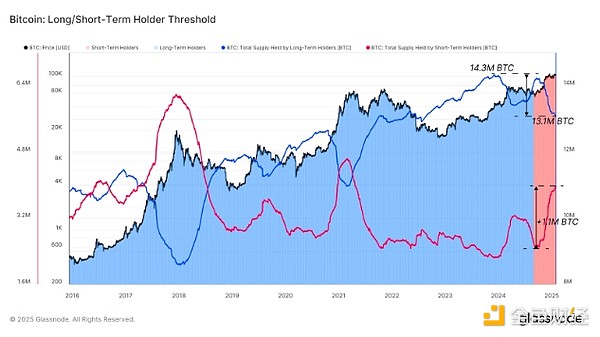

On the supply side, a key indicator that needs attention is the long- term/short-term holder threshold. It tracks capital rotations from long-term investors to new buyers, giving a clearer picture of supply dynamics.

The peak of Bitcoin cycles is usually consistent with the time when long- term holders take profits and sell their tokens to new buyers. Glassnode data shows that this is not the case at present. Although long-term holders have transferred more than 1 million BTC to new buyers since November, they still hold a considerable share of supply, indicating their confidence in future price increases.

Bitcoin long and short term holders threshold. Source: Glassnode

How high will Bitcoin rise in 2025?

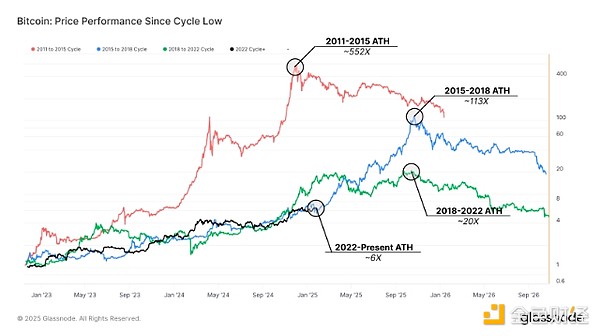

Other data from Glassnode show that the 2022-2025 annual cycle is very similar to the 2015-2018 annual cycle so far. However, the possibility of complete repetition is unlikely. In 2017, Bitcoin’s all-time highs allowed its price to grow 113 times, while the next peak brought 20 times the return. As Bitcoin matures, growth rates are declining in each cycle, and increasing capital inflows are needed to maintain new price levels.

So far, BTC has risen 6 times from its December 2023 cycle low of $16,000, indicating an expected multiplier of between 10 and 13 times. This means the peak is between $160,000 and $210,000 – a target range that is consistent with the predictions of many analysts. Matthew Sigel, head of digital assets research at VanEck, expects the price of Bitcoin to reach $180,000, while Bitwise Asset Management and Bernstein expect the price of Bitcoin to reach $200,000. Tom Lee, a CNBC contributor and managing partner at Fundstrat, predicts that the price of Bitcoin will reach $250,000.

Bitcoin price performance since the cycle lows. Source: Glassnode

When will Bitcoin peak?

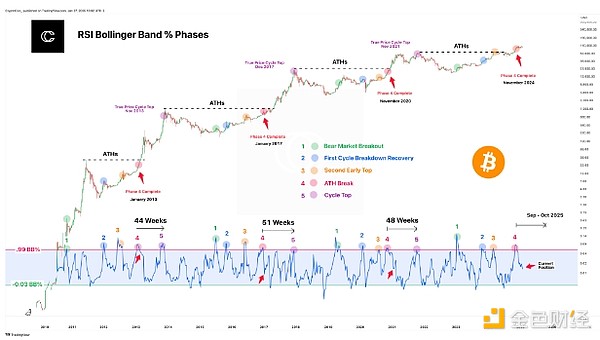

Technical analyst CryptoCon believes that Bitcoin’s relative strength index is quite accurate in determining the cycle phase. RSI is a momentum oscillator used to measure the speed and amplitude of price movements, helping to identify overbought and oversold conditions of assets.

By analyzing the RSI approaching the 99% threshold, CryptoCon identified critical cycle phases. Their data show that Bitcoin entered its fourth cycle phase last November, suggesting that the market may peak around September to October 2025.

RSI Bollinger Band % stage. Source: CryptoCon_ /X

RSI Bollinger Band % stage. Source: CryptoCon_ /X

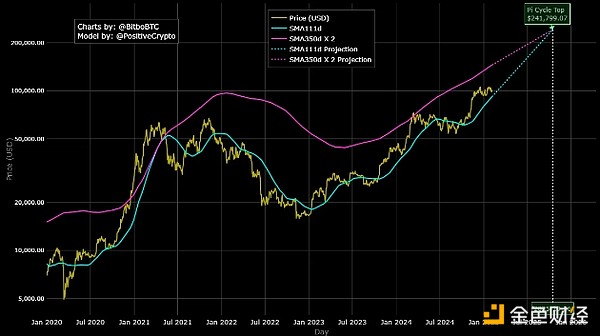

Another indicator of identifying the top of the market with historical accuracy is the top of the Pi cycle. This indicator tracks multiples of the 111-day moving average (111DMA) and the 350-day moving average (350DMA x 2). In the previous cycle, when 111DMA exceeds 350DMA x 2, the price of Bitcoin peaks.

Based on the Bitcoin Pi cycle top forecast, which infers these moving averages to estimate the next peak, Bitcoin is expected to peak around September 26.

Bitcoin Pi cycle top forecast. Source: Bitbo, PositiveCrypto

While no indicator is perfect, the market’s resilience and ongoing demand suggest that the real top may still be ahead.

panewslab

panewslab

chaincatcher

chaincatcher