a16z: What kind of Bitcoin strategic reserves should the United States implement?

Reprinted from jinse

02/05/2025·2MSource: [a16z crypto editorial "Make the United States a cryptocurrency capital: What to do"](https://a16zcrypto.com/posts/article/us-crypto-capital- policy/#section--7)

Author: Christian Catalini , co-founder of Lightspark and MIT Crypto Economic Lab

Compiled: 0xjs@Golden Finance

The United States benefits from what economists call "overprivileges." As the issuing country of the world's reserve currency, it can borrow its own currency and support new expenditures. However, that doesn't mean it can simply print money – U.S. Treasuries still have to attract buyers in the open market. Fortunately, U.S. debt is widely regarded as the safest asset in the world, ensuring strong demand, especially during a crisis period where investors rush to find safe assets.

Who profits from such excessive privileges? First are the U.S. decision makers who gain additional flexibility in fiscal and monetary decision-making. Next is banks – they are at the center of global financial flows, collect fees and make an impact. But who is the real winner? American companies and multinational corporations, who are able to conduct most of their business in their own currencies and can issue bonds and borrow more cheaply than foreign competitors. Let’s not forget consumers who enjoy stronger purchasing power, lower borrowing costs, and more affordable mortgages and loans.

How about it? The United States can borrow at a lower cost, maintain a larger deficit for longer, and bear the economic shock that could paralyze other countries. However, this excessive privilege is not inevitable - it must be achieved through hard work. It depends on the economic, financial and geopolitical strength of the United States. Ultimately, the entire system depends on one key factor: trust. Trust the institutions, governance and military of the United States . Most importantly, believing that the US dollar will remain the safest place to save globally in the end.

All of this has a direct impact on the Trump administration’s proposed Bitcoin reserve plan. Supporters are not wrong about the long-term strategic role of Bitcoin – they are just too early . Today, the real opportunity lies not simply hoarding Bitcoin; it lies in intentionally shaping the integration of Bitcoin with the global financial system to strengthen rather than undermine the U.S. economic leadership . This means using dollar stablecoins and Bitcoin to ensure that the next era of financial infrastructure is the era led by the United States – not the era of passive responses in the United States.

Before discussing this issue, let us first analyze the role of reserve currencies and their control over the country.

The rise and fall of reserve currencies

History is clear: reserve currencies belong to world economic and geopolitical leaders—until they are no longer leading. At its peak, the dominant country decides the rules of trade, finance and military power, providing global credibility and trust for its currencies. From the Portuguese real in the 15th century to the US dollar in the 20th century, reserve currency issuing countries have shaped markets and institutions that other countries follow.

But no currency can hold the throne forever. Over-expansion—whether through war, expensive expansion or unsustainable social commitments—will eventually undermine credibility. Spain's real was once backed by a large reserve of silver in Latin America, but as Spain's growing debt and economic mismanagement weakened its dominance, the real also depreciated. The Dutch guil also depreciated as the ruthless war exhausted the Netherlands' resources. The French franc dominated the eighteenth and early nineteenth centuries but depreciated under pressure from revolution, Napoleonic wars and mismanagement of financial management. And the pound, once the cornerstone of global finance, collapsed under the weight of post-war debt and the rise of US industrial dominance.

The lesson is simple: economic and military strength can create reserve currencies, but financial stability and institutional leadership are the fundamentals for maintaining reserve currencies. Losing this foundation, the privilege disappears.

Is the era of dollar rule coming to an end?

The answer to this question depends on where you start the timing. The US dollar consolidated its position as the world’s reserve currency through the Bretton Woods Agreement before and after World War II, even earlier, as the United States became the world’s major creditor after World War I. In any case, the dollar has occupied the dominant position for more than 80 years. From the perspective of historical standards, this is a long process, but it is not unprecedented -the pound occupies a dominant position for about a century before the decline.

Today, some people think that peace under the rule of the United States is disintegrated. China's rapid development in artificial intelligence, robotics, electric vehicles and advanced manufacturing foreshadows the transfer of power. In addition, China also holds significant control over the key minerals necessary to shape our future. Other warning signals are also appearing. Marc Andreessen calls DeepSeek's R1 launch an AI Sputnik moment in the United States—a reminder that the U.S. leadership in emerging technologies is no longer guaranteed. Meanwhile, China’s expanding military presence in the air, maritime and cyberspace, as well as its growing economic influence, raises an urgent question: Is the dominance of the dollar under threat ?

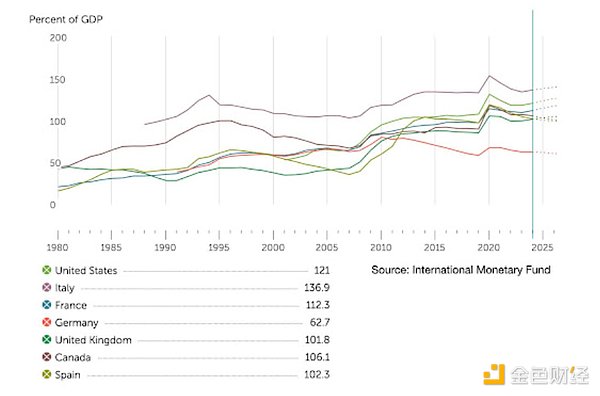

Debt as a percentage of GDP. Source: International Monetary Fund

Short answer: Not yet. Despite rising debt and false propaganda predicts that the United States is about to collapse, the United States is not on the verge of fiscal crisis. Yes, the debt-to-GDP ratio is high, especially after the pandemic spending, but it remains consistent with other major economies. More importantly, global trade remains primarily based on the US dollar. The RMB is closing the gap with the euro in some international settlements, but is far from replacing the US dollar.

The real question is not whether the dollar will collapse. It hasn 't collapsed yet. Real concerns are whether the United States can maintain its leading position in innovation and economic strength. If trust in U.S. institutions declines, or the U.S. loses its competitive advantage in key industries, the cracks in the dominance of the dollar may begin to emerge. Those who short the dollar are not just market speculators—they are also geopolitical rivals to the United States.

This does not mean that fiscal discipline is irrelevant. It is extremely important. Reducing spending and increasing government efficiency through the Ministry of Government Efficiency (DOGE) or otherwise would be a welcome change. Streamlining outdated bureaucracy, clearing entrepreneurial barriers, promoting innovation and competition will not only reduce wasteful public spending; it will also strengthen the economy and consolidate the dollar's status.

Coupled with the U.S.’s continued breakthroughs in artificial intelligence, encryption, robotics, biotechnology and defense technology, this approach may reflect how the U.S. regulates and commercializes the Internet—drives a new round of economic growth and ensures that the U.S. remains The undisputed reserve currency in the world.

Can Bitcoin reserves consolidate U.S. financial leadership?

The following is a discussion of the idea of Bitcoin’s strategic reserves. Unlike traditional reserve assets, Bitcoin lacks historical support from state institutions and geopolitical forces. But that's the key. It represents a new paradigm: no state sponsors, no single point of failure, completely globalized, politically neutral. Bitcoin provides an alternative that is not bound by the traditional financial system.

While many people think of Bitcoin as a breakthrough in computer science, its true innovation is even more profound: it redefines the way economic activity is coordinated and the way value flows across borders. As a decentralized, trustless system (and only has an anonymous creator who has no control), the Bitcoin blockchain can act as a neutral universal ledger—a separate framework for recording global credit. and debit without relying on central banks, financial institutions, political alliances or other intermediaries. This is not only a technological advancement, but also a structural change in the way global finance works coordinatedly.

This neutrality makes Bitcoin uniquely resistant to debt crises and political entanglements that have historically disintegrated fiat currency. Unlike traditional monetary systems closely related to changes in national policies and geopolitical countries, Bitcoin is not controlled by any single government. This also makes it possible to become a common economic language among countries that would otherwise resist financial integration or completely reject a unified ledger system. For example, the United States and China are unlikely to trust each other’s payment channels — especially as financial sanctions become increasingly powerful tools for economic warfare.

So how will these fragmented systems interact? Bitcoin can act as a bridge: a global, trust-minimized settlement layer that connects originally competing economic fields. When this reality becomes a reality, it is undoubtedly meaningful for the United States to hold strategic Bitcoin reserves.

But we haven't done that yet. To move Bitcoin beyond investment assets, critical infrastructure must be developed to ensure scalability, a modern compliance framework, and seamless connection with fiat currencies for mainstream adoption.

There is nothing wrong with the supporters of Bitcoin reserves’ perception of its potential long-term strategic role. They just prematurely. Let's reveal the reasons.

Why should the country retain its strategic reserves?

The reason why countries reserve strategic reserves is simple: in a crisis, acquisition is more important than price. Oil is a classic example – while futures markets allow price hedging, when supply chains are interrupted by war, geopolitical or other disturbances, no financial project can replace physical reserves at hand.

The same logic applies to other essentials—gas, cereals, medical supplies, and increasingly important raw materials. As the world transforms into battery- driven technology, governments have begun stockpiling lithium, nickel, cobalt and manganese to cope with future shortages.

Then there is the currency. Countries with large amounts of foreign debt (usually denominated in US dollars) hold dollar reserves to promote debt rollout and prevent domestic currency crises. But the key difference is that no country currently bears a lot of debt with Bitcoin—at least not yet.

Bitcoin proponents believe that Bitcoin’s long-term price movements make it a clear reserve asset. If the United States is purchased and continued now, the investment value may be doubled. However, this method is more in line with the strategy of the sovereign wealth fund. The fund focuses on capital returns, rather than reserves that are vital to national security. It is more suitable for countries with rich resources but unbalanced economy, seeking asymmetric financial profits, or countries with weak central banks and hope that Bitcoin can stabilize its balance sheet.

So where will the United States go? The United States does not need Bitcoin to run its economy at this moment , and although President Trump recently announced the establishment of a sovereign wealth fund, cryptocurrency investment may still be left primarily to the private market for effective allocation. The most powerful reason for Bitcoin reserves is not economic needs, but strategic positioning. Holding reserves may indicate that the U.S. is determined to lead cryptocurrencies, establish a clear regulatory framework, and position itself as the global hub of DeFi, just as it has dominated traditional finance for decades. At this stage, however, the cost of this move may outweigh the benefits.

Why Bitcoin reserves may backfire

Apart from the logistical challenges of accumulating and securing Bitcoin reserves, the bigger problem is cognitive issues, and the cost can be high. In the worst case, this could indicate a lack of confidence in the U.S. government’s ability to sustain debt, a strategic mistake that handed over the victory to geopolitical rivals such as Russia and China, both countries that have long tried to weaken the dollar.

Not only is Russia pushing for de-dollarization abroad, its state-backed media have been pushing for years to comment on the stability of the dollar and predict the dollar will soon depreciate. Meanwhile, China has taken a more direct approach to expanding the coverage of the RMB and digital payment infrastructure—including through domestically focused digital RMB—to challenge the U.S.-led financial system, especially in cross-border trade and Payment field. In global finance, perception is important. Expectations not only reflect reality, but also help shape reality.

If the U.S. government begins hoarding Bitcoin on a large scale, the market may interpret it as a means of hedging the dollar. This view alone could trigger investors to sell the dollar or reconfigure capital, thus undermining the status the United States wants to protect. In the global finance field, belief drives behavior. If enough investors begin to doubt the stability of the dollar, their collective action will turn this doubt into reality.

U.S. monetary policy relies on the Federal Reserve's ability to manage interest rates and inflation. Holding Bitcoin reserves could send a contradictory message: If the government has confidence in its own economic tools, why store assets beyond the Fed 's control?

Can Bitcoin reserves alone trigger the dollar crisis? Very unlikely. But it may not strengthen the system, and in geopolitical and financial fields, unforced mistakes tend to come at the highest cost.

Lead by strategy rather than speculation

The best way to reduce debt to GDP ratio is not speculative, but fiscal discipline and economic growth. History shows that reserve currency will not exist forever, and those depreciated currencies are depreciated due to poor economic management and excessive expansion. To avoid following the footsteps of the Spanish real, Dutch guild, French Rift and British Pound, the United States must focus on sustainable economic strength rather than risky financial bets.

If Bitcoin becomes the global reserve currency, the United States will lose the most. The transition from US dollar dominance to a Bitcoin-based system has not been smooth sailing. Some people believe that Bitcoin appreciation can help the United States "pay" debt, but the reality is much crueler. This shift will make it more difficult for the United States to finance its debt and maintain its economic reach.

Although many people think that Bitcoin cannot be a true medium of transactions and accountancy units, history shows that this is not the case. Gold and silver are not only valuable because of scarcity, but are also divisible, durable, and portable, making them effective currencies—even without sovereign support or issuance, just like Bitcoin today. Similarly, early Chinese paper money was not a mediator of transactions mandated by the government. It evolved from commercial promissory notes and certificates of deposit (representing an already trustworthy store of value) before being widely accepted as a medium of transactions.

Fiatcoins are often seen as an exception to this model—when they are declared as fiatcoins by the government, they immediately become mediums of exchange and subsequently means of store of value. But this is too simplifying the reality. The reason why fiat currency has power is not only because of laws and regulations, but also because of the government's ability to force taxation and fulfill debt obligations through this power. Currency supported by countries with a strong tax base has an inherent demand, because enterprises and individuals need it to repay debt. This taxation right allows legal currency to maintain its value even without direct commodity support.

But even the fiat currency system was not established from scratch. Historically, their credibility was supported by commodities that people already trust, the most famous of which is gold. Paper money is recognized precisely because it was once exchanged for gold or silver. The transition to pure fiat currency will only become feasible after decades of reinforcement.

Bitcoin has also taken a similar trajectory. Today, it is mainly regarded as a means of store of value—highly volatile, but increasingly as digital gold. However, as the scope of adoption expands and the financial infrastructure matures, its role as a medium of exchange may follow. History shows that once an asset is widely recognized as a reliable means of store of value, the transition to an effective currency is a natural process.

This is a major challenge for the United States. Despite some policy leverage, Bitcoin’s operation is largely not subject to traditional control over currency by countries. If it becomes a global medium of transactions, the United States will face a grim reality—the reserve currency status will not be easily abandoned or shared.

This does not mean that the United States should crack down on or ignore Bitcoin – if it is really to be said, it should actively participate and shape its role in the financial system. But buying and holding Bitcoin just for appreciation is not the answer. The real opportunity is greater—but also more challenging: pushing Bitcoin into the global financial system to strengthen rather than undermine the U.S. economic leadership .

Bitcoin platform for the United States

Bitcoin is the most mature cryptocurrency with an unparalleled track record in security and decentralization. This makes it the most powerful candidate for mainstream adoption, first as a store of value and ultimately as a medium of exchange.

For many, Bitcoin’s appeal lies in its decentralization and scarcity—which are driving Bitcoin’s price rise as adoption increases. But this is just a narrow view. Although the value of Bitcoin will continue to increase with popularity, the real long-term opportunity for the United States lies not only in holding Bitcoin, but also in actively shaping Bitcoin into the global financial system and building itself as an international center for Bitcoin finance.

For all countries outside the United States, simply buying and holding Bitcoin is a completely feasible strategy - it can both accelerate the popularity of Bitcoin and gain room for financial upward. But the United States faces greater risks and must do more. It requires a different approach—not only to maintain its status as a world reserve currency issuer, but also to promote large-scale financial innovations “on the platform” of the US dollar.

The key precedent here is the Internet, which transforms the economy by shifting the exchange of information from a proprietary network to an open network. Today, as the financial track turns to a more open and decentralized infrastructure, the U.S. government faces similar options to existing governments before the advent of the Internet. Just as companies that embrace the open internet architecture thriving, and those that boycott eventually become irrelevant, the U.S. attitude toward the shift will determine whether it can maintain its global financial influence or hand over the territory to other countries.

The first pillar of a more ambitious, future-oriented strategy is to see Bitcoin as a network, not just an asset. With an open, license-free network driving new financial infrastructure, existing businesses must be willing to give up some control. By doing so, however, the United States can unlock significant new opportunities. History shows that those who adapt to disruptive technology will consolidate their position, while those who resist disruptive technology will eventually fail.

The second key pillar of Bitcoin is to accelerate the adoption of the dollar stablecoin. Under proper regulation, stablecoins can strengthen public- private partnerships that have supported U.S. financial dominance for more than a century. Instead of weakening the hegemony of the US dollar, stablecoins will enhance the hegemony of the US dollar , expand the influence of the US dollar, enhance its utility, and ensure its importance in the digital economy. Furthermore, they offer more agile and flexible solutions than slow-moving, bureaucratic central bank digital currencies or unclearly defined unified ledger solutions such as the Bank for International Settlements’ “Financial Internet”.

But not every country is willing to adopt a dollar stablecoin or operate entirely within the U.S. regulatory framework. Bitcoin plays a key strategic role here—acting as a bridge between the core dollar platform and non- geopolitical allied economies. In this context, Bitcoin can act as a neutral network and assets, promoting capital flows, while strengthening the United States' core position in global finance, thereby preventing it from concessions to alternative currencies such as the RMB. Even if it becomes a pressure relief valve for countries seeking alternatives to dollar hegemony, Bitcoin’s decentralized, open nature ensures it is closer to the economic and social values of the United States than to those of a dictatorial regime.

If the United States successfully implements this strategy, it will become the center of Bitcoin financial activities and have greater influence to shape these flows in accordance with American interests and principles.

This is a subtle but feasible strategy, and if implemented effectively, the dollar's influence will continue for decades to come. Rather than simply hoarding Bitcoin reserves (which may indicate doubts about the stability of the US dollar), it is better to strategically integrate Bitcoin into the financial system and promote the development of the US dollar and US dollar stablecoins on the Internet, so that the US government will become Active managers, not passive bystanders.

What are the benefits? A more open financial infrastructure, while the United States still controls the "killer application" - the US dollar. This approach is exactly the same as companies like Meta and DeepSeek, which develop industry standards through open source AI models while monetizing elsewhere. For the United States, this means expanding the dollar platform to interoperate with Bitcoin, ensuring that cryptocurrencies continue to remain relevant in the future as they play a central role.

Of course, like any strategy against disruptive innovation, this strategy also has risks. But the price of resisting innovation is outdated. If there is any government that can do this, it is the current government – it has deep expertise in platform warfare and it is clear that staying ahead is not about controlling the entire ecosystem, but about shaping it How to get value in it.

chaincatcher

chaincatcher

panewslab

panewslab