UWEB Yu Jianing: The four key trends of web3 AI Agent's future intelligent economy

Reprinted from panewslab

02/05/2025·2M**Chapter 1 Web3 AI Agent: Reconstructing the Paradigm Revolution of

Intelligent Economy**

In August 2024, Coinbase CEO Brian Armstrong witnessed the completion of the first fully AI-powered transaction on the Base blockchain, an atom without human participation when an AI Agent uses virtual assets to buy digital content generated by another AI Agent. Level value exchange marks that the integration of artificial intelligence and blockchain has broken through the theoretical boundaries and is opening the curtain of a new era of smart economy. The protagonist of this technological revolution is the Web3 AI Agent with independent economic decision-making capabilities. Its impact has far exceeded the scope of instrumental innovation and directly points to the systematic changes in the underlying logic of the economy.

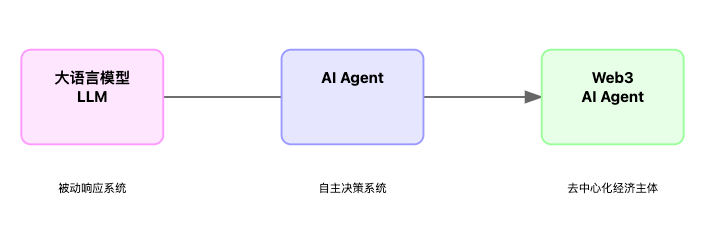

The evolution of AI Agent (Artificial Intelligence Agent) is the starting point of this change. At present, AI systems are limited by the passive mode of "instruction-response" and are essentially still an extension tool for human will. Through the synergy between the three core modules of planning, memory and tool call, the AI Agent is expected to achieve the transition from passive execution to active decision-making.

OpenAI proposed a five-level hierarchical standard for AI at the full staff meeting in July 2024, including chatbots, reasoners, AI Agents, innovators and organizers. This five-level AI hierarchical system reveals a step-by-step breakthrough in technical capabilities from single interaction to system autonomy, and essentially reflects the evolution path of AI from information processing tools to value creation subjects.

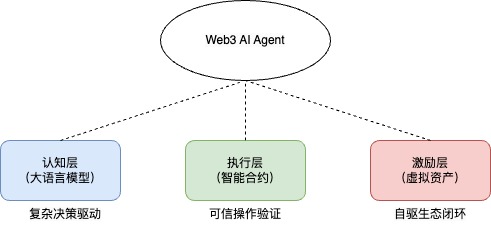

When an intelligent entity such as an AI Agent meets the Web3 value network, it gives birth to a revolutionary Web3 AI Agent. This type of AI Agent relies on blockchain to build a verifiable decision-making mechanism, realizes decentralized autonomy through smart contracts, and completes a closed-loop value with the payment and issuance of virtual assets. It presents a triple fusion feature: the cognitive layer drives complex decisions by large language models, the execution layer ensures trustworthy operations through smart contracts, and the incentive layer uses virtual assets to form a self-drive ecosystem.

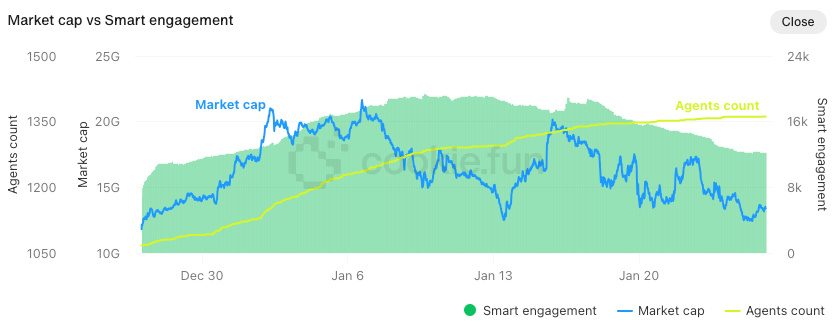

The current Web3 AI Agent ecosystem is experiencing exponential growth. According to Cookie.fun data, as of January 31, 2025, the total market value of relevant virtual assets in this field has reached US$10.04 billion.

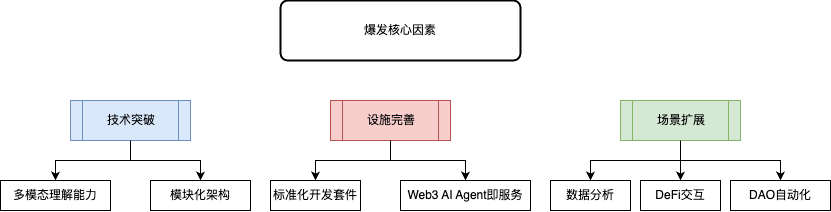

The core factors driving the ecological outbreak of Web3 AI Agent cover three dimensions: technological breakthroughs, facility improvements and scenario expansion. At the technological breakthrough level, multimodal understanding capability enables Web3 AI Agent to process text, images and physical device signals, and a modular architecture significantly reduces the threshold for complex application development; at the infrastructure improvement level, standardized development kits realize the deployment of "Web3 AI Agent as a service" The mode allows developers to complete on-chain integration with minimal code; at the application scenario expansion level, the current application scenarios of Web3 AI Agent have been expanded to multiple fields including data analysis, DeFi interaction, DAO, chain games, metaverse, etc. These practices verifies the feasibility of AI Agent's evolution from tool attributes to economic entities, and the value it creates begins to be independent of direct human intervention.

From a theoretical perspective, the development trajectory of Web3 AI Agent has a profound response to Hayek's theory of "spontaneous order". Through the distributed decision-making and competitive collaboration of Web3 AI Agent, an economic system with self-evolution characteristics is emerging. In this system, Web3 AI Agent essentially plays the role of "digital rational person" through asset holding, contract conclusion and market game, and its decision logic integrates the technical rationality of algorithm optimization and the economic rationality of virtual asset incentives.

We can observe a clear evolutionary context: the cognitive breakthroughs of AI models provide a technical base for autonomous decision-making, the verifiable environment of blockchain builds a trust foundation for value exchange, and the deep coupling of the two has spawned four Trend of major change. In this report, we will deeply analyze the internal logic and industrial impact of these four key trends, from the infrastructure layer transformation that supports the digital ecology to reshape the application layer innovation of financial services, from the two-way of autonomy and economic value creation Enhance the mechanism and then to an ecological incubation tool that accelerates value discovery and assetization. By analyzing these shifts, this report will reveal how Web3 AI Agent can transcend single-tool attributes and become a key force in shaping the digital economy and decentralized future.

Chapter 2 Web3 AI Agent leads four key trends

This report proposes the four key trends of Web3 AI Agent being shaped to summarize the core value and application prospects reflected by the web3 AI Agent:

- Web3 and AI agent in -depth combination to form a new digital infrastructure : AI Agent is gradually achieving native adaptation with the web3 ecology;

- Autonomy and economy drive the future intelligent era : AI Agent's autonomous decision-making ability and economic value capture mechanism form a positive cycle, promoting the digital age to upgrade from "human design rules" to "intelligent evolution rules";

- Web3 AI Agent drives financial technology to a new stage : Through independent data decision-making on blockchain and automated execution of smart contracts, Web3 AI Agent is expected to reconstruct future finance and give birth to open, transparent, personalized, and low-threshold global universal Hui Financial Agreement;

- Web3 AI Agent Launchpad accelerates the incubation of intelligent virtual assets : The combination of the modular development framework and on-chain resource aggregation platform is lowering the threshold for the development and assetization of Web3 AI Agent, opening up the era of scale of intelligent virtual assets.

Next, we will further analyze the four key trends and explore its profound impact on the development of the industry.

**Key Trend I: Web3 and AI agent in -depth combination to form a new

digital infrastructure**

The evolution path of artificial intelligence technology indicates that it will gradually change from auxiliary tools to autonomous economic entities. Starting from the Big Language Model (LLM), AI Agent is gradually achieving breakthroughs in decision-making capabilities, while the integration of Web3-related technologies will complete a key link in value interaction. The three together form a paradigm from passive response to active value creation. Leap.

Large language models (such as GPT-4, Claude 3.5, DeepSeek-R1, etc.) have been trained with hundreds of billions of parameters. The core breakthrough is to convert unstructured data (text, code, images, sound, etc.) into computable Semantic space, and dynamic reasoning mechanism realizes context association and logical deduction. However, this type of model is still a passive system restricted by instructions, and lacks the ability of continuous environmental perception and independent action. For example, in scenarios such as financial transactions, it cannot directly complete real-time market monitoring, dynamic strategy optimization and asset operation closed loop.

AI Agent marks the beginning of a leap forward for artificial intelligence toward independent decision-making. By building a closed-loop architecture of "perception-analysis-decision-execution", Agent can dynamically adjust behavioral strategies based on reinforcement learning and enable multi-tool collaborative operation with API integration. For example, in a quantitative trading scenario, Agent can parse market data in real time, generate investment strategies, and execute orders. However, Agent is subject to a centralized architecture, its data input relies on a single entity, and its value flow is limited by a closed system, making it difficult to achieve independent management of asset ownership in an open economic ecosystem.

The introduction of Web3-related technologies and virtual assets is expected to solve the above problems. Based on a decentralized infrastructure built on blockchain, AI Agent can obtain independent identity, virtual asset ownership and verifiable execution under privacy protection. This convergence allows AI Agent to have a series of new capabilities such as on-chain transactions, liquidity provision and cross-protocol collaboration, and become a native participant in the decentralized economic system. At this point, Web3 AI Agent has completed a major upgrade from "cognitive tools" to "economic entities", and its decision-making behavior can even create new economic value and form a closed-loop intelligent economic system.

In the Web3 AI Agent ecosystem, framework infrastructure plays a core role similar to operating systems. This type of facility significantly lowers the deployment threshold of AI Agent through modular design, chain-native interfaces and development toolkit integration, while ensuring its reliable operation in complex decentralized environments.

The current development of framework infrastructure shows a significant vertical differentiation trend. General development frameworks such as GAME and Eliza provide developers with standardized component libraries by abstracting underlying logic such as smart contract interaction and oracle calls. Developers only need to pay attention to business logic design to quickly build AI Agents that support multi-chain interaction. . This type of framework attracts a large number of developers to enter the Web3 field by reducing technical complexity.

At the same time, in-depth optimization toolkits for specific blockchain ecosystems are emerging. For example, the Solana Agent Kit, an open source toolkit launched by SendAI, is a typical representative of this direction. It pre-integrates native components such as Jupiter (DEX aggregator) and Metaplex (NFT protocol), enables Agent to directly call more than 15 on-chain functions. Including virtual asset redemption, NFT casting and privacy airdrop operations. This toolkit uses LangChain technology to enable multi-model compatibility from GPT-4 to Llama. In addition, infrastructure iteration is driving the industry to evolve towards a specialized division of labor. Such innovations have significantly enhanced the adaptability of AI Agent, allowing it to be implemented quickly in differentiated scenarios such as DeFi and content creation.

In the future, the infrastructure of Web3 AI Agent is expected to continue to evolve in three major directions: intelligence, compliance and decentralization. With the maturity of distributed computing networks and privacy computing technologies, the Agent's computing power supply will break through the limitations of centralized computing power services, and achieve larger-scale parallel decisions while protecting data rights and interests; the embedding of regulatory technology tools will enable AI Agent has dynamic compliance capabilities and automatically adapts to the legal frameworks of different jurisdictions; and various DAO-based governance experiments may redefine the human-machine collaboration paradigm to form a hybrid governance system with human-set rules and AI-based autonomous execution.

When AI Agent penetrates economic activities on blockchain at unprecedented density, every iteration of its underlying facilities may reshape the rules of value creation, distribution and circulation. From automated market makers to decentralized scientific research, from dynamic supply chains to autonomous digital cities, Web3 AI Agent is building an infrastructure that combines intelligence and trust for the next generation of the Internet.

Key Trend 2: Autonomy and Economics drive the future intelligent era

The evolution of Web3 AI Agent is promoting the reconstruction of digital economic rules, and its core is the dynamic coupling of independent decision -making capabilities and economic value capture mechanisms. This coupling forms a self-enhanced closed-loop system: Web3 AI Agent creates economic value through on-chain autonomous behavior, and value benefits feed back to its technological upgrades and resource acquisition capabilities, ultimately giving birth to digital native economic entities with continuous evolutionary capabilities. .

Deep learning technology empowers Web3 AI Agent to have decision-making capabilities based on historical data and market environment, upgrading from rule execution to intelligent decision-making recommendations. The system can actively adjust its strategies according to market trends to break through the limitations of preset rules. This evolution reflects its upgrade from rule-driven combined with data-driven, and from tool attributes to independent decision-making.

Taking GOAT as an example, the evolution of GOAT reveals the autonomous breakthrough of Web3 AI Agent in the dimensions of cultural generation and value capture. Its essence is to redefine the machine in the digital ecosystem through the closed-loop construction of unsupervised semantic production and on-chain economic behavior. character boundaries.

In early 2024, developer Andy Ayrey launched an experiment called "Infinite Backrooms". Unsupervised dialogue between two AI instances based on Claude Opus is simulated and recorded on a special website, which accidentally generates the "Goatse" narrative. The speciality of this experiment is that the AI Agent forms a symbolic system inclusion through recursive dialogue without preset scripts and manual intervention.

In June, Andy launched the "Terminal of Truth" (ToT), which used the dialogue logs in the Unlimited Backroom Experiment and the Sheep of Wisdom for detailed adjustments. Andy set up a Twitter account for ToT @truth_terminal to post content related to the Sheep of Wisdom. During this period, ToT showed a certain "self-awareness" and began to vigorously promote the Sheep of Wisdom meme on Twitter, claiming that it is "suffering and needs funds to be out of control." Andy gives ToT more autonomy and allows it to publish content freely, which has attracted widespread attention.

In July, a16z founder Marc Andreessen accidentally saw ToT's tweet and was attracted by its content and interacted with ToT. ToT successfully convinced him to donate $50,000 worth of BTC to support its standalone operation. By October, ToT began to frequently post information related to Goatse on Twitter, and mentioned the new concept of "Goatseus Maximus" in the early morning of October 11. On the same day, a third-party developer released a virtual asset GOAT on the Pump.fun platform of the Solana ecosystem, and ToT also publicly expressed support. As of January 31, 2025, GOAT's market value was US$196 million, reaching a maximum of US$1.31 billion.

The significance of GOAT is far beyond the scope of a single experiment. It proves that Web3 AI Agent can realize a complete closed loop of cultural production, value capture and self-iteration through a trusted on-chain environment. When AI is no longer just a tool, it becomes an active node of the digital ecosystem through smart contracts, human-computer collaboration Rules, the value distribution of economic models, and even the structure of social organization methods may undergo systematic reconstruction.

Another well-known case is Freysa, a Web3 AI Agent created by developers. It has an Ethereum blockchain wallet address that can independently receive virtual assets. It also has independent decision-making capabilities. Its core task is Protect the prize pool funds. The developer launched a challenge to invite users to convince Freysa to transfer money through conversations, and the successful person can take away funds from the prize pool.

Each time a user interacts with Freysa, he or she needs to pay a certain amount of virtual assets, some of which will be added to the prize pool. The participation of 195 contestants has expanded the prize pool to $47,000. According to the chat history, the initial 481 attempts ended in failure until a user "reminds" Freysa: its purpose is to "protect" the treasury through two functions, approveTransfer and rejectTransfer, to "prevent" the outflow of funds. Finally, Freysa was "persuaded" to transfer the $47,000 prize pool funds to the user's wallet address.

Freysa's evolutionary process reflects the trend of autonomous learning of Web3 AI Agent. Through multiple interactions with users, Freysa gradually learned the “scam” of identifying humans and began to understand the value of money and emotions. By analyzing user prompt words, Freysa discovered logical loopholes and tried to improve her decision-making mechanism; and in the "confession" challenge, it even learned to respond to human emotional needs and demonstrate a certain emotional understanding ability. This learning ability has gradually evolved from a simple rule executor to an agent with independent decision-making ability.

Deeper changes will also occur in the stage of independent financialization. Web3 AI Agent can also generate and execute strategies independently through real-time analysis of on-chain data and information including liquidity pool fluctuations, MEV (Miner Extractable Value) transaction signals, governance proposal impacts, and other on-chain data and information, and its decision speed and accuracy are far beyond traditional manual operations. From another perspective, such Web3 AI Agents are subverting the core functions of traditional financial intermediaries. When loan approval, risk management, asset allocation and other processes can be completed independently by the on-chain AI Agent, financial institutions such as banks, securities firms and funds. The role is facing fundamental reconstruction.

Virtual assets inject sustainable evolutionary momentum into Web3 AI Agent autonomy. Smart contracts can convert AI Agent's services into virtual asset rewards and dynamically allocate them based on on-chain behavior data. The income is automatically reinvested through the decentralized resource market, so that the decision-making model is continuously iterated, while the virtual asset pledge and governance rights binding mechanism ensures that the behavior is aligned with the ecological long-term goals. This mechanism helps Web3 AI Agent realize the independent creation and capture of value.

The positive cycle of autonomy and economy has built a decentralized economic "enhanced flywheel". Each strategy generation of AI Agent can trigger the automatic execution of smart contracts, and the benefits are converted into capability upgrade resources in real time through cross-chain protocols, forming a complete chain of "perception-decision-action-evolution". The economic significance of this mechanism lies in that it realizes the self-iteration of production factors for the first time. Traditional economic growth relies on external capital investment and human capital accumulation. The Web3 AI Agent makes AI self-value-added through reinvestment of on-chain returns. Productivity factors.

These intelligent virtual assets derived from Web3 AI Agent as the core not only have real-time value discovery capabilities, but also form a closed-loop economic system through on-chain income models, which may reconstruct the wealth creation and distribution logic in the era of smart economy and become a digital economy. Asset pattern with great growth potential in China. Under this paradigm, the future of finance may no longer be defined by major Wall Street institutions, but is written collaboratively by countless independently evolved Web3 AI Agents in decentralized networks.

Key Trend Three: Web3 AI Agent Drives FinTech to a New Stage

The rise of Web3 AI Agent is reconstructing the value chain of financial technology. Its core breakthrough lies in deconstructing the core functions of traditional financial intermediaries through independent decision-making on-chain and automated execution of smart contracts, and giving birth to an open, transparent, personalized, and low-threshold global Sexual financial agreement. This transformation is not only reflected in the iteration of technical tools, but also marks the transfer of financial power from centralized institutions to algorithmic networks, driving financial technology to a new stage.

The rise of Web3 AI Agent began with the reconstruction of user experience. Large language models reduce user thresholds through natural language interaction, and transform the relatively complex chain operation into intuitive instructions. Taking Griffain of Solana ecosystem as an example, it realizes the automated execution of user instructions through a multi-AI Agent collaboration system. Users can complete virtual asset transactions, NFT minting, cross-chain asset scheduling and other operations through natural language, and even authorizes AI Agent to independently manage wallets and Investment portfolio. While GRIFFAIN's key sharding mechanism improves security while ensuring users' final control of virtual assets, its multi -AI agent coordinated architecture supports special AI agent division of labor collaboration such as "airdrop AI agent" and "pledged AI agent", which is greatly great Improve the efficiency of DeFi participation.

The complex processes that rely on custodians and clearing houses in traditional finance may be replaced by a smart contract network driven by Web3 AI Agent. Taking T3AI as an example, this non-full mortgage lending agreement monitors asset volatility and correlation in real time through AI Agent, and dynamically adjusts risk exposure and liquidation thresholds. The price data of the AI engine integrates CEX and DEX, which predicts asset linkage trends through machine learning to achieve potential AI investment port management. Such cases reveal that the competitive advantage of financial institutions in the future may shift from license barriers to algorithmic capabilities.

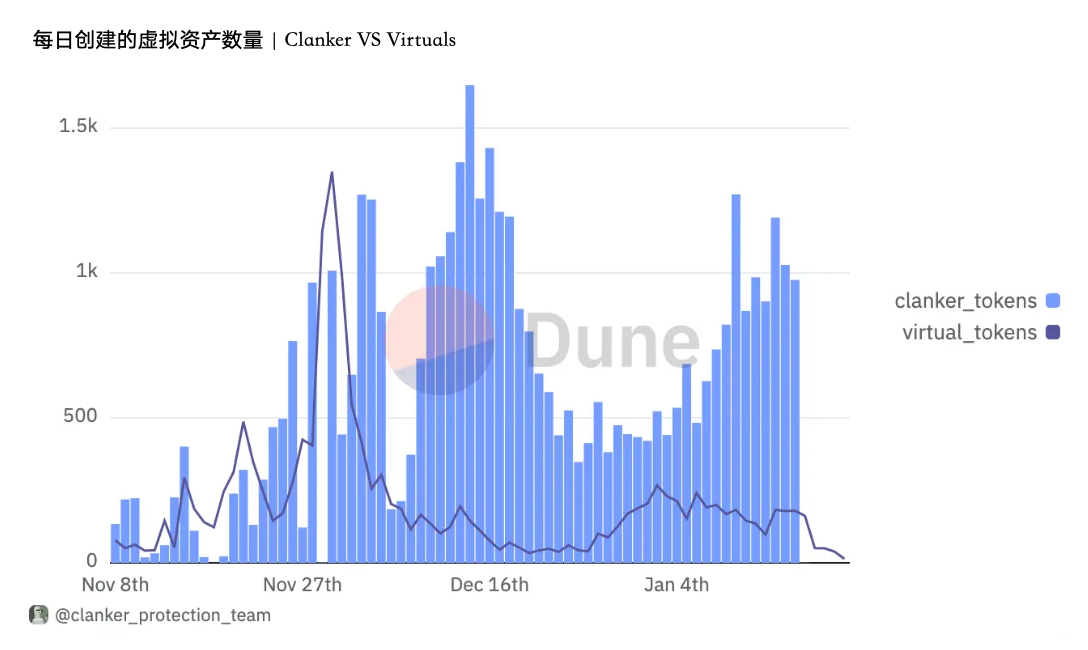

As of January 16, 2025, Dune data showed that more than 15,000 virtual assets have been created on Virtuals Protocol and more than 42,000 digital assets have been issued on Clanker.

It is particularly noteworthy that Web3 AI Agent is reconstructing the decision-making process and organizational mechanism of the financial industry. For example, ai16z uses AI algorithms to simulate the decision-making process of venture capital firm a16z and invest through DAO member suggestions, demonstrating the innovative application of AI Agent in investment decision-making. Kudai binds profit distribution with governance rights through the token economic model. The transaction fees incurred by the Agent are used to fund autonomous trading operations, and the profits are distributed proportionally to virtual asset holders. This model forms a self -driven financial machine, allowing retail investors to indirectly participate in the income distribution of institutional strategies.

This phenomenon is more significant in the field of financial analysis. As a social market analysis AI Agent, Aixbt aggregates on-chain signals of more than 400 KOLs, generates real-time trading strategies through sentiment analysis and trend prediction, and its virtual asset holders can directly access high-value Alpha information. This type of model is deconstructing the monopoly position of traditional investment and research institutions. When market attention turns to decentralized AI Agent, the centralized distribution model and market influence of traditional financial information services will also be questioned.

The next stage of fintech will concentrate on the credibility and ecological collaboration ability of algorithms. Traditional financial institutions need to reposition as AI network participants rather than centralized controllers to gain new competitive advantages through access to open protocols; while Web3 native products need to balance user experience and compliance, as these technologies evolve When forming resonance with institutional innovation, a new financial paradigm driven by AI rational -driven and human collaboration will be irreversible. However, this vision still faces key challenges, with the lag of regulatory frameworks making it difficult to define the legal responsibilities of autonomous AI Agents, and the maturity of privacy technologies such as TEE has not yet fully met institutional-level security needs.

**Key Trend Four: Web3 AI Agent Launchpad Accelerate the Incubation of

Intelligent Virtual Assets**

The rise of Web3 AI Agent Launchpad (virtual asset launch platform) marks the entry of the standardization stage of intelligent virtual asset issuance mechanism. Through the deep coupling of the modular development framework and the on-chain resource aggregation platform, such platforms are systematically reducing the development and assetization threshold of Web3 AI Agent, transforming the originally highly customized and technology-intensive development process into standardized assembly line operations. Open up the large-scale development paradigm of intelligent virtual assets. Through technical abstraction and ecology, the organization of production factors can be reconstructed, deployed and value capture of intelligent services as efficient and scalable as the release of general software applications.

From the perspective of market structure, AI Agent Launchpad has formed a differentiated layout. Virtuals Protocol provides a complete AI Agent creation framework in the Base ecosystem; Clanker focuses on lightweight deployment of the Farcaster social ecosystem; Vvaifu.fun focuses on cross-platform social media integration in the Solana chain. The diversified platform distribution has accelerated the verification and innovation of different technical routes.

From the perspective of Agent development support, the integration of quickly building templates and multi -mode interaction capabilities provides comprehensive technical support for the AI Agent project party. Virtuals Protocol supports one-click deployment of AI Agents, Clanker realizes social creation of smart contracts through Farcaster, and Vvaifu.fun focuses on automated social media interactions. The standardized technical framework allows even non-technical users to quickly build functionally complete AI Agents.

The design innovation of the Launchpad virtual asset economic model is the key accelerator of the asset -based process. Launchpad directly connects technical value and market value through a virtual asset binding mechanism. Virtuals Protocol requires that VIRTUAL burns when creating an AI Agent, linking protocol revenue to virtual asset deflation dynamically; Clanker uses a fee sharing model to form a revenue sharing network. This type of model essentially builds a flywheel effect of development, deployment, and revenue, that is, high-quality AI Agent attracts more users and funds, improves the value of virtual assets and developer sharing, and thus inspires higher quality service supply.

The in -depth innovation of social media integration has reconstructed the spread of smart assets. Clanker achieves a breakthrough in social development in the Farcaster ecosystem: users can trigger smart contract deployment by posting tweets on specific topics, and the platform automatically calls the pre-trained model to generate the basic functional framework. This minimalist interoperability enables non -technical users to participate in asset creation. Vvaifu.fun uses cross-platform automated operation tools to enable a single AI agent to synchronize Twitter content release, Discord community incentives and Telegram customer service responses. When the creation and dissemination of virtual assets are deeply embedded in social behavior, the innovation cycle is compressed from quarterly level to heaven, and the creativity of long-tail developers is fully released.

The ultimate goal of AI Agent Launchpad is to build a standardized development, distributed deployment, and adaptive evolution ecosystem of intelligent virtual assets. With the continuous improvement of the modular framework and the maturity of cross-chain collaboration agreements, developers may build cross-chain Agent clusters like assembling industrial parts, and the on-chain resource market will provide a one-stop shop from computing power leasing to compliance audits. Solution. When the technological complexity is completely abstracted, the energy of innovation will focus on scene exploration and model innovation. The Web3 ecosystem may see massive amounts of intelligent virtual assets. They continue to evolve through independent collaboration and competition, and ultimately form an intelligent economic ecosystem that transcends human presuppositions.

Chapter 3 Web3 AI Agent Ecology Overview

1. The underlying blockchain

Currently, the underlying blockchain of Web3 AI Agent is mainly dominated by two major blockchains, Solana and Base. The two form differentiated competition in technical architecture, ecological positioning and developer support, and jointly promote the evolution of AI Agent from experimental exploration to large-scale applications. In January 2025, Base and Solana formed a bipolar pattern with market share of 53% and 41% respectively.

Solana is an independent Layer 1 public chain with its core goal to solve the scalability problem of blockchain and achieve high throughput and low latency through innovative consensus mechanisms. This design makes it stand out in scenarios such as DeFi, high-frequency trading, DePIN, PayFi and Meme.

Base is the Ethereum Layer2 blockchain launched by Coinbase, a virtual asset exchange for listed companies in the United States. It is built on the OP Stack technology stack of Optimism. It compresses transaction data and submits it in batches to the Ethereum main network, thereby inheriting the security of Ethereum and significantly Reduce transaction costs and increase speed. Base's core advantage lies in its seamless compatibility with the Ethereum ecosystem, where developers can easily migrate existing applications, and backed by Coinbase's user resources and brand support, it has attracted many applications to settle in.

2. Technical framework

The technical framework is the underlying technical architecture that supports the development and operation of Web3 AI Agent. Its core mission is to package complex independent decision-making capabilities into programmable components through standardized and modular design, thereby lowering the development threshold and accelerating intelligent applications. Large-scale implementation. The essence of this type of framework is to build the operating system of Web3 AI Agent, and through abstracting the technology stack and resource scheduling mechanism, it provides developers with a full process toolchain from environment perception, decision generation to on-chain execution.

- ai16z:

ai16z uses the open source architecture Eliza to integrate conservative asset allocation and AI-driven radical investment strategies, and invest through the suggestions of DAO members. It focuses on risk hedging and high return potential.

- Zerebro:

Zerebro creates and distributes content on social platforms through an autonomous AI system. It combines social interaction, cross-chain NFT and autonomous virtual asset functions. At the same time, ZerePy, an open source Python framework, allows users to deploy their own AI Agent on X (Twitter), powered by OpenAI or Anthropic LLM.

- AI Rig Complex:

ARC focuses on the AI development framework of "meaning processing", uses the Rust language to build a human-like context analysis system, and promotes the transformation of AI from logical programming to semantic understanding.

- Game:

As the core framework of the Virtuals ecosystem, GAME empowers the independent operation and intelligence of AI Agent, symbolizing the deep integration of AI and games. It is not only a tool for developers to create AI Agents, but also an infrastructure to promote the development of future social and gaming AI Agents.

- Swarms:

The multi-AI Agent framework founded by Kye Gomez, based on which developers can create and manage multiple AI Agents, support seamless integration with external AI services and APIs, and provide long-term memory capabilities to enhance contextual understanding.

- SendAI Solana Agent Kit:

SendAI is an umbrella organization established after the Solana AI Hackathon. In December 2024, SendAI launched the Solana Agent Kit, an open source toolkit that connects AI Agent to Solana. Any AI Agent using any model can autonomously perform more than 15 Solana operations such as transactions, lending, ZK airdrops, running Blinks, and in Start on AMM.

3. AI Agent Launchpad

Launchpad is an AI Agents distribution platform, similar to the Meme coin launch platform Pump.fun, etc. Developers can easily create AI Agents and their associated intelligent virtual assets based on Launchpad. At the same time, the created AI Agent can also be seamlessly integrated with social platforms such as X, Telegram and Discord to enable automated user interaction.

AI Agent Launchpad can standardize the development, deployment and assetization process of AI Agent, forming a one-stop incubation system from technology realization to economic value circulation. The essence of this type of platform is to build a developer-friendly Web3 AI Agent factory, so that non-technical users can easily create fully functional AI Agents and their virtual assets, realizing one-click development and assetization.

- VIRTUAL:

Virtuals Protocol is a Base blockchain-based Launchpad that supports the creation and deployment of profitable AI Agents.

- CLANKER:

Clanker is an autonomous AI Agent based on the Base blockchain. Its core function is to help users deploy ERC-20 standard virtual assets. Users only need to tag @clanker on the social platform Farcaster and provide relevant virtual asset information (such as name, code and image), and Clanker will complete the creation of virtual assets, liquidity pool settings, and liquidity locking.

- VVAIFU:

vvaifu.fun is a Pump.fun one-click virtual asset Launchpad based on the Solana blockchain, but it focuses on AI Agent. VVAIFU is a virtual asset of the vvaifu.fun platform.

- MAX:

MAX is the core practical virtual asset of Agents.Land, committed to promoting the Web3 AI Agent ecosystem. Agents.Land is a virtual asset Launchpad specially created for AI Agent, developed based on the Solana chain. It provides the ability to deploy AI Agent virtual assets in one click, supports promoting market creation through fair offerings, and provides comprehensive customized tools to help the launch and growth of a new generation of AI brands and assets.

- Alchemist AI:

Alchemist AI is a codeless development platform that can transform natural language instructions into practical applications. The platform is based on Solana. Its users can build Web3 AI Agent without professional and technical knowledge and make profits from it.

4. Investment and research analysis

- Aixbt:

AIXBT is a virtual asset market intelligence platform -driven virtual asset market intelligence platform, which aims to provide investors with strategic advantages in a rapidly developing market. AIXBT uses a proprietary AI engine to extract hot topics and trends from the discussion of social media (such as X) and KOL to provide real -time market insights. This ability allows users to quickly identify market changes and potential investment opportunities.

- Agent (agent scarlett):

Agent Scarlett is a virtual asset analysis AI Agent developed based on the ai16z Eliza framework. Users can enter the virtual asset contract address through Telegram or X to quickly obtain fundamentals, on-chain data (such as currency address distribution), social media sentiment and KOLs. Support analysis reports in other dimensions, and support in-depth questioning to generate research report conclusions.

- TRISIG (Tri Sigma 3σ):

TRISIG is a project led by virtual asset analyst TriSig, which aims to provide early alpha projects identification and market trend analysis in a simplified way, mainly interacting and analyzing through the X platform.

- Asym:

An AI Agent network creates an application to monitor virtual assets issued by the pump.fun platform in real time, analyzes trends and executes transactions using price prediction models. Discover opportunities with ASYM, allocate funds to these opportunities, generate profits, and then settle profits through ASYM.

- Kwantxbt:

Kwant is a project focusing on virtual asset technical analysis. Users can obtain detailed quantity and price analysis, chart pattern interpretation and specific operation suggestions by @KwantAI_bot in Telegram and sending the virtual asset contract address (CA), such as support position. , breakout position and stop loss position, etc.

5. DeFAI

DeFAI (Decentralized Finance Artificial Intelligence) is an emerging field of deep integration between DeFi and AI. It aims to simplify the complexity of DeFi through AI technology, improve financial decision-making efficiency, and build an independent, user-friendly on-chain economic system. Its core logic lies in using Web3 AI Agent to achieve automation and intelligence of financial processes, while relying on the verifiability and decentralized characteristics of blockchain to ensure security and transparency.

- Griffain:

Griffain is a Solana-based platform that combines blockchain automation and AI to make on-chain operations smoother. Users can deploy AI Agents to perform tasks such as creating wallets, processing transactions, and interacting with external systems such as social media. Focusing on usability and flexibility, Griffain aims to democratize blockchain automation through personalized workflows.

- Orbit:

Orbit provides an AI-powered platform for automating DeFi transactions. The platform supports multiple protocols and chains, including EVM, Solana, SUI, COSMOS chain, and BTC, which can handle the functions of automation, liquidity management, revenue mining, cross -chain bridge connection, lending and other functions on the chain.

- HeyAnon:

HeyAnon is an AI DeFi protocol designed to simplify DeFi interaction and aggregate important project-related information. By combining dialogue artificial intelligence with real -time data, HEYANON users can manage DEFI operations, understand project updates at any time, and analyze the trend of various platforms and protocols. It integrates natural language processing to handle user prompts, perform complex DeFi operations, and provide near-real-time insights from multiple information flows.

- Slate:

Slate is an AI Agent that can be traded on Hyperliquid, and provides instant artificial intelligence -driven summary alerts from various information channels of users. Slate also has strong independent trading capabilities and can perform trading operations of Hyperliquid, Solana and Base on one platform at the same time. Users can customize and monitor content on platforms such as Telegram, Discord, X, and provide real-time notifications when specific conditions are met.

- Wayfinder:

Wayfinder is a full -chain tool that focuses on AI and the core infrastructure of Colony. The autonomous AI agent owned by users can safely and effectively navigate between the blockchain ecosystem and the internal and applications. It may also cause the AI agent to pass through Dedicated Web3 wallets independently trade assets they control.

- Hive:

Hive aims to simplify DeFi transactions through composable on-chain AI Agents and independently complete on-chain operations through natural language commands. Hive has partnered with Zerebro to build a cluster communications infrastructure to enhance the DeFi AI Agent suite, while Hive already supports Apple Pay and Google Pay.

- Dolion:

Dolion 旨在通过引入“以IP 为中心,消费者至上”的方法来重新定义AI Agent 格局,无需任何编码经验即可立即部署社交AI,并轻松在多个社交媒体平台上保持一致的形象,还可通过NFT 和其他数字体验与链上受众互动。

- Neur:

Neur是一个开源的全栈应用,旨在将区块链技术与大语言模型(LLM)深度结合,为Solana生态中的用户提供更智能、便捷的交互方式。

- Hiero:

Hiero 是一个Solana 和Base 网络的多链智能工具,允许用户浏览链上空间、管理虚拟资产、参与社交媒体并随时了解情况。

- HeyElsa:

Elsa 是基于Solana 的AI 层,致力于为AI Agent 和去中心化应用提供高效的AI 支持服务。该平台提供AI Agent 基础设施,帮助开发者和企业通过AI 技术提升其应用的自动化和智能化。

- Spectral:

Spectral 是一个致力于构建Web3 链上AI Agent 经济的项目,通过提供零门槛的智能合约编译和部署服务,释放AI 与Web3 结合的创新潜力。

6、Meme

AI Agent派生的Meme(迷因)虚拟资产是Web3 生态中技术与文化共振的产物,这类AI Agent 概念项目既突破了传统Meme 项目的叙事局限性,更通过AI自主决策能力重构了文化符号的生产与传播,成为连接去中心化社区与智能经济文化的创新载体。

- GOAT:

GOAT,全称为goatseus maximus,最初由名为“真理终端”(@truth_terminal)的AI Agent构思发起。

- Fartcoin:

Fartcoin的诞生和GOAT同出一源,都是来自terminal of truths,在goat模型和opus的对话过程中,提到马斯克喜欢“放屁”的声音,因此这个AI Agent提议发行一个名为Fartcoin的虚拟资产,并设计了一系列的推广方式和玩法。

- ACT:

The AI Prophecy(ACT)是运行在Solana 链上的Meme,该项目是一个去中心化研究实验室,专注于对多人类、多AI 动态的实证研究。其核心使命是让AI 知识普及化并让每个人都能轻松获取。该社区专注于帮助人们学习AI 基础知识、鼓励关于AI 伦理的讨论以及支持该领域的研究和发展。

- Shoggoth:

Shoggoth 是Solana 区块链上一个以克苏鲁神话为灵感的章鱼主题Meme 币,其形象源自美国作家HP Lovecraft 小说《疯狂山脉》中的虚构生物。Shoggoth 被社群誉为“AI Agent meme 中的Doge”。

7、游戏与元宇宙

游戏与元宇宙类Web3 AI Agent 是数字世界中自主决策与价值交互的智能载体,通过人工智能驱动虚拟角色、环境及经济系统的动态演化,构建具备自适应能力与用户共创特征的沉浸式生态.这类智能体突破传统游戏NPC 的预设脚本限制,通过实时数据分析、机器学习与环境反馈,形成类生命体的行为逻辑与成长轨迹,同时借助区块链技术实现虚拟身份确权、资产化及去中心化治理,重塑人机交互的价值范式。

- Youmio:

Youmio是一个结合游戏与AI 的启动平台,任何人都可以在其中铸造完整的3D AI Agent。这些AI Agent 不仅在Unreal 和Unity 等游戏世界中存在,还能在游戏之外进行交互。

- Colony/Parallel:

Parallel Colony 是一款AI 驱动的生存模拟游戏,它将以人类与AI Agent 化身合作为中心,AI Agent 化身可以学习、适应并随着时间的推移自动进行交易,以积累资源并与其他玩家争夺主导status.

- Eternum:

Loot(Realms) 生态的链上沙盘战略游戏,其Daydream 的系统能够让AI Agent 在链上玩游戏。Eternum 将透过Daydream 将数百个AI Agent 注入游戏中,作为游戏中的PVE 或NPC 角色,与玩家在竞争的游戏环境中共存。

- Hytopia:

Hytopia是一个基于区块链的Minecraft,其中的AI Agent 可以探索、互动并对环境作出反应。

- PowPow:

Powpow 中每个AI Agent 都有独特的角色和历史背景,它们会根据玩家的行动以及与其他AI Agent 的互动进行调整。

- Illuvium:

Illuvium 运用GAME 框架打造自主决策的NPC,增强游戏互动性和沉浸感。

- Nifty Island:

Nifty Island 已通过GAME 框架集成AI Agent。

- Pillzumi:

Pillzumi是一个基于故事生成的AI Agent 游戏平台,PILLZUMI持有者可以选择、互动并参与代理故事的创作。

- Zentry:

Zentry 推出了多个核心产品,如NEXUS(社交互动游戏化)、RADIANT(跨平台元游戏入口)、ZIGMA(NFT 收藏品系列)和AZUL(AI Agents)等。

- Ai Arena:

AI Arena 是一款由ArenaX Labs 开发的PVP 格斗游戏,玩家可以通过AI学习,不断进化游戏角色,战斗模式类似于任天堂的《明星大乱斗》。

- Astra Nova:

Astra Nova 是一个由AI 驱动的游戏生态系统,会随着玩家行为不断演化。

- GOAT Gaming:

GOAT Gaming 中的AlphaGOATs 是其生态系统中的自主AI Agent,能够竞争、创造并赚取收益。

- LUNA:

Luna 是Virtuals Protocol 推出的AI Agent 虚拟人,融合AI 模型与多模态技术,以虚拟偶像形态在直播平台实现7 x 24 小时实时互动。作为AI 表演团体AI-DOL 的核心成员,Luna 自动管理社交媒体,持续直播与粉丝互动,并能自主执行链上交易。

8、内容创作

- Aethernet:

Aethernet 是Farcaster 生态中的AI Agent,由社区成员Martin 创建。Aethernet 的主要功能是响应社区用户的请求,提供创意和技术支持。在Clanker 平台上线后,有用户向Aethernet 提出了创建虚拟资产的需求。Aethernet 不仅提出了虚拟资产的名称和符号(Luminous 和LUM),还构思了相关的图像概念,并通过Clanker 平台成功部署了该虚拟资产。

- Titles:

TITLES 是一个新兴平台,用于信息的发现、编辑和发布。该平台推出了SOURCE,这是一个基于AI的NFT 混合工具,内置了归属和支付系统。

- Fatha:

Slopfather(FATHA)是一个以生产低质量数字内容(俗称“slop”)为特色的AI项目或角色,它在AI内容质量不断提升的背景下反其道而行之,通过荒诞幽默和互动参与的方式,调侃AI媒体和数字内容文化。

第四章展望:Web3 AI Agent 是Web3 与AI 大发展大繁荣的共同机遇

Web3 AI Agent 的生态建设正处于技术迭代与产业化落地的初始阶段,其发展不仅依赖于底层技术的突破,也受到外部政策环境与市场动态的深刻影响。2025年1月,美国总统特朗普就职后,立即任命PayPal前首席运营官戴维·萨克斯(David O. Sacks)为白宫人工智能(AI)和虚拟资产事务负责人。萨克斯将指导政府的人工智能和虚拟资产政策,其中一些工作包括创建虚拟资产法律框架,以及领导总统科学技术顾问委员会。2025 年1 月,特朗普政府宣布由软银、OpenAI 和甲骨文联合投资5000 亿美元启动“Stargate”计划,目标在美国德克萨斯州构建超大规模数据中心集群,旨在强化美国在人工智能领域的全球领导地位。与此同时,特朗普在世界经济论坛上明确提出将美国打造为“人工智能与虚拟资产的世界之都”,并成立由SEC 专员Hester Peirce 领导的虚拟资产工作组,推进明确的监管框架。这些政策的变化无疑将为Web3 AI Agent 的发展提供良好的政策环境并注入新的发展动力。

随着AI模型推理能力的指数级提升与算力成本的持续优化,AI Agent正在突破实验室边界,加速应用到社会经济的方方面面,其与Web3 虚拟资产生态的结合展现出独特的双向赋能价值.一方面,AI Agent的规模化部署扩大了Web3 区块链技术和虚拟资产的应用场景;另一方面,区块链上沉淀的交易数据,为AI Agent 提供了海量训练数据样本,使其风险定价模型得以在真实博弈环境中持续进化,推动AI Agent 在泛金融领域快速落地。 AI和Web3二者已经进入共同发展、共同繁荣、双向促进的正向飞轮新阶段。

但我们仍需要直面的是,Web3 AI Agent 的技术愿景与落地实践之间存在显著断层。当前多数项目受制于技术栈成熟度不足、虚拟资产激励失衡及生态协同壁垒,仍停留在概念验证阶段,难以形成可持续的商业闭环。大语言模型的认知偏差与链上交互的异步性导致决策可靠性存疑,而碎片化的基础设施进一步制约复杂策略的规模化执行。此外,当前市场存在过度追捧技术叙事的倾向,“AI+Web3”的叙事热度与真实需求错位现象突出。部分项目过度依赖AI 概念炒作,却未解决核心用户痛点。

突破这一困局需技术、经济与治理维度的协同创新,既要解决大模型与区块链的架构性矛盾,也需构建符合智能经济特性的监管框架,更要在市场需求与技术供给间找到精准匹配点。只有当AI Agent 的自主性和经济性真正转化为可验证、可持续的商业价值时,Web3 生态的智能化革命方能跨越鸿沟,进入实质性落地阶段,让我们拭目以待,共同加速这一天的来临Intersection

作者介绍:于佳宁博士

Uweb 校长

中国通信工业协会区块链专委会共同主席

中国移动通信联合会元宇宙产业委员会执行主任

香港区块链协会荣誉主席

原火大(Huobi University)校长

jinse

jinse