What is the top ten news list of the Spring Festival holiday that has severely slashed the crypto market?

Reprinted from jinse

02/05/2025·2MCompiled by: Tao Zhu, Golden Finance

For the crypto market, this is an uneasy Spring Festival: Trump launched a tariff war, causing the crypto market to plummet; Deepseek released, and the market responded violently; El Salvador canceled Bitcoin's official currency status; the Federal Reserve continued to maintain the decision not to cut interest rates... Mowing

Golden Finance compiles the top ten encrypted news that happened during the Spring Festival and takes you to review this unforgettable Spring Festival.

1. Trump starts a tariff war

Trump vs Canada, Mexico

On January 31, local time, American White House spokesman Caroline Levitt said at the briefing that confirmed that it would impose a 25%tariff on Mexico and Canadian goods from February 1. On January 30, local time, US President Trump stated that he plans to fulfill his commitment to 25%of tariffs on goods imported from Mexico and Canada on February 1.

Trump also posted on the "Truth Social" platform that if Canada becomes the 51st state in the United States, it will be "exempt tariffs!" The president wrote: "So, Canada should be the 51st state we cherish. Canadians will enjoy much lower taxes, get much better military protection, and – exempt from tariffs!”

In response, Canadian Prime Minister Trudeau said at a press conference that Canada will impose a 25%tariff on US goods worth 155 billion Canadian dollars, including the immediately imposed tariffs on goods worth 30 billion yuan from Tuesday. Further tariffs were imposed on US $125 billion worth of US products 21 days later.

Trump vs China

At 8 pm on February 1st, Eastern Time, the White House released a list of facts, announcing that it will impose a 10%tariff on China's exporter products on the grounds of Fentney.

The Chinese side strongly dissatisfied with this and resolutely opposed. The US's unilateral tariff imposition is seriously violated WTO rules, which is not only unhelpful to solve its own problems, but also causes damage to normal economic and trade cooperation between China and the United States. Regarding the wrong approach of the United States, China will filed a lawsuit with the WTO and will adopt corresponding countermeasures to firmly safeguard their rights and interests.

On February 4, the State Council Tariff Commission issued an announcement: With the approval of the State Council, tariffs will be imposed on some imported goods originating in the United States starting from February 10, 2025. A 15%tariffs are imposed on coal and liquefied natural gas, and 10%tariffs are imposed on crude oil, agricultural machinery, large -displacement cars, and pickups.

Trump vs. EU

On February 2nd, local time, US President Trump said he was "sure" would impose new tariffs on the European Union. He once again complained that the United States had a trade deficit with the European Union and believed that the EU was insufficient to import US and agricultural products. Trump does not specify the tariff level or timetable. "I won't say that there is a time watch, but it will be there soon," he said to the media.

In response, the EU said that if the United States imposes tariffs on the EU, the EU will "resolutely respond", which is the latest manifestation of dissatisfaction with President Trump's trade policy, the impact of which is spreading around the world. The use of tariffs is “harmful to all parties” and the EU regrets Trump’s decision to impose tariffs on Canada, Mexico and China.

In addition, Trump said that the United States will impose tariffs on imported goods such as computer chips, medicines, steel, aluminum, copper, oil and natural gas as soon as mid-February.

But on February 3, Trump temporarily put down the tariff stick.

Canadian Prime Minister Trudeau said after speaking with US President Trump that the United States will suspend imposing tariffs on Canada for at least 30 days. Earlier on February 3 local time, Trump spoke with Mexican President Sinbaum. Both announced after the call that the United States and Mexico agreed to suspend the implementation of the tariffs for one month immediately and continue negotiations.

2. "Tariff War" Shocks the Market

After the announcement of the news that the United States will impose 25% tariffs on Canada and Mexico, the US dollar index DXY rebounded by as much as 69 points from the day low to 108.48. The US dollar against the Canadian dollar USD/CAD erased its previous decline in the day and turned to a rise again. Spot gold once fell to $2795.34 per ounce. Bitcoin fell below $103,000 per coin during the day, down 1.67% during the day. The declines of the US and Blanc oil intraday narrowed to close to flat, at $72.89 per barrel and $77.02 per barrel respectively.

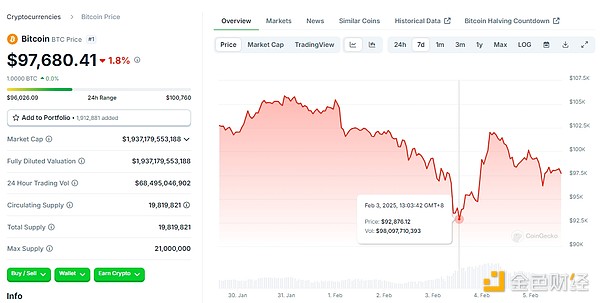

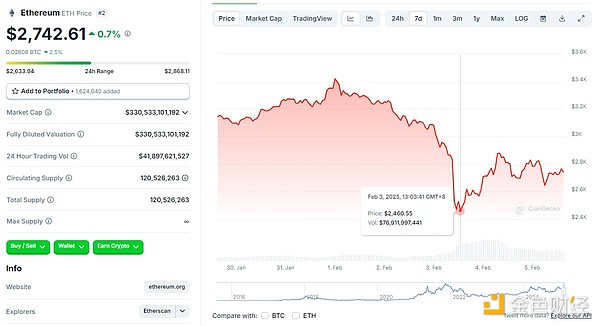

Since then, the crypto market has been falling continuously, and by February 3, BTC fell to a low of around $92,876.12, the lowest level in more than two weeks, down 12.29% from $105,893 on January 30. The ETH market was worse, down to a minimum of $ 2460.55, a drop of nearly 1,000 US dollars from US $ 3422 on February 1, a decrease of 28.10%.

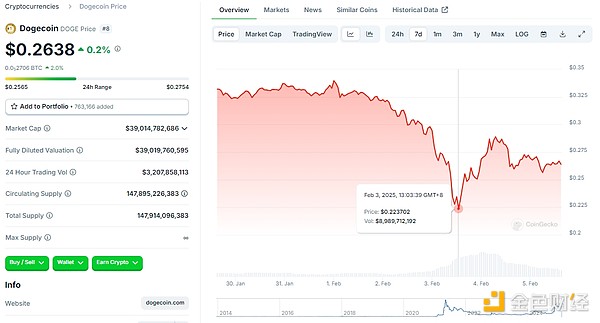

The selling of cottage coins is even more intense. Doge recorded a new low of $ 0.2237, down 34%from $ 0.3398 on January 1. All cottage coins such as XRP, ADA, Avax and Link have fallen by more than 10%.

The Japanese and Korean financial markets also suffered a heavy blow: the South Korean KOSPI index closed down 64.04 points, or 2.54%, to 2453.33 points on February 3rd (Monday). The Nikkei 225 index closed down 1052.40 points, or 2.66%, to 38,520.09 points on February 3. Affected by the US tariff order, the yield on 10-year new treasury bonds, the main indicator of long-term interest rates, once rose to 1.260%, the highest since April 2011.

In this regard, many institutions or people in the industry have expressed their views:

-

Former US Minister of Finance Larry Summers said in an interview that Trump's tariff policy violated economic logic. This means higher prices for consumers and much higher investment costs for American manufacturers. Summers questioned: Why do we now decide to launch an economic war against Canada among so many countries in the world? Canada has higher minimum wages and basic wages, and unions protect workers more than the United States. I just don't understand the logic of these policies, and there is no doubt that this is a regressive tax imposed on American consumers.

-

Citi said we believe that further tariff escalation will lead to bullish gold in 6-12 months, with gold prices rising to $3,000 per ounce; at the same time, silver will rise to $36 per ounce; we are also bearish on copper prices in the next three months It will drop to $8,500 per ton.

-

JPMorgan Chase said it has short-term bearish on base metals due to U.S. tariffs and strengthened its bullish gold view. The London Metal Exchange (LME) base metal prices may face severe bearish pressure in the near future, as economic growth concerns, macro risks fade and strengthening the dollar.

-

Unless high tariffs are imposed on the EU or economic conditions force the Fed to raise interest rates, Trump's tariffs are unlikely to have a significant impact on investment-grade credit risks or spreads, JPMorgan analysts Eric Beinstein and Nathaniel Rosenbaum said.

-

Robert Kiyosaki, author of "Rich Dad Poor Dad" tweeted that as Trump's new tariff policy takes effect, gold, silver and Bitcoin may collapse. But the price collapse also brings more opportunities to buy. The real problem is debt, which only gets worse.

-

"Trump's tariff policy is affecting the market as a whole, and concerns about a trade war and stagflation triggering recession are spreading to the altcoin and Bitcoin markets," said Caroline Bowler, CEO of BTC Markets .

-

Jeff Park, the strategic director of Bitwise Alpha , said that tariffs may be just a temporary tool, but the long -term conclusion is that Bitcoin will not only go higher, but also go faster because the "both parties" in the trade imbalanced equation want Bitcoin. So the end result is the same: higher prices and faster speeds.

-

Petr Kozyakov, CEO of crypto payment platform Mercuryo , pointed out that after Trump announced tariffs on Friday, the cryptocurrency market has set off a wave of FUD, and the prospect of long-term interest rate hikes has shaken all markets around the world. Although Bitcoin has fallen below the $ 100,000 mark, the King of cryptocurrencies once again proves that he is unique and compared with the cottage that has fallen across the board. Bitcoin fell overnight to a slightly higher than $ 91,000, a minimum of nearly 10%, and then rebounded to about $ 95,000. Other major cryptocurrencies have fallen more, Ethereum fell about 20%. Solana's performance seemed to be better than Ethereum, only 6%.

3. Deepseek releases, shocking the technology and crypto market

On January 27, Deepseek became the number one in Apple's APPStore in the US, surpassing ChatGPT. DeepSeek has performed well recently. With its low-price strategy and excellent performance of RMB 0.1 per million token, DeepSeek has attracted the attention of technology giants including Meta.

On Monday, January 27, Eastern Time, DeepSeek triggered a sharp drop in AI concept stocks, with the market value of European and American technology stocks evaporating by US$1.2 trillion, and European and American chip manufacturers and companies that power AI and data centers all fell. Among them, Nvidia closed down 16.97%, and its market value evaporated by US$592.658 billion (approximately RMB 4.3 trillion) in one trading day, the largest scale in the history of US stocks.

Japanese chip stocks fell sharply as a competitive AI model released by DeepSeek has raised concerns about its threat to the US's technological leadership. Nvidia supplier Advantest fell 8.2%, Disco Corp fell 2.9%, SoftBank Group fell 5.4%, and data center cable manufacturers Furukawa Electric and Fujikura Ltd both fell more than 8%. Market participants pointed out that huge investment returns in large technology companies in the AI field are doubtful, and DeepSeek or key factors that cause technology stocks to call back.

The crypto market also responded sharply.

According to the GMGN market, on January 27, the market value of the meme coin of the same name of DeepSeek was US$40 million, and the price was 0.0376USDT, with an increase of 70% in one hour. On January 28, the AI project VVV based on DeepSeek rose to above $17, with a 24-hour increase of 103.7%.

Other tokens are obviously not so lucky, especially AI-related tokens have been greatly affected. The total market value of cryptocurrencies in the field of artificial intelligence has been hit hard, down 10% from $47.54 billion on January 26 to $42.5 billion. Trading volume increased by more than 42% in 24 hours to $3.55 billion, strengthening the intensity of seller pressure. In addition, the cryptocurrency market is sluggish, accompanied by a wave of leverage liquidation. Leverage allows traders to borrow funds to increase trading positions, thereby amplifying potential gains and losses. The latest data shows that the crypto market has liquidated nearly US$860 million in the past 24 hours, of which US$794 million is long liquidation. The $260 million long position of Bitcoin has been liquidated.

-

U.S. President Trump said at a Republican meeting held at Miami, Florida that the rise of Chinese artificial intelligence startup Deepseek should sound a "alarm" for American companies. American companies "need to focus on competition to win."

-

NVDA.O calls DeepSeek "an outstanding advance in artificial intelligence." A Nvidia spokesman said DeepSeek's work demonstrates how to use widely available models and limited computing power to create new models.

-

"DeepSeek just accelerates all timelines," Ejaaz Ahamadeen, a global digital asset architect at ConsenSys , said in X. "We have accepted the 'fact' that the build of these products will cost $100 billion, and it will be Close source means forming a monopoly. Then DeepSeek surpassed all leading models at a very low cost and opened the technology, and now any AI builder can access this most powerful model. Why no one talks about us How will you see 'better proxy'? Fat application theory becomes more realistic. This is great for open source AI."

-

The founder of Black Myth Goku commented on DeepSeek: It may be a national running -level scientific and technological achievement.

-

Ai16z founder Shaw posted a post to evaluate Deep Seek and other big models. He pointed out that the AI field is undergoing an open source revolution, from Google, OpenAI, Claude to today's DeepSeek, major AI laboratories have continuously made breakthroughs in benchmarking and capabilities. Shaw particularly emphasizes that open source models like DeepSeek are a major benefit to the industry as it can help developers scale AI applications to millions of users at a lower cost. As AI models gradually become commercialized, this technology is moving towards free, open source and running at zero cost on home computers.

-

Nirgunan Tiruchelvam, head of consumer and internet at Aletheia Capital , said DeepSeek products seriously violate the argument that Silicon Valley invests huge capital and operating expenses as the most appropriate way to deal with the AI trend. It creates doubts about the huge amount of resources invested in artificial intelligence.

-

Anthropic co-founder Jack Clark said DeepSeek's progress has challenged perceptions of the West's significant leadership in the field of artificial intelligence.

4. Crypto Tsar David or Change the encryption industry

Recently, the encrypted tsar was very active and made a lot of remarks that favored the encryption industry:

On February 5, crypto czar David Sacks reiterated at a press conference held at 3:30 Beijing time that it will "clear the encryption regulatory framework", "ensure that crypto innovation occurs in the United States", and "create the golden age of digital assets." "It has not announced new content.

Crypto Tsar David Sacks also said that the feasibility of Bitcoin reserves is studying. He regards NFT and Memecoins as "collectibles", not securities or products. Compared with securities and goods, collectibles have different tax procedures.

David Sacks was asked during a Fox News TV interview program when the United States will announce its strategic Bitcoin reserves, David Sacks said: "Trump has asked us to study this issue, which is one of the things we are currently looking at." He also praised President Donald Trump's administrative order on cryptocurrencies. The order is designed to clarify regulations, define digital assets, and strengthen the dominance of the dollar through stablecoins. According to Sacks, the newly formed digital assets task force will oversee regulatory developments. It will divide digital assets into categories such as securities, commodities and collectibles. The government is also seeking to expand the use of stablecoins, believing it could drive demand for U.S. Treasury bonds. Sacks believes this strategy can support Treasury bonds and lower long-term interest rates.

5. El Salvador abolishes Bitcoin’s status as official currency

On February 2, the ruling party-controlled parliament of El Salvador just quietly approved reforms to the Bitcoin law, which invalidates the use of Bitcoin as an official currency, at the discretion of users. This reform was only carried out after the pressure of the International Monetary Fund (IMF) for nearly two years. IMF set a condition to "reduce the risk of Bitcoin" in exchange for Kenya President Naibal ( NAYIB Bukele) approves a $ 1.4 billion loan that urgently needs. If the Salvador administration wants to receive the money, it must amend the law before the last day of January. The law was implemented for more than three years, and the representatives amended six of the clauses and abolished three of the sixteen clauses. From now on, Bitcoin will no longer be regarded as "currency"; its acceptance changes from mandatory to voluntary, and will not be used for taxation.

As of February 3, El Salvador held 6,056.18 BTC, or approximately US$586 million.

6. Trump signs executive order to establish sovereign wealth fund

US President Trump signed an executive order on February 3 local time to create a US sovereign wealth fund. The White House stated that the order indicated that the Ministry of Finance and the Ministry of Commerce began to review the establishment of a sovereign wealth fund.

"We will start this issue within the next 12 months. We will start this issue in the next 12 months. We will realize the realization of assets on the American people's balance sheet." He mentioned that they plan to study other funds from other funds. "Best Practice" and the fund will hold a range of current assets and other U.S. assets. Trump mentioned this idea many times during the campaign. He called on a fund that "invests in the great country's cause of all the interests of all American people", such as infrastructure construction and medical research.

It is unclear to the source of funds for the US sovereign wealth fund. Most sovereign wealth funds are composed of surplus income generated by natural resources, such as the wealthy country in Saudi Arabia. However, the United States is facing major budgets and trade deficits. At the same time, the United States also has a powerful private market, which allows investors to support multiple initiatives that the new funds that Trump mentioned in hopes to invest.

Trump also said the fund may acquire TikTok. After signing the executive order to set up a sovereign wealth fund, Trump said in his speech, "We will use it to do something, maybe it's acquiring TikTok, maybe it's not acquiring ... If we make the right deal, We will do that, if not, we won't do it... We may include this deal in sovereign wealth funds, and we may work with very wealthy people."

Bitcoin advocate and U.S. Senator Cynthia Lummis mentioned Bitcoin in response to the news, and posted on X that “it’s a big deal” and used the symbol of Bitcoin, which excited cryptocurrency enthusiasts. It is not clear how to build and fund the US sovereign wealth fund. According to the New York Times and the Financial Times, the Biden administration also considered setting up such a fund before Trump was elected in November last year.

-

"Given the clear support for digital assets in the United States, sovereign wealth funds will likely include Bitcoin and perhaps even other “Made in the United States” digital assets with real economic utility, such as Ethereum," said Flexa CEO Danny McCab e. Inclusion of these digital assets will not only provide greater stability for the U.S. economy, but will also be a big leap forward to making the U.S. a leader in the digital asset field.”

-

Austin King, co-founder of Omni Network , said Trump's establishment of a sovereign wealth fund could be an alternative to acquire Bitcoin without a bureaucracy.

7. Federal Reserve resolution issuance: No interest rate cuts

On January 30, the Federal Reserve announced that it would maintain the target range of the federal funds rate between 4.25% and 4.5%, and continue to implement balance sheet reduction at the original pace. The Federal Reserve's decision is in line with general market expectations.

On February 4, the Federal Reserve Collins said that the Federal Reserve should be patient and cautious about policies and there is no need to rush to adjust interest rates. At present, there is no urgency to cut interest rates again. The Fed should be patient and cautious about the policy, and there is no need to rush to adjust interest rates. At some point in the future, it is expected that interest rates will be further normalized.

-

Trump said the Fed's decision to keep interest rates unchanged last week "is right under the current circumstances."

-

Fed Bostic : Be prepared to wait for a period of time before cutting interest rates.

-

Morgan Stanley economists said they no longer expect the Federal Reserve to cut interest rates in March and are now expected to cut interest rates in June this year. The Trump administration imposes tariffs faster than we expected, which could mean that inflationary declines will stagnate at higher inflation levels, blocking the possibility of any recent rate cuts.

-

Galaxy Securities released a research report showing that taking into account the performance of the US economy at the end of 2024 and the current economic data, the US economy has shown a certain growth momentum and resilience. Since the stage on January 20, Trump has quickly signed a series of administrative orders. Its policy style emphasizes protectionism and economic nationalism, but it often bypass Congress to promote the agenda through administrative orders, so it also faces many political and legal resistance during its implementation. Considering these factors, the Fed is expected to take a more cautious interest rate reduction path in 2025, with a rate reduction of the year from 0.25%to 0.50%.

-

Traders cut bets on the Fed's interest rate cuts and now expects a 50% chance of two rate cuts in 2025.

-

According to the CME Fed's observation data, the probability of the Federal Reserve ’s interest rate reduction in March was 17%, and the probability of maintaining unchanged was 83%.

8. Progress of Litecoin and Dogecoin ETFs

On January 24, CoinShares submitted a registration statement for the “CoinShares Litecoin ETF”. In addition, the New York Stock Exchange (NYSE) filed a 19b-4 document on behalf of Grayscale (Grayscale), which contains terms regarding the conversion of trusts to spot ETFs.

On January 30, the U.S. Securities and Exchange Commission has endorsed Canary Capital’s 19b-4 filing for its spot Litecoin ETF.

On February 5, Litecoin official tweeted that NYSE has now submitted a 19b-4 document application for Grayscale's Litecoin ETF to the US SEC in order to convert its Litecoin (LTC) trust into spot ETF.

On January 29, Bitwise has submitted an application to the US Securities and Exchange Commission (SEC) to list a trading fund (ETF) that tracks the Dogecoin price. According to the S-1 file submitted to the US SEC on January 28, the proposed Bitwise Dogecoin ETF will hold Doge and track its price trend closely.

9. Micro -strategy pause coins

MicroStrategy did not sell any Class A common shares under the stock issuance plan from January 27 to February 2, nor did it buy any Bitcoin. As of February 2, the company held about 471,107 bitcoins, with a total purchase price of $30.4 billion.

Since its recent inclusion in the Nasdaq 100, MicroStrategy has been subject to various rules and regulations, such as a lockdown period, to prevent potential insider trading, which may be one reason for its continuous overselling of Bitcoin. In addition, some speculate that they chose to suspend their Bitcoin increase because MicroStrategy is changing its strategy based on market conditions. The company may face huge tax bills that have not realized Bitcoin earnings, with an amount of more than $19 billion, so financial planning must be carried out to deal with tax payments. obligation. However, analysts believe that there is almost no sign that MicroStrategy is abandoning its Bitcoin-centric strategy.

According to data from data platform Arkham Intelligence, BlackRock, MicroStrategies and Fidelity have purchased a total of approximately $94 billion worth of Bitcoin in 2024. Specifically, BlackRock, the world's largest asset management company, bought $50 billion, while MicroStrategics successfully accumulated $24 billion worth of BTC. Fidelity is at the last place after acquiring $20 billion worth of BTC.

10. Binance’s “Best Friends Rumor”

On February 2, 2024, the first anonymous report letter spread widely on the Internet. The letter described in detail the possible misconducts of Dana, the head of the investment department of Binance Laboratory, He Yi's "best friend" Dovey and others, including manipulating the price of currency, soliciting bribes for currency, colluding with overseas leeks to cut off leeks.

Several key figures mentioned in the letter report, such as Dana, Duowei, etc., were accused of using their positions to participate in improper interest exchanges and project operations. If true, these allegations will undoubtedly cause significant damage to Binance's symbolism and trust.

Regarding the surging doubts, He Yi posted a long article on social media of "reasoning and caution" and responded in detail to the rumors. She emphasized:

1. Independent operation and firewall mechanism: He Yi pointed out that Binance Labs has been renamed Yzi Labs, operated independently, and is responsible for Ella Zhang. There is a strict firewall mechanism between Binance and Labs, and the coins and investment decisions are independent of each other.

2. Welcome to supervision and reporting: She once again emphasized Binance's zero-tolerance policy for bribery and misconduct, publicly supported any reports of employees' bribery or misconduct, and stated that the reward reporting will always be effective.

3. Clarification of the rumors about "Best Friends": He Yi admitted that there was an improper profit in her name in the market, but she had no special relationship with the characters mentioned in the rumors. Regarding the statement "He Yi's best friend", anyone is welcome to establish contact with Binance or the laboratory through normal channels.

panewslab

panewslab

chaincatcher

chaincatcher