Is it really safe and legal to withdraw money from Hong Kong cryptocurrency OTC?

Reprinted from panewslab

02/05/2025·2MWritten article: Niu Xiaojing, Xu Xiaohui

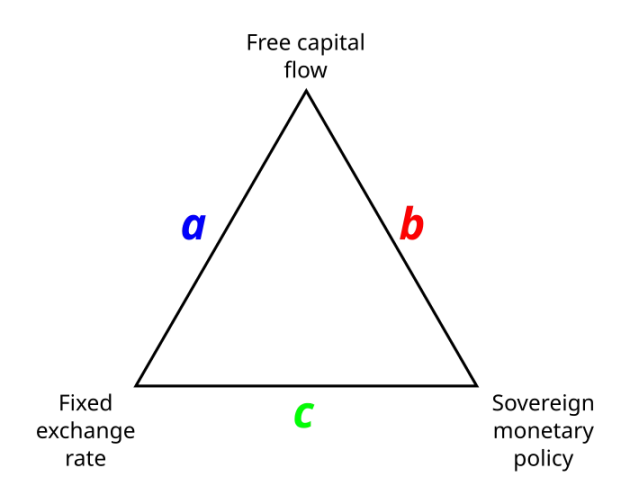

I believe that many friends have heard of "Mundellian Trilemma" in international finance, also known as Sanyuan Paradox, which refers to a country that cannot achieve the following three at the same time:

- Capital mobility

- Exchange Rate Stability

- Independent monetary policy

Similar "impossible triangle" phenomena are also common in other fields. For example, the process of cryptocurrencies (exchanging cryptocurrencies into legal currencies and withdrawals) is also facing the "Sanyo Paradox". Here, the "Impossible Triangle" can be described as: high security, high convenience and low cost. These three elements are often difficult to achieve at the same time, but they also constitute the core needs of users.

So, can OTC over-the-counter trading in Hong Kong's cryptocurrency field alleviate this contradiction or even break through this constraint? The following will analyze the performance of the Hong Kong OTC market in this "impossible triangle" one by one.

Analysis of the advantages and advantages of Hong Kong OTC market

Security

Funding Security: Currently, Hong Kong's digital currency OTC market is not fully regulated. These over-the-counter dealers are generally not subject to the jurisdiction of the Hong Kong Money Services Association (MSO) or the Hong Kong Securities and Exchange Commission (SFC). However, some merchants hold money-renewal licenses (regulated by Hong Kong Customs), so they are more reliable to a certain extent.

According to the public consultation document on the Legislative Recommendations on Regulating OTC Trading of Virtual Assets (hereinafter referred to as the "Virtual Assets OTC Consultation Document"), in the future, Hong Kong Customs will issue licenses to virtual asset over-the-counter trading service providers. All service providers are required to be licensed. The introduction of this regulatory framework is expected to increase the transparency of the industry and reduce the risk of unsatisfactory operations.

However, due to lack of effective supervision, there is still a certain risk of OTC transactions. For example, some customers' bank cards are frozen by Hong Kong banks after receiving remittances from OTC merchants. To reduce such risks, users should prioritize merchants that hold money-renewal licenses or have passed certification on large exchanges such as Binance or OKX.

Personal information security: Personal information leakage is the main hidden danger in Hong Kong's OTC industry. Since 2012, Hong Kong stores have implemented a real-name system, requiring customers to provide real-name information before transactions. By 2023, further RMB exchange requirements:

- Customer Hong Kong bank account

- Customer's Chinese bank account

- Customer Hong Kong and Macau Pass

Some companies even require the funding flow of domestic bank cards. These personal information is kept by each looking for a store, and the lack of unified platforms and strict supervision makes the information leakage risk.

Under the existing legal framework of Hong Kong, the information confidentiality in the store replacement industry is far less than that of banks, securities, insurance and other fields, and information spot checks do not require judicial authorization. This is a significant risk for high net worth clients. Therefore, choosing a compliant and credible merchant is very important.

Exchange cost

Spread and handling fee: The spread (spread) for OTC transactions is usually higher, about 1%-3%. Compared with the exchanges publicly hanging orders, OTC transaction costs are higher, but in exchange for the flexibility of the transaction scale and speed.

Large transaction advantages: For large transactions, the differences and fees of the OTC market are usually lower than the exchange. Some service providers can adjust their rates according to customer needs to provide more attractive cost solutions for large customers.

Negotiation space and hidden costs: The flexibility of the OTC market allows users to negotiate prices with merchants. Loyal customers may enjoy extra discounts. In addition, the compliance platform usually provides transparent rate quotes to avoid hidden costs. But in informal platforms, it is possible to increase customer burden through opaque exchange rates or additional expenses.

Convenience

OTC market transactions are relatively convenient.

Flexible trading hours: Most well-known OTC platforms provide 24/7 all-week service, allowing users to complete transactions at any time.

Quickly handle large transactions: OTC market supports large -scale transactions of millions of dollars, without having to worry about market slippery points (the price fluctuates due to changes in transaction volume). This is especially important for institutions or high net worth clients.

Offline trading network: multiple financial centers in Hong Kong (such as Central) have physical OTC counters. It is recommended that users with large exchanges need to go directly to the store to complete the transaction.

Lawyer Mankun Summary

Hong Kong's OTC OTC market cannot break through the impossible triangle of "high security, high convenience and low cost", but its flexibility, diversified services and unique geographical advantages have alleviated the currency to a certain extent. Circle investors' gold problems.

At the same time, with the gradual introduction of the regulatory framework for virtual asset transactions, the security and transparency of the OTC market are expected to further improve. However, users still need to be cautious when choosing a trader, prioritizing compliant platforms or reputable merchants, weighing the trade-offs between security, convenience and cost, and finding the best solution for themselves to avoid potential risks.

chaincatcher

chaincatcher