The "Black Monday" of the cryptocurrency market is reproduced. Is this the last fall or the beginning of a bear market?

Reprinted from panewslab

02/05/2025·2MAuthor: babywhale, techub news

One week ago, due to DeepSeek, investors' expectations for the future demand for the artificial intelligence chip industry chain may decrease. The US stock market, including Nvidia, and AMD stocks, have begun to decline from the night disk. drag. In the morning of this morning, the Night market time of the U.S. stocks may be that the US government announced on Saturday that it will impose a 25% tariff on imported goods from Mexico and Canada, and the impact of 10% of tariffs on imported goods in China. Bitcoin is in The weekend continued to decline after a slight decline, and it fell around 91,000 US dollars at around 10 o'clock in Hong Kong.

In fact, the decline in Bitcoin this morning is not large, but most tokens, including Ethereum, have fallen. Ethereum has fallen by about 40%in the past three days. Near the US dollar, a large number of cottage coins reached a new low since the bear market in 2022.

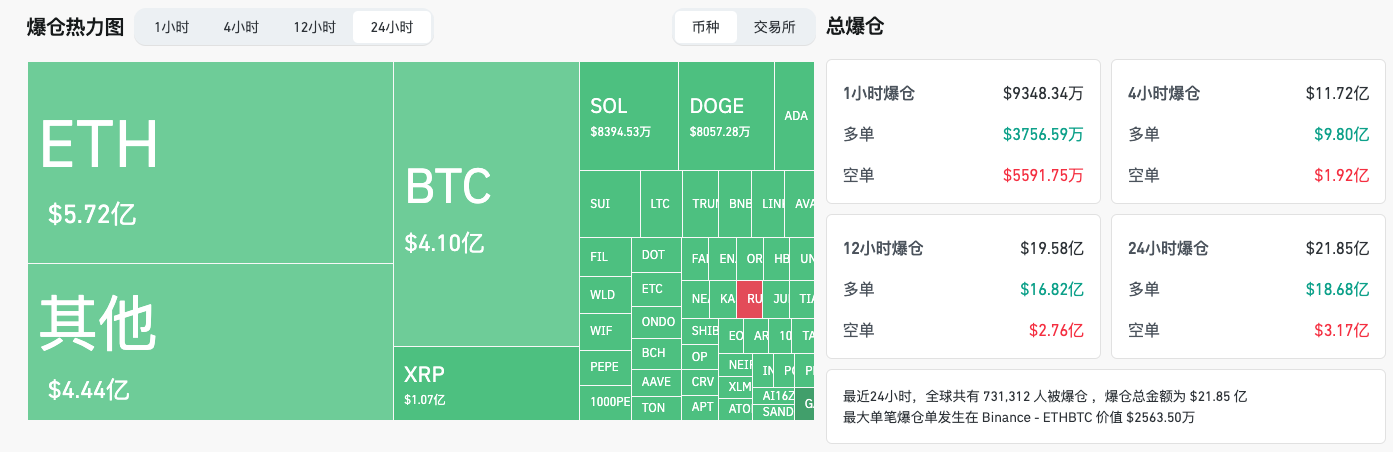

The contract market is even more storm. According to COINGLASS data, based on the lowest point at noon today, the cryptocurrency contract market in 24 hours exceeded $ 2 billion, more than 700,000 people. The number was even higher than that of the market panic caused by the market panic after the Bank of Japan accidentally raised interest rates last year, which set the highest amount of positioning in the past two years in the past two years.

The total market value of other cryptocurrencies in the top ten cryptocurrencies of TRADINGVIEW's statistics has fallen to the minimum of nearly US $ 220 billion this morning, which has reached the level from August to October last year.

"Last Fall" OR "Bear Start"?

In the analysis article last Monday, the author pointed out that after Bitcoin tried to exceed $ 106,000 to $ 107,000, we had reason to prevent short -term callback risks. Bitcoin rebounded quickly after falling to $ 98,000 last Monday, and once again touched the level of about $ 106,000, allowing many investors to start looking forward to the "Spring Festival red envelope market" that has been fulfilled for many years.

But just like Bitcoin fell rapidly after the level rebounded at the end of July and early August at the end of July, it fell quickly. If you try to break through a certain high point, it is likely to bring a rapid decline.

During the week of last week, the Fed announced that he would not move his soldiers, continued to keep interest rates, and in the statement removal of inflation to achieve continuous progress. The market is expected that the Federal Reserve may not cut interest rates in the first half of the year. As soon as this news came out, the risk asset market did not decline. To some extent, this also made a good explanation for the decline last Monday:

Many investors are confusing to the plunge caused by Deepseek on Monday. They believe that the emergence of Deepseek has made many companies use less computing power to train models to help the promotion and development of AI. Nvidia's chip designer is hundreds of profit but no harm. But the capital market is often not afraid of bad news of certainty, but more afraid of uncertainty. This is also one of the reasons why Bitcoin was able to quickly recover its decline last week. The brief decline is due to uncertainty, while the subsequent reversal is more like "even bad news, it is predictable."

But this time I want to remind the Fed's subsequent policy path and Trump's radical strategy on the global economy have entered a state of uncertainty. Originally, the Trump team announced that Trump would not start the process of raising tariffs in the early days of his term, but the current fact is that this strategy has been a lot ahead of the expected implementation time, and the impact of increasing tariffs on the US economy is still not unparalleled. It can be seen that this makes the Fed's next move unpredictable.

The two events that may determine the trend of the capital market have become unpredictable that the market becomes extremely fragile, and any follow -up wind blowing may cause market volatility that exceeds expected. Although the author still believes that it is too early to assert that beef and bears are now, the risk factors have been quickly accumulated in the short term. Even if a large number of policies that support Web3 development have been proposed in the future, even if the United States supports government investment in Bitcoin in a short period of time, it may still be unable to offset the impact of macro uncertainty.

Whether it is the short opening of the S & P 500 Index Futures this morning, the short opening of the US dollar index and the recent new high price of gold prices indicate a large amount of funds to choose to avoid risks. The other side of Crypto can bring excess revenue is a huge loss that many people cannot bear. The author recommends that in a market environment with an uncertainty, look at the more strategies.