Think deeply: Should the United States establish a strategic reserve of Bitcoin?

Reprinted from panewslab

02/05/2025·2MAuthor: Christian Catalini, co -founder of LightSpark

Compilation: Luffy, ForeSight News

The United States is benefiting from the so -called "excessive privileges" of economists. As the issuer of the world's reserve currency, the United States can borrow money and support new expenses with its national currency. However, this does not mean that the United States can print banknote at will, and national debt must still attract buyers in the open market. Fortunately, U.S. Treasury bonds are widely regarded as the safest assets in the world. It has strong demand, especially during the crisis period, which is a general risk aversion option for investors.

Who is profitable from this "excessive privilege"? First, there are U.S. policy makers who gain additional flexibility in fiscal and monetary policy decisions. Followed by banks, they are at the core of global capital flow, earning costs and impact. But real winners are American companies and multinational companies. They can use their domestic currencies to carry out business, and they can issue bonds and borrowings cheaper than foreign competitors. In addition, consumers enjoy stronger purchasing power, lower borrowing costs, and easier loan loans.

What is the result? The United States can maintain higher deficits for a long time with lower costs, and resist economic impact that may cause other countries to be in trouble. However, this "excessive privilege" is not for granted, but must be strived for. It depends on the economic, financial and geopolitical strength of the United States. Ultimately, the entire system relies on one key factor: trust. Trust in U.S. institutions, governance, and military power. Most importantly, it is believed that in the end the US dollar will remain the safest place to store savings around the world.

All of this has a direct impact on the Trump administration’s proposed Bitcoin reserves. Supporters of Bitcoin reserves have not been wrong about the long-term strategic role of Bitcoin, but the time has not come. At present, the real opportunities are not simply hoarding Bitcoin, but to actively guide Bitcoin into the global financial system to strengthen rather than weaken the US economic leadership. This means utilizing both the US dollar stablecoin and Bitcoin to ensure that the United States leads the next era of financial infrastructure.

Before exploring this, let us first analyze the role played by reserve currencies and their issuing countries.

The rise and fall of reserve currencies

History shows that reserve currencies belong to the dominant country in the world economy and geopolitics. At its peak, the dominant country formulated rules for trade, finance and military power, giving its currency global credibility and trust. From the Portuguese real in the 15th century to the US dollar in the 20th century, reserve currency issuing countries have shaped markets and institutions, attracting other countries to follow suit.

But no currency can always dominate. Over-expansion, whether it is due to war, high expansion actions or unsustainable social commitments, will eventually erode credibility. The Spanish Balir Silver coin, which has a strong silver reserve from Latin America, has gradually declined as Spanish debt has continued to increase debt and poor economic management. The Dutch guil gradually declined as endless wars exhausted Dutch resources. The French franc, which dominated the 18th and early 19th centuries, was weakened under the weight of revolution, Napoleonic Wars and financial mismanagement. The British Pound, once the cornerstone of global finance, gradually collapsed under the influence of post-war debt and the rise of US industry.

The lessons of history are obvious that economic and military power may create a reserve currency, but financial stability and institutional leadership ensure its status. Losing these foundations, the privileges disappear.

Is the dominance of the US dollar coming to an end?

The answer to this question depends on the starting point of time. Before and after World War II, through the Bretton Forest Agreement, the US dollar consolidated its status as a world reserve currency, and even earlier, after the United States became the main global debt country after the First World War. No matter which time point the US dollar has dominated the world economy for more than 80 years. By historical standards, it was a long time, but not unprecedented, and the pound also ruled for about a century before its decline.

Nowadays, some people believe that the United States' world hegemony is disintegrating. China's rapid development in artificial intelligence, robotics, electric vehicles and advanced manufacturing industries marks a transfer of power. In addition, China has important control in key minerals that are vital to shaping the future. Other warning signals are also constantly appearing. a16z co-founder Mark Anderson called DeepSeek's R1 launch a "Artificial Intelligence Sputnik moment" for the United States, a wake-up call that the U.S. leadership in emerging technologies is no longer solid. At the same time, China's expanding military power in air, sea and cyberspace, as well as its growing economic influence, has raised an urgent question: Is the dominance of the US dollar under threat?

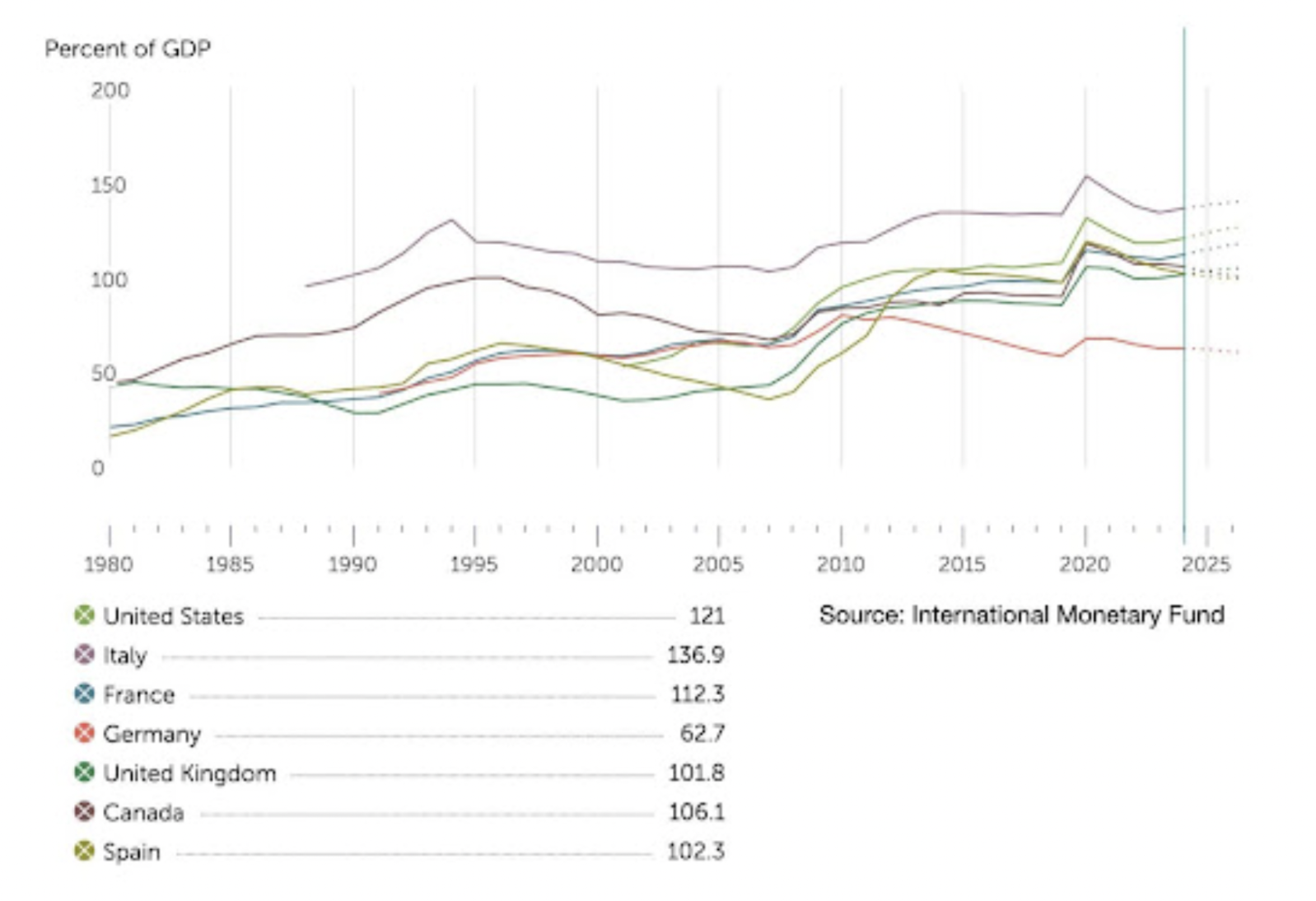

Debt as a percentage of GDP in some major economies. Source of data: International Monetary Fund

The short answer is: Not yet. Despite rising debt and false information that the dollar is about to collapse, the United States is not on the brink of a fiscal crisis. Indeed, the debt-to-GDP ratio is at a high level, especially after spending has increased significantly during the pandemic, but it is still comparable to other major economies. More importantly, the vast majority of global trade is still in US dollars. The RMB is closing the gap with the euro in some international settlements, but it is far from enough to replace the US dollar.

The real question is not whether the dollar will collapse, it won't. What is really worrying is whether the United States can maintain its leading position in innovation and economic strength. If trust in U.S. institutions is eroded, or the United States loses its competitive advantage in key industries, the cracks in the dominance of the dollar may begin to emerge. Those betting on the decline of the dollar are not only market speculators, but also the geopolitical rivals of the United States.

This does not mean that fiscal discipline is irrelevant. It is extremely important. Reducing spending and increasing government efficiency through the Ministry of Government Efficiency (DOGE) or other means will be a welcome change. Streamlining outdated bureaucracy, removing entrepreneurial barriers, and promoting innovation and competition can not only reduce wasteful public spending, but also strengthen the U.S. economy and consolidate the dollar's position.

Coupled with the United States' continued breakthroughs in artificial intelligence, cryptocurrencies, robots, biotechnology and defense technology, this approach can emulate the US regulatory and commercialization model of the Internet, drive a new round of economic growth and ensure that the US dollar remains The world's undisputed reserve currency.

Can Bitcoin reserves consolidate U.S. financial leadership?

This leads to the idea of Bitcoin’s strategic reserves. Unlike traditional reserve assets, Bitcoin lacks historical support for national institutions and geopolitical forces, but this is exactly the key. It represents a new paradigm: no state support, no single point of failure, completely globalized and politically neutral. Bitcoin provides an alternative that operates outside the constraints of traditional financial systems.

While many see Bitcoin as a breakthrough in computer science, its true innovation is even more profound: it redefines the way economic activity is coordinated and the way value is transferred across borders. As a decentralized, trustless system (and its anonymous creator exerts no control), the Bitcoin blockchain acts as a neutral, universal ledger, an independent framework for recording global credit and debt. , without relying on central banks, financial institutions, political alliances or other intermediaries. This not only makes it a technological advance, but also structurally changes the way financial coordination works globally.

This neutrality gives Bitcoin a unique resilience to debt crises and political entanglements that have historically led to the collapse of the fiat currency system. Unlike traditional monetary systems that rely deeply on national policies and geopolitical changes, Bitcoin’s operations are not controlled by any single government. This also gives it the potential to become a common economic language among countries that had resisted financial integration or completely rejected a unified ledger system. For example, the United States and China are unlikely to trust each other's payment channels, especially as financial sanctions increasingly become powerful tools for economic warfare.

So, how will these split systems interact? Bitcoin could become a bridge: a globally common settlement layer with minimum trust requirements, connecting the originally competing economic sectors. When this idea becomes a reality, the US holding of strategic Bitcoin reserves will undoubtedly make sense.

But we haven't reached this point yet. To bring Bitcoin beyond investment assets, critical infrastructure must be developed to ensure scalability, establish a modern compliance framework, and provide channels for seamless access to fiat currencies for mainstream adoption.

The supporters of Bitcoin reserves’ views on its potential long-term strategic role are not wrong, but the time is not yet available. Let's explain the reason.

Why should the country maintain its strategic reserves?

The reason why countries reserve strategic materials is simple: in a crisis, the convenience of obtaining materials is more important than price. Oil is a typical example. Although the futures market can hedge prices, when the supply chain is interrupted by war, geopolitical or other interference, no amount of financial means can replace the physical oil at hand.

The same logic applies to other essentials, such as natural gas, food, medical supplies, and increasingly important key raw materials. As the world transitions to battery-driven technology, governments are already stocking up on lithium, nickel, cobalt and manganese to cope with future shortages.

The same is true for currency. Countries with large amounts of foreign debt hold US dollar reserves in order to extend their debts and prevent local currency crises. But the key difference is that no country currently bears a lot of Bitcoin debt, at least not yet.

Bitcoin supporters believe that the long-term price movement of Bitcoin makes it obviously a reserve asset. If the United States buys now, the value of this investment may grow exponentially as Bitcoin adoption continues to increase. However, this approach is more in line with the strategy of sovereign wealth funds, which is to focus on returns on capital rather than reserve strategies that are crucial to national security. It is better for countries with rich resources but economic imbalances, who want asymmetric financial gains, or for countries with weak central banks and hope that Bitcoin can stabilize their balance sheets.

So what is the situation in the United States? It does not need to maintain economic operations than Tetcoin, and although President Trump recently announced the establishment of a sovereign wealth fund, cryptocurrency investment may be mainly left for effective configuration for the private market. The strongest reason for building Bitcoin reserves is not due to economic necessity, but strategic positioning. Holding reserves can show that the United States is decisively betting on leading the cryptocurrency sector, establishing a clear regulatory framework, and positioning itself as the global hub of decentralized finance (DeFi), just as it has dominated traditional finance for decades. Same. At this stage, however, the cost of this move may outweigh the benefits.

Why Bitcoin Reserves Could Backfire

In addition to the logistical challenges of accumulating and securing Bitcoin reserves, the bigger problem lies in perception, and the cost can be high. In the worst case, this may indicate that people lack confidence in the US government's ability to maintain debt. This is a strategic error that will make geopolitical opponents such as Russia and China take the lead. These two countries have been trying to weaken for a long time. The status of the US dollar.

Russia has not only promoted de-dollarization abroad, but its official media has been spreading rhetoric for years questioning the stability of the dollar and predicting its imminent decline. At the same time, China has taken a more direct approach to expanding the influence of the RMB and its digital payment infrastructure, including challenging the US-led financial system through digital RMB, which is mainly aimed at home, especially in cross-border trade and payments. In the global finance field, cognition is crucial. Expectations not only reflect reality, but also shape reality.

If the U.S. government begins to accumulate Bitcoin on a large scale, the market may interpret it as a hedge against the U.S. dollar itself. This perception alone may prompt investors to sell the dollar or reconfigure capital, thereby weakening the dollar's status. In the global finance field, belief drives behavior. If enough investors start to doubt the stability of the US dollar, their collective actions will turn this suspicion into reality.

The US monetary policy depends on the Fed's ability to manage interest rates and inflation. Holding Bitcoin reserves may send a contradictory signal: If the government is confident in its own economic tools, why should we reserve an asset that is not controlled by the Federal Reserve?

Will Bitcoin reserves trigger the dollar crisis alone? Very impossible. But it may also not be able to strengthen the existing system. In geopolitics and finance, non-essential mistakes are often the most expensive.

Strategic leadership, not speculation

The best way for the U.S. to reduce its debt-to-GDP ratio is not through speculation, but through fiscal discipline and economic growth. History shows that reserve currency will not continue forever, and those declining reserve currencies are often due to poor economic management and excessive expansion. In order to avoid repeating the mistakes of Spain's Balle Silver Coins, Dutch Shields, France, and British pounds, the United States must focus on sustainable economic strength, not adventure financial bets.

If Bitcoin becomes a global reserve currency, the United States will be the country with the largest loss. There will be no smooth transition from the US dollar to the Bitcoin-based system. Some people think that the appreciation of Bitcoin can help the United States "repay" debts, but reality will be much cruel. Such a shift will make it more difficult for the United States to finance its debt and maintain its economic reach.

While many people think that Bitcoin will never become a true medium of exchange and accountancy unit, this is not the case in history. The reason why gold and silver are valuable are not only because of their scarcity, but also because they can be divided, durable, and easy to carry, making it an effective currency, just like today's Bitcoin. Similarly, early Chinese paper money did not initially appear as a medium of exchange forced by the government. It evolved from commercial tickets and deposit vouchers. These vouchers represent the form of value storage that have been trusted, and then it has been widely recognized as an exchange medium.

French currency is usually regarded as an exception of this model. After the government announced as a legal currency, it immediately played a role in exchange for medium and then became a means of value storage. But this is too simplifying the reality. It is not only the legal provisions to give legal currency forces, but also the ability of the government to enforce taxes and the ability to fulfill debt obligations through this power. Currencies backed by countries with strong tax bases have inherent needs because businesses and individuals need it to settle their debts. This taxable power allows fiat currencies to maintain value even without direct commodity support.

But even the fiat monetary system was not established out of thin air. Historically, their credibility stems from commodities that people already trust, the most typical of which is gold. Paper money was accepted precisely because it could once be exchanged for gold or silver. The transition to pure fiat currency was achieved after decades of strengthening.

Bitcoin is following a similar development trajectory. Today, it is mainly regarded as a means of store of value, with high volatility, but is gradually regarded as "digital gold". However, with the expansion of adoption and the maturity of financial infrastructure, the role of Bitcoin as a medium of exchange may follow. History shows that once an asset is widely recognized as a reliable means of store of value, the transition to a functional currency is a natural process.

For the United States, this presents a major challenge. Although there are some policy leverage, Bitcoin is not largely controlled by the currency of the currency to a large extent. If it is recognized as a global exchange medium, the United States will face a severe reality: the status of reserve currency cannot be given up easily.

This does not mean that the United States should resist or ignore Bitcoin. On the contrary, it should actively participate in and shape the role of Bitcoin in the financial system. But buying and holding Bitcoin simply for the appreciation of the price is not the answer. The real opportunity is greater, but also more challenging: pushing Bitcoin into the global financial system in a way that strengthens U.S. economic leadership.

Bitcoin platform strategy in the United States

Bitcoin is the most mature cryptocurrency and is unparalleled in terms of safety and decentralization. This makes it the strongest candidate for mainstream adoption, first as a means of store of value and ultimately as a medium of exchange.

For many people, the attraction of Bitcoin lies in its decentralized characteristics and scarcity, which has promoted its price increase with the acceleration of the adoption rate. But this is a narrow view. Although Bitcoin will continue to value in the process of popularization, for the United States, the real long -term opportunity is not only to hold it, but also to actively guide it into the global financial system and establish itself as an international center of Bitcoin Finance.

For each country other than the United States, simply buying and holding Bitcoin is a completely feasible strategy. It can accelerate the use of bitcoin and obtain financial benefits. But the stakes facing the United States are much more complex and more action must be taken. It requires a different way to maintain its role as the world's reserve currency issuer, but also to promote large -scale financial innovation with the US dollar as the "platform".

The key precedent here is the Internet, which changes the economic landscape by shifting the exchange of information from a proprietary network to an open network. Today, the U.S. government is facing similar choices before the emergence of the Internet, because the financial track is changing towards a more open and decentralized infrastructure. Just like those companies that accept the openness of the Internet's open structure boom, and the anti -resistance companies are eventually eliminated, the United States' attitude towards this transformation will determine whether it maintains a global financial influence or gives positions to other countries.

The first pillar of a more ambitious, future-oriented strategy is to see Bitcoin as a network, not just an asset. With an open, license-free network driving new financial infrastructure, existing companies must be willing to give up some control. However, in doing so, the United States can open up major new opportunities. History shows that countries that adapt to disruptive technologies will strengthen their status, while countries that boycott will eventually fail.

The second key pillar that complements Bitcoin is to accelerate the adoption of US dollar stablecoins. With proper regulation, stablecoins can strengthen public-private partnerships, a relationship that has supported the U.S. financial dominance over the past century. Stabilizing currency will not weaken the dominant position of the US dollar, but it can consolidate it, expand the influence of the dollar, improve its utility, and ensure its correlation in the digital economy. In addition, compared with the slow -moving and bureaucratic central bank's digital currency or international clearing bank "Financial Internet", the unified ledger of the "Financial Internet" provides a more flexible and agile solution.

But not every country is willing to adopt a dollar stablecoin or operate entirely within the U.S. regulatory framework. This is where Bitcoin plays a key strategic role, which can serve as a bridge between the core dollar platform and non-geopolitical ally economies. In this case, Bitcoin can be used as a neutral network and assets, promoting the flow of capital, and strengthening the core role of the United States in global finance, thereby preventing the United States from competing for competitive currencies such as RMB.

If the United States successfully implements this strategy, it will become the center of Bitcoin financial activities, thus having greater influence, and guide these funds to flow in accordance with the interests and principles of the United States.

This is a subtle but feasible strategy that, if implemented effectively, could last the dollar's influence for decades. Rather than simply hoarding Bitcoin reserves, which may suggest doubts about the stability of the dollar, strategically integrate Bitcoin into the financial system and promote the development of USD and USD stablecoins on the Internet, which will make the U.S. government active management rather than passive bystanders.

What are the benefits? A more open financial infrastructure, while the United States still controls the "killer application" - the US dollar. This approach is similar to what companies like Meta and DeepSeek do, which set industry standards through open source AI models while making profits in other ways. For the United States, this means expanding the dollar platform and interoperating it with Bitcoin, ensuring that the dollar remains relevant in the future where cryptocurrencies play a central role.

Of course, like any move to deal with disruptive change, this strategy also has risks. But the price of resisting innovation is being eliminated. If any government can successfully implement this strategy, it is this government, which has deep expertise in platform competition and clearly recognizes that staying ahead is not about controlling the entire ecosystem, but about how Get value in it.

jinse

jinse