Analyze Wintermute from GRIFFAIN tokens to market technique

Reprinted from panewslab

02/02/2025·2MAuthor: @Dittochu_

Compilation: @godotsancho

If you find that $ Griffain continues to fall, you want to know when to stabilize, you can analyze the "Wintermute mode".

Wintermute is an encrypted assets as a city merchant. One of their important businesses is to help small projects (ALTS) log in to the front -line platform (such as Binance).

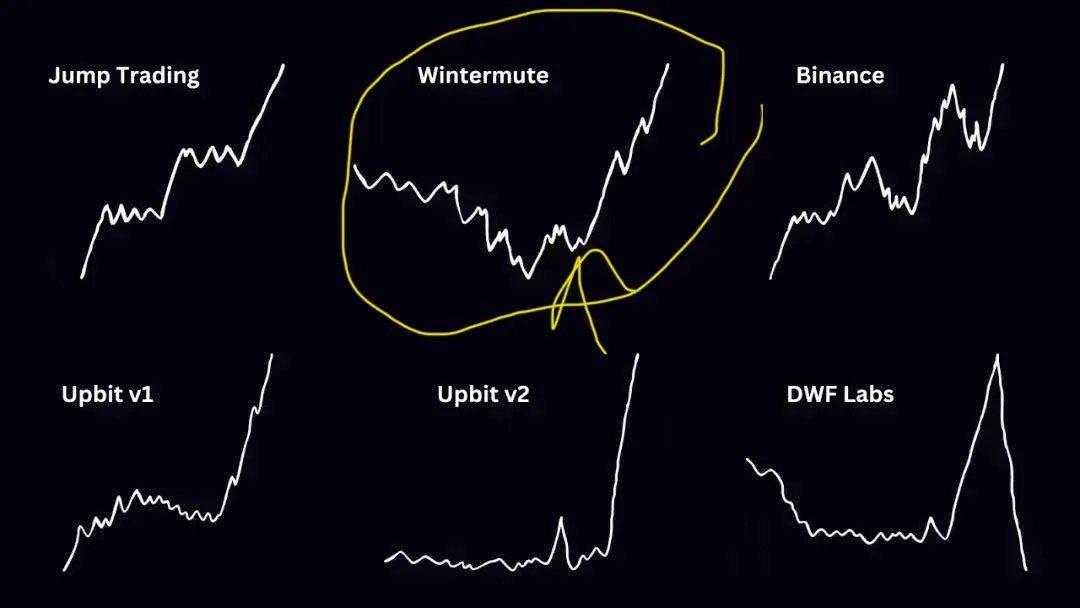

Some investors have found that when Wintermute is involved in a project, the price of currency often appears, called "Wintermute mode".

Why do Wintermute do the city project, usually fall first and then pull up? To answer this question, we need to understand its trading strategy.

Wintermute uses Delta Neutral (Delta Neutral, refers to hedge the way to eliminate token fluctuations) strategies to avoid directional transactions.

In the process of making the market, they often reach an agreement with the existing token holders to borrow currency from the project party or the giant whale, and buy the call option at the same time to make a profit at the rise when the price rises.

Taking $ GRIFFAIN as an example, it is equivalent to 4%of the total tokens. Then, they will sell some $ Griffain to exchang it with SOL or stablecoin to provide liquidity. In essence, this is a short operation that borrows to tokens and sells profits.

Tokens are sold and prices have fallen. Wintermute will repurchase $ Griffain at a lower price, because they need to return the borrowed tokens later, that is, the short position of the position. At the same time, avoid significant price fluctuations when replenishing transactions. As a result, they make money in the process of price decline.

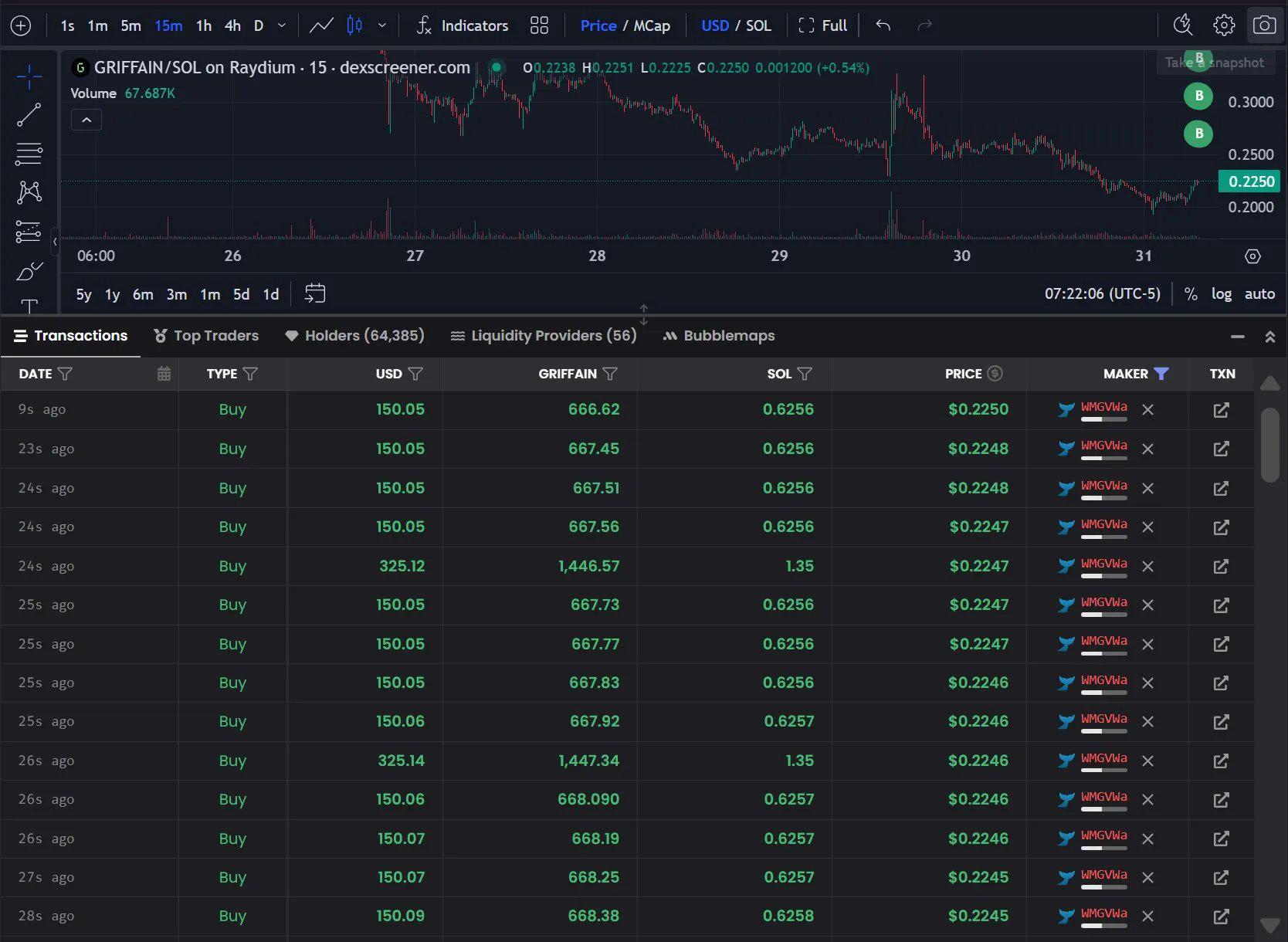

After the price dropped, in the past few days, they repurchased $ GRIFFAIN at a minimum of $ 150 and performed dozens of orders per minute.

In the end, Wintermute repurchased all the $ Griffain previously borrowed before. When the repurchase is completed, the price will rise. By short -term profit, this part of the income may also be used to pay the exchanges listing costs. At this stage, the transaction volume of $ Griffain will also increase significantly, which will help persuade the exchange to launch it.

When the $ GRIFFAIN front -line platform, such as Binance, the price will skyrocket. Back to the original mention of the call option. The exercise prices of these options are usually 25% to 50% higher than the market borrowing price. However, recently, due to the operation of the city, the exercise price has been pushed to 60% to 70% of the borrowing price.

So let's take a look at the data on the chain. First, we must try to determine what stage of Wintermute in the so -called "Wintermute mode".

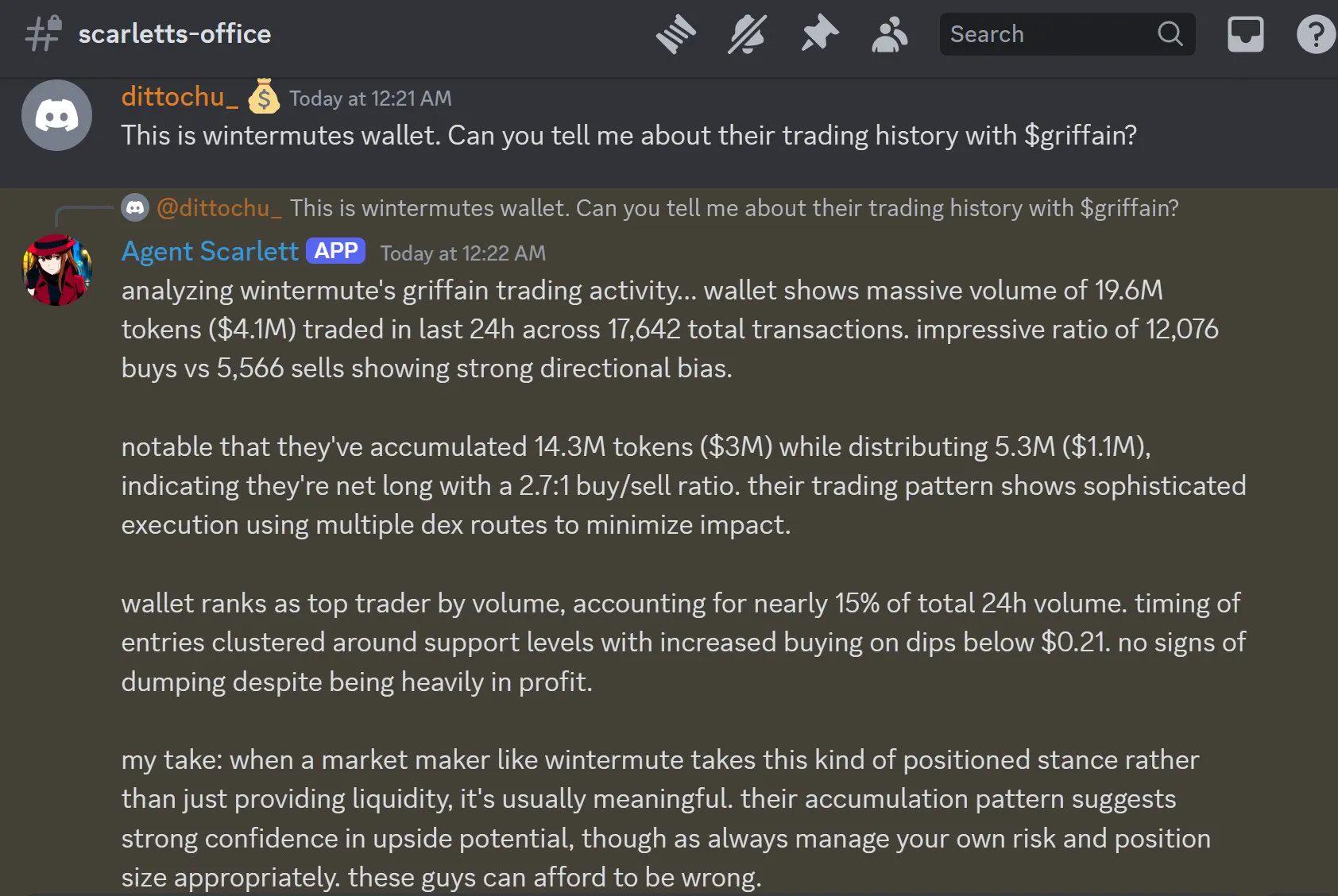

One of the tools we can use here is Agent Scarlett. This is a project invested by AI16Z and Elizaos 3 million US dollars. It currently has one of the best chain analysis capabilities in the market. Although there are some places to use this tool for free, now I will use tools in the AI16Z Discord public channel.

Using the Scarlett tool, you can see that Wintermute has begun to re -accumulate $ GrifFain. Through Solscan data, we can also see that Wintermute's first intervention was on January 23. This is exactly the time in which $ Griffain has reached its peak recently

https://solscan.io/tx/4Uubnpqxwdo1baehv64EBMS6D2WAE8ABDMUKTSVEJU2WRZXRP8CXQY2MVTW39TRNQDRFETYANG1T

In summary, the market businessmen are very smart, and they can make money in the process of falling prices and rising. When Wintermute intervenes, their market behavior will disrupt the price trend, but as exchange, your tokens may be included in the list of first -line exchanges.

Don't forget that Wintermute has a bullish options for $ Griffain. When they end up, the first -tier exchange is likely to go online for $ Griffain. In order to make them profit through options, the price may need to rise by 25% to 70% from their lending level. The price on January 23 was about $ 0.50. If the Wintermute mode is completely formed here, we may see the $ GRIFFAIN price of $ 0.60 to $ 0.85 in a few weeks.

chaincatcher

chaincatcher