Analyzing BGB investment opportunities and price trends, it may reach US$31.66 within the year

Reprinted from panewslab

01/08/2025·1M

Author: Crypto Frontline (Brother Sugar) @Xxoo3k5k

Recently, the Bitget platform currency BGB has risen against the trend, and the increase has been staggering. Some people in several communication groups of the author regretted not getting on the bus. On December 27, Bitgte announced that it would destroy BGB worth over US$5 billion. Affected by this news, the price of BGB hit ATH US$8.49 that day, and the market value once exceeded the tens of billions mark.

On December 30, Bitget announced that it had completed the destruction of 800 million BGB (accounting for 40% of the total supply and worth over US$5 billion), and the total market value dropped to about 8.9 billion. BGB's destruction plan originates from the newly released white paper. The entire plan includes this destruction and quarterly destruction plans. In the future, 20% of Bitget exchange and wallet business profits will be used to repurchase and destroy BGB every quarter in order to implement the BGB deflation model commitment. This is further positive for the market.

This series of market performance and initiatives have made BGB the focus of the industry recently, attracting widespread market attention. This article will review the development history of the platform currency and BGB's recent market performance data, help readers analyze the logic behind the rise of BGB, and analyze its future trend and whether there are any investment profit opportunities.

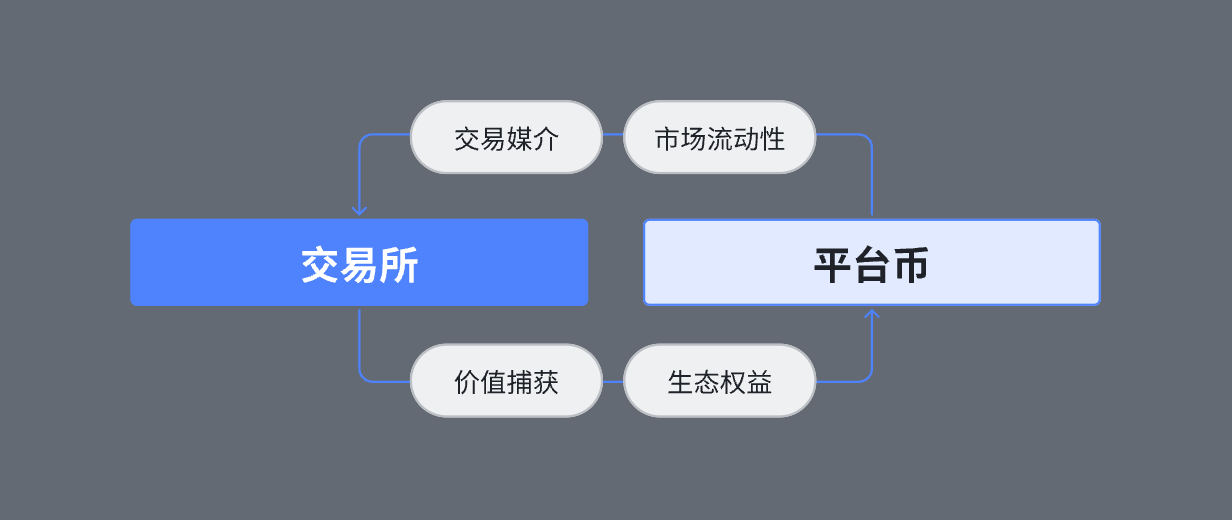

1. Symbiotic evolution of CEX and platform currency

In the complex ecology of cryptocurrency, CEX (centralized exchange) and platform coins are like a synchronous rising spiral, driving each other and developing collaboratively. As the core hub of cryptocurrency trading, CEX provides investors with an efficient and convenient trading environment, gathering massive funds and transaction flows. In the process of development, CEX launched a series of innovative financial products to attract more investors, and the platform currency came into being in this process.

The platform currency was initially mainly used to meet the exchange's internal transaction needs, such as deducting transaction fees. With the continuous development of the market, the functions and values of platform coins have gradually diversified and been given more application scenarios. For example, users can use the platform currency to participate in various activities on the exchange, such as voting for currency listing, subscribing for high-quality project tokens, etc. In the voting for currency listing, users who hold platform coins can vote for projects to be launched based on the number of coins they hold. If the project is successfully launched, users may receive certain rewards, which not only enhances users' role in platform governance A sense of participation also provides users with additional revenue opportunities. In addition, some platform coins have begun to get involved in the field of decentralized finance (DeFi), providing users with financial services such as lending and pledging.

The core value of the platform currency can be summarized as follows:

- Transaction medium: Platform coins are widely used in payment scenarios for transaction fees, and provide users with varying degrees of discounts. This enables the platform currency to form a stable demand foundation within the exchange ecosystem, and its value as a trading medium is highlighted.

- Ecological rights and interests: Platform currency is an important certificate for users to deeply participate in the exchange ecosystem and obtain various rights and interests, such as participating in potential project subscription and voting for currency listing activities and receiving rewards.

- Value Capture: As the exchange’s business expands, the number of users grows, and market share increases, the platform’s profitability and market influence will continue to increase, allowing platform currency holders to share in the economic benefits of the exchange’s growth.

- Market liquidity: The high liquidity of the platform currency enables it to have a price discovery function, which has an important impact on the resource allocation and risk pricing of the entire market.

We can clearly see the interdependent and mutually reinforcing relationship between CEX and platform currencies. The development and growth of CEX has provided broad application scenarios and solid value support for the platform currency, while the innovation and application of the platform currency have further enhanced the competitiveness and user stickiness of CEX.

However, this development process has not been smooth sailing. For example, there have been many incidents where CEX was attacked by hackers due to security vulnerabilities, resulting in heavy losses of user assets and a sharp decline in platform currency prices. These incidents have sounded the alarm to the entire encryption industry and reminded investors of the investment risks of platform coins.

2. The rise of BGB and Bitget

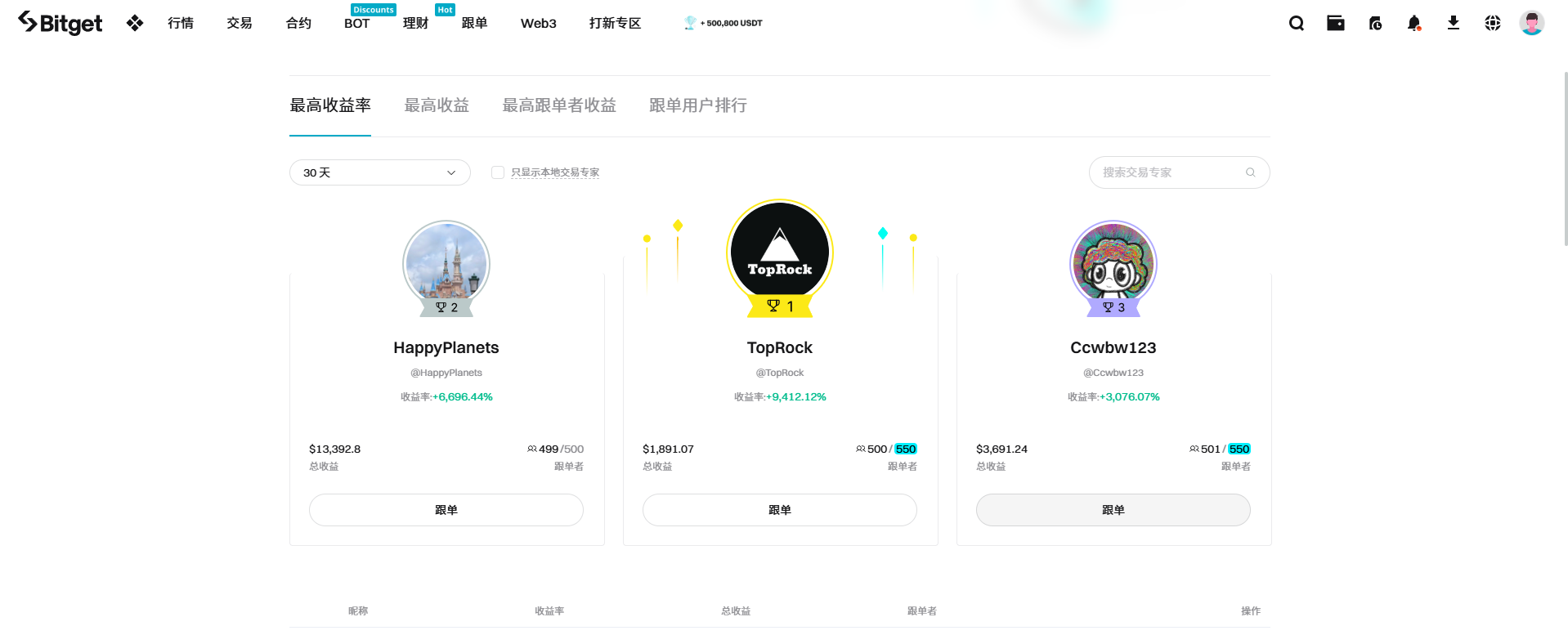

This section first gives an introduction to BGB and Bitget. Bitget is a cryptocurrency derivatives exchange established in 2018, providing spot, derivatives and copy trading. After a period of exploration, Bitget suspended spot trading in 2019 and instead launched U-standard contracts, turning losses into profits. The first copy trading in 20 years has greatly lowered the threshold for cryptocurrency trading, allowing novice investors to follow the strategies of professional traders, thereby attracting a large number of new users to the platform. Since then, "product innovation" has become Bitget's foundation.

After several years of development, Bitget transformed from derivatives to a comprehensive exchange with multi-dimensional operations. In 2022, Bitget began to expand its team and focus on operations and growth. It opened up KOL channels in East Asia and copied the methodology to Asia and Europe. Users The number has grown rapidly from 300,000 at the beginning of 2021 to 20.2 million at the end of 2023.

In the past 24 years, Bitget has focused on expanding globalization, compliance and Web3 on-chain entrances, and disclosed executives with backgrounds corresponding to the goals - COO Vugar Usi Zade with many years of experience in multinational markets, CLO Hon Ng who is responsible for compliance and legal GR, and former CEO Gracy Chen, an investor in BitKeep.

Currently, the Bitget team has more than 1,500 people, serving more than 45 million users in more than 150 countries and regions. The average daily trading volume exceeds 10 billion U.S. dollars. It is the world's largest cryptocurrency trading platform and ranks fourth in comprehensive market share among cryptocurrency exchanges.

As the native token of the Bitget platform, BGB has experienced continuous evolution and expansion in its role and functions since its birth. BGB was first launched on July 29, 2021. At first, it was mainly used to deduct transaction fees within the platform. Later, with the gradual improvement of the Bitget ecosystem, BGB’s application scenarios have been fully expanded, such as LaunchPad new creation, LaunchPool Mining etc.

In Bitget's LaunchPad, users who hold BGB can get priority to subscribe for new project tokens, which provides users with the opportunity to participate in high-potential projects early and obtain generous returns. In LaunchPool mining, users can participate in the division of new tokens by staking BGB to achieve disguised dividends. In addition, BGB also plays a role in Bitget's ecological governance. It is a key tool to encourage users to actively participate in platform decision-making and increase transaction activity, further enhancing the interaction and stickiness between users and the platform.

In terms of currency price trends, after Bitget restarted spot products and released BGB in 2021, the market turned from bullish to bearish. However, with the launch of Bitget's multiple products and the rapid implementation of its brand strategy, BGB's independent market has soared, reaching new highs every time. After an average correction of 30%, the average price rose by 250%, which was a very impressive performance, and finally stayed at around US$0.2 at the end of 2022. From 2023 to 2024, the bear market turned bullish. As Bitget released products such as Bitget Wallet and expanded in the Middle East and other regions, BGB followed the trend and rose to a new high of $1.486, before making a slight correction. Entering December, BGB began to surge. After the Bitget team announced the merger of BGB and BWB (Bitget Wallet Token) on the 26th, it rushed to a new high of $8.49, and then fell back to around $6.

Regarding the repurchase and destruction mechanism of BGB, as of December 30, 800 million BGB held by the core team had been destroyed for the first time, and then a quarterly destruction mechanism was launched in 2025, with 20% of the profits of the exchange and wallet used for repurchase and Destroy BGB and ensure that the destruction record is open and transparent. The current circulation of BGB has been reduced from 2 billion to 1.2 billion. This move demonstrates Bitget's commitment to the BGB deflation model and its determination to accelerate ecological development.

The two core attributes of the platform currency are asset attributes and tool attributes. The former is the value projection of the exchange, and the latter is the "points-type" tool operated by the exchange. BGB is an asset that embodies the market value of the exchange in the Bitget exchange ecosystem and runs through different products and businesses. The operating points that run through the three-party relationship between the exchange, the project party and the user, borrowing the B-side interests of the project party, BGB empowers the exchange to use services to retain C-side users and their assets, and then distribute dividends with the golden shovel attribute of BGB The profit-sharing C-side is expected to be fixed, forming a positive cycle of asset precipitation and asset increment. At the same time, it helps the B-side obtain early liquidity and early users, and allows the C-side to jointly build an ecosystem.

3. Comparison between BGB and mainstream platform currencies

In the cryptocurrency market, mainstream platform coins such as BNB and OKB rely on their respective exchanges to provide users with diversified rights and services, participate in the development of the ecosystem, and continuously innovate and optimize to consolidate their market position.

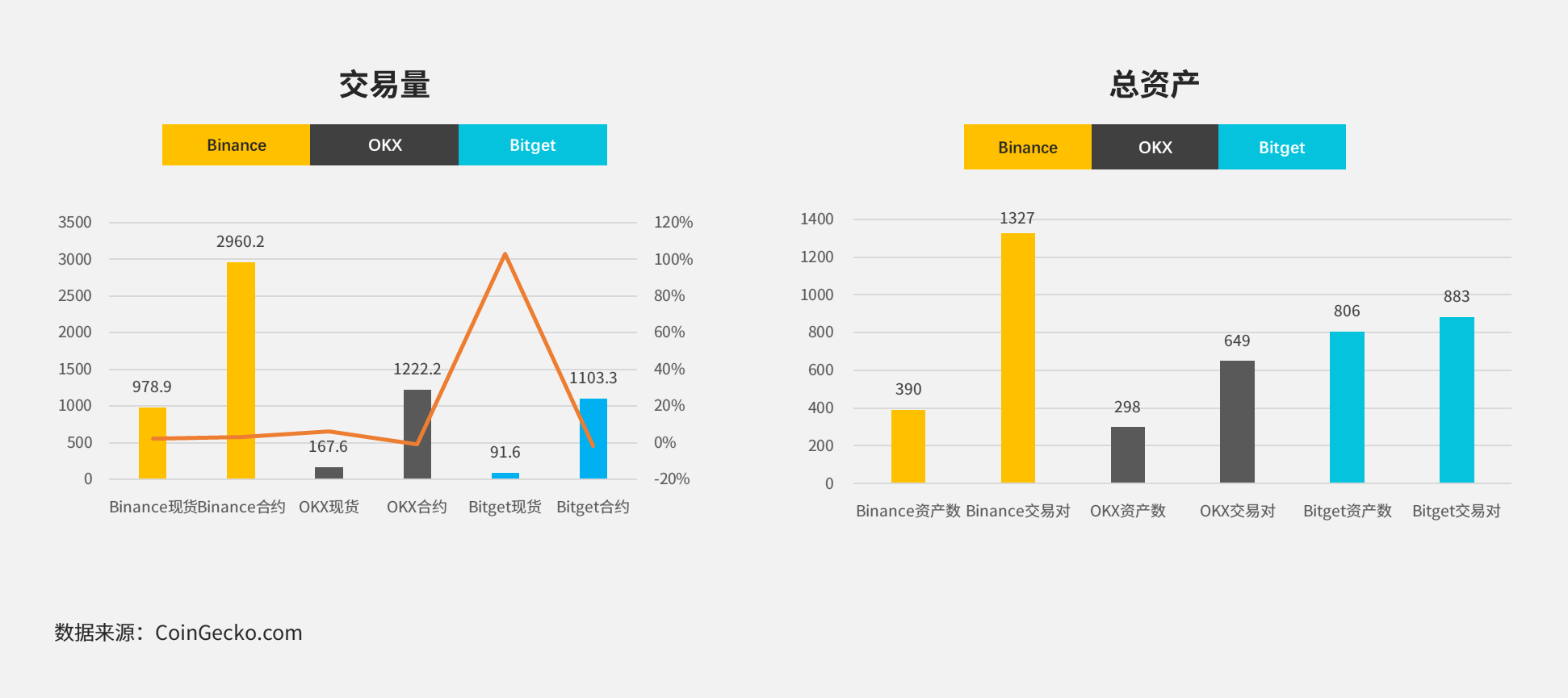

First, make some comparisons with mainstream CEX:

- As can be seen from the chart, the trading volume of various exchanges in December did not change much from the previous month. However, Bitget’s spot trading volume increased by 102.7% from the previous month, which is a very prominent increase. This is in line with various important measures of Bitget in December and BGB. Factors such as price increases are highly correlated, reflecting market approval;

- In terms of the number of assets, Binance and Bitget have relatively abundant assets and trading pairs, and the asset accumulation of Altcoin, which is mainly platform currency, accounts for more than 45%, indicating that the assets are of higher quality and users are more willing to hold them.

Secondly, the comparison of mainstream platform currencies is as follows:

- In terms of currency price and market value, BGB leads the way: the currency price increased by 153.59% on the 30th, and an increase of 880.63% in the past year; the market value increased by 208.98% on the 30th, and an increase of 828.09% in the past year. Both are well above BNB and OKB, reflecting strong market confidence.

- In terms of average daily trading volume, BGB's average daily trading volume is lower than BNB and higher than OKB; however, in terms of growth, BGB increased by 264.02% month-on-month and 1335.08% year-on-year, significantly ahead of other platform currencies. The liquidity brought by the full exchange of chips means, on the one hand, that the price discovery mechanism is more effective and provides a more reasonable price for investment; on the other hand, it also means an increase in fee income, which provides more opportunities for the continued operation and development of Bitget. More financial support will be provided for technology upgrades, safety maintenance and new business development.

- In terms of V/MC coefficient, OKB is lower than 1%, at 0.53%; BGB and BNB are both higher than 1%, and BGB is as high as 3.12%. The V/MC coefficient can reflect the evaluation status of market value to a certain extent. A higher V/MC reflects that BGB may still be undervalued by the market and has greater upside potential.

- In terms of equity, BGB has added the final piece of the "buyback" puzzle after launching the quarterly destruction plan, and BNB has also improved the airdrop function in the new version of the wallet. The ecological empowerment of the two is relatively more comprehensive. BGB develops new products such as LaunchPad, LaunchPool, PoolX, etc., as well as ecological applications on the Bitget Wallet and Morph chains, and has more channels to obtain revenue.

4. Factors supporting BGB’s current rise

Next, we try to do some analysis on the reasons for BGB’s current rise, judge and understand whether its price is strongly supported, what are the positive and negative factors, and whether there are still profit opportunities.

The author believes that the following factors support the price of BGB:

- Continuous innovative product releases. Whether it was the debut of U-standard contracts and copy trading in the early years, or Launchpad, LaunchPool, and PoolX, Bitget continues to attract new users and promote activity through innovative products on the user side. The addition of new users has brought more funds and trading activity to the platform. Combined with BGB for asset operations, we will continue to deepen user stickiness and jointly promote the market demand and price increase of BGB.

- MCN-based differentiated play and global channel control. Bitget has established its own global KOL channel through MCN-based differentiated play. The follow-up transaction is similar to live streaming. It uses KOL to release the accumulated advantages of contract business and increase transaction frequency and user stickiness with low threshold. With the rapid growth of new users in many places in Asia and Europe, the demand for BGB has also been further boosted.

- Explicitly deliver on deflationary model commitments. The Bitget team has fulfilled its commitment to the BGB deflation model, destroyed 40% of the BGB held by the team in circulation and launched a quarterly destruction plan. This demonstrates the team's determination for long-term development and eliminates previous market doubts about its team's currency holdings. At the same time, the increased scarcity of BGB is also an important factor that directly increases the price.

- BGB and BWB merge. With this move, the Bitget team has clarified the core position of BGB and further expanded the function and value of BGB's incentive activities in the original wallet business. At the same time, it has eliminated new users' confusion about the two currencies in the exchange and wallet business. Breaking down the barriers to participating in various activities within the ecosystem.

- Continuous improvement of user experience. Bitget's continuous optimization of user services, such as providing multi-lingual customer service support, improving the user experience of the trading interface, etc., has also enhanced users' stickiness to the platform, making users more willing to hold and use BGB, thus providing support for the increase in the price of BGB. Adequate user base support.

It can be seen that many adjustments and optimizations related to BGB and Bitget form a flywheel: on the one hand, by optimizing the user experience of new users, it forms a positive cycle with its high-speed global new recruitment activities; on the other hand, through BGB combining funds Management tools are used to promote activation and precipitation, and continue to convert deep users; the increase in BGB usage demand drives the currency price to rise, and the room for currency price increase further stimulates the entry of new users.

5. Analysis of BGB investment opportunities

Regarding the current feasibility of BGB investment, here is a summary and supplement of the positive and negative factors:

Pros:

- Strong growth momentum: In the past month, the price of BGB has shown strong growth momentum, with a high cumulative increase, far exceeding mainstream platform coins such as BNB and OKB. The Bitget exchange behind it has performed well in the derivatives business and has seen significant growth in market share. According to Coinglass data, it ranks among the top three in 24-hour contract trading volume of BTC and ETH.

- Rich empowerment measures: multiple benefits such as Launchpad new coin mining, Launchpool new coin mining, VIP experience, handling fee discounts, preferential price subscription for mainstream coins, additional income from financial management, and free withdrawals, etc., bring diverse benefits to holders. Among them, the wealth gains created by Launchpad are particularly significant, and high frequency and high returns are one of its highlights.

- Expansion of application scenarios: In addition to using BGB as a way to pay gas fees, Bitget is also promoting its application in mainstream public chains and DeFi ecology, increasing on-chain liquidity, staking revenue, and opportunities to obtain cooperative token airdrops.

- Deflation mechanism: Bitget promises to maintain the status of BGB tokens, and plans to allocate 20% of exchange and wallet fee income every quarter from 2025 to repurchase BGB and enter it into a black hole address for destruction. The core team has recently been destroyed With 40% of tokens held, this will reduce BGB’s circulating supply and may help increase its value.

- Application in PayFi field: BGB is actively exploring applications in payment, DeFi, NFT and other fields. For example, some merchants accept BGB as a means of payment, and some DeFi projects integrate BGB as a mortgage asset. PayFi tools such as Bitget Card and Bitget Pay are currently launched. Holding a certain amount of BGB can unlock specific merchant discounts, consumer feedback, rate discounts and more services.

- The market valuation is relatively low: Judging from the V/MC coefficient mentioned above, BGB may still be undervalued by the market, and there is still much room for improvement compared to BNB and OKB. This is also a reference factor.

Negative factors:

- Insufficient depth of the on-chain pool: This may affect the execution efficiency and price stability of some transactions.

- Relatively low market capitalization: The market capitalization is relatively low compared to BNB and others, which may lead to relatively large price fluctuations and relatively weak market influence and liquidity.

- Price overheating: BGB prices have been rising fiercely recently. Such a large price increase may be divorced from its fundamentals to a certain extent. There are signs of price overheating. Once market sentiment turns, prices may fluctuate significantly.

It can be seen that its advantages such as strong price growth, rapid platform development, active community, rich application scenarios, deflation mechanism and layout in PayFi and on-chain development provide opportunities for investment. Disadvantages such as the shallow pool on the chain and low market value cannot be ignored, which may lead to large price fluctuations and affect transaction efficiency.

6. BGB price forecast in 2025

There are more positive factors in 2025 than in the past few years, such as Trump’s support for cryptocurrency, the liquidity brought by the global interest rate cut cycle, and more recognition of cryptocurrency by countries around the world. In 2025, especially in the first quarter, It may be an explosive stage of the market.

Considering BGB's current destruction action and subsequent deflation mechanism, its more potential undervalued market value than BNB, its stronger growth trend and more comprehensive ecological applications than OKB, all have provided solid support for the price of BGB. In 2025 The BGB performance will be more worth looking forward to than last year's BNB performance.

Therefore, in terms of specific price prediction, the author uses BGB's current price of US$6 as the base, and calculates the room for BGB currency price increase based on the V/MC coefficient, transaction volume growth rate and deflation model.

- The price calculation for the whole year is mainly based on three relevant factors: it is known that the current V/MC coefficient of BGB is 3.12%, and it is assumed that the market is appropriately revised to the ideal value of 1%, reaching 2.5%; it is known that the transaction volume growth rate in the past 365 days 1335.08%. It is conservatively assumed here that the growth rate will reach 250% in 2025; BGB’s circulation is expected to decrease at a rate of 5% throughout the year due to the deflation plan.

- V/MC = trading volume/market capitalization, so when V/MC decreases and trading volume increases, market capitalization will increase accordingly. V/MC dropped from 3.12% to 2.5%, and the trading volume increased by 400%. It is calculated that the market value will increase to 4.38 times the current value, recovering the undervalued part of the market value.

- Combining the formula of market value = currency price × circulation volume, since the market value has increased to approximately 4.38 times the original market value and the circulation volume has decreased by 5% due to the deflation model, it can be concluded that the currency price will rise to approximately 4.61 times the current currency price.

- The value of BGB's LaunchPool, LaunchPad, PoolX and other revenue-generating products, as well as the further application expansion in the Bitget Wallet and Morph chain ecology after the merger of BGB and BWB, add an overall 10% weighting, and it can be concluded that the currency price increase will reach 5.071 times. Coupled with the optimistic investment sentiment brought about by the increase, the actual increase may be even higher.

- The short-term (first quarter of 2025) forecast involves fewer factors. The two factors of V/MC coefficient revision and decrease in circulation will not have a significant impact. Only the increase in transaction volume and the reduction in circulation caused by the first destruction are considered. With these two factors, a price increase of about 1 times can be conservatively estimated.

Here is the author’s final predicted price: a new high of $ 12.34 in the first quarter of 2025 , and $ 31.66 during the year .

Readers should then comprehensively consider their own risk tolerance and investment goals when establishing a position, pay close attention to BGB's recent performance in application expansion, on-chain construction and market competition, make careful decisions after weighing the pros and cons, and include it in diversified investments appropriately. It is not advisable to overweight the portfolio to prevent potential risks from having a greater impact on the investment portfolio.

The above is the author's development review and future judgment of BGB based on public information. I hope that the analysis in this article can provide some valuable reference for investors. But please remember that investment decisions should be based on comprehensive research and prudent judgment, and do not blindly follow trends. At the same time, we should also pay close attention to crypto market dynamics and industry development trends in order to adjust investment strategies in a timely manner.