Berachain announces $632 million BERA airdrop plan and launches main network

Reprinted from jinse

02/06/2025·2MAuthor: Tom Mitchelhill, CoinTelegraph; Translated by: Tao Zhu, Golden Finance

The Berachain Foundation, an organization supporting the Liquidity Proof Layer 1 blockchain, has announced its airdrop plan for native BERA tokens worth approximately $632 million, to be distributed when the main network launches on February 6.

In a February 5 post to X, Berachain announced the launch of the same Layer 1 mainnet as Ethereum Virtual Machine (EVM), which will distribute nearly 80 million BERA tokens to eligible users.

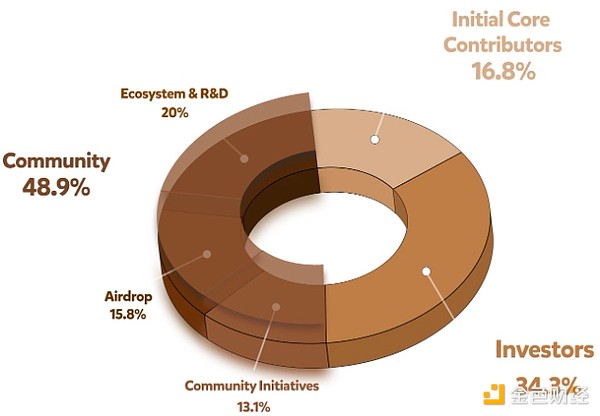

According to Berachain's token economics documents, Genesis will issue 500 million BERA tokens. Of these, 15.8% (i.e. 79 million) will be airdropped to users who meet the criteria.

Although the BERA token has not been launched yet, according to perpetual futures data on Aevo, BERA is currently trading at about $8 per coin.

At current prices, the total initial airdrop is approximately US$632 million, but it is worth noting that pre-issued futures contracts are extremely volatile and the number of BERAs planned to drop may change.

Token allocation can be viewed on the Berachain Airdrop Checker, with the initial application time starting February 6, but users who get allocations from social engagement and Broposal requests will be able to apply starting February 10.

The maximum share of BERA airdrops will be allocated to holders of Bong Bears NFT and affiliated NFT projects, including Bond, Boo, Baby, Band and Bit Bears.

The Bong Bears NFT series is available on OpenSea. Source: OpenSea

BERA Token Economics

Apart from airdrops, 13.1% of the supply is left as other community programs, while 20% is designated for ecosystem research and development.

15.8% of BERA's initial supply will be airdropped to eligible users. Source: Berachain

Another 34.3% are left to Berachain’s institutional investors, while 16.8% are left to Big Bera Labs’ consultants and members, core developers and contributors to Berachain’s blockchain.

Berachain positioned itself as a “high performance, same as Ethereum Virtual Machine (EVM)” layer 1 blockchain, aiming to convert liquidity into security through its liquidity proof consensus mechanism.

The upcoming Bera token will serve as a gas token for the network, used to pay transaction fees and serve as a stake token to enhance network security.

Berachain’s liquidity proof consensus mechanism maintains security and preserves network liquidity by transferring a portion of network revenue and profits back to ecosystem participants.

chaincatcher

chaincatcher

panewslab

panewslab