The long-term upward trend has not changed? Standard Chartered Bank predicts Bitcoin may reach $500,000 in 2028

Reprinted from panewslab

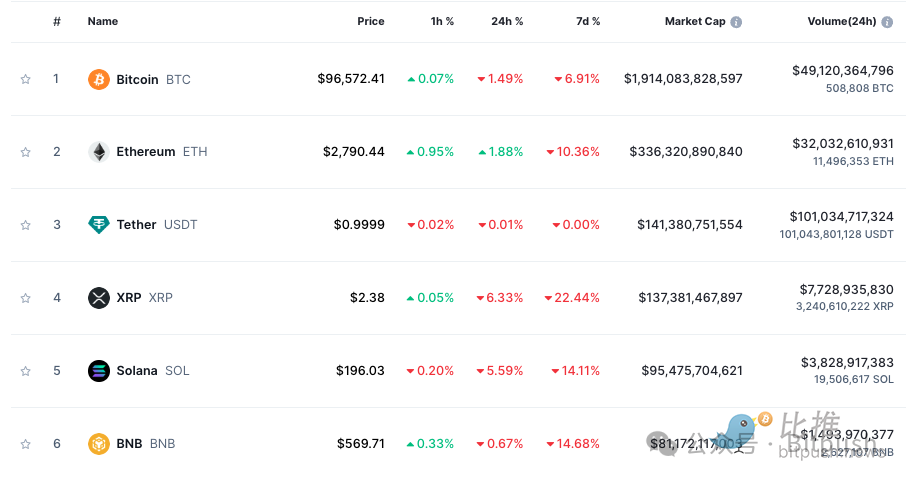

02/06/2025·2MThe crypto market fell slightly on Wednesday, giving up some of yesterday's gains. Bitu data shows that Bitcoin is currently consolidating around $96,500, down 1.6% in the past 24 hours. Ethereum rose 2% to $2,790. Meanwhile, XRP fell 7% to $2.4, while Solana (SOL) fell 6% to $196. The total market value of cryptocurrencies has fallen by 1.8% in the past 24 hours to $3.17 trillion.

Trump's tariff agreement causes market fluctuations

As the market falls, uncertainty over changes in U.S. economic policy and regulatory continues. Although Trump's suspension of tariffs on Canada and Mexico temporarily eased market pressure, investors remained cautious about increased volatility, inflationary pressure and upcoming legislative developments.

"The market outlook has shown a positive turnaround as the Mexican president reaches a deal with Trump," said Antonio Di Giacomo, senior market analyst at XS.com. However, despite the rebound in prices, he warned that cryptocurrency market volatility remains very high. high.

Di Giacomo said: “Bitcoin continues to face challenges such as Fed monetary policy, government regulation and large investor behavior. Experts believe that the $100,000 level may become a strong resistance in the short term, and continued growth will become without new catalysts. difficulty."

What does market sentiment suggest?

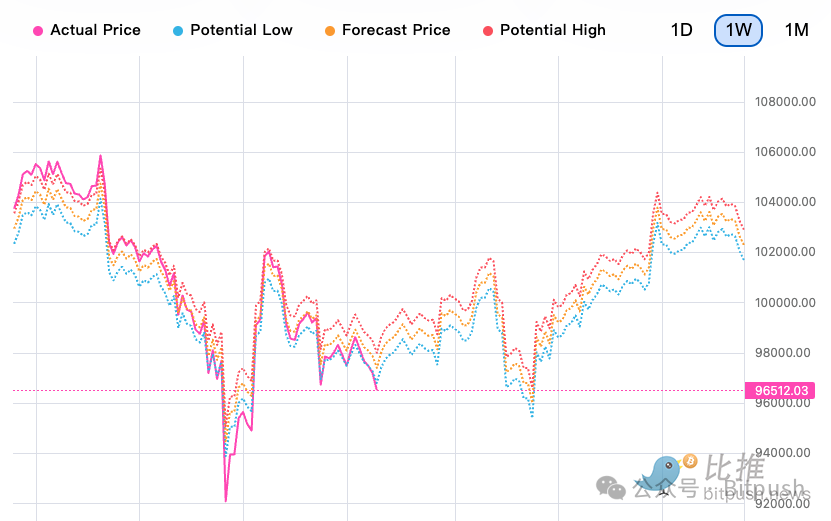

According to a daily time frame chart released by chart analyst Trivedi, Bitcoin recently rebounded from a range low of $92,000 and retested the 50% Fibonacci resistance level. However, the price failed to break through the 20-day moving average (EMA) resistance and continued to trade below it, indicating that the market lacks enough buying momentum.

Although BTC prices have significantly fallen below the $100,000 mark, the overall uptrend has not been disrupted. As long as the price remains above $90,000, the bulls will continue to dominate and may restart the uptrend.

According to Coinglass data, the long-short ratio is currently 0.9849, indicating a slight improvement in market sentiment. However, open contracts (OI) fell by 2.30%, to $58.84 billion.

The current key support is at $95,000 and $92,000, while resistance is at $100,000 and $105,000.

Optimistic forecast: $170,000 in a few months, and $500,000 in 2028

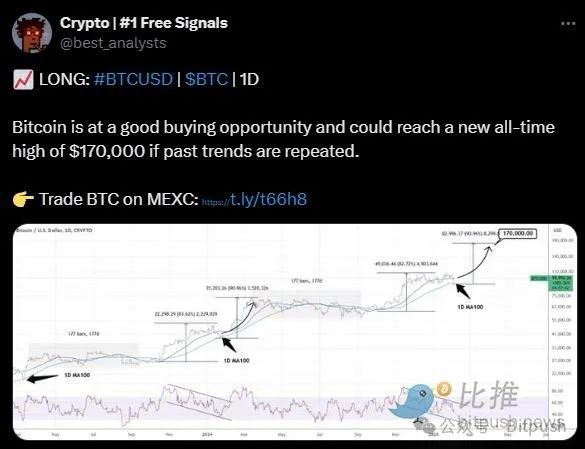

Market analyst best_analysts pointed out in its latest post on X platform that if historical price trends repeat, Bitcoin may be on the verge of a larger breakthrough. According to long-term trend analysis, BTC is expected to climb to around $170,000 in the next few months, and the specific increase will depend on whether it can maintain the current trend.

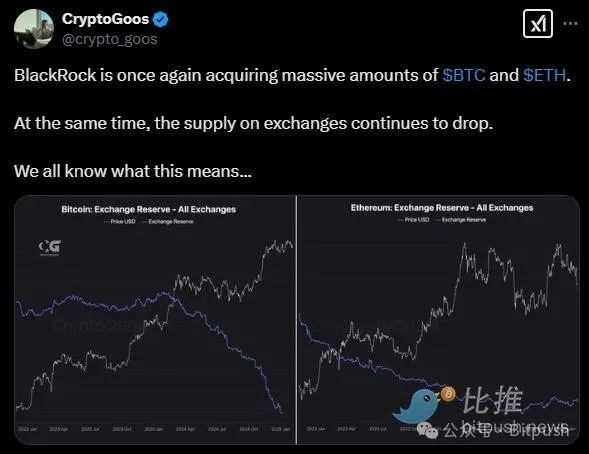

At the same time, CryptoGoos mentioned in its post that BlackRock continued to increase its holdings in BTC and ETH during the recent market pullback. This trend echoes the continued decline in exchange supply, indicating that market demand for the asset is gradually increasing.

Judging from historical data, the reduction in exchange supply is usually an important signal that cryptocurrency assets are about to rebound. In addition, as BTC prices have experienced a significant pullback from highs, the market may be accumulating momentum for the next round of recovery to an all-time high (ATH).

Standard Chartered, which has always been aggressive, predicts in its latest report that Bitcoin (BTC) prices are expected to reach $500,000 in 2028. This prediction is based on two key factors: the popularity of spot Bitcoin ETFs and the decline in volatility.

Geoffrey Kendrick, global head of digital assets research at Standard Chartered Bank, pointed out in the report that as the US spot Bitcoin ETF market matures, Bitcoin's volatility will gradually decrease. He said that with the support of the Trump administration's policy, the access channels for Bitcoin are improving, and the trend of institutional funds flowing into spot Bitcoin ETFs will continue to grow.

Kendrick believes that the optimized dual-asset portfolio ratio of Bitcoin and gold will gradually increase, which will drive the long-term rise in Bitcoin prices. “As the portfolio gradually approaches its optimal state, the price of Bitcoin will experience a long-term appreciation,” he wrote.

Standard Chartered's predictions for Bitcoin are as follows:

- 2025 end-of-year target: $200,000

- Target for 2026: $300,000

- 2028 Target: $500,000

Kendrick stressed that this upward trend will be gradually realized during the US President Trump's presidency and is enough to push Bitcoin to $500,000 before Trump leaves office.

chaincatcher

chaincatcher

jinse

jinse