BTC bull market remains unchanged, institutions buck the trend and increase their positions

Reprinted from panewslab

01/09/2025·1MThe U.S. dollar index (DXY) broke a new high and the cryptocurrency market pulled back for a second day in a row as U.S. Treasury yields rose and investors adjusted their expectations for the Federal Reserve's monetary policy.

CMC data shows that in the past 24 hours, BTC once fell to an intraday low of $92,600, and recovered to around $94,400 as of press time. It is still down 2.1% in the past 24 hours, and Ethereum fell to around $3,330.

The move was closely tied to strong economic data from the U.S., including a surge in job openings and better-than-expected manufacturing performance. The data further reinforces Federal Reserve Chairman Jerome Powell's view that inflation may be effectively controlled this year without an aggressive rate-cutting strategy. "Fed spokesperson" Nick Timiraos pointed out that the minutes of the Federal Reserve meeting released today further indicate that officials are generally willing to keep interest rates unchanged at the upcoming meeting at the end of this month. As a result, the market adjusted its expectations for the Federal Reserve's future monetary policy, and risk assets fell under pressure.

CoinGlass data shows that the two-day retracement resulted in nearly $1 billion worth of crypto leveraged derivatives positions being liquidated, mainly long positions betting on an increase.

Macroeconomic and policy expectations dominate market sentiment

This correction in the price of Bitcoin reflects the market’s revision of its early optimistic expectations for Bitcoin. Previous optimism was mainly based on two assumptions: first, the Federal Reserve will adopt a looser monetary policy, that is, actively cutting interest rates; second, if Trump is re-elected as President of the United States, it is expected to bring a clearer regulatory framework to the cryptocurrency industry.

However, current economic data and the Federal Reserve's statements have cast doubts on the degree to which the above two assumptions can be realized.

Philipp Pieper, co-founder of Swarm Markets, pointed out that driven by the lack of new market narratives, the cryptocurrency market is gradually returning to the logic of traditional financial markets. When interest rates are low, investors often tend to increase allocations to risk assets, such as cryptocurrencies and technology stocks, in search of higher returns. But currently, as the Trump administration’s cryptocurrency policy remains unclear and market sentiment is more cautious, this uncertainty is expected to continue for some time.

An analysis report by 10x Research also emphasized the importance of macroeconomic data on Bitcoin prices. The report believes that the Federal Reserve’s response to U.S. economic data and global liquidity conditions are the two key macro factors affecting Bitcoin price trends. In the short term, Bitcoin prices may therefore enter the "banana zone" of violent fluctuations. The "banana zone" vividly describes the turbulent trend of asset prices under the combined influence of macro factors.

BitMEX founder Arthur Hayes also analyzed the impact of U.S. dollar liquidity on Bitcoin prices in his latest blog post. He believes that Bitcoin and cryptocurrency prices usually rise when U.S. dollar liquidity increases.

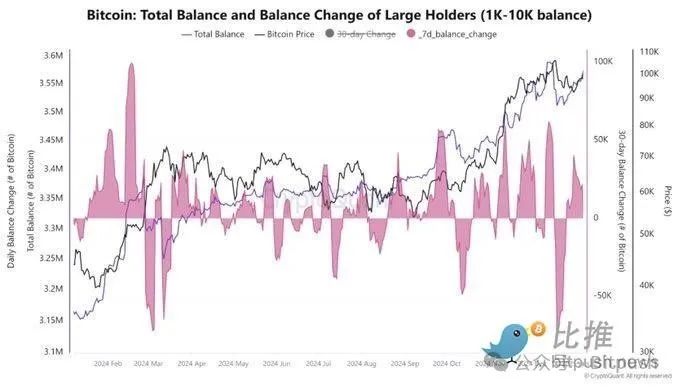

Institutions have accumulated more than 34,000 Bitcoin holdings in the

past 30 days

Although the market is facing correction pressure in the short term, analysts remain optimistic about Bitcoin's long-term prospects. CryptoQuant’s on-chain data shows that “underlying demand for Bitcoin remains very strong.” The agency measures market demand by comparing the number of idle bitcoins to the new supply of bitcoins added by miners. When the decrease in idle bitcoins far exceeds the new supply, it indicates strong market demand.

CryptoQuant analysts wrote that around December 21, 2024, institutional investors sold approximately 79,000 Bitcoins in a week, resulting in a 15% correction in the market. However, large institutions subsequently took advantage of the market consolidation period and continued buying below $95,000 using a time-weighted average price (TWAP) strategy. In the past 30 days, institutional investors have accumulated more than 34,000 Bitcoins, providing buying support for Bitcoin’s recent rebound.

Despite periods of correction in institutional portfolios, the trend of on-chain Bitcoin accumulation since June 2023 remains evident. This shows that institutional interest in Bitcoin remains high at a time when retail demand is at a five-year low.

CryptoQuant analysis also shows that Bitcoin’s correction has caused traders’ unrealized profits to shrink significantly, which is normal after a sharp rise. Currently, traders’ realized prices are about $88,000 (which usually constitutes price support in bull markets).

Historical data shows that Bitcoin has experienced corrections in January after the past two U.S. presidential elections, falling 36% in January 2017 and January 2021.

Jamie Coutts, chief crypto analyst at Real Vision, commented on the The strength of the buying and market expectations that the Fed will have to take action; otherwise things will start to deteriorate and more liquidity is coming and Bitcoin should be much higher in 6 months.”

Taken together, Bitcoin's recent correction is mainly affected by changes in macroeconomic data and Fed policy expectations. In the short term, the market may remain volatile. However, the continued accumulation behavior of institutional investors and the strong demand reflected in on-chain data will provide support for the long-term trend.

jinse

jinse