Coinbase: What else should we pay attention to besides the tariff stick?

Reprinted from jinse

04/15/2025·10DSource: Coinbase; Translated by: Tao Zhu, Golden Finance

summary

-

Affected by the news of US tariffs, market volatility continued to intensify. The S&P 500 Volatility Index (VIX) broke through 60 on Monday, and the stock market fluctuated significantly during the session.

-

Market participants are looking forward to potential guidance from the Fed in the context of rising recession concerns, but we believe that the Fed is unlikely to take preemptive action in the current economic environment as they focus more on the inflation aspects of their dual mission.

-

However, cryptocurrency-related catalysts remain strong. The Securities and Exchange Commission (SEC) announced that interest-bearing stablecoins will not be considered securities and will continue to hold roundtable meetings with industry insiders. On-chain data further suggests that long-term holders are increasing their holdings of Bitcoin (BTC).

Affected by the news of US tariffs, market volatility continues to intensify. On Monday, the S&P 500 Volatility Index (VIX) broke through 60, and the stock market fluctuated significantly intraday. Affected by concerns about closing positions and unemployment in yen arbitrage trading, the volatility hit the highest level since August 5, 2024. The last multi-day trading window with similar volatility levels (VIX exceeds 50) was in March 2020. It is worth noting that despite intensifying stock market volatility, Bitcoin prices remain relatively resilient this week—whether they are rising or falling.

While President Trump announced a 90-day suspension of the imposition of specific country tariffs on non-retaliatory regions (maintaining a benchmark increase of 10% of global imports), alleviating concerns about uncontrollable tit-for-tat tariff escalations, there is still great uncertainty about how the long-term situation will develop. Especially after China imposed 84% tariffs on U.S. goods, tariffs on China rose again to 125%. Although the complete suspension of additional tariffs on most countries is beneficial to short-term market stability, the long-term impact of reaching a reconciliation between China and the United States remains the primary concern. In addition to the direct impact of tariffs, escalating tensions could have other effects, such as the sale of TikTok to U.S. entities. This could have indirect effects on the development of technical regulation and national security issues, both of which are closely related to the cryptocurrency industry.

Meanwhile, market participants are paying attention to the Federal Reserve 's potential guidance amid growing concerns about the economy, with Goldman Sachs expecting a 45% chance of a U.S. recession. Even so, we believe that in the current economic environment, the Fed is unlikely to take preemptive action because they are more focused on the inflation aspects of their dual mission. We also believe that an emergency rate cut would send investors a false signal about the vulnerability of financial markets. In the minutes of the March FOMC meeting released on April 9, Fed staff stressed that “the core inflation rate fell less than expected last year” and that “changes in trade policy may put greater upward pressure on inflation than…assumes.” That is, we believe that the Fed is unlikely to take decisive action in the short term based solely on fulfilling its inflation mission.

However, under macro uncertainty, specific catalysts in the cryptocurrency sector remain strong. The U.S. cryptocurrency policy continues to advance, and the Securities and Exchange Commission (SEC) announced that "covered stablecoins" (that is, stablecoins backed by low-risk, liquid assets and easily convertible to the US dollar) will not be considered a securities. The statement explicitly excludes earnings stablecoins and states that decisions will be made on the asset type in the future. It is worth noting that this is also a difference between the US House of Representatives (Stable Act) and the Senate (Genius Act) bill on stablecoins, the former explicitly prohibits income stablecoins, while the latter is not mentioned. The SEC will also continue to host the industry roundtable, with the next discussion on April 11 on the theme of cryptocurrency-specific transaction regulations.

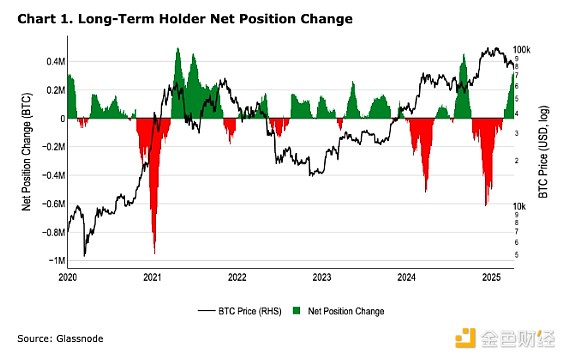

Given macro uncertainty and strong regulatory benefits, on-chain data shows that long-term Bitcoin holders have begun to steadily increase their holdings of more BTC since BTC fell below $90,000 at the end of February. Prior to this, long-term holders were in a net increase before the fall 2024 U.S. election and did not start actively selling until BTC broke through $100,000 in December. While the increase in holdings by long-term holders does not necessarily indicate an imminent price increase, we do think that this suggests that an increasing number of “fair value” buyers view current BTC price levels as buying opportunities.

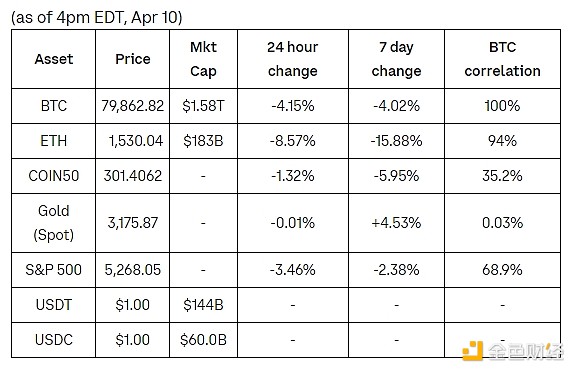

Overview of Cryptocurrencies and Traditional Assets

Coinbase Exchange and CES Insights

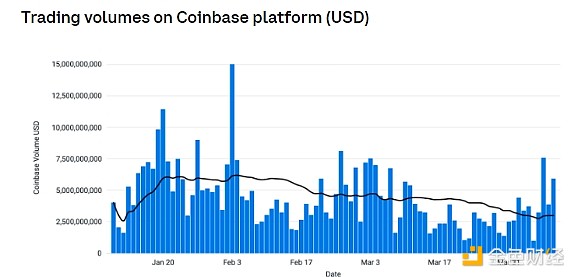

The market has been volatile over the past week, with Bitcoin trading between $74,400 and $83,600 and Ethereum trading between $1,385 and $1,810. Cryptocurrencies show a high correlation with the broader risk market, and their response to tariff news is synchronized with the stock market. Active funds adopt cautious strategies to avoid excessive trading in the event of intensified price volatility. Long-term investors took advantage of the weak market opportunity to increase their positions in BTC, SOL and other projects they believe are valuable. But overall, the financing rate of altcoins remains negative, indicating that some areas of the riskier market remain cautious.