DuckChain was retaliated against. Is the consumption chain industry change or the change of shells and cut off leeks?

Reprinted from panewslab

02/06/2025·20DIn recent years, a large number of projects with the "consumption chain" as the core concept have emerged in the blockchain industry, aiming to attract more Web2 users to the Web3 world by lowering user thresholds and simplifying operation processes. As the first consumer Layer project in the TON ecosystem, DuckChain quickly attracted millions of users with its innovative EVM compatibility and Telegram Star tokenization capabilities.

However, as the project progresses, feedback from users and the market has shown a polarization: on the one hand, DuckChain's technological innovation and user growth are eye-catching; on the other hand, some users have been "retaliated" because of their participation in activities. Question its business model. We will start from the case of DuckChain and explore the essence of the consumption chain: is it the pioneer of industry change, or a tool for changing the shell and cutting leeks?

1. DuckChain 's innovation and achievements

- Technical breakthrough: EVM compatibility and Telegram ecosystem integration

The biggest highlight of DuckChain is its EVM compatibility, which allows developers to use the familiar Solidity language to build applications in the TON ecosystem, greatly reducing the development threshold. At the same time, DuckChain converts Web2 users' points into on-chain assets through Telegram Star tokenization function, further simplifying the process for users to enter Web3. This technological integration not only brings new liquidity to the TON ecosystem, but also provides a seamless on-chain experience for Telegram’s billion users.

- User growth and ecological expansion

Since the launch of the Test Network, DuckChain has attracted more than 5.3 million users, the number of paid users in the Test Network activities exceeded 1 million, and the on-chain transaction volume exceeded 29 million. After the main network was launched, DuckChain's active wallets quickly exceeded 1 million, and the on-chain transaction volume exceeded 5 million, showing strong user growth momentum. In addition, DuckChain has reached cooperation with well-known projects such as Arbitrum, OKX, and Camelot, further expanding its ecological map.

- Token economy and incentive mechanism

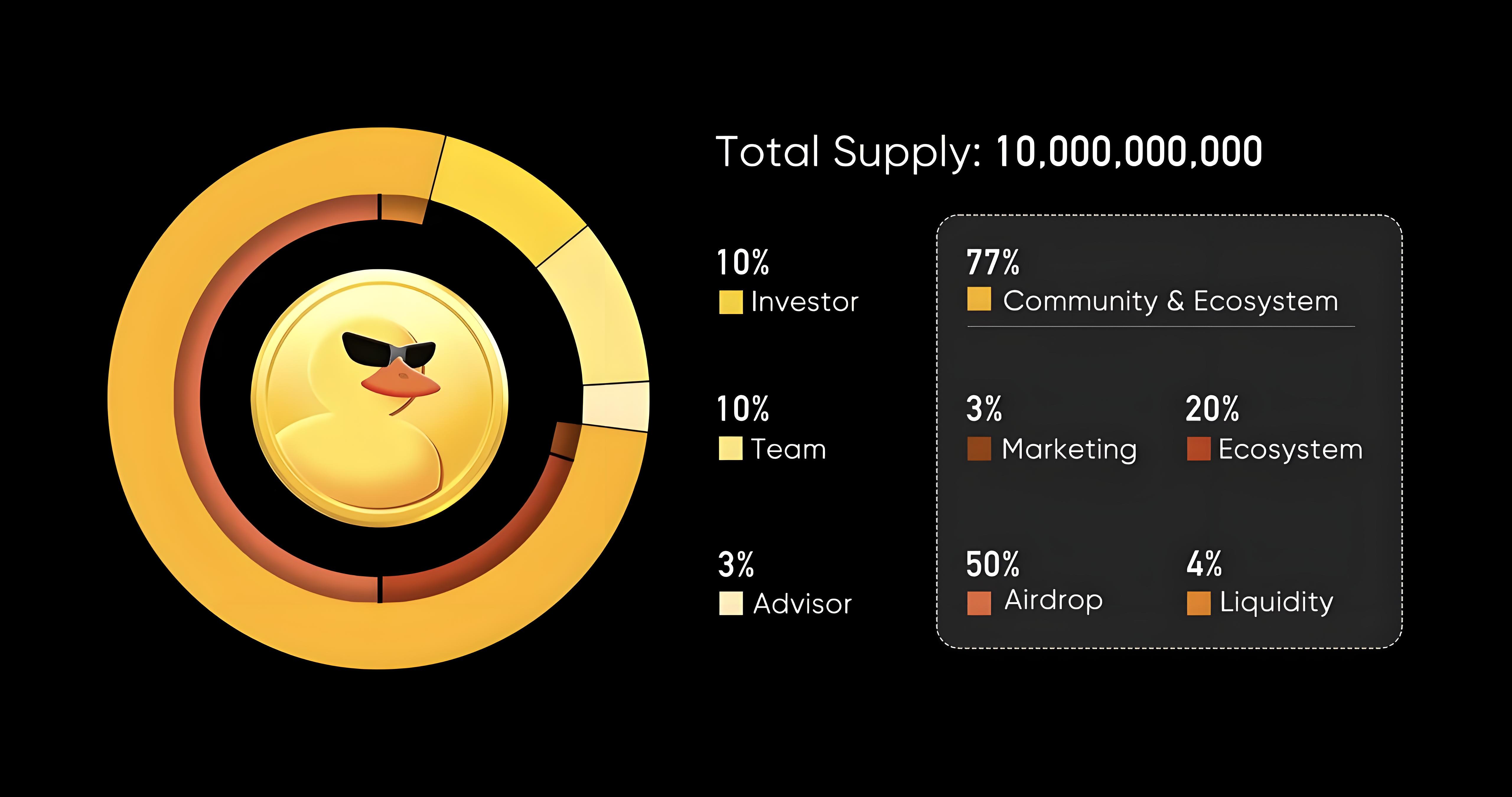

DuckChain's token DUCK totals 10 billion, of which 77% are allocated to community and ecological development, including 50% for airdrops and 20% for ecological development. This incentive mechanism is designed to attract users through airdrops and staking activities, while providing financial support for ecological projects.

**2. Behind the user 's "reversal": the hidden worries of the

consumption chain**

- Complex activity rules and high cost of user participation

Although DuckChain has attracted a large number of users through airdrops and staking activities, some users have reported that the activity rules are complex and the participation costs are high. For example, users need to pledge a certain asset to receive airdrop rewards, and in the case of large market fluctuations, the value of pledged assets may shrink significantly, resulting in users' actual returns being lower than expected. This design has been questioned by some users as "disguised cutting leeks".

- The limitations of Telegram Star tokenization

Although DuckChain's Telegram Star tokenization function lowers the threshold for users to enter Web3, its actual application scenarios are limited. At present, Telegram Star is mainly used to pay Gas fees and participate in on-chain activities, and has not yet formed a wide range of consumption scenarios. This limitation may lead to users’ doubts about the long-term value of the project.

- Insufficient ecological liquidity

Although DuckChain is committed to integrating liquidity in the TON, EVM and BTC ecosystems, the DeFi protocols and applications within its ecosystem are still in the early stages and liquidity is relatively insufficient. This liquidity fragmentation problem may limit the user's actual experience and thus affect the long-term development of the project.

**3. The essence of the consumption chain: industry change or change the

shell and cut leeks?**

The potential for industry change:

The core goal of the consumption chain is to lower user thresholds through technological innovation and promote the migration of Web2 users to Web3. DuckChain's EVM compatibility and Telegram Star tokenization capabilities are exactly the embodiment of this concept. This compatibility not only smoothly transitions existing Web2 applications to the Web3 ecosystem, but also provides developers with more powerful tool support, improving user experience and application penetration. If the problems of insufficient liquidity and limited application scenarios can be effectively solved, the consumption chain is expected to become a catalyst for the blockchain industry to achieve large-scale applications and promote the comprehensive development of the decentralized economy.

Risks of cutting leeks:

However, the incentive mechanisms and business models behind the consumption chain are also easily abused. Some projects may attract users' capital investment through complex participation rules and high-threshold participation costs, but ultimately cause investors to suffer losses. This phenomenon of "cutting leeks" with high returns as bait and at the cost of user funds is not new in the blockchain field, especially in the absence of effective supervision, which may aggravate the irrational speculation in the market and harm the majority of people. The interests of ordinary users. Therefore, how to ensure the transparency, sustainability of the consumption chain mechanism and the protection of user rights and interests, establish user trust, and ensure the healthy development of the market has become a key challenge for its future development.

**4. DuckChain 's case inspiration: Dilemma and way out of the

consumption chain**

- Double-edged sword of token economic design

DuckChain's token economic model is at the heart of its controversy. Although it allocates 77% of the tokens to the community (including 50% airdrop, 20% ecological development, etc.) to try to attract users to participate through high incentives, according to the historical data of airdrops, more than 88% of the tokens are three months after airdropping. Internal selling pressure depreciated significantly. Although this model can quickly accumulate users in the short term, if there is no support for practical application scenarios, the value of tokens will be difficult to maintain, which will eventually lead to users being "brutally beaten" due to the shrinking of assets. For example, although users in the DuckChain test network activity recharged 9.3 million Telegram Star, their tokenized usage scenarios are limited to paying Gas fees and pledges, which failed to form a closed consumption loop.

- The distinction between reality and reality of technology integration

Although DuckChain's technological innovations—such as EVM compatibility, Telegram Star tokenization, and cross-chain liquidity integration—are packaged as "industry changes", the actual implementation effect still needs to be verified. For example, its claim to "integrate EVM, TON and BTC ecological liquidity" relies on cross-chain bridges and incentive mechanisms, but the TVL of TON ecosystem is only US$700 million (90% TON and USDC), and the underlying support for liquidity integration is weak. . In addition, although the development threshold has been lowered through the Arbitrum Orbit architecture, the DApps of the TON ecosystem are still mainly based on Meme and simple GameFi, and lack complex applications.

- Community-driven sustainability challenges

DuckChain's "Fun Community Culture" is a highlight of its user growth, such as attracting millions of users through DuckChainBot design gamified interactions. However, this model is highly dependent on short-term incentives, and user retention is doubtful. Data shows that although 230,000 users recharge Telegram Star during its test network, the growth rate of on-chain transaction volume slowed down after the main network was launched, indicating that user activity may decline with the end of the airdrop. In contrast, mature consumption chains need to build long-term value capture mechanisms, such as converting user behavior into on-chain productivity through the DeFi protocol, rather than relying solely on the "traffic-airdrop" cycle.

**5. The future of the consumption chain: from "traffic games" to "value

network"**

- Return to the essence of user needs

The core proposition of the consumption chain should be to lower the threshold for use of Web3 and create real needs. DuckChain's tokenization of Telegram Stars is an important attempt to "open the chain without any sense" for users, but if it only stays at the level of paying Gas fees, it is no different from the Web2 points system. In the future, application scenarios need to be expanded, such as using Stars for high-frequency consumption behaviors such as social rewards and content subscriptions, forming a closed loop of "points-consumption-returns".

- Deepening of liquidity integration technology

Currently, cross-chain liquidity integration depends on bridging protocols, but security and efficiency issues are prominent. If DuckChain wants to truly break the isolation of TON ecosystem, it needs to explore more underlying solutions, such as using ZK technology to achieve lightweight cross-chain verification, or aggregating multi-chain assets through a unified liquidity pool. At the same time, introducing real income agreements (such as lending and derivatives) can improve capital utilization and avoid "false prosperity" of liquidity.

- Construction of regulatory and compliance framework

The vision of "massive adoption" in the consumption chain needs to face regulatory challenges directly. For example, Telegram Stars as a fiat currency entrance may involve KYC/AML issues, and the financial attributes of tokenized points may also be included in the scope of securities regulation. DuckChain needs to cooperate with compliance agencies to explore the integration of on-chain identity and compliant payment channels, rather than relying solely on "regulatory arbitrage".

6. Conclusion

DuckChain's case reflects the typical contradictions in the consumer chain track: on the one hand, there is the innovative potential of technology integration and user growth, and on the other hand, there is the token economic bubble and short-term profit-seeking risks. Its future success will depend on whether the expansion of application scenarios can develop from simple Memes and games to high-frequency demands such as social and finance. Whether the so-called liquidity and cross-chain integration truly improve capital efficiency, rather than staying at Surface account data and whether its community governance can transform from a short-term interest-driven "Horse Party" to an active ecological co-builder to participate in long-term value distribution.

If the consumer chain project only conducts "traffic harvesting" in the name of "lowering the threshold", it will inevitably become a tool for "changing shells and cutting leeks"; only by deeply binding technological innovation with user value can we change the industry Take a place in the country.

chaincatcher

chaincatcher