Ethereum futures optimism is at monthly lows – can you buy $2,800?

Reprinted from jinse

02/06/2025·2MAuthor: Marcel Pechman, CoinTelegraph; Translated by: Tao Zhu, Golden Finance

ETH suffered a heavy blow on February 3 and has been difficult to maintain above $2,800 since then. Ethereum has fallen 24.5% in the past 30 days, while cryptocurrency market capitalization has fallen 10% over the same period. This performance disappointed investors, with some starting to question whether ETH has enough momentum to return to the bullish zone.

The ETH futures market currently shows that professional traders have the lowest level in more than a month. This development has raised concerns about whether Ethereum can rebound to $3,400 in the near term.

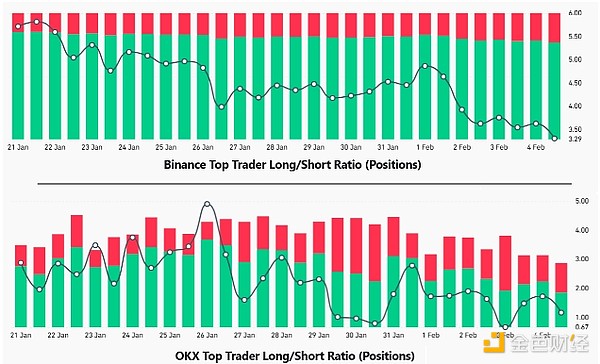

ETH Top Traders Long-to-Short Ratio. Source: CoinGlass

A higher long-to-short ratio usually means that traders tend to be long (buy) positions, while a lower ratio means that traders prefer short (sell) contracts. Currently, Binance's top ETH traders report a long-to-short ratio of 3.3 times, well below the previous two-week average of 4.4 times. At OKX, the ratio is 1.2 times, while the two-week average is 2.2 times.

Part of the reason for Ethereum 's recent underperformance can be attributed to increased competition. However, Ethereum's monetary policy and ongoing scalability disputes are also one of the reasons.

Over the past 30 days, Ethereum’s supply has grown at an annualized rate of 0.5%. This trend reflects low demand for blockchain space and is driven by the adoption of layer 2 scaling solutions.

The Ethereum Foundation has been strongly criticized for its limited involvement in several key ecosystem projects. Some long-term developers have publicly expressed their dissatisfaction, prompting Ethereum co-founder Vitalik Buterin to claim his sole power to the Ethereum Foundation on January 21.

On the positive side, the inflow of spot ETH exchange-traded funds (ETFs) and the recent ETH purchases by World Liberty Financial indicate that buyers are still interested. Since January 30, the net inflow of spot Ethereum ETFs in the U.S. is $487 million, the exact opposite of the net outflow of $147 million in the previous four trading days.

On January 31, World Liberty Financial, a tokenized digital asset project backed by the Trump family, acquired another $10 million worth of Ethereum, according to Arkham Intelligence. As of February 5, the company's holdings reached 66,239 ETH, worth $182 million, making it the largest holdings, surpassing Wrapped Bitcoin (WBTC) and other altcoins.

Ether derivatives premium drops to 7% after leverage demand drops

To determine whether whales and market makers are bearish on Ethereum, analysts should look at the ETF monthly futures market. These contracts are typically traded between 5% and 10% higher than the spot market to make up for longer settlement periods.

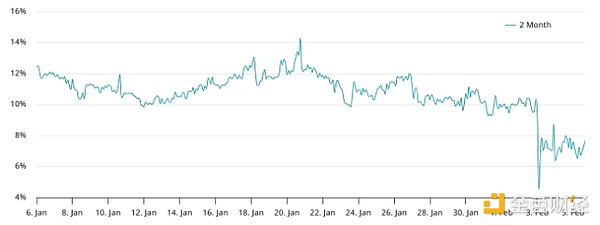

Ethereum 2-month futures annualized premium. Source: Laevitas.ch

The Ethereum derivatives market reinforced this sentiment, with the premium dropping to 7% from 10% on February 2. Although still in the neutral range, professional traders have less demand for leveraged long positions. More notably, even during the February 3 crash, the ETH futures premium remained above the 5% threshold of bear market.

The ETH derivatives market has no clear evidence that the whales have turned bearish or abandoned hopes of further bullish momentum. Meanwhile, intensified competition from Solana and Hyperliquid has led investors to reevaluate Ether's upside potential. Investors also don’t seem willing to increase their bullish positions before the upcoming “Pectra” upgrade, as its direct benefits for average users are still uncertain.

Ultimately, the current $2,800 price seems to provide a reasonable entry point given Ethereum’s leadership in total lock-in value (TVL) and growing institutional demand. The ability to recover the $3,400 level depends on the clearer interests of ETH stakeholders and long-term investors.

panewslab

panewslab