Financing Weekly | 12 public financing events; startup Codex completed a seed round of $15.8 million, led by Dragonfly

Reprinted from panewslab

04/07/2025·23DWhat's the highlight of this issue

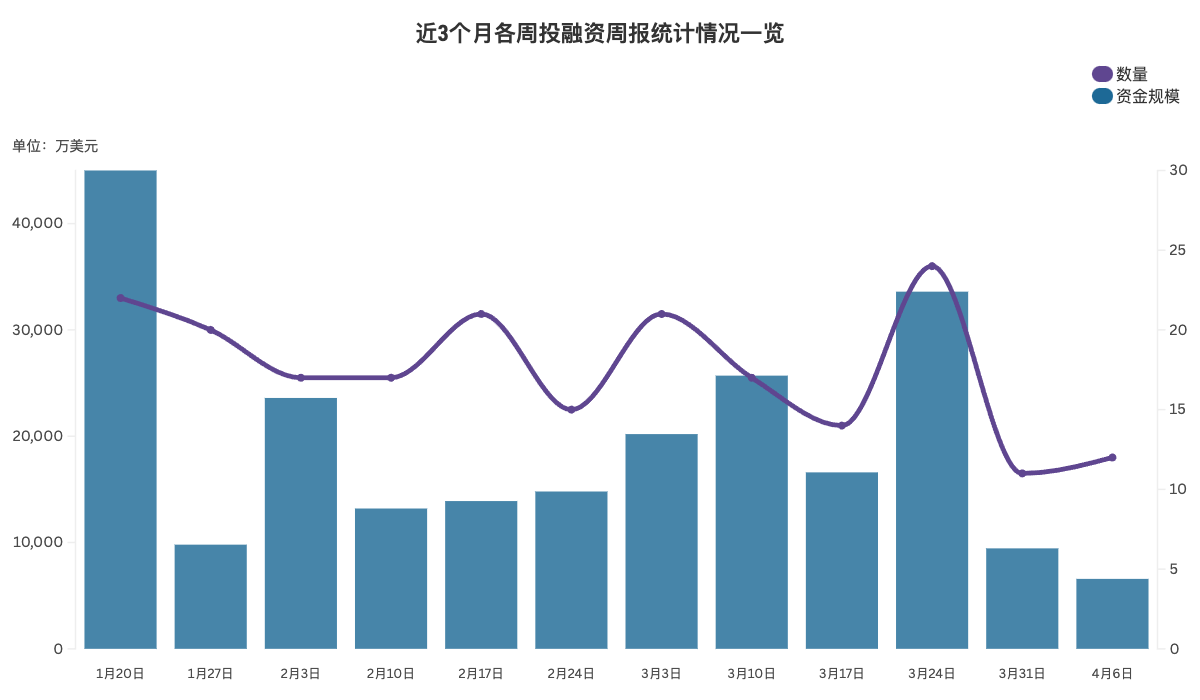

According to incomplete statistics from PANews, there were 12 investment and financing events in global blockchain last week (3.31-4.6), with a total funding scale exceeding US$65.8 million, and inflows continued to decrease. The overview is as follows:

- DeFi announced a investment and financing event, P2P.me completed a seed round of $2 million, with Multicoin and Coinbase Ventures participating in the investment;

- A financing event was announced in the NFT field, and the luxury fragmented investment platform Collecto completed a seed round of financing of 2.8 million euros (about 3.05 million US dollars);

- Web3 Game Track announced two investment and financing events, among which the chain game platform Ultra completed a US$12 million financing, led by NOIA Capital;

- Web3+AI announced four investment and financing events, among which the AI infrastructure agreement Cambrian Network completed a seed round of $5.9 million, led by a16z CSX and participated by BB Fund;

- Three investment and financing events were announced in the field of infrastructure and tools , of which Ambient completed a $7.2 million seed round of financing, with a16z, Delphi Digital and Amber Group participating;

- A centralized financial track announced an investment and financing event, with startup Codex completing a seed round of $15.8 million, led by Dragonfly

DeFi

P2P.me completes a $2 million seed round, with Multicoin and Coinbase Ventures participating

Cryptocurrency-to-fiat payment application P2P.me announced a $2 million seed round of financing, with investors including Multicoin and Coinbase Ventures. P2P.me uses a group of middleman networks to enable users to pay to merchants who only accept fiat currency using stablecoins, and the transaction process takes about 90 seconds. The platform uses zero-knowledge proof technology to verify user identity to ensure privacy and security.

NFT

Collecto, a luxury fragmented investment platform, completed a seed round of 2.8 million euros (about US$3.05 million), with LinkedIn Italy CEO Marcello Albergoni, Accenture Interactive Managing Director Alessandro Zanotti, McKinsey senior partner Andrea Travasoni and Guido Frisiani, Wind Tre Italian co-CEO Gianluca Corti, BCG senior consultant and former CEO of ING Italy, Marco Bragadin, Jakala Civitas CEO Giacomo Lorusso, BizPal CEO Fabio Peloso and several seed round investors participated in the investment. The financing structure of this round includes 2.3 million euros equity financing and 500,000 euros from the "Smart & Start Italia" entrepreneurship support program of the Italian Ministry of Economic Development.

According to reports, Collecto is a platform that democratizes luxury collections by providing partial ownership of exclusive items, including modern art, luxury watches and investment-grade wines.

Web3 Games

Ultra completes $12 million in financing, led by NOIA Capital

Chain game platform Ultra announced the successful completion of a US$12 million financing, led by Luxembourg multi-family office NOIA Capital through its NOIA Digital Assets fund. In addition, Ultra has appointed Maxime van Steenberghe as COO, further promoting it to become Europe's leading gaming platform. Ultra plans to accelerate the realization of the 2025 roadmap through this financing, injecting transformative power into the gaming industry.

Nasdaq-listed Internet company The9 Limited announced that it had signed a targeted share issuance agreement with cryptocurrency investment funds Elune Capital, Fine Vision Fund and Bripheno Pte. Ltd. Under the agreement, investors will inject $8 million into The9. The9 will issue Class A common shares to investors at the average closing price of the 30 trading days before the agreement is signed, and the issued shares will comply with the statutory lock-up period regulations. The9 will set up a new company to operate its global GameFi platform. The company plans to reach a cooperation with the third-party International Cryptocurrency Foundation to use the GameFi tokens issued by the foundation as the official cryptocurrency of the platform. It will also cooperate with the cryptocurrency exchange to promote platform crypto users to join The9's GameFi ecosystem.

The9 will issue 302,263,200 warrants to investors, with the warrants valid for two years. The exercise price of some warrants is US$60 per ADS, and the remaining warrants are divided into two batches: the first batch can be exercised after the investor or its business partners sign a strategic cooperation agreement with The9, and the second batch must be exercised after the GameFi platform of The9 is officially launched. The exercise price is the same as the issuance price of the ADS in this agreement.

AI

Cambrian Network completes $5.9 million seed round, led by a16z CSX

AI infrastructure agreement Cambrian Network announced that it has completed a $5.9 million seed round led by a16z Crypto Startup Accelerator (CSX) and participated by BB Fund. Cambrian aims to build an intelligent infrastructure for AI financial agents, and empower AI agents to make smarter market forecasts and financial decisions by integrating on-chain and off-chain data. Founded by former members of The Graph and Semiotic Labs, the project has now launched a private beta and plans to launch a test network.

AI+Crypto project Mahojin completed a $5 million seed round financing, led by a16z CSX and others

AI+Crypto project Mahojin announced the completion of a $5 million seed round of financing, led by a16z CSX and Maelstrom. It is reported that Mahojin is a GitHub for AI model creators and datasets, which can track IP and pay model creators and dataset owners.

Capx AI, an Ethereum Layer2 network for AI agents, completed a seed round of $3.14 million, led by Manifold and Luganodes, and followed by institutions such as Echo, P2 Ventures (Polygon Ventures), Gate Labs, Stix, MH Ventures, Blue7, Cogitent Ventures, Autonomy Capital, Next Web Capital, Blockarm Capital, Mythos Venture Partners (MVP), Arcanum Capital and other institutions. Individual investors include well-known industry insiders such as Sandeep Nailwal, Richard Ma and Amrit Kumar.

According to reports, Capx AI is an Ethereum Layer2 network designed to enable users to build, monetize and trade AI agents. It provides an integrated ecosystem of Capx Chain, Capx Super App and Capx Cloud to facilitate the creation, deployment and exchange of AI-driven applications.

On-chain AI agent fund bAI Fund receives $1 million investment

On-chain AI agent fund bAI Fund received $1 million in joint investment by Morph and Foresight Ventures. According to reports, bAI Fund is an on-chain proxy fund operating in a Trusted Execution Environment (TEE), which integrates quantitative transactions, investments and marketing to create a diversified AI proxy ecosystem. The fund helps creators independently issue AI proxy tokens and promote decentralized governance.

Infrastructure & Tools

Ambient completed a $7.2 million seed round, with a16z, Delphi Digital and Amber Group participating

Crypto-AI project Ambient completed a $7.2 million seed round of financing, with a16z's crypto accelerator program, Delphi Digital and Amber Group participating. According to reports, Ambient aims to combine artificial intelligence technology to provide fast, cheap and open intelligent services. The project uses a proof of work mechanism similar to Bitcoin and works similar to Solana's network.

Singapore-based digital asset infrastructure provider BetterX announced a SGD2.3 million (approximately US$1.7 million) Series A financing to support its expansion in Asia, the Middle East and the United States. The round attracted new investors, including Grand Prix Capital, Aument Capital, and angel investors such as Sabrina Tachdjian of the HBAR Foundation and Riaz Mehta of Crypto Knights. Existing supporters, including Aura Group and Tibra co-founder Kinsey Cotton, also participated in the round. Founders of former investors Scalare Partners, Wholesale Investor, B7 Capital and Audacy Ventures were also involved in the round.

According to reports, BetterX was established in Singapore to provide institutional-level infrastructure for the tokenization, trading and portfolio management of digital assets. The company aims to provide compliant, scalable solutions to financial institutions, including wealth managers and licensed intermediaries. The company's platform supports the issuance and management of tokenized financial products, digital asset trading infrastructure and custody solutions.

Bloctopus completes $1 million in financing to promote the construction of dApp development tools

The original LZero is now renamed Bloctopus and has completed a US$1 million pre-seed round of financing led by Hivemind Capital. Participants include Techstars, IronKey Capital and several blockchain founders. Bloctopus is committed to building an on-chain "Firebase". It cooperates with the Ethereum Foundation, Kurtosis, etc. to launch developer tools that can be deployed on demand, aiming to reduce DevOps costs by 90% and improve development efficiency by 20 times. Its v1 version has been launched and supports cross-chain environment simulation.

Centralized Finance

Startup Codex completes $15.8 million seed round, Dragonfly leads investment

Startup Codex raised $15.8 million in a seed round led by Dragonfly Capital. Codex is building a blockchain designed specifically for stablecoins. Other investors include Coinbase and Circle's venture capital divisions. Crypto market makers such as Cumberland, Wintermute and Selini Capital also contributed. Dragonfly's general partner Rob Hadick said the company has invested about $14 million in this round.