Golden Encyclopedia | Is BTC a safe haven during the trade war?

Reprinted from jinse

04/16/2025·4DSource: CoinTelegraph; Compilation: Baishui, Golden Finance

1. As trade tensions intensify, Bitcoin joins the ranks of risk aversion

For decades, whenever a crisis hit, investors have flocked to gold and U.S. Treasury bonds, but in today's digital and decentralized world, Bitcoin is beginning to become a safe-haven asset. Despite its high volatility, Bitcoin has shown resilience during a period of global turmoil, including trade wars, prompting people to revisit its value-preserving role.

Let's review it and understand the origin of this problem.

For decades, whenever uncertainty (whether it is war, inflation or sudden political changes) disrupted the global economy, investors have done what they are used to - to flee to the safest hills. Historically, these hills were made of gold or filled with U.S. Treasury bonds. But things are changing.

In a world that is more digital, decentralized and turbulent than ever, people are beginning to wonder whether Bitcoin may become part of modern safe-haven assets, especially during disruptive events such as trade wars.

To understand this, you need to first explore what makes an asset a safe haven, how Bitcoin has performed in recent trade-related turmoil, and whether it has won a position alongside more traditional defensive assets.

First of all, the concept of "safe-haven assets" is not for profit, but for value preservation. During times of crisis, investors hope that assets can withstand pressure. Gold has maintained this state for decades. Although the US dollar is a fiat currency, it is often regarded as a safe haven due to its global reserve currency status and the strength of U.S. financial institutions.

U.S. Treasury bonds are supported by the full trust and credit of the U.S. government. All of these assets should have relatively low volatility and high liquidity.

Now, the problem is: Bitcoin’s volatility is not low. It is known for its volatility. But despite this, you may have seen moments when it act like a safe haven. Not always, but sometimes it does, which is interesting.

Isn't it?

2. The trade war and the role of Bitcoin in turbulent times in 2018-19

During the 2018-2019 Sino-US trade war, Bitcoin soared all the way during the traditional market turbulence, suggesting its potential as a hedge tool during turbulent times. Although the image of "digital gold" is becoming increasingly concerned, Bitcoin's trend is often the same as that of speculative technology stocks, and its risk-averse status has not been confirmed.

Take the Sino-US trade war from 2018 to 2019 as an example. Global markets are increasingly turbulent as the tariff threat escalates and tensions between the two major economic giants intensify. Technology stocks have suffered heavy losses and commodity prices have also fluctuated. However, in the midst of all this, something strange happened. Bitcoin is soaring quietly. From April to July 2019, the price of Bitcoin climbed from about $5,000 to over $12,000.

Bitcoin is not an isolated case. Gold prices also rose during this period. However, this is one of the earliest signs that Bitcoin may be more than just a risky asset, but can also act as a hedge during turbulent times. That period sparked a new saying: Bitcoin is "digital gold."

A fixed supply of 21 million pieces gives it scarcity. Its decentralized nature means it is not subject to any single government policy. And, because it is built on a global, censorship-resistant network, it is protected from the influence of capital controls common during periods of financial stress. These traits are beginning to resonate with investors seeking alternatives to traditional safe havens.

To be fair, Bitcoin is not always sticking to the rules. While sometimes it moves the opposite of risky assets, more often it performs more like a speculative tech stock, especially in the short term. Historically, Bitcoin has a strong correlation with the Nasdaq Index. So despite the growing prevalence of “digital gold”, it still matches the idea that Bitcoin is a high beta investment product for risk-seeking investors.

3. Insider of Trump's tariff war in 2025: Market turmoil, Bitcoin rises

In early 2025, Trump's comprehensive tariffs triggered panic in financial markets, and the Nasdaq and S&P indexes suffered historic declines. Within two days, the U.S. stock index evaporated trillions of dollars, triggering another debate about Bitcoin as a modern haven.

Fast forward to April 2025, and the question of whether Bitcoin can become a safe haven is tested again. This time, the test is even more obvious. In February 2025, Trump, who has entered his second term, announced a new round of radical tariffs aimed at revitalizing the U.S. manufacturing industry.

Such news headlines instantly alarmed the financial markets, especially as major trading partners began to talk about retaliation privately. On April 2, Trump announced what he called "Liberation Day" to impose comprehensive tariffs on almost all imported goods. This is labeled as economic patriotism, but it means chaos for the market.

Chaos come quickly. On April 3, the Nasdaq Composite Index plummeted by nearly 6%, with a single-day decline of more than 1,000 points. In terms of the original data, this is a record decline. The S&P 500's performance is not much better, down nearly 5%. Investors are beginning to panic about supply chain disruptions, inflationary pressures and a possible global economic slowdown.

On April 4, the panic deepened further. The Nasdaq Index officially entered the bear market area, with the Dow Jones Index falling by more than 2,200 points in a single day. Within 48 hours, the market value of major U.S. stock indexes evaporated by trillions of dollars.

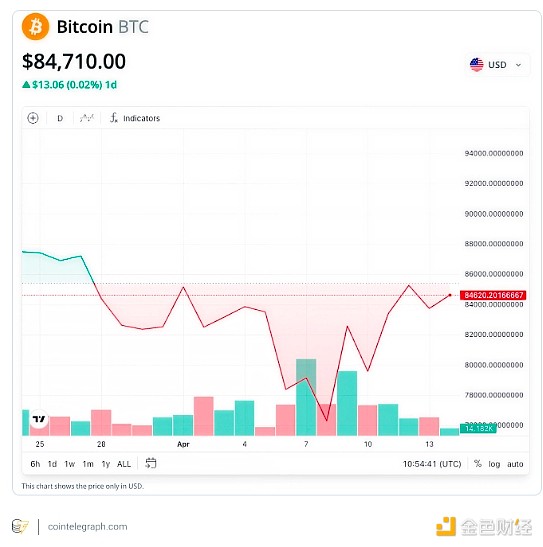

4. Bitcoin did not soar during the market crash, but did not fall

Bitcoin remained stable during the April 2025 market crash, and its resilience surprised many. It hasn't soared, but its stability in chaos suggests its growing role as a value-preserving asset during turbulent times.

So, how is Bitcoin performing? Surprisingly, it didn't change disastrously, and that's the truth of the story. Almost all other currencies plunged during the tariff-induced selloff, but Bitcoin did not collapse. This alone is eye- catching.

In a market where even the most mature benchmark indexes are shattering, Bitcoin’s relative stability has attracted the attention of portfolio managers and institutional observers.

Bitcoin has long been criticized for being too volatile to be suitable for building a rigorous portfolio, but it has quietly survived the storm better than many traditional assets. This is not a "moon landing plan", but a resilience moment. It focuses more on preserving value rather than adding value. And this is exactly the original intention of investors to seek safe havens. Bitcoin remains firm at a time when the Nasdaq and S&P indexes plummeted, which further confirms people's view that Bitcoin may be evolving into a more robust asset.

It should be clear that Bitcoin has not yet completely separated from risky assets. It will still be affected by liquidity, monetary policy and investor sentiment. But in such a period in April 2025, it showed some different qualities. It did not collapse, but held on! And for more and more investors, this is becoming more and more important.

5. Bitcoin is not new gold, but it is not old BTC.

Bitcoin’s growing resilience stems from its growing mature market, growing institutional adoption, and its attractiveness as a non-sovereign, transferable hedging tool during a time of financial or geopolitical pressure. While it is not the ultimate haven, it has clearly gone beyond the roots of speculation and is winning a place.

This growing momentum stems in part from structural factors. In the past few years, the Bitcoin market has become increasingly mature. The institutional adoption rate has increased. Spot Bitcoin ETFs are now listed in major markets. The hosting solution is also more complete. Perhaps most importantly, people have a broader understanding of what Bitcoin means.

Bitcoin is no longer just a speculative currency. It is a tool to safeguard financial sovereignty, hedge against the depreciation of fiat currency, and break through the boundaries of politicized financial infrastructure.

Furthermore, Bitcoin is completely non-sovereign. In the context of a trade war, fiat currency can be weaponized and capital controls will be deployed, and Bitcoin is extremely attractive to those who want to transfer funds across borders without being disturbed. It is portable, license-free, and is becoming more and more fluid. These three qualities are exactly the assets people desire during crisis periods.

Of course, this does not mean that Bitcoin is now the undisputed king of safe- haven assets. For most conservative investors around the world, gold still plays this role. The dollar remains the default choice for people when seeking liquidity in a crisis. Bitcoin’s price fluctuations can still make people feel nervous. But you will see it mature in the midst of market chaos. It is no longer marginalized as it used to be.

6. Bitcoin in crisis, safe haven 2.0?

In 2019 and 2025, Bitcoin showed bright spots in safe-haven behavior, proving that it could act as a hedge tool during times of geopolitical tensions. Although it is not gold at the moment, its unique attributes make it an increasingly important competitor in the global financial landscape.

Whether it was during the trade tensions in 2019 or the tariff escalation in 2025, Bitcoin has performed more like a hedging tool than previous cycles. This is worth paying attention to. Even if Bitcoin has not yet continued to play a safe-haven role, it is starting to show its capabilities, at least in certain situations.

A bigger problem is also brewing here. If Bitcoin really becomes a mainstream safe-haven asset, what does it mean for the financial market? How will this change portfolio construction, risk models, and even geopolitical strategies? After all, Bitcoin is not gold. It follows completely different rules.

Bitcoin is programmable. It can be instantly transferred around the world. It can be split into satoshis and embedded into smart contracts. If it becomes one of the global tools for responding to crises, the rules of the game will change.

So, will Bitcoin become a new safe haven during the trade war? Not so, at least in the traditional sense. But it certainly won a place.

Bitcoin may not be the asset your grandparents bought to protect themselves during uncertain times, but for an increasing number of investors, especially in the digital age, it is becoming a safe thing in their hearts. As geopolitical tensions intensify and people's confidence in the traditional financial system declines, Bitcoin is positioning itself as a potential hedging tool for the future.

chaincatcher

chaincatcher

panewslab

panewslab