Broker Act abolished, CAKE governance attacks...Recent thoughts on DeFi

Reprinted from panewslab

04/16/2025·4DDeFi loosening, broker bill repeal, CAKE governance attacks, sUSD continues to dean, restoring recent thoughts on DeFi:

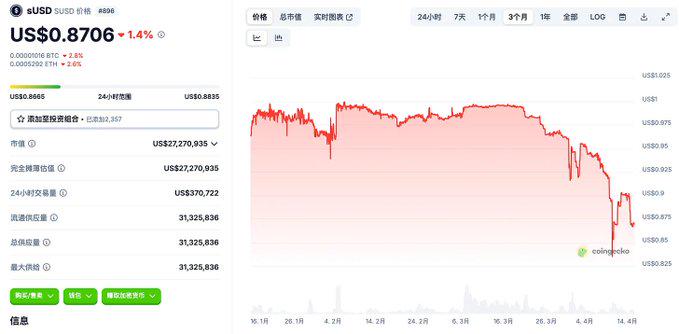

1/ sUSD continues to dean, why hasn't it been repaired for a long time?

After the adoption of the SIP-420 proposal at the beginning of the year, sUSD has deaned the anchor, and has recently entered a serious dean interval below $0.9. The key change to this proposal is to introduce a "commission pool". The design of the commission pool is to encourage users to cast sUSD through this mechanism. The advantage is that

- 200% mortgage rate (original design is 500%+)

- Debt can be transferred linearly to agreements

- After all transfers, users can pay back without any compensation

- The agreement resolves debt through profitable means and $SNX value-added

The advantages are obvious, which improves SNX's casting efficiency and eliminates the borrower's liquidation risks. If the market has strong confidence in SNX, it will enter a positive cycle.

But the problem is immediately revealed:

- The market still has serious PTSD for SNX - sUSD endogenous collateral

- Insufficient confidence, while improving SNX casting efficiency has caused additional sUSD to flow into the market, Curve Pool has deviated significantly

- Due to the design of the "entrusted pool", users no longer actively manage their debts and cannot repay debts by purchasing low-priced sUSD in the market.

The most concerned issue is whether it can be restored. This issue depends very much on the project party because it is necessary to increase the demand or incentives of sUSD. @synthetix_io is also very clear about this point. However, whether the market will pay for this algorithmic stablecoin with endogenous collateral is unknown. The sequelae of LUNA is still too great. However, from a design perspective alone, synthetix design is still advanced. If it was born in that period of stable grassroots, it may be favored.

(This does not constitute a buying and selling suggestion, and only states the reasons for the incident for study and research)

2/ veCAKE governance attack, cakepie protocol faces clearance

Dramatically, the ve model itself was designed to prevent governance attacks, but veCAKE was killed by centralized sanctions.

The process of this incident will not be described in detail. The main controversy is that Pancake believes that @Cakepiexyz_io guides CAKE emissions to inefficient liquidity pools through governance power, which is a "parasitic" behavior that harms Pancake's interests.

However, this result does not violate the operating principle of the ve mechanism. Cake emissions are determined by Cakepie's governance token locking vlCKP, which is the representative of governance power and can form a bribery market. This is the significance of the existence of protocols such as Cakepie and Convex.

The relationship between Pancake - cakepie and Curve - Convex is basically the same. Frax and Convex benefit from the accumulation of a large number of veCRV ticket rights, and the design of the ve model does not directly link the handling fee and emissions. The unreasonable problem of guiding emissions pointed out by cakepie is the result of insufficient competition in governance rights from the market perspective. The conventional practice is to wait or promote market competition. If human intervention is required, there are actually better human adjustment plans, such as setting an incentive upper limit for the pool, or encouraging more people to compete for vecake ticket rights.

3/ Continuing the above veCAKE governance attack, Curve founder

@newmichwill gave a quantitative calculation method:

- Measure the number of CAKEs locked to veCAKEs via Cakepie (these CAKEs are permanently locked).

- Compare a hypothetical scenario: if the same veCAKE is used to vote for a "quality pool" and all proceeds are used to buy back and destroy CAKE, what would be the number of CAKEs destroyed?

- Through this comparison, it can be judged whether Cakepie's behavior is more efficient than directly destroying CAKE.

According to Michael's experience, on Curve, the veToken model is about 3 times more efficient than directly destroying tokens in reducing the circulation of CRV tokens.

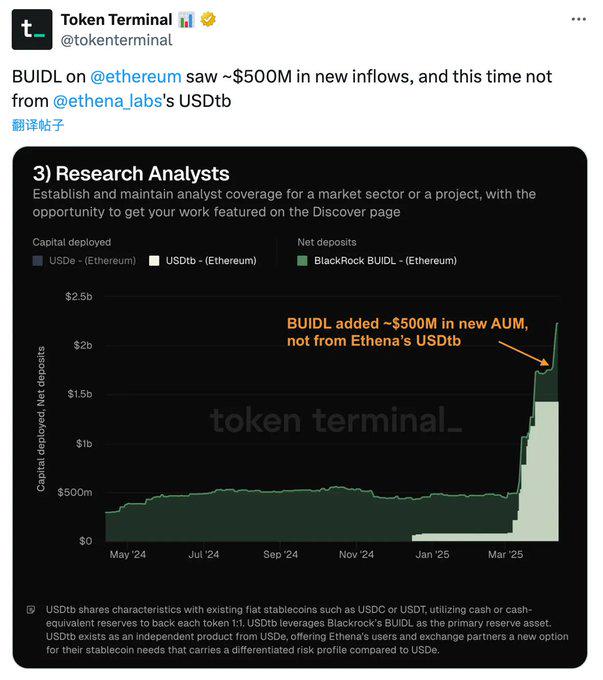

4/ BUIDL continues to grow, with an increase of 24% in 7 days

(1) Last time I paid attention to it exceeded 2 billion, and now it is close to exceeding 2.5 billion

(2) The latest increase of $500 million does not come from Ethena

(3) May attract new investor groups

(4) According to the traces on the chain, it may come from the loan agreement Spark under Sky (MakerDAO).

RWA business has always maintained growth, but has not been well integrated into DeFi Lego School. It is currently in a state of "disconnection from the market and not related to retail investors".

5/ IRS DeFi Brokers Act is officially revoked

On April 11, US President Trump signed a bill to officially repeal the IRS DeFi encryption broker rules.

The DeFi sector has risen, but not much. I personally believe that it is actually a major benefit to DeFi. The regulatory attitude is relaxing DeFi, which may release more possibilities for application innovation.

6/ Unichain starts liquidity mining, $5 million in $UNI token rewards 12

pools

Tokens involved: USDC, ETH, COMP, USDT0, WBTC, UNI, wstETH, weETH, rsETH, ezETH

Uniswap has been five years since the last liquidity mining. The last time was with the launch of UNI tokens in 2020. This time, the goal is to guide liquidity for Unichain. I guess many people will go to mine and get UNI tokens at low cost.

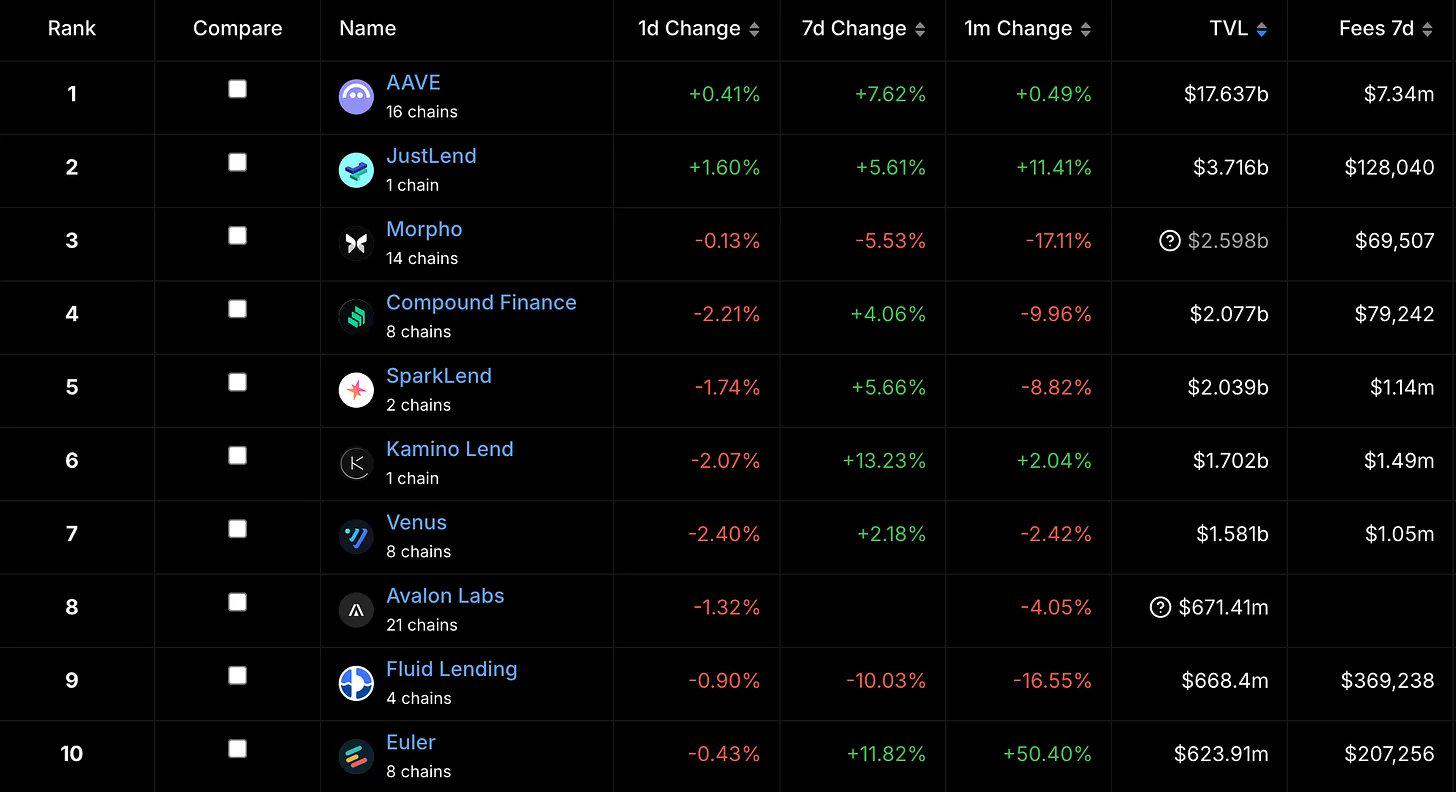

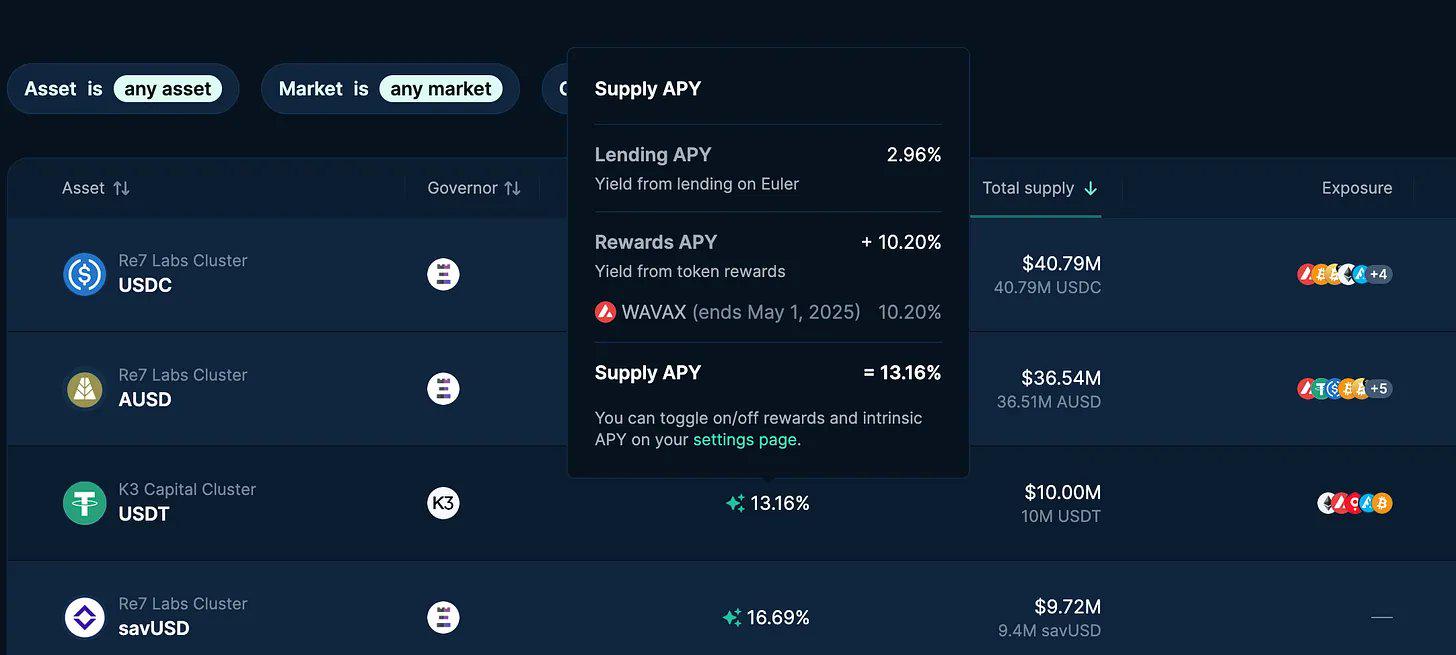

7/ Euler expands to Avalanche, TVL has entered the top 10 lending

agreements

(1) TVL increased by 50% in one month

(2) Most of the growth comes from incentives, mainly from Sonic, Avalanche, EUL, etc.

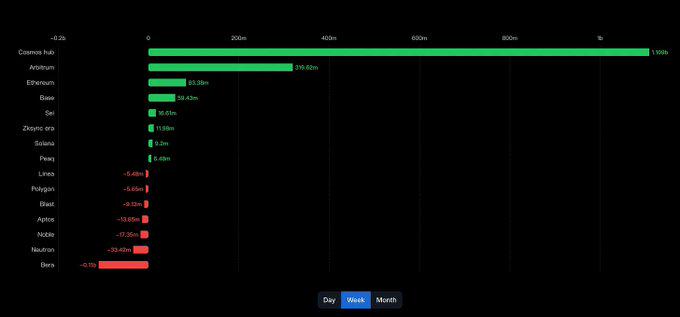

8/ Cosmos IBC Eureka officially launched

(1) Based on IBC v2

(2) Gas $ATOM consumed per transaction

(3) Support cross-chain between Cosmos and EVM

(4) Mainstream assets that currently support Ethereum mainnet and Cosmos have not yet been expanded to L2

(5) Cosmos hub cross-chain inflows of US$1.1 billion in the past week

A strong empowerment has been introduced to ATOM. Any chain in Cosmos can attract a large amount of capital to enter, which may drive the value growth of ATOM. The situation where the ecological outbreak that occurred during the LUNA period will be improved.

Although there has been a large inflow of funds in the past week, if we want to change the fundamentals of ATOM, we need to examine sustainability.

9/Repurchase

(1) AaveDAO begins to repurchase tokens

(2) Pendle proposes to launch PT token to Aave

10/ Berachain farming

(1) Update POL reward allocation rules to set an upper limit of 30% for the allocation ratio of a single Reward Vault

(2) Berachain Governance Update introduces a new guardian committee responsible for reviewing and approving RFRVs

(3) OlympusDAO deals with new rules to prepare to move part of POL liquidity to maintain high incentives for $OHM pool

(4) Yearn's $yBGT login to Berachain

After Berachain experienced gold in March, both the coin price and TVL entered adjustments, and the official made changes and restrictions on the exposed unreasonable incentive allocation. Although TVL has been outflowing large amounts in the past few weeks, it is still one of the most DeFi chains. Continue to observe more protocol integrations, as well as TVL inflows.

jinse

jinse