Should Bitcoin investors worry about spot BTC ETF inflows remain flat

Reprinted from jinse

04/16/2025·5DAuthor: Marcel Pechman, CoinTelegraph; Translated by: Deng Tong, Golden Finance

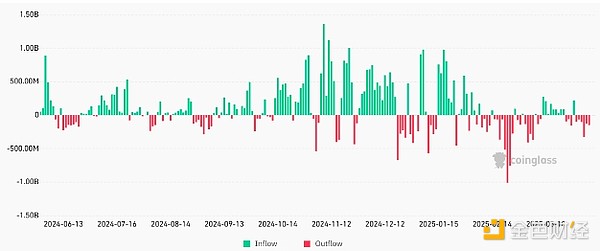

From April 3 to April 10, the total net outflow of spot Bitcoin ETFs reached $872 million, which caused traders to worry whether the overall interest in Bitcoin was fading. Strong selling pressure began on April 3, when global trade tensions intensified and concerns about a recession increased. This trend is particularly worrying after both April 11 and April 14 net outflows of spot Bitcoin ETFs were below $2 million.

Total net inflow of spot Bitcoin ETFs (USD). Source: CoinGlass

Bitcoin prices have remained relatively stable over the past five weeks, around $83,000, further suggesting that both buyers and sellers are weaker. On the one hand, this lack of volatility may indicate that Bitcoin is becoming a more mature asset class. For example, the share prices of several S&P 500 companies have fallen 40% or more from all-time highs, while Bitcoin’s biggest drop in 2025 was only 32%, which is healthier.

However, Bitcoin’s performance has disappointed those who believe in the “digital gold” claim. Gold prices have risen 23% so far in 2025 and hit an all-time high of $3,245 on April 11. Although Bitcoin has outperformed the S&P 500 by 4% in the past 30 days, some investors are worried that its attractiveness is fading as it currently lacks correlation with other assets and cannot act as a reliable store of value.

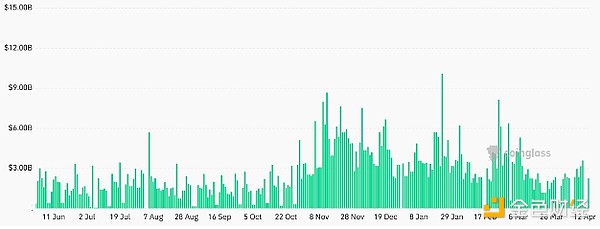

Bitcoin ETF average daily trading volume exceeds US$2 billion

Looking at the spot Bitcoin ETF market - especially compared to gold - Bitcoin has some advantages. On April 14, the total trading volume of spot Bitcoin ETFs was US$2.24 billion, 18% lower than the 30-day average of US$2.75 billion. Therefore, it is not accurate to say that investors' interest in these products has disappeared.

Spot Bitcoin ETF Daily Trading Volume (USD). Source: CoinGlass

While the Bitcoin ETF trades below the SPDR S&P 500 ETF (SPY) daily trading volume, it is not much different from the $5.3 billion trading volume of the gold ETF and exceeds the $2.1 billion trading volume of the U.S. Treasury ETF. Considering that the U.S. spot Bitcoin ETF was launched in January 2024, and the gold ETF has been trading for more than 20 years and has managed assets of $137 billion, this achievement is impressive.

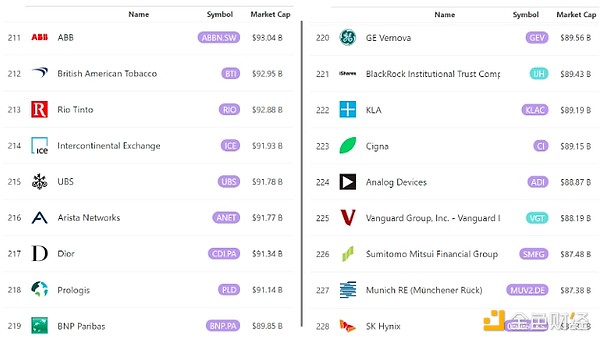

Even if the Grayscale GBTC Trust (which had daily trading volumes of more than 200,000 shares before it was converted into an ETF in 2017), it was less than eight years since its birth. At present, the scale of managed assets of spot Bitcoin ETF is approximately US$94.6 billion, exceeding the market value of well-known companies such as British American Tobacco, UBS, InterContinental Exchange, BNP Paribas, Cinox Group, Sumitomo Mitsui and other well-known companies.

Trading assets ranked by market capitalization, USD: Source: 8marketcap

To understand the solid position of spot Bitcoin ETFs in the industry, take a look at the main holders of these products. These include well-known companies such as Brevan Howard, DE Shaw, Apollo Management, Mubadala Investment and Wisconsin Investment. From pension funds to some of the world’s largest independent asset managers, Bitcoin ETFs offer alternatives to traditional assets regardless of short-term price trends.

As asset classes grow and more products such as futures and options are listed, Bitcoin may eventually be included in global indexes, whether in commodity or currency categories. This may attract passive funds to invest, thereby increasing price potential and trading volume. Therefore, it is not uncommon to lack a strong net inflow or outflow at present and should not be regarded as a sign of weakness.

panewslab

panewslab