Grayscale: What factors are changing the current state of the crypto market?

Reprinted from jinse

02/08/2025·5DSource: Grayscale; Translated by: Tao Zhu, Golden Finance

summary

-

In January, the cryptocurrency market continued to climb, although weekend tariff news caused valuations to fall. There was also a series of activities in January, which could have an impact on the digital asset industry for the rest of 2025 and beyond.

-

The Trump administration has issued a comprehensive executive order on cryptocurrencies that promise key principles to protect markets, including self-custody of digital assets. The order also said the government will "promote the development and growth of stablecoins." On the same day, the U.S. Securities and Exchange Commission (SEC) issued updated policy guidance that allows traditional financial institutions to custody crypto assets.

-

In addition to policy news, the technological breakthroughs of China's artificial intelligence laboratory DeepSeek have also attracted people to the needs of decentralized artificial intelligence models and related infrastructure.

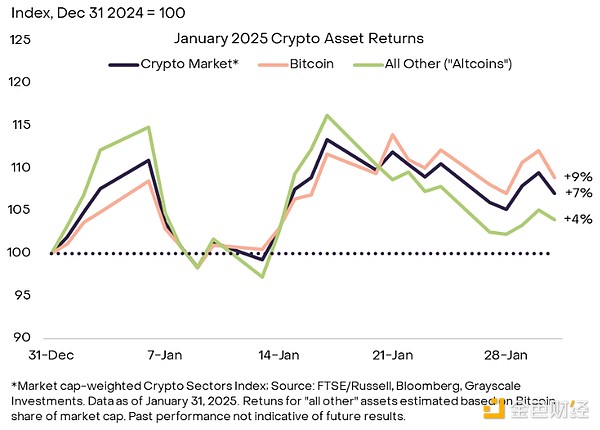

According to the Grayscale Crypto Industry Index we developed in partnership with FTSE/Russell, the overall valuation of the crypto market rose by 7% in January 2025. The Grayscale Crypto Industry Index is a weighted indicator for measuring the market value of investable digital assets. Bitcoin’s price rose 9% month-on-month, with the highest price reaching about $109,000 in the month, and rose to [1] at the end of January. Crypto assets with market capitalization below Bitcoin (commonly known as "altcoins") generally rose by about 4% (Figure 1).

Figure 1: Bitcoin outperforms the overall cryptocurrency market in January

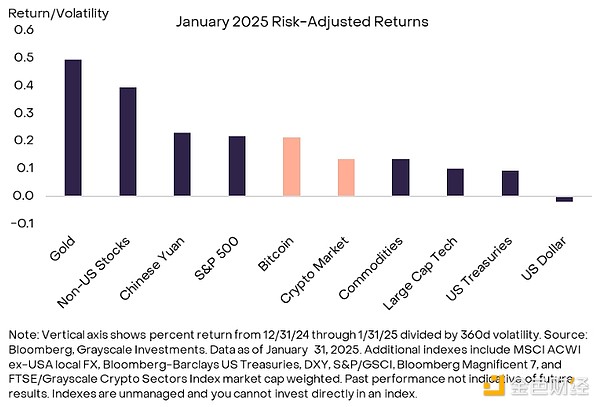

Most traditional asset classes also generally rose in January (Figure 2). The increase in Bitcoin price is in the middle of the range after risk adjustment (i.e., taking into account the volatility of each asset). The dollar has depreciated, and several non-U.S. stock markets have performed well, possibly due to the Trump administration’s signal that any tariff hikes could be gradual—although these expectations eventually proved wrong. [2] In contrast, some large tech stocks were suppressed by increased earnings uncertainty after Chinese startup DeepSeek announced a breakthrough in new technology development in artificial intelligence. Gold has also performed well in the past month and has been ahead of most other major assets after risk adjustments. [3]

Figure 2: Most asset classes rose last month

After President Trump took office on January 20, the new administration immediately began to change U.S. policies on blockchain technology and digital assets. The first specific policy change is the revocation of the Securities and Exchange Commission (SEC) Staff Accounting Notice (SAB) 121, which requires financial institutions to treat crypto assets escrowed as assets on the balance sheet, thus preventing them from participating in the process. business. On January 23, the SEC, led by Acting Chairman Uyeda, issued SAB 122, revoking the previous order. This change should allow existing securities custodians to protect crypto assets in the United States as well.

On the same day, the White House issued an executive order (EO) on crypto policy titled “Strengthening the U.S. leadership in the field of digital financial technology.” Grayscale Research believes that the most important feature of the executive order is the fundamental principles that support the industry, including the right to access open networks, develop and deploy software, participate in mining and staking/verification, peer-to-peer transactions, and self-custodial digital assets. It also highlights the need to protect individuals and businesses from access to traditional banking services. The Executive Order further outlines a timeline for amending federal government regulations and set up a Presidential Digital Asset Markets Working Group, which will include the Finance Minister and other regulatory agencies.

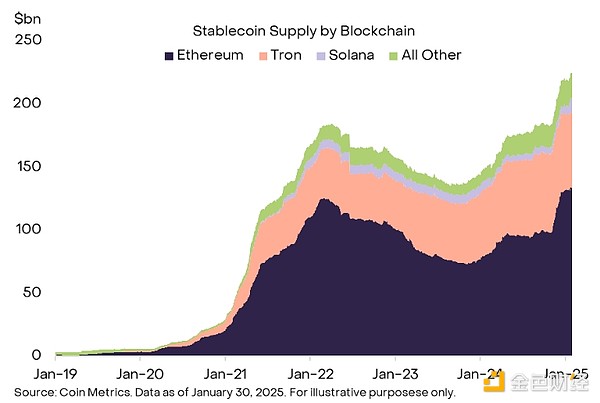

The president's executive order also stated that the government's policy is to "promote the development and growth of legitimate and legal dollar-backed stablecoins." Stablecoins provide a way to trade in fiat currencies such as the US dollar using blockchain infrastructure. Today, the total circulation value of stablecoins exceeds US$200 billion (Figure 3). Given the clear requirements in the executive order, stablecoins may be the area where regulatory guidance changes the fastest. In the EU, stable currency policy has been incorporated into the Crypto Asset Market (MiCA) regulation, which came into effect at the end of last year. The stablecoin USDC has reached a regulatory agreement with MiCA, while Tether (USDT) has not yet reached it, which may be one of the reasons for USDC's recent market share growth. Tether said in January that it is developing a strategy for the European market [4] and announced that USDT will join the Bitcoin Lightning Network [5].

Figure 3: Stablecoin market value exceeds US$200 billion

Finally, the Executive Order directs the Working Group to “assess the potential possibilities of establishing and maintaining national digital asset reserves.” [6] Grayscale Research expects the White House to fulfill this commitment, but we are not sure if the federal government will raise taxes or borrow funds to buy bitcoin on the open market. In addition, several U.S. states are advancing measures to establish Bitcoin reserves, and bitcoinist.com reports that 14 states (such as Texas and Oklahoma) are undergoing legislative procedures.

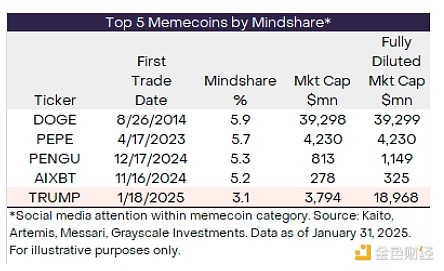

In addition to executive orders on crypto policy, President Trump and his family have also launched memecoins $TRUMP and $MELANIA on the Solana blockchain. [7] Memecoins is a digital asset that does not claim to provide real-world utility, but it can still have economic value to a community as a form of entertainment (such as a physical collection). Figure 4 shows the most popular memecoin currently calculated by "mindshare". Dogecoin is the dominant memecoin calculated by mindshare, and it is also the largest memecoin calculated by market value.

Figure 4: TRUMP is the fifth most popular memecoin

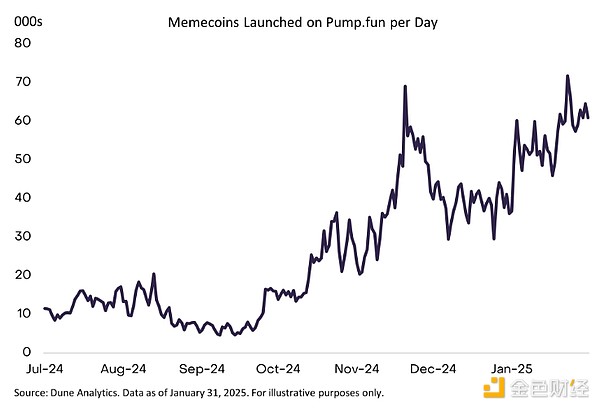

Over the past year, the Solana blockchain’s memecoin issuance has surged. This activity is driven primarily by pump.fun, an innovative platform on which users can create and deploy their own memecoins. Over the past year, about 7 million new memecoins have been created on Solana, and new tokens on pump.fun are issued at a rate of about 60,000 per day (Figure 5). Memecoin transactions incur transaction fees, thus bringing value to Solana token holders. Pump.fun itself (nearly $150 million in January 2025 alone). [8] Solana Blockchain (hosting applications and activities other than memecoin) Solana's fee income is comparable to Ethereum's fee income, while Solana's (fully diluted)[9] has a market capitalization of only 35% of Ethereum. [10] Ethereum has lagged Solana in terms of memecoin activity in January over the past year, partly due to higher transaction fees.

Figure 5: Solana platform pump.fun releases about 60,000 memecoins per day on average

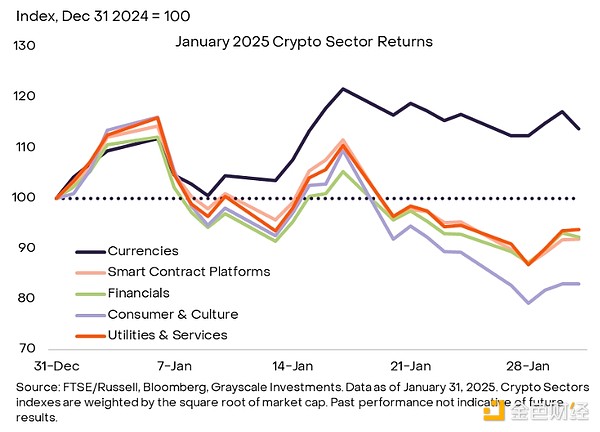

From the perspective of the cryptocurrency industry, the best performing segments are the currency sector, and the worst performing are the consumer and cultural sectors (Figure 6). Our cryptocurrency industry index is weighted by the square root of the market value of each asset to reduce the weight of the maximum token and better represent the broader market. The strong performance of the currency sector reflects the rise in Bitcoin. [11] XRP Ledger (XRPL) is a blockchain designed for fast and efficient digital payments. XRP is a native asset that supports XRPL and facilitates low-cost cross-border transactions. We attribute XRP’s price performance to several factors, including significant changes in regulatory risks associated with changes in the U.S. government. In addition, XRPL development company Ripple said that its performance has been strong so far, with RLUSD's market value growing to over $500 million [12] and becoming the fourth largest stablecoin in centralized exchanges in the past month. [13]

Figure 6: The currency cryptocurrency sector performed well in January

Just like traditional markets, the development of artificial intelligence technology was the dominant theme in the crypto asset class in January. Most importantly, on January 20, Chinese startup DeepSeek launched its new open source artificial intelligence model R1,

Meanwhile, DeepSeek News highlights the risks associated with centralized AI development, such as data security, bias and censorship—risks that can be addressed through blockchain-based AI platforms such as Bittensor. Bittensor is a decentralized network designed to create an “artificial intelligence internet” where the interconnected ecosystem is called “subnets”, each focusing on different specific use cases. Bittensor plans to conduct a potential major network upgrade called Dynamic TAO (“dTAO”) in mid-February, which will make it possible to invest in a single subnet; we believe this could inject a new wave of liquidity into the Bittensor ecosystem. . [16] Accessing DeepSeek's high-performance open source model may also reduce costs and lower entry barriers to many open source decentralized AI projects, especially at the application layer, such as AI agents. We've seen this happen. For example, the decentralized AI Agent launchpad ai16z (renamed ELIZAOS) allows access to DeepSeek's models using agents built by its ELIZA framework.

The digital asset industry is growing rapidly – as evidenced by a series of news in January 2025. While there are many different developments, in general, they show increased regulatory transparency, increased institutional adoption, and continuous advancement in technology. New tariffs announced by the Trump administration in late January could put pressure on all markets in the near term, and cryptocurrency investors need to pay close attention to these developments. In addition to tariffs, Grayscale Research expects crypto markets to focus on ongoing changes in U.S. federal government regulatory guidance on stablecoins and other topics, as well as other macro issues, including U.S. tax policy outlook and the Fed 's interest rate cut prospects.

Comments

[1] Source: Artemis. Data as of January 31, 2025.

[2] Source: Bloomberg.

[3] Source: Bloomberg. Data as of January 31, 2025.

[4] Source: Crypto Slate.

[5] Source: Coin Telegraph.

[6] Source: Transcript vs Roll Call.

[7] Source: Artemis. Data as of January 25, 2024.

[8] Source: Dune Analytics. Data as of January 25, 2024.

[9] Source: Token Terminal. Data as of January 31, 2025.

[10] Source: Artemis. Data as of January 31, 2025.

[11] Source: Artemis. Data as of January 25, 2025.

[12] Cryptorank

[13] CCData Stablecoins and CBDC Report, January 2025.

[14] "How China's top artificial intelligence model overcomes US sanctions." MIT Technology Review. January 24, 2025

[15] “China’s DeepSeek AI shocks the industry and weakens the momentum of the United States.” BBC. January 28, 2025.

[16] X.com

panewslab

panewslab

chaincatcher

chaincatcher