Gulf Bank of Singapore: Embrace new banking services under the cryptocurrency and compliance framework

Reprinted from panewslab

04/16/2025·5DAuthor: Zen, PANews

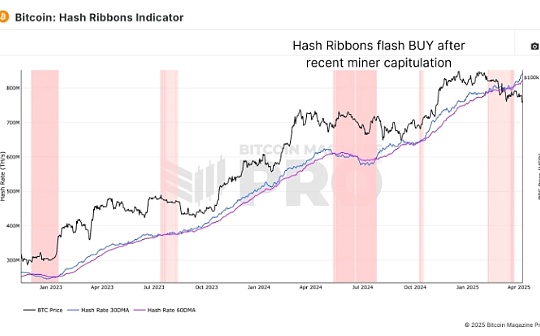

In recent years, with the rise of cryptocurrencies such as Bitcoin and Ethereum, the global digital asset market has expanded rapidly. As of early April 2025, the total market value of the global cryptocurrency market fell to US$2.63 trillion after a sharp drop, it is still an important pole of the global financial market.

At the same time, traditional banks have a clear gap in meeting customer needs

- according to a latest survey by Bitpanda, less than 20% of European banks provide digital asset services, while more than 40% of business investors already hold crypto assets. In addition, Fnality CEO Michelle Neal pointed out that many international banks are accelerating their embrace of blockchain technology to achieve 24/7 real-time settlement and cost efficiency improvements.

Against this background, Singapore Gulf Bank (SGB) is trying to break this situation by combining crypto-friendly services and strict compliance supervision to provide new banking solutions for crypto users and digital nomads who are ignored by the traditional financial system.

The establishment and background of the Singapore Gulf Bank

The Gulf Bank of Singapore was established at the end of 2023. The digital bank, established in the Middle East Gulf country of Bahrain, was initiated by Singapore's Whampoa Group. Huangpu Group is an investment company active in the technology field, founded by Lee Runying, the niece of Singapore’s founding Prime Minister Lee Kuan Yew and Lee Hanshi, the grandson of Lee Guangqian, the founder of OCBC Bank.

After being officially established and obtained a bank license issued by the Central Bank of Bahrain, the bank soon obtained investment from Bahrain's sovereign wealth fund Bahrain, and promoted the banking project to a national strategic development project, becoming a new benchmark for financial technology services innovation in the Kingdom of Bahrain and the Bay Area.

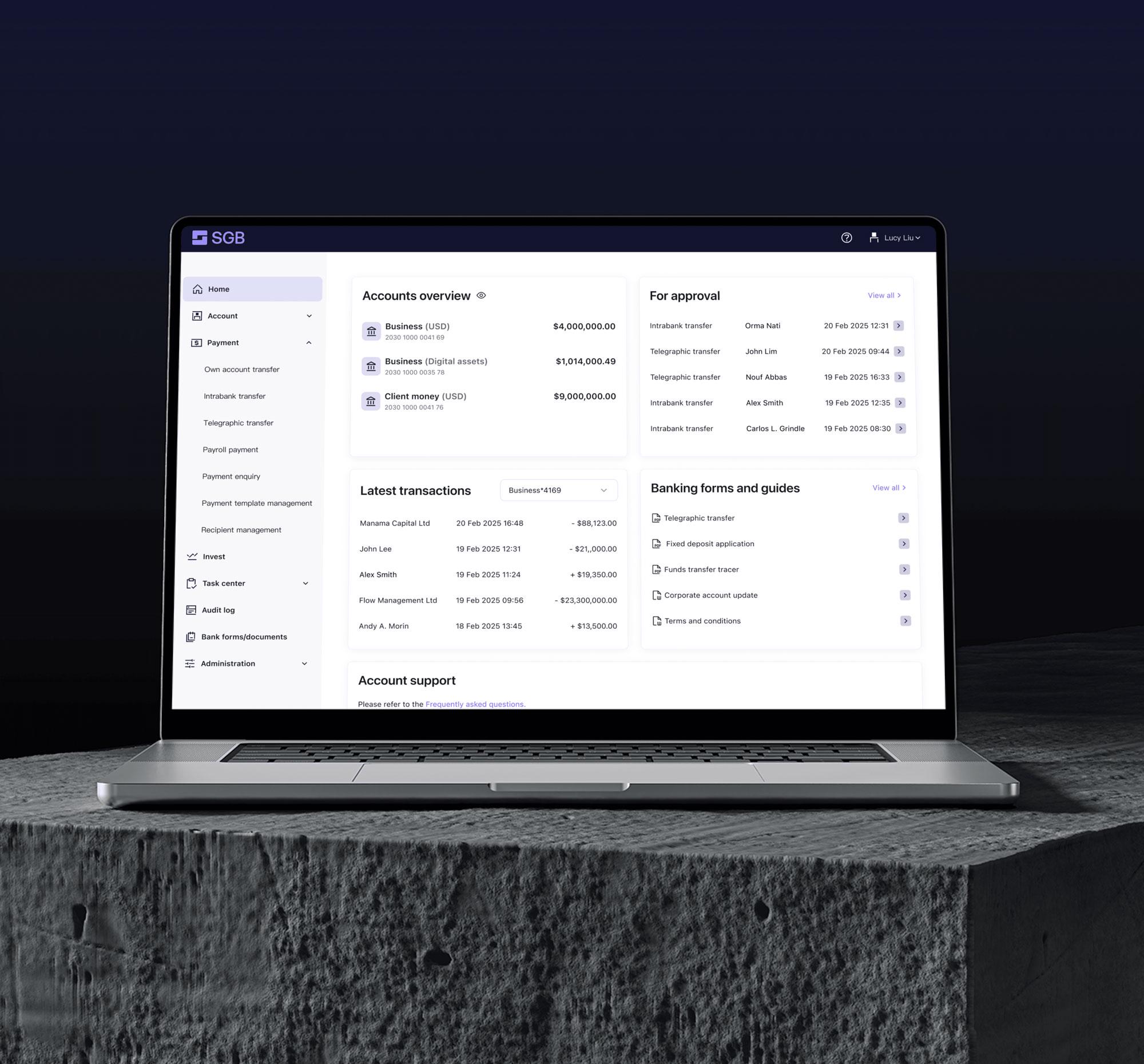

On November 4, 2024, the Gulf Bank of Singapore, together with the Central Bank of Bahrain and the Economic Development Commission of Bahrain, announced that it had begun to provide corporate banking services to the global digital economy, and became the first licensed bank in Bahrain to provide comprehensive cryptocurrency-compatible banking services. In addition to regular corporate banking services, the bank will also provide real-time settlement network, digital asset custody and intuitive and efficient transaction solutions. As its Chief Development Officer and Executive Vice President Tsai Yile said, digital companies such as Web3 will form the bank's main customer base for its services.

SGB announces

corporate banking services at the 2nd Bay Portal Investment Forum

SGB announces

corporate banking services at the 2nd Bay Portal Investment Forum

After corporate banking services received a strong market response, in April this year, the Gulf Bank of Singapore expanded its services to individual customer groups and officially launched personal banking services. As the first and only regulated bank in the Middle East and North Africa to provide fully remote digital account opening services to global investors, innovators and institutions, SGB aims to provide remote account opening and integrated traditional and digital assets to millions of individuals around the world. Currently, personal banking services are launched by invited registration.

Break through the limitations of traditional banks

Under the comprehensive supervision of the Central Bank of Bahrain, the Gulf Bank of Singapore provides global remote account opening services. Investors, innovators and small businesses around the world can complete account opening without visiting Bahrain, and use its settlement network to achieve cross-border payments and settlements. This not only greatly lowers the threshold for opening an account, but also opens up a new situation for users who cannot enjoy high-quality financial services due to geographical restrictions.

Faced with global Web3 users, Singapore Gulf Bank strives to break through the limitations of traditional banks in the field of digital asset services and pioneered a crypto-friendly bank account. This account not only supports customers to deposit wages through fiat currency or cryptocurrency, but also has multiple functions such as payment, transfer and investment. Through in-depth integration with top licensed trading platforms and exchanges, SGB can achieve instant, secure and seamless conversion between fiat currency and cryptocurrency, greatly improving the efficiency and convenience of capital flow.

In addition, in terms of cross-border payments and foreign exchange needs, the Singapore Gulf Bank will combine the multiple advantages of wire transfers, own bank cards and cryptocurrency payment channels to provide global users with low-cost and efficient international remittance solutions. Whether it is studying abroad, business travel or daily cross-border transactions, SGB can provide flexible and convenient financial services to effectively deal with the complexity faced by traditional banks in cross-border payments and settlements.

With its comprehensive banking services, Singapore Gulf Bank has also opened up diversified investment channels for its customers. These channels not only cover high-yield savings and fixed deposit accounts (annual interest rate of up to 4%), but also include products with unique investment opportunities in Asia and the Middle East and North Africa, providing customers with more diversified asset allocation options.

Through its own settlement network, Singapore Gulf Bank has achieved real-time payment services 24/7. This not only applies to rapid transfers between individual users, but also meets the needs of high-frequency capital flows between institutions. Its instant transfer service without fees has greatly improved the overall efficiency of financial transactions and improved user experience.

Practical exploration of building a "new bank" model

"The company has no intention of competing with traditional banks, but in areas where it can be competed, I hope to be the first." Last year, Li Youqiang, chairman of the Gulf Bank of Singapore, said in an exclusive interview with Lianhe Zaobao that he is firmly optimistic about the development prospects of digital assets and emphasized that he will focus on those customer groups that have not been fully served by traditional banks. SGB focuses on differentiated competition and crypto-friendly banking services, with the goal of building an ecosystem covering transactions, transfers, payments and storage between digital assets and cash.

When building this new banking model, Singapore Gulf Bank fully relies on advanced digital technology and AI technology. By building an AI-driven risk control system, the bank can realize real-time monitoring of customer behavior and reduce the risk of fraud. At the same time, through the automated identity verification process, the Singapore Gulf Bank has greatly improved the efficiency of account opening and ensured strict compliance management in various services. In this way, SGB not only realizes the seamless integration of traditional banking business and digital asset services, but also provides global users with a unified and convenient banking service entrance.

Bahrain Minister of

Finance and National Economy Salman (left) and Singapore Gulf Bank Chairman Li

Youqiang (right)

Bahrain Minister of

Finance and National Economy Salman (left) and Singapore Gulf Bank Chairman Li

Youqiang (right)

In an exclusive interview with Lianhe Zaobao, Li Youqiang emphasized that the Singapore Gulf Bank is not a cryptocurrency exchange, and he himself does not regard cryptocurrency as a speculative asset, but as a payment channel that can be used to promote cross-border trade. Based on this concept, Singapore Gulf Bank clearly identified its native users of cryptocurrencies and customers interested in cryptocurrencies. While ensuring that traditional financial needs are met, it focuses on building an integrated ecosystem for digital asset services.

As the global digital asset market continues to expand, countries are increasingly strict in supervision of cryptocurrency transactions. In its new banking model, the Gulf Bank of Singapore has always adhered to the principle of legal and compliant operation, especially in terms of cryptocurrency business. Under the comprehensive supervision of the Central Bank of Bahrain, SGB strictly follows international financial and regional compliance standards in the process of account opening, trading and asset management to ensure that all links involving fiat and cryptocurrency transactions meet the requirements of anti-money laundering (AML) and understanding customers (KYC).

Can innovative models lead new trends in digital banking

"I come from a traditional banking background and see a lot of disruptive changes happening. Technology allows us to do many things that we could not have done before." In Li Youqiang's banking career in the past 40 years, he has successively served as chairman and CEO of DBS Weigotha and vice chairman of JPMorgan Asia Pacific. Now, he sees “developing Singapore Gulf Bank into the industry’s leading or largest digital bank” as the ultimate goal of his career, which has a long way to go for this fledgling bank.

Bahrain Crown

Prince Salman (right) Meets with Singapore Gulf Bank Chairman Li Youqiang

(left)

Bahrain Crown

Prince Salman (right) Meets with Singapore Gulf Bank Chairman Li Youqiang

(left)

At present, with a number of core competitiveness such as crypto-friendliness, cross-border payments and strict compliance, Singapore Gulf Bank is gradually showing its head and becoming an important new force in the new banking field. Faced with challenges in technology, regulation and market, the bank provides global users with safe, convenient and diversified financial solutions through differentiated strategies and refined management. Its innovative model provides global individual users with a new financial choice, and will continue to be tested by the market and time.

jinse

jinse