Have we arrived at altcoin season?

Reprinted from jinse

01/08/2025·1MSource: The Defi Report; Compiled by: Wu Baht, Golden Finance

2025 is going to be a big year. I'm excited to share our data-driven analysis and market insights with you.

To kick off 2025, we're sharing our thoughts on "copycat season," as well as our current thoughts on macro issues for the year ahead.

Has copycat season arrived?

Given Solana’s stellar performance in 2024, meme coin mania, the resurgence of DeFi, and the recent rise of artificial intelligence agents, some believe “altcoin season” has arrived.

We disagree. Why?

-

We believe SOL's outperformance is largely a result of a severely undervalued rally in 2023;

-

Meme mania looks more like the DeFi summer of 2020 (a glimpse of the coming bull run in 2021);

-

The DeFi renaissance (Aave, Hyperliquid, Aerodrome, Pendle, Ethena, Raydium, Jupiter, Jito, etc.) is real, but DeFi still feels niche. According to Kaito AI, its narrative share as an industry will decline in 2024;

-

The rise of artificial intelligence agents looks more like a glimpse of "copycat season" than the actual thing.

We can admit that there are plenty of bubbles in the market. But the overall numbers don't lie.

Source: CoinGecko

Quick analysis:

-

In the last cycle, the total cryptocurrency market capitalization increased by $431 billion in the fourth quarter of 2020. Bitcoin accounted for 71.5% of the gains. BTC dominance reached 72% on January 3, 2021 (cycle peak).

-

During the current cycle, the total cryptocurrency market capitalization increased by $1.16 trillion in the fourth quarter. BTC accounted for 59.5% of the gains. BTC dominance currently stands at 56.4% – just below the cycle peak of 60% set on November 21, 2024.

Now. You might think that BTC’s smaller share of total cryptocurrency market cap growth this cycle would mean that altcoin season is upon us.

But look what happened as we entered 2021, the last year of the previous cycle:

-

From January 1, 2021 to May 11, 2021, the cryptocurrency market capitalization increased by $1.75 trillion. BTC accounted for only 31% of the gains. Dominance dropped to 44%.

-

From May 11, 2021 to June 30, 2021, the total market value fell by nearly 50%. BTC fell by approximately 50% during the same period.

-

The market subsequently rebounded, reaching a peak market value of $3 trillion on November 8, 2021. BTC accounted for only 38% of the second surge.

Key points to focus on:

-

While some believe this is “Bitcoin’s cycle” (due to ETH’s underperformance, ETF dominance, strategic Bitcoin reserve hype, L2, etc.), the data shows that as we transition to ’21 – the previous cycle In the last year of the year, BTC has actually been stronger.

-

In the last cycle, with the arrival of the New Year, the "copycat season" kicked off with a bang. From January to May, ETH increased 5.3 times. Avalanche is up 12 times. SOL rose 28-fold during the same period. DOGE is up 162 times. This is the true face of "copycat season". During this period, Bitcoin’s dominance dropped by almost 30%.

-

As mentioned, we are seeing some froth in the market today. Having said that, we believe that “altcoat season” has just begun – as evidenced by Bitcoin’s 60% decline in dominance from its cycle peak on November 21, 2024.

-

We predict that the total cryptocurrency market capitalization will grow to $7.25 trillion next year (a 113% increase from today). If 35% of funds flow to BTC from now on, the total market cap will reach $3.2 trillion, or $162,000 per BTC. Our optimistic scenario predicts a total cryptocurrency market capitalization of $10 trillion. If 35% of funds flow to BTC, the total market value will reach $4.2 trillion, or $212,000 BTC. Our pessimistic case forecast total market capitalization is $5.5 trillion. If 35% of funds flow to BTC, the total market value will reach $2.6 trillion, or $131,000 BTC.

-

We expect $2.5 trillion to flow into non-BTC assets this year—double the previous cycle in 2021. To look at it another way: Solana, Avalanche, and Terra Luna had a combined market capitalization of $677 million on January 1, 2021. They peaked at $146 billion at the end of the year. That's a 21,466% increase. again. We have not seen such a large-scale initiative. That doesn't mean it will definitely happen.

-

"Copycat season" occurs for a variety of reasons. But we believe there are 4 main driving factors:

-

BTC wealth effect: BTC investors make profits + seek greater returns on the risk curve.

-

Media attention. More attention = more users getting into cryptocurrency. Many people will invest in what they think is the “next Bitcoin”.

-

Innovation. We typically see new and exciting use cases emerge later in the cryptocurrency cycle.

-

Macro/liquidity conditions/Fed policy – driving market sentiment and animal spirits.

Speaking of macro conditions…

If we want to have a proper “altcoin season,” we believe macro and liquidity conditions must align with market participants’ growing risk appetite.

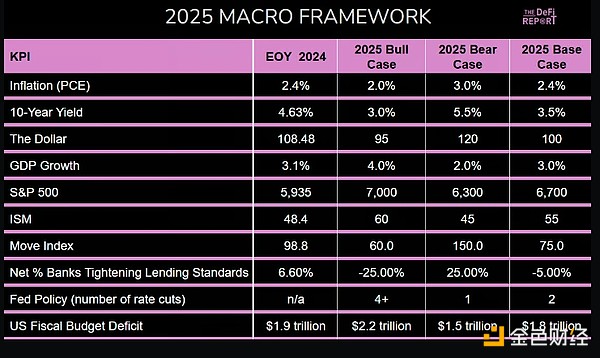

2025 Macro Framework

In this section, we will analyze some of the key economic drivers of risk assets such as cryptocurrencies while considering the probabilities of various outcomes in 2025.

Inflation (PCE)

As we noted in our last report, the Fed is worried about inflation. Therefore, they changed their forecast for rate cuts this year from 4 to 2 at the November FOMC meeting. The market sold off as a result.

Our view on inflation:

We think the Fed/markets are one sided on inflation. Why? The main drivers of inflation during COVID-19 are 1) supply chain issues, and 2) wartime money printing (fiscal) + zero interest rate policy (Fed).

Therefore, to predict a pickup in inflation, we need a catalyst. Some might point to oil. But we think Trump's "drill baby drill" policy is deflationary for oil prices (increased supply should lead to lower prices). Others pointed to fiscal spending and a projected $1.8 trillion deficit in 2025. Tax cuts, deregulation, tariffs, all fair game.

But there are also deflationary forces in our economy. Such as artificial intelligence and other technological innovations. Our population is aging—many baby boomers are retiring. As birth rates continue to be low, our population is also shrinking. Now we have a strict border policy.

These are all deflations. However, some still believe inflation will "come back" to levels seen in the 1970s. They make these comparisons without taking into account differences in today's economies, demographics, commodity markets, etc.

Therefore, our base case forecast is for inflation to remain broadly within the range we see today (2.4% PCE). It might even go down. We think this is positive for risk assets as it could lead to more than 2 rate cuts next year - something that is not yet factored in.

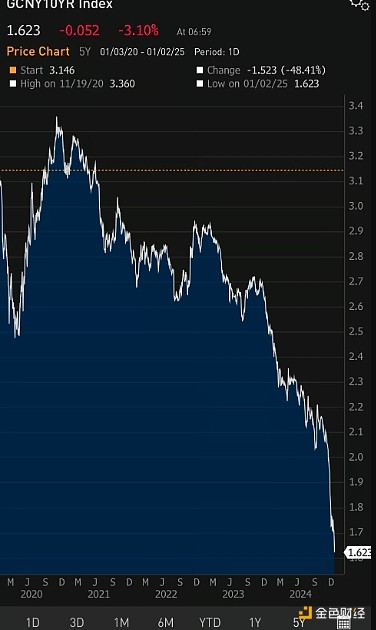

10-year yield

Yields ended the year at 4.6% - a full 1% higher than on September 16, when the Fed began cutting interest rates. Therefore, the Fed is trying to ease monetary policy. But bond markets tightened monetary policy. Why? We believe there are three main drivers:

-

inflation. The bond market believes that the Fed's rate cuts could lead to a resurgence of inflation.

-

Fiscal spending concerns and debt growth. Large deficits lead to increased issuance of Treasury bonds—which can lead to oversupply in the market. To attract buyers, interest rates must rise (unless the Fed steps in as a buyer - which we expect to happen later this year).

-

Growth expectations. Economic growth will accelerate in 2025 due to Trump's policies (tax cuts, deregulation), which could lead to higher inflation.

Our take on interest rates:

We believe it is fair for bond markets to reprice 10-year yields in light of the above concerns. We note that the Treasury will need to refinance more than a third of all outstanding debt this year, much of which is on the short end of the curve—where there are more buyers—while Secretary Yellen said in the last cycle Most refinancings of . If new finance minister Scott Bessent attempts to pay down debt, it could create a supply-demand imbalance at the long end of the curve and send yields soaring.

We believe these risks are reasonable. But we also think the Fed has the tools (quantitative easing) to control rising yields if needed. We believe the Trump administration will do whatever it takes to increase asset prices.

We believe the 10-year yield will reach 3.5-4%. It could go lower. Again we think this is positive for risk assets.

Growth and the S&P 500

Although the fourth quarter data has not yet been released, the growth in the first three quarters indicates that our economy will grow by 3.1% in 2024. The Atlanta Fed's latest GDP Now forecast shows growth next year at 2.6%.

Meanwhile, the S&P 500 rose 25% last year. It increased by 24% in 2023. The CAPE ratio (which measures valuation relative to inflation-adjusted earnings over the past 10 years) is currently at 37.04, which is significantly higher than the historical average of 17.19, indicating a possible regression in 25 years.

But we shouldn’t blindly assume that mean reversion is imminent. What if lower taxes and deregulation would increase revenue? What if automation increases efficiency? Or will expectations of these things prompt market participants to buy stocks?

Notably, the CAPE ratio bottomed in October 2022, close to peak valuation levels in 1929 (on the eve of the Great Depression). We believe the nature of the modern global liquidity cycle may be distorting asset valuations - particularly in the wake of the 2008 financial crisis. After all, governments around the world continue to cover up the problem of aging populations by printing money—creating asset bubbles and spawning more and more zombie companies in the process.

Data: DeFi report, S&P 500 CAPE ratio (from multpl.com)

Our view on growth and the S&P 500:

We think this year's numbers could surprise higher. But much will depend on whether Trump can push Congress to pass tax cuts and deregulation.

That being said, we do not believe a recession is imminent. Despite the high CAPE ratio, we also don't believe we are in a bubble. Our base case forecast is for the S&P 500 to grow 12.8% this year.

Short term view:

The labor market is cooling, with the unemployment rate at 4.3% (up from 3.6% last year). The ISM index was 48.4, indicating a moderate contraction in the manufacturing sector (11% of GDP). At the same time, the Federal Reserve has cut interest rates three times, and the interest rate reduction cycle has reached 1%. The market currently expects that interest rate hikes will be suspended in January and the rate cut rate will be 88%. There will be no FOMC meeting in February.

Therefore, it appears that the federal funds rate will remain at 4.25-4.5% until March at the earliest. Additionally, the debt ceiling battle looms, as Secretary Yellen said the Treasury Department will hit the borrowing limit between January 14 and January 23. Therefore, we believe that the Treasury may have to use the TGA, the Treasury's operating account at the Federal Reserve, which can be used in emergencies. There are currently approximately $700 billion in the account. The Fed can also use its reverse repurchase facility to free up liquidity in emergencies.

Therefore, we think there may be some shocks in the first quarter that will ultimately lead to liquidity injections from the Fed/Treasury et al. We expect some volatility in the short term.

in conclusion

We believe that “altcoin season” has just begun. But we also believe that macro and global liquidity conditions need to support appropriate altcoin rotation this year.

Of course, macroeconomics are difficult to predict. But we hope our analysis helps you develop your own framework for how this year might unfold.

-

We believe there is no risk of interest rate hikes - the last interest rate hike cycle ended in November 2021;

-

We see no recession risks ahead (although some sectors, such as commercial real estate, are still experiencing pain);

-

We think the Fed/markets are offside on inflation;

-

We believe the labor market may show signs of further weakness in the first quarter;

-

We think yields will fall later this year and the Fed will likely buy Treasuries (quantitative easing) while driving rates lower;

-

We still see upside risk this year as we believe the market landscape for Trump coming to power during a period of rapid technological advancement is similar to the late 1990s;

-

As the debt ceiling debate unfolds in the coming weeks, we expect some volatility/drama;

-

The biggest risk is a black swan event, which would force the Fed to cut interest rates quickly, as markets may sell off in panic and then eventually be buoyed by liquidity.

chaincatcher

chaincatcher

panewslab

panewslab