Hot spots are gradually lost, ETP is out, and BTC may test the support level of US$92,000

Reprinted from panewslab

02/19/2025·2MAuthor: BitpushNews Mary Liu

Cryptocurrency markets continue to decline as inflation concerns escalate, with crypto exchange-traded products (ETPs) experiencing their first net outflow in 19 weeks.

Bitu data shows that in the past 24 hours, Bitcoin once hit an intraday low of $93,388.83, rebounded above $95,000 at press time, Ethereum fell 3% to $2,600, and Solana (SOL) fell nearly 5%, with the lowest drop to $163.

"It's not too surprising that the cryptocurrency market has fallen 3% today -this seems to be driven primarily by macro factors. Recent inflation reports show that inflation will continue, so interest rates are cut in the short term The possibility is less. "

Crypto funds outflow

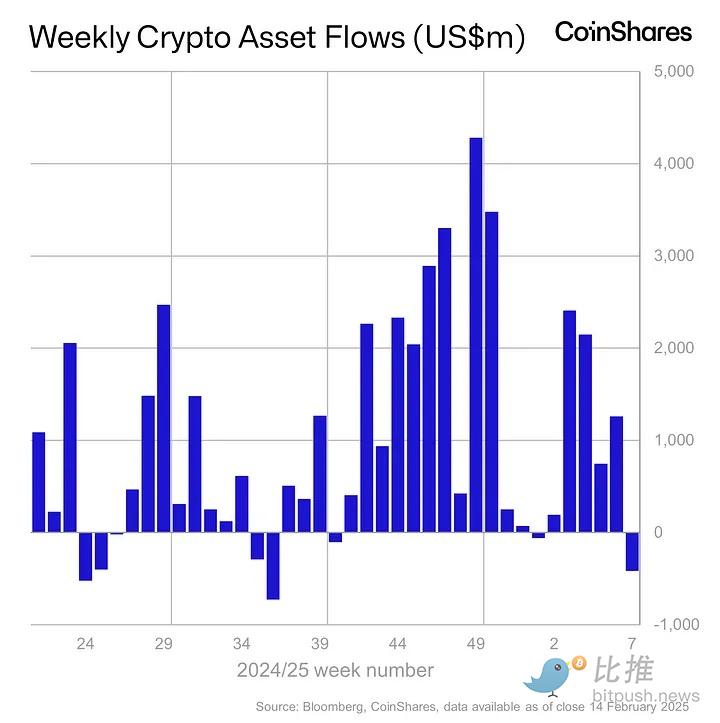

The callback also coincides with the first net outflow of digital asset exchange-traded products (ETPs) in 19 weeks.

According to the latest weekly report on CoinShares Digital Asset Fund Traffic, a large amount of capital outflows occurred in digital asset investment products last week, with a total amount of US$415 million. This marks the end of a trend of cumulative inflows of US$29.4 billion in 19 consecutive weeks.

"The ETF ended its 19-week straight inflows, with net outflows in the first week as investors have been seeking to cut exposure," the report said. CoinShares attributed these outflows to Fed Chairman Jay Rom Powell recently sent hawkish signals and higher-than-expected U.S. inflation data.

The report pointed out that BTC was particularly affected, with outflows reaching US$430 million, reflecting its sensitivity to interest rate expectations. Interestingly, the short-selling Bitcoin products also recorded a $9.6 million outflow.

By comparison, Solana leads with $8.9 million inflows, followed by XRP and Sui, with $8.5 million and $6 million respectively, crypto concept stocks attracted $20.8 million inflows, bringing its total to date this year $220 million.

Technical indicators show that support level of $92,000 may be retested

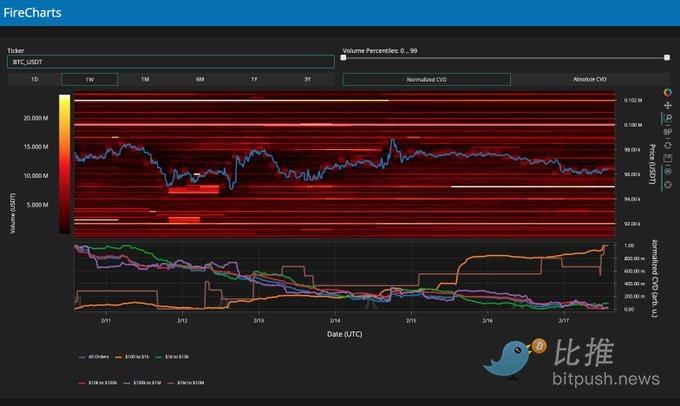

According to an analysis shared by Material Indicators on February 17, Bitcoin may fall further due to the "death cross" on the daily chart. Death crossing refers to a short-term moving average falling below the long-term moving average, which usually indicates a weakening of price momentum. However, the analysis also pointed out that there is buy order liquidity around $95,000 and $92,000 is the secondary support level, which may help stabilize prices.

Analysis of Binance Order Book data further supports the view of the upcoming tests. Technical charts shared by Material Indicators show that there is significant interest in buying orders around $95,000, while nearly all order categories except retail traders reduce exposure. The $92,000 support level suggests that further declines may validate key support areas, laying the foundation for future price action.

Traders are cautious and many are paying close attention to technical signals. The emergence of the death cross indicates a possible long-term downtrend, but some investors view the current conditions as an opportunity to accumulate more Bitcoin. Material Indicators emphasizes the importance of strategic planning in such market conditions, and advises traders to be patient and stick to their goals.

Standard Chartered Reiterates Its $500,000 Bitcoin Price Target

Standard Chartered maintains its $500,000 price target for Bitcoin, citing changes in investor landscape, including institutions, banks and sovereign buyers. The bank expects Bitcoin to reach this level before U.S. President Trump leaves office, driven by increased access channels and reduced volatility.

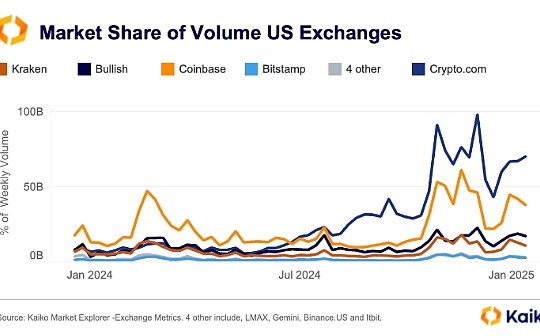

According to Standard Chartered, the purchase volume of spot Bitcoin ETFs in 2024 was 499,000 BTC, while Strategy purchased 257,000 BTC. The bank expects institutional inflows to increase further in 2025, but stresses the need for new buyers to maintain momentum.

"To achieve this, we need new buyers; banks have been buying in large quantities, and now sovereign states are joining in," the analyst wrote.

A key factor supporting this outlook is data from the SEC 13F filing, which shows an increase in Bitcoin positions in banks and hedge funds in the fourth quarter.

Standard Chartered Bank pointed out: "The buyer type will gradually evolve, from retail buyers before ETFs to hedge funds in the early stages of ETFs, and finally to sovereign investors." Looking ahead, Standard Chartered Bank expects pension funds and central banks to be the long-term Institutional investors join the market.

chaincatcher

chaincatcher

jinse

jinse