In-depth analysis Kaito: How did the Yap event detonate the social flywheel?

Reprinted from chaincatcher

02/08/2025·5DCompiled by: Wu Shuo Blockchain

This issue is Alex's personal YouTube channel content, focusing on the recent popular social product Kaito, and in-depth discussion of its product strategy, market background and development logic. Alexon is the CIO of Ferryboat Research. By analyzing Kaito's choice on the Twitter platform and its characteristics in the collection, processing and application of encrypted social data, it explains its high pricing reasons and core advantages. In addition, the direction exploration of similar projects was compared and it pointed out how Kaito broke through the limitations of traditional data services through API call optimization, KOL graph construction and social binding mechanism, successfully completed strategic transformation and established a unique market position. At the same time, it shared the entrepreneurial experience and insights of practitioners in related industries, and directly pointed out the challenges and opportunities faced in the process of productization and commercialization of Web3.

Crypto traffic acquisition method: the difference between delivery and

fission mode

Crypto is a field with high volatility, high risk, and strong financial attributes. You may find opportunities from this, or you may need to prepare for the principal to completely zero. Next, let’s talk about the first part: why Kaito and similar products chose Twitter as the main position.

First of all, from the perspective of the consumer goods industry, traffic structures are generally divided into two categories: public domain traffic and private domain traffic. In terms of how to obtain traffic, it is divided into two main paths: delivery and fission. Public domain traffic usually includes Twitter and YouTube, while Telegram and Discord are private domain traffic in the crypto industry. In contrast, traffic in private domains is more difficult to track and the structure is relatively single.

Although there are platforms such as Reddit or Instagram and TikTok that are gradually involved in the crypto industry, at present, Twitter and YouTube still have the highest traffic concentration. If it is put into the domestic environment, it may require promotion with Xiaohongshu, Douyin, and Kuaishou. At the same time, it also requires grass planting platforms such as Bilibili, and finally promote in-site through the express train or Vientiane. After that, the traffic will be directed to private domains such as WeChat for conversion and repurchase.

In general, the way to obtain traffic in the Crypto industry is relatively simple, because the delivery logic cannot carry enough performance at the current industry stage. This leads to a relatively single way of obtaining the entire traffic ecosystem, mainly focusing on fission and distribution.

Comparison of user acquisition costs and fission effects in different

regions

More than two years ago, we tried delivery strategies when developing our own tool products. I invested tens of thousands of dollars in testing. Although the specific data is inconvenient to disclose, an obvious result is that the cost of acquiring an American user is about ten times that of acquiring a Vietnamese user. However, the fission rate of Vietnamese users is significantly higher than that of American users. This shows that American users are less inclined to actively participate in fission promotion, such as relatively few actions in making and disseminating a landing page.

In the entire crypto industry, I think there are only two ways to get traffic: distribution and fission. Although both methods are essentially a form of fission, their application logic is different. Distribution is more inclined to rely on KOLs (key opinion leaders) or KOCs (key opinion consumers) for promotion, and you endorse the product and then distribute it to retail investors or retail users.

Fission is designed by designing an efficient fission mechanism to create a set of activities that attract users to actively participate. Kaito's Yap activity is a typical case, for example. Users share their own Crypto Twitter (CT) account data, such as displaying how many "smart followers" are there, forming a way to play similar to NetEase Cloud's annual playlist or consumption bill. Essentially, the purpose of these mechanisms is to achieve fission through spontaneous sharing of users, thereby obtaining more traffic.

After explaining this background knowledge, we can understand why we chose Twitter as the main platform rather than the private domain. The biggest problem with private domains is that it is difficult to obtain all content in a standardized manner, and it is difficult to effectively weighted evaluation of content in private domains. For example, if a community is discussing all around Kaito, you cannot accurately evaluate the true value and impact of this data. At the same time, the decentralization of private domain platforms also makes it very difficult to fully obtain relevant data. Because of this, this is not a priority.

Why Kaito chose Twitter as the main platform

On public domain platforms like YouTube, content is usually suitable for long videos. For example, it can be a stand-alone video or interview format similar to the one I have recorded now, or it can focus more on tutorials and interactions, or even some mining machine operation guides. Such content often requires long-term production and viewing, suitable for topics that require detailed explanation and learning. Therefore, such content carriers are not essentially suitable for scenarios driven around immediate events or hotspots.

These long video content is often better suited to deal with PoW (Proof of Work) related topics. So although we also tried to introduce Kaito's monitoring and analysis logic on YouTube and Farcaster, we finally found that the targets that can be effectively observed are usually projects like Kaspa and Helium, and for some short-term meme tokens , the performance is completely ineffective.

In contrast, Twitter is naturally suitable for use as a data platform, especially in environments where social data is very concentrated. Almost everyone's marketing budget is concentrated on Twitter, forming a high consensus. At the same time, Twitter's social graph is also very transparent, such as your follower list, interaction and other data are presented in an obvious form. And platforms like YouTube, it's hard to get clear fan relationships or interaction details.

Ultimately, the reason why Twitter is chosen as the main platform is that it is the optimal solution. Its transparent social graph and centralized traffic structure provide us with clear advantages. In contrast, it is very difficult or even impossible to obtain similar network data on platforms like YouTube. Therefore, both us and Kaito prefer to prioritize Twitter as the main position.

Two reasons why Kaito is priced high: API costs and regulatory

restrictions

We used some "strange tricks and tricks" at that time. At that time, Twitter had not been acquired by Musk, and there were some gray areas in the system. For example, using an educational account or other means to obtain data, although it is not completely compliant, this method is common in the early stages. For early projects like Kaito, I guess they initially adopted a similar strategy to get data through these informal avenues. However, when the product starts commercialization, this method obviously cannot continue to be used.

Two years ago, when they completed financing and launched their products, they could only rely on commercial APIs, and after Musk acquired Twitter, they blocked many irregular channels. The cost of using commercial APIs is quite high, and as the number of calls increases, this cost increases linearly rather than decreases.

The second reason for the high pricing is Twitter’s regulatory restrictions. Even if a company uses a commercial API, there is an upper limit on the number of calls per month (you can't remember the specific number of calls). This means that if the product is particularly popular, the limit on call volume will make the ToC (consumer-oriented) model unsustainable. Ultimately, we and Kaito both chose the ToB (enterprise-oriented) model at similar points in time, the best solution to maximize the economic value of limited call volumes. For Kaito, there are few other alternative directions.

Specifically, since the call volume is fixed, the only way is to achieve greater economic returns by increasing the value of a single user, which is commonly referred to as price increases. And this is precisely a necessary choice for the product, otherwise the entire business model will not be established.

I learned that their delay is about 15 minutes, which is about the same as ours. It should be understood that the shorter the delay time, the higher the cost required. This is because historical data needs to be swept at higher frequencies, and this cost increase is exponential. The setting of delay time also directly affects the efficiency and economic feasibility of API calls. All in all, Kaito's high pricing under API call costs and regulatory restrictions makes sense.

Evolution and choice of Kaito's product direction

Next, let’s talk about Kaito’s product direction and why they have developed from “trending” type products to the current KOL type features. Here we first give a small conclusion - it is not to teach others how to start a business, but to share our own experience. We have tried multiple directions and found that there are three directions that can be derived based on this set of logic.

The first direction is the pure Alpha tool for your own use. Kaito's CEO mentioned in a Podcast that they had also considered this direction. If the tool is only used for Alpha type purposes, the more developed the more it is, the more it is, the more it is, the more suitable it is for large-scale users. We have also encountered similar problems - if there is no charge, users may not cherish it; if there is a charge, why not just use it yourself? This type of problem makes Alpha tools usually more suitable for self-use rather than productization.

We have developed a set of tools using logic similar to Kaito. The application of this set of tools allows us to often discover them before projects get popular. We have considered using this logic to make listing tools for exchanges. For example, I once wanted to work with Binance to provide this set of tools for free to optimize their listing selection criteria. Because some projects, such as ACT, do not show any performance worth paying attention to in our "God's Perspective" based on Twitter data analysis, but are still listed on the exchange. This unreasonable choice could have been avoided through data-driven tools.

In addition, we have also studied the application of Alpha logic to quantitative trading strategies. We test the top 200 or top 100 projects on Badcase, and make transaction decisions based on text mining, sentiment analysis, etc. Test results show that this strategy is more effective for projects with smaller market capitalization and susceptible to emotions and event-driven, but has limited effectiveness for projects with larger market capitalization. I believe Kaito has done similar research, after all, their CEO has a trading background. From this point of view, we and Kaito have many similarities in early starting points and logic, but the path we chose in the end was different.

Kaito's community news tools explore and its industry potential

Under the current model framework, some phenomenal themes, such as meme and NFT, are very significant. They can show the potential for price increase in this logic. However, such phenomena cannot be completely solved through standardized programmatic transactions, because they still require strong manual intervention. This characteristic makes them effective, but lacks standardization. As for whether Kaito has products in similar directions and is used for itself, I don’t know this.

The second direction worth exploring is news and GPT products. What does this mean? For example, a Web3 assistant like the current Alva (formerly Galxe) can obtain all tweet corpus by integrating Twitter's time-sharing data and process it with the ChatGPT interface. By tweaking the prompt on the front end, this data can be output in a more intuitive form, resulting in a lot of immediate community news.

For example, if you see the dispute over uppercase and uppercase "elisa" or you may be confused. At this time, you can directly ask this tool: "What is the reason for the dispute over capitalization and uppercase and uppercase elisa? Who is the initiator?" In this way, the tool will summarize the answer based on the latest data. The original GPT cannot do this because its data has a fixed deadline and usually cannot provide the latest content within the six months. You can only crawl the relevant corpus yourself and feed it to the GPT, and then summarize the logic through prompts. This type of tool has great potential and is a direction worth exploring in depth.

From the moment, Kaito seems to be exploring such products or trying similar directions. The Alva product I mentioned is a good example. It integrates a large amount of industry data by calling APIs related to encryption fields such as Rootdata to connect users and industry information point-to-point. However, the problem with Alva is that the quality of data cleaning is not high enough. They spent a lot of time connecting with the data network, but there was room for improvement in the accuracy of data and the meticulousness of cleaning. In contrast, Kaito's advantage lies in the accuracy of its data, which is beyond doubt.

To give a practical example, I have obtained quick answers to the recent dispute over capitalization "elisa" through such tools. The application of such products in the crypto industry can indeed significantly improve efficiency. We also developed similar tools more than two years ago, and the test results showed that it can indeed improve work efficiency. However, when we try to commercialize, the core problem we encounter is that the user's willingness to pay is not strong enough. Although tools can improve efficiency, they are not targeted at a core pain point, which makes users lack a strong purchasing motivation.

In addition, due to the high cost of calling such tools (there is a fee to be paid for each call to the GPT interface), the gross profit margin of the product is relatively low. Therefore, although such tools have some significance, their commercialization faces great challenges. Many call behaviors are more for the purpose of promoting activation, and the actual scenarios of generating income are limited, which have become problems that need to be overcome. In general, although this direction has great potential, more optimization and breakthroughs are still needed in actual implementation.

The role of data accuracy and KOL graph construction in marketing

When exploring these tools, there is a core question: How do they achieve revenue? If the VIP mode alone allows users to call the API unlimited times, it is difficult for this kind of product to have a large profit margin, but its existence is meaningful. It can directly use Kaito's logic to read Twitter data and use it to generate and distribute self-media content, such as community news similar to "Wu Says" or other forms of community news. This type of tool can not only improve efficiency, but also help project parties distribute content on multiple platforms, such as generating short videos through AI and posting them on TikTok, or directly posting them on Twitter.

I think this product direction is not only Kaito or Galxe to try, projects like Mask are actually very suitable for this. Strangely, Mask does not seem to be deeply involved in this direction at the moment. If any friends from the Mask team hear these suggestions, I hope you can try to consider it.

For Kaito, its current product direction has shown that they want to go to a greater market capitalization rather than keep moving along the Alpha tool’s route. Although Alpha tools can be profitable, they lack the potential for productization. If you only focus on this, it will eventually be limited to internal use and cannot form products for a larger market. Kaito's move to KOL graph construction is obviously to break through this bottleneck.

The early users who were interested in Kaito products were almost the same as the user group who followed our tools at that time. Our tools were also recommended to be sold to some trading companies or secondary funds in the early stages. Although these trading companies are more concerned about profitability, this direction will fall into a cycle of "profitability or not". In contrast, KOL map provides accurate support for marketing delivery, improving delivery effect through data accuracy, thereby increasing the marketing value of the project party.

Data accuracy is the key. Although there are many companies on the market that can collect Twitter data, whether the data is accurate is another matter. Kaito and our early tools are among the few that can be accurate in the open market. The core of data accuracy lies in "washing data", which is the most difficult and critical link. Acquisition of data is relatively simple, but weighting and cleaning of data requires a lot of repeated testing and logical adjustments, which often requires a combination of experience and intuition.

For example, Crypto Twitter (CT) in the Chinese community often has a lot of noise and the weight needs to be reduced. This noise causes Chinese CT to lag 24 to 48 hours later than English CT. How to effectively clean and adjust data is a "supervised skill" and the company's core competitiveness.

Through the accurate KOL map, Kaito can help project parties optimize delivery strategies and improve delivery accuracy. This product can not only help project parties achieve more efficient marketing, but also obtain marketing expenses and form a sustainable business model. Choosing this direction is exactly the smart strategy Kaito has shown in market competition.

The strategic logic behind Yap activities and the flywheel effect

Throughout the Crypto space, advertising has been a relatively vague and inefficient behavior. Current marketing agencies are essentially more like simple tools to maintain address books, with relatively single means. In this context, Kaito provides tools to help project parties determine which KOLs are worth investing and which are not worth it, and provide evidence-based references through data analysis. This accuracy greatly improves the efficiency of advertising.

Kaito optimizes KOL delivery through two key metrics: correctness and core circle. Correctness refers to whether the KOL's judgment is accurate, such as whether they have discussed it before a project rises, rather than participating after the project rises. Every time KOL's judgment is correct, it will be recorded and weighted, affecting its weight score. All of this can be repeatedly verified by timestamping and data analysis tools.

The core circle (called "smart follower" in Kaito) measures the depth of a KOL's influence. If an account has more smart accounts (i.e., smart follower) interact with it, its weight score will be higher. This can help project parties screen out truly influential KOLs, rather than just having an account with a large number of fans.

Kaito’s Yap event demonstrates the success of its strategic transformation. This campaign significantly reduces marketing costs by using free KOL leverage. Traditional marketing requires contacting KOLs one by one and paying high fees, and Kaito directly discloses a page to provide KOLs with allocated rewards through weighting algorithms. This approach not only simplifies the process, but also increases credibility through data transparency. This model has allowed many KOLs to participate in the promotion voluntarily, helping the project spread rapidly.

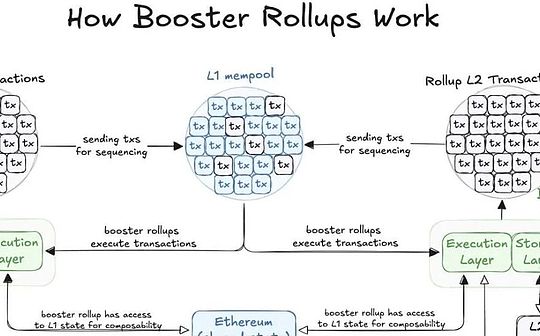

At the same time, the Yap activity also addresses potential risk issues. Considering that if Twitter changes API rules in the future, Kaito allows all CT users to bind their accounts to their backend through TGE and actively authorize the use of data. This approach has gradually enabled Kaito to gradually break away from its dependence on Twitter API and begin to master its own data assets. This not only gives Kaito stronger independence, but also forms a positive cycle between supply and demand: as more CT users are bound, the project party's interest increases, forming a flywheel effect of data matching.

Ultimately, Kaito created business imaginations like Alibaba Mama or Juliang Engine through this model, becoming a successful marketing ecosystem platform in the crypto industry. At present, this strategy has been implemented quite successfully.

Entrepreneurship Reflection: How practitioners with atypical elite

backgrounds break through

If all CT (Crypto Twitter) users bind their accounts to Kaito's backend, then when entering the secondary market in the future, Kaito can clearly tell the outside world: "These data are mine." Whether it is the project party or the CT user , this binding behavior can form data consensus and trends. This is the core logic behind Yap activities.

Before I finish the Kaito topic, I want to share a little story about ourselves. Before Kaito raised funds, we also developed similar products, and it can even be said to be carried out at the same time. More than two years ago, we tried both the Alpha tool and the GPT tool. At that time, it was a downturn in the industry. Our team was not very good at socializing and there were very few people in the industry. Although our products are interesting and have potential, few friends have introduced us to VCs.

At that time, we contacted four VCs, one of which was willing to follow up, but we needed to find the lead investor. The other three companies directly ignore us, one of the reasons is that our background does not conform to the typical image of an elite entrepreneur. Instead of delving into the logic behind our products, or even trying to imagine its potential value, they simply vetoed it.

Until later, we gradually attracted more industry attention through platforms such as YouTube. Most of these audiences are institutions and practitioners in the industry. Even so, I haven't mentioned the past to those VCs I've ever had with us because it's a little awkward. Interestingly, I later saw on the timeline that VC employees I had come into contact with now praise Kaito, which made me feel very moved.

We ended up taking the Alpha tool route, which was related to the limited social circle we had at the time. We believe that it will be difficult to successfully commercialize ToB products without external help. We hope to achieve market expansion by finding recognition from well-known VCs, with their resources, rather than just moving forward with our own difficulties.

For entrepreneurs with atypical elite backgrounds, I have some advice. VCs focus more on connections and relationship networks, rather than on your product itself. However, I always believe that good products can speak out themselves. If your product is really good, don't be afraid to show it out. Nowadays, I also realize the importance of building social influence. Through social networks, you can not only meet more people, but also accumulate a certain degree of popularity and trust for future entrepreneurship.

For those of you who watch my videos or browse my Twitter, the belief I want to convey is that whether you have an elite background or not, as long as your product is excellent enough, I am willing to help you. Good products and ideas are more important than gorgeous resumes. As long as what you bring out can make me recognize, I will do my best to help you find resources.

panewslab

panewslab

jinse

jinse