In the era of “country-based”, Bitcoin returns to the “road of globalization”

Reprinted from panewslab

01/08/2025·1MProduced by OKG Research

Author|Wang Lele, Bi Lianghuan, Jiang Zhaosheng

In the past year, there have been constant disputes over the "deglobalization" of the physical world. In the digital world, a new globalization model is gradually emerging.

In 2024, countries and regions representing more than half of the world’s population will hold general elections. The Russo-Ukrainian war has entered its third year, and the war between Kazakhstan and Israel continues to spread. In his new book Nexus, Israeli historian Harari attributes the secret of human civilization to the ability to tell stories. As the dominant narrative, globalization has experienced its peak period from the end of the 20th century to the beginning of the 21st century. However, the developed countries are the first to oppose the win-win narrative of globalization: the dividends brought by globalization are not universally beneficial. The slowdown in economic growth has highlighted problems such as the widening income gap and asset price bubbles, and further divided the rich and the poor.

At the same time, a quietly emerging wave of digitalization is taking a completely different direction. According to statistics from the Ouke Cloud Chain Research Institute, as of now, crypto assets have been legalized in more than half of the countries and regions (119 countries and 4 British territories). Since El Salvador became the first country in the world to use Bitcoin as legal tender in 2021, many third world countries such as Cuba and the Central African Republic have followed suit. At the beginning of 2024, the United States approved 11 Bitcoin spot ETFs, and Bitcoin entered the mainstream financial market. In addition, Trump made ten major commitments to crypto-assets during the election year, including establishing a national strategic reserve of Bitcoin, setting off a new wave of adoption of crypto-assets by sovereign countries and further promoting the globalization of crypto-assets.

Developed countries’ “self-opposition”

Globalization was once regarded by developed countries as a tool to shape the global economic order. However, they, the first to advocate globalization, are now the first to question this system. The cross-border flow of capital and industry has promoted the improvement of global production efficiency and helped developed countries complete the transformation from manufacturing to high value-added technology and financial services. At the same time, it has promoted consumption upgrades with lower-cost goods.

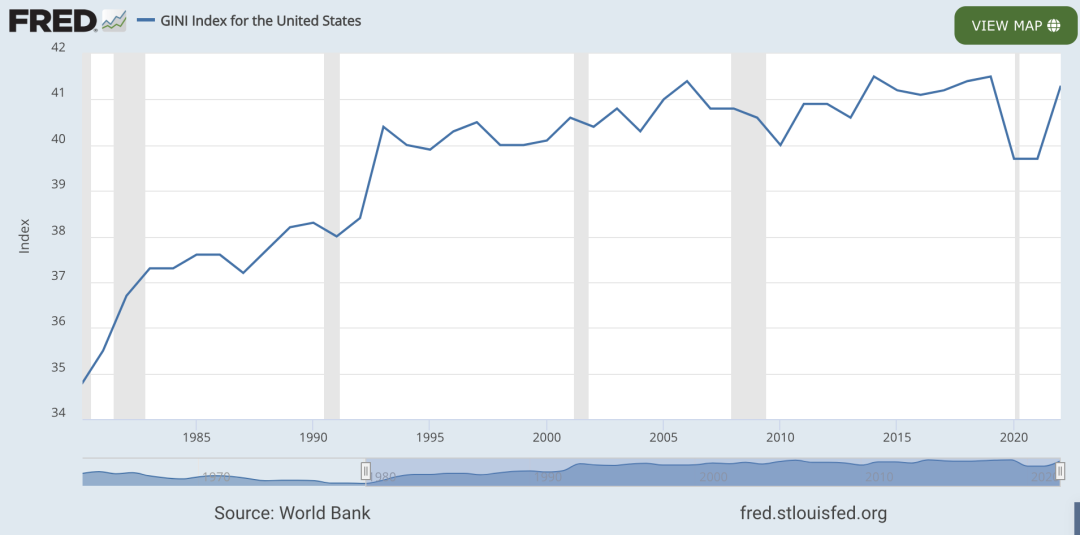

However, this process also laid deep structural contradictions, causing the original beneficiaries to begin to reflect on the costs of globalization. The most obvious of these is the uneven distribution of wealth. Taking the United States as an example, its Gini coefficient increased from 34.7% in 1980 to 41.3% in 2019, and income inequality increased by 19%. Although it fell back in 2020, it has since risen to a high level, and the income distribution problem remains serious, sounding the alarm for the globalization model.

Figure US Gini coefficient (1980-2022)

In addition, the production dominance of developed countries has declined: the BRICS' share of global GDP jumped from 7.7% in 2000 to 37.4% in 2023, the US share fell from 30.5% in 2000 to 24.2% in 2023, and the EU's share dropped from 26.6% % dropped to 17.5%. Looking at manufacturing alone, developed countries’ share of global manufacturing will drop from 70%+ in 2000 to about 45% in 2023, while the share of manufacturing value added in East Asia and the Pacific will rise from 31.9% in 2007 to 46.5% in 2021. This imbalance has intensified global competition and uneven distribution, and has become a microcosm of the deep-seated contradictions in the globalization model.

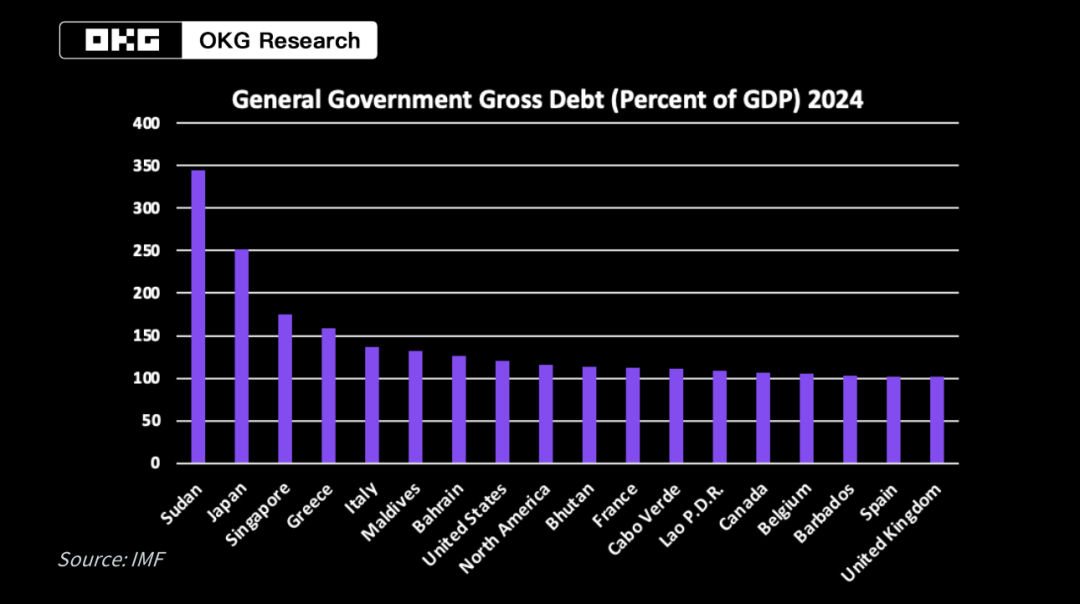

At the same time, the public debt problem in developed countries is also increasingly intensifying, and high public debt has further aggravated the hidden worries of globalization. The U.S. government debt-to-GDP ratio has risen from 58% in 2000 to 98% in 2023. In Japan, it has remained above 200% for a long time, and will be close to 260% in 2023. Debt pressure has undermined policy flexibility as fiscal deficits and interest payments surge. These economic structural problems highlight the imbalance in benefit distribution and risk transfer brought about by globalization, which is forcing developed countries to re-examine the globalization system they dominate and its sustainability.

Figure 2024 Global Government Public Debt/GDP

Currently, as the deep-seated contradictions of globalization become more apparent, the uneven distribution of capital flows and wealth has led to deepening social rifts. Historically, war has often been an extreme means to resolve economic conflicts and political disputes, especially when the international system is out of balance or the economic structure encounters a major crisis. The Marshall Plan after World War I promoted the reconstruction of Europe and became the starting point of postwar economic globalization; during the Cold War period after World War II, the arms race and technological innovation between the East and the West accelerated the revolutionary transformation of technology and industry. Although war brings great destruction, it often leads to new orders and the restructuring of global systems.

Today, we are standing in the wave of digital change and see technological innovation gradually replacing the previous armed confrontation and becoming one of the new driving forces for economic and social development. In this new context, the approach to globalization is also undergoing profound changes: it is no longer a simple expansion, but a process of constant self-correction and evolution. Innovation is opening up an unprecedented "new continent" for the global economy.

Globalization’s “New World”

At the end of the 15th century, Columbus originally intended to search for gold and spices in the Asian continent, but unexpectedly discovered a new American continent full of opportunities.

Bitcoin was born 16 years ago. This was defined in the white paper as "a peer-to-peer electronic cash system" to solve systemic problems such as the fragility caused by relying on traditional financial credit intermediaries. However, this initially seemingly "subversive" idea has already changed. Bitcoin is no longer just "electronic cash", but is regarded as "digital gold", and has even been discussed as a national strategic reserve. The crypto market represented by Bitcoin is gradually penetrating the global financial landscape: from a niche testing ground for geek punks, it has gradually evolved into the "New American World" of the financial world.

This "New World" is different from traditional globalization. It not only breaks through the limitations of geographical boundaries, but also breaks through the inherent model dominated by one power center. It does not rely on a single economy or political power, but establishes a new trust system through global consensus mechanisms and technical means, which is the foundation of a new type of globalization.

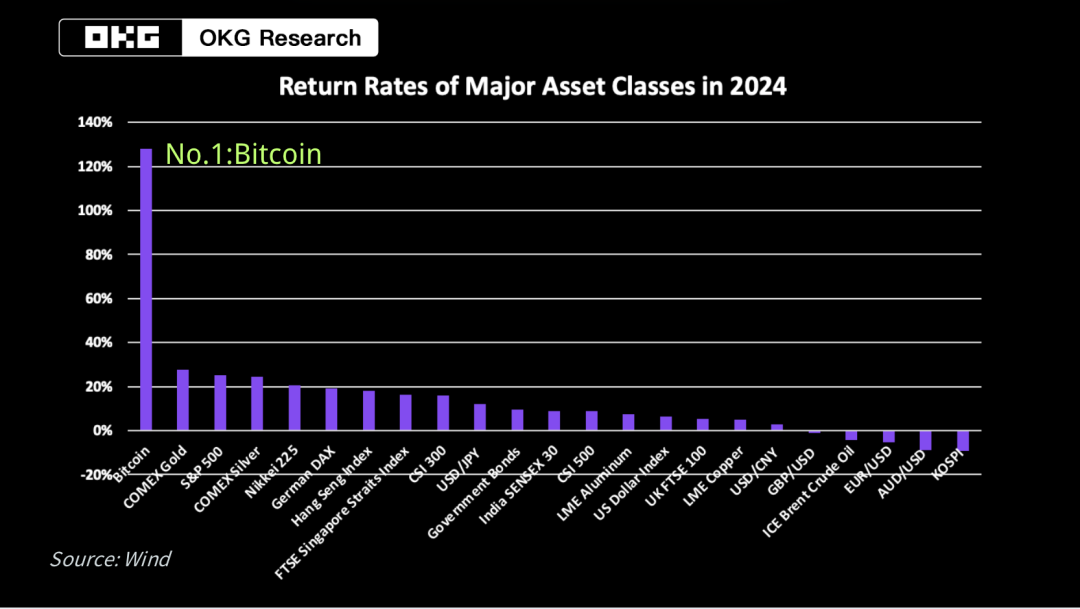

In the context of the intensifying "de-globalization" trend of the real economy and the escalation of geopolitical tensions, the global economy is under pressure, and the encryption market is gradually becoming a new "decompression valve." Take Bitcoin as an example. In the performance ranking of major asset classes in 2024, Bitcoin ranks first with an annual return rate of 128%. From a market value perspective, as of November 12, 2024, the asset market value of Bitcoin has surpassed that of silver, becoming the eighth largest asset in the world. This not only highlights the new status of crypto-assets in the traditional financial system, but also reflects their potential for risk aversion and value-added in a complex economic environment.

Figure 2024 ranking of asset class return rates

This is not only the result of capital pursuit, but also a manifestation of the borderless nature of crypto assets that promotes the formation of a new global market. In the context of geopolitical conflicts and restricted capital flows, cryptocurrencies have demonstrated their unique economic function of “depoliticization.” Traditional economic systems are often deeply influenced by geopolitics. For example, the SWIFT system (a communication protocol between global banks) is often used as a gaming tool between countries in the sanctions process. After Russia was hit by SWIFT sanctions, some economic activity turned to crypto assets. It demonstrates the flexibility and depoliticization characteristics of crypto assets in responding to international conflicts. Russian President Vladimir Putin immediately signed a law that recognized crypto assets as "property" and established a tax framework for their trading and mining, giving them legal status. Another example is that in 2022, the Ukrainian government raised more than $150 million in donations through crypto assets, proving its rapid response and transnational capital flow capabilities in crises.

Looking deeper, cryptoassets are driving a new economic model that does not rely on power centers. This system based on technological trust replaces traditional institutional trust. Unlike the fragility of the traditional financial system—where financial crises, bank failures, currency devaluation and other issues often expose the shortcomings of power centers—cryptoassets fundamentally reduce these risks through technological means. In this world of trust dominated by algorithms, real power no longer comes from a single authority, but from the joint participation and guarantee of countless nodes around the world. Just like the Bitcoin network has about 15,000 nodes, which changes with the activity of the network and user participation, this decentralization greatly reduces the risk of "single point of failure".

This trust mechanism also provides a new basis for global collaboration. The 24-hour uninterrupted trading and borderless attributes of encrypted assets break through the restrictions of religion, holidays and national boundaries. Crypto-assets are providing the possibility to bridge the rifts and reconstruct order in a world divided by deglobalization.

As the saying goes, everyone who wants to make the last copper coin will never get what they want. The "globalization" of the physical world is like a thing of the past, and attempts to squeeze out the last profit will often eventually lead to imbalance and rupture of the system. Today's encryption market seems to have given a brand new answer.

jinse

jinse