Nearly 20% of the indicators hit the top and fell back, has the top of the crypto market passed?

Reprinted from panewslab

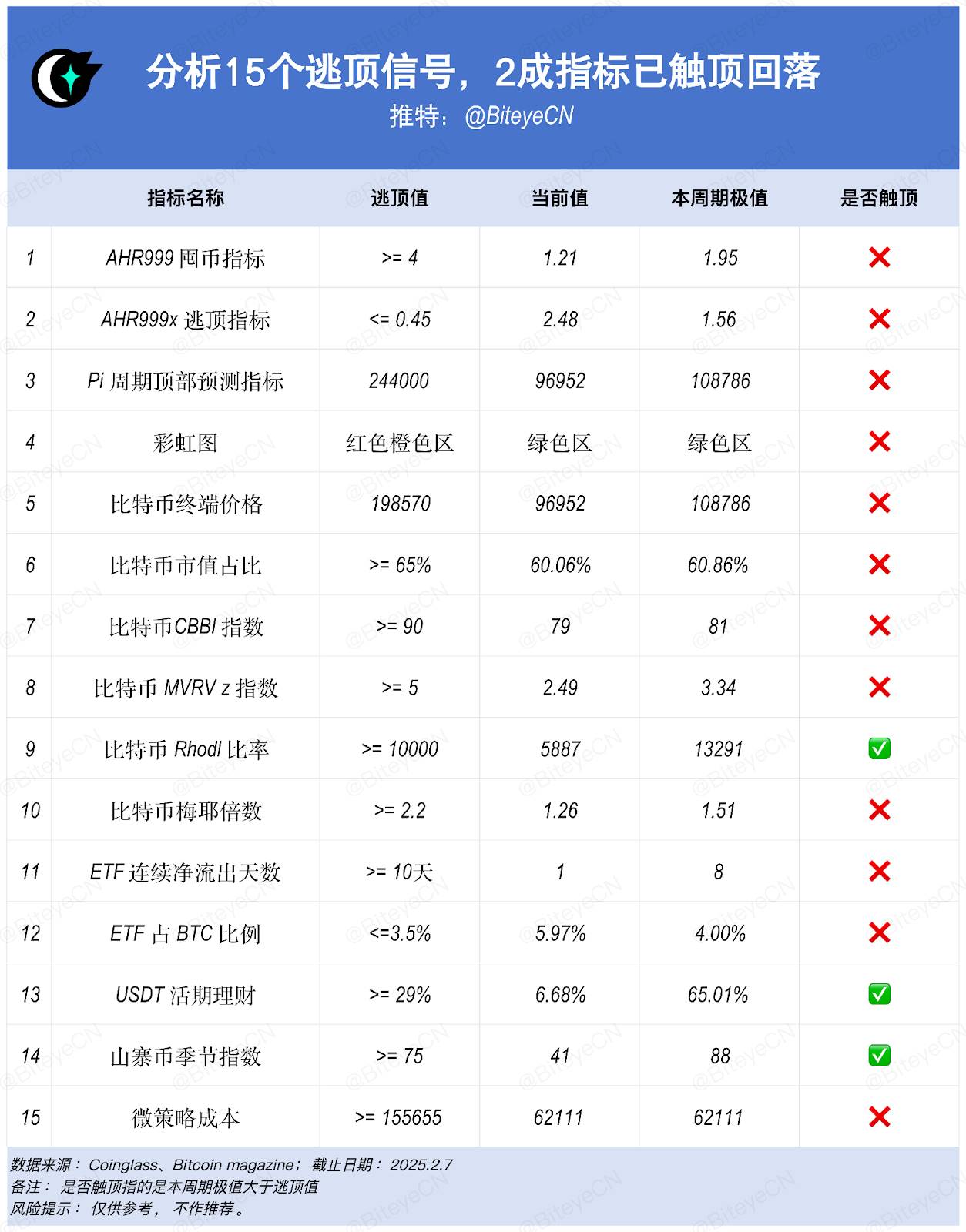

02/08/2025·4DThis article analyzes 15 commonly used escaping indicators and finds that one-fifth of the indicators have reached their peak in 2024.

Author: Biteye Core Contributor Viee

Every bull market not only creates wealth, but also creates countless illusions of wealth. When the market is excited, few people can keep their heads sober and elegantly "escape". In the face of a market with sharp rise and fall, how to leave the market in a timely manner near the high point and avoid the asset shrinkage caused by deep pullbacks requires us to comprehensively analyze multiple market indicators.

In this article, Biteye analyzed 15 commonly used top-escape indicators and found that one-fifth of the indicators have reached the top-escape range in 24 years, namely: Bitcoin Rhodl ratio, USDT current financial management, and altcoin seasonal index. In this way, how should we deal with the subsequent development of the market?

1. Indicator introduction

1. AHR999 Coin Hoarding Index

This indicator was created by Weibo user ahr999, assisting Bitcoin fixed investment users to make investment decisions based on the opportunity-based strategy. This indicator implies the yield of Bitcoin’s short-term fixed investment and the deviation between Bitcoin price and expected valuation.

Index range:

-

4: It is recommended to significantly reduce positions

-

1.2-4: Watch the area and stay alert

-

0.45-1.2: Regular investment area, you can gradually build positions

-

<0.45: Powerful bottom-buying area

🔥 Current status: The index value is 1.21, it has not reached the top yet, it is in the wait-and-see range, so it is recommended to be cautious.

Link: https://www.coinglass.com/zh/pro/i/ahr999

2. AHR999 Escape Top Index

The AHR999 top escape indicator is a sister indicator of the coin hoarding indicator, which is specifically used to identify the top areas of the market. This indicator determines whether the market is overheated by observing the degree of deviation of the price from the long-term trend line. It gave accurate warning signals at the top of the two big bull markets in 2017 and 2021, and is an important tool to avoid chasing highs.

Index range:

- <=0.45: Severe overheating, consider escaping the top

🔥 Current status: The indicator value is 2.48, and no peak signal appears in this cycle.

Link: https://www.coinglass.com/zh/pro/i/ahr999-escape

3. Top indicators of Pi cycle

The Pi cycle top indicator predicts potential market tops by comparing the relationship between the 111-day moving average and the 350-day moving average. Historically, when the moving average crosses, the price of Bitcoin is usually close to the top of the cycle, indicating a potential market reversal.

Signal characteristics:

-

Two lines cross: top signal triggers

-

Quick divergence: Bearish in the future

-

Gradually approaching: alert

🔥 Current status: The two moving averages are still far away, and there is no top signal yet. It is expected that the next cross will be in October 2025.

Link: https://www.bitcoinmagazinepro.com/charts/pi-cycle-top-prediction/

4. Bitcoin Rainbow Chart

The Rainbow Chart is an intuitive long-term valuation model that divides the Bitcoin price range into 9 different color bands. The model is based on logarithmic regression and takes into account the long-term growth characteristics and cyclical characteristics of Bitcoin. Over the past several market cycles, the rainbow chart has shown good guidance, especially in identifying extreme areas.

Index range:

-

Red: bubble zone, sell signal

-

Yellow: Overheating zone, stay alert

-

Green: Healthy area, holding range

-

Blue: Value area, buying opportunity

🔥 Current status: The price is in the green area, indicating that the valuation is relatively reasonable and there is no top signal.

Link: https://www.coinglass.com/zh/pro/i/bitcoin-rainbow-chart

5. Bitcoin terminal price indicators

The terminal price is the transfer price multiplied by 21. The price transferred requires the number of days of coins it has been destroyed by the existing Bitcoin supply and its time in circulation. This indicator can effectively filter out market speculation factors and reflect the true value of the Bitcoin network.

Signal characteristics: The closer the price of Bitcoin is to the red line, the closer the market is to the top.

🔥 Current status: Not touched yet

Link: https://www.bitcoinmagazinepro.com/charts/terminal-price/

6. Bitcoin market value proportion

The market value share indicator reflects Bitcoin’s dominance in the entire cryptocurrency market. This indicator is usually used to judge market cycles and capital flows, and when Bitcoin’s market value falls, it usually means that funds begin to transfer to altcoins. Historical data show that changes in Bitcoin’s market value often indicate a turning point in the entire cryptocurrency market.

Index range:

-

65%: Bitcoin’s strong period

-

40-65%: Equilibrium period

-

<40%: Altcoin active period

🔥 Current status: The market value accounts for about 60%, which is in a relatively balanced range.

Link: https://www.coinglass.com/zh/pro/i/MarketCap

7. Bitcoin CBBI Index

CBBI (Combined Bitcoin Binary Index) is a comprehensive index that combines multiple technical indicators and on-chain data, which can better identify the conversion points of the bull and bear cycle. Its advantage is that it reduces the limitations of a single indicator through multi-dimensional data.

Indicator range: greater than 90 means that the market reaches its top.

🔥 Current status: The index value is 79, indicating that the market is slightly hot, but it has not yet reached its peak.

Link: https://www.coinglass.com/zh/pro/i/cbbi-index

8. Bitcoin MVRV Z index

The MVRV Z index is an important on-chain analysis indicator, which judges the market cycle by comparing the degree of deviation between market value and realized value. When this indicator is too high, it means that the market value of Bitcoin is overvalued relative to its actual value, which is not conducive to the price of Bitcoin; otherwise, it is undervalued. According to past historical experience, when this indicator is at a historical high, the probability of Bitcoin price showing a downward trend increases, and you must pay attention to the risk of chasing highs.

Indicator range: greater than 5 means that the market reaches its top.

🔥 Current status: The index is 2.5, and has not reached the top yet.

Link: https://www.coinglass.com/zh/pro/i/bitcoin-mvrv-zscore

9. Bitcoin Rhodl ratio

The Rhodl ratio is a composite on-chain indicator. The indicator judges the potential turning point of the market by comparing the behavioral characteristics of coin holders in different periods. When the RHODL ratio begins to approach the red band, it may indicate that the market is overheated. Historically, this has been a good time for investors to take profits in each cycle.

Index range: When approaching the red band, it may indicate that the market is overheated. When the ratio >= 10000, the market is close to the top.

🔥 Current status: The red band is not currently entered, but this indicator entered the peak range during November 2024.

Link: https://www.coinglass.com/zh/pro/i/r-hodl-ratio

10. Bitcoin Mayer Multiple Bitcoin Mayer Multiple is a technical indicator used to analyze the Bitcoin market conditions and was proposed by Trace Mayer. It evaluates the market's relative valuation level by comparing Bitcoin's current price to its 200-day Moving Average (200DMA).

Index range:

-

Mayer multiple > 1: Indicates that the current Bitcoin price is above its 200-day moving average and the market may be overbought.

-

Meyer multiple < 1: Indicates that the current Bitcoin price is below its 200-day moving average and the market may be oversold.

-

Mayer multiple ≈ 1: indicates that the current Bitcoin price is close to its 200-day moving average, and the market may be in a relatively balanced state.

-

Historically, when the Mayer multiple exceeded 2.4, it usually indicates that the market is overheated and there may be a pullback or bear market. When the Mayer multiple is below 0.8, the market may be undervalued and may be a good time to buy.

🔥 Current status: The index is 1.26, the market is in an overbought state, but it has not yet reached its peak.

Link: https://www.coinglass.com/zh/pro/i/mayer-multiple

11. Number of consecutive net outflow days of ETF

This indicator tracks the flow of funds in Bitcoin ETFs, and the number of consecutive net outflow days often reflects the confidence status of institutional investors. This is a relatively new indicator, and it has gradually attracted market attention since the launch of spot ETFs.

Signal characteristics:

-

10 days: Significant bearish signal

-

5-10 days: Beware

-

<5 days: Normal fluctuation

🔥 Current status: Net outflow for 1 consecutive day, which belongs to the normal market fluctuation range. This cycle lasts for up to 8 consecutive days, and there is no 10-day situation.

Link: https://www.coinglass.com/zh/bitcoin-etf

12. The proportion of ETF to BTC

This indicator reflects the proportion of Bitcoin held by ETFs in total circulation and is used to evaluate institutional participation. This indicator can reflect the acceptance and depth of Bitcoin by traditional financial institutions.

Signal characteristics: <=3.5% is an escape index, which also implies that the institutional participation is low

🔥 Current status: accounting for nearly 6%, indicating that institutional participation is in a stage of benign growth.

Link: https://www.coinglass.com/zh/bitcoin-etf

13. USDT Current Financial Management

USDT current financial management interest rate is an important indicator to measure the cost of market capital. This indicator reflects the overall liquidity status of the cryptocurrency market.

Signal characteristics: >=29% is the escape range

🔥 Current status: The interest rate is about 6.68%, at a normal level. However, during March 2024, the indicator entered the peak range, reaching 65%.

Link: https://www.coinglass.com/zh/pro/i/MarginFeeChart

14. Altcoin Seasonal Index

This indicator is used to determine whether the market has entered an active period of altcoins. By comparing the performance of Bitcoin with major altcoins, it can be judged whether funds have begun to turn to smaller currencies with higher risks.

Index range:

-

75: The altcoin season, exceeding 75 means the market is close to the top

-

25-75: Equilibrium period

-

<25: Bitcoin dominant period

🔥 Current status: The index is 41, but during December 2024, the indicator entered the peak range, reaching 88.

Link: https://www.coinglass.com/zh/pro/i/alt-coin-season

15. Micro-strategy cost indicators

This indicator tracks MicroStrategy's average Bitcoin holding cost as a reference benchmark for institutional investors. Since MicroStrategy is one of the largest corporate Bitcoin holders, its cost line often becomes an important psychological price in the market.

Index range:

-

Current price is higher than cost: institutional profit range

-

Current price approaches cost: support level

-

Current price below cost: potential buying opportunities

🔥 Current status: The average cost of micro-strategy is about 60,000, which is within the institutional profit range.

Link: https://www.coinglass.com/zh/pro/i/micro-strategy-cost

2. Summary

"A bear market makes you bankrupt, and a bull market makes you fall back into poverty." Staying rational in the market carnival and getting out of it when you are crazy is much more difficult than buying at the bottom. At present, only some indicators show signs of escape from the top, which does not mean that the entire market is definitely reaching the top. If you think the market is at risk of reaching the top, you can also consider:

-

Set up batch reduction points and don’t expect a perfect top.

-

Cash profits into stablecoins or fiat currencies instead of turning to more risky altcoins.

-

It is better to sell early than late at a high level. Profit settlement is not an end, but accumulating ammunition for the next round.

Remember, every top is an opportunity for some people to create wealth, and it is also a wealth trap for most people. The opportunities given to everyone by the market are equal, but those who can seize the opportunities are often those who are prepared.

chaincatcher

chaincatcher